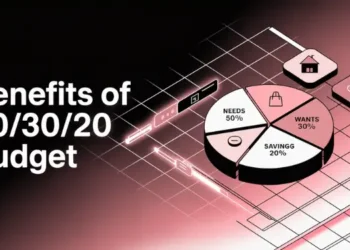

Creating a 50/30/20 budget makes money management easy. It works like a background system. Most budgets fail because people can’t handle emergencies.

A Federal Reserve survey found 40% of Americans can’t cover a $400 emergency. Senator Elizabeth Warren says this approach doesn’t need endless sacrifice. It’s about smarter money use.

She notes that using the 50/30/20 rule helps keep finances balanced. It’s easy to follow, even in tough times.

This budget splits your money into three parts: 50% for needs, 30% for fun, and 20% for savings. It’s flexible. You don’t have to track every coffee or feel bad about treats.

The budgeting method works because it understands us. It sets clear limits for reaching financial goals.

Quick hits:

- Works with irregular income patterns

- Eliminates daily money decisions

- Automates savings without feeling deprived

- Adapts to changing financial situations

- Reduces money stress almost immediately

Even one 30-day late payment can slash a credit score by 90-110 points and stays on reports for 7 years—prioritizing minimum payments is essential when allocating the 20% savings/debt bucket.Ref.: “Experian Editorial Team. (2024). Does a One-Day Late Payment Affect Your Credit Score? Experian.” [!]

Set vivid goals motivating your spending decisions

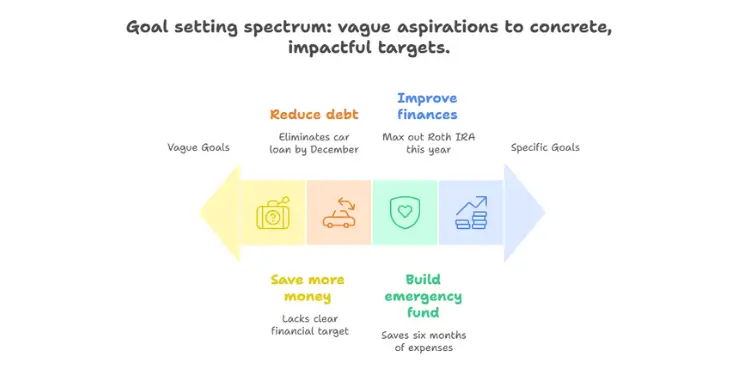

The secret to sticking with your 50/30/20 budget isn’t willpower. It’s having clear goals that make you excited to spend. Saying “save more money” or “spend less” doesn’t work when you face real choices. I learned this after months of not making progress and feeling frustrated.

Your budget needs something to make it exciting. When you link your spending to important financial priorities, every choice feels meaningful. This makes budgeting feel like a journey to what’s truly important in your life.

“A goal without a plan is just a wish. Your financial goals deserve better than wishful thinking—they deserve concrete action steps and emotional investment.”

Visualize Dream Outcomes Like Debt Freedom

Start by imagining what financial freedom means to you. Is it paying off your last debt? Building an emergency fund? Or helping family without worrying about money?

Write these dreams down with lots of details. How will you feel when you’re debt-free? What will you say to yourself? Where will you be when you reach your savings goal? These clear pictures help you stay focused on your long-term financial journey.

Make a vision board with pictures of your dreams. Put it somewhere you see every day—like your desk or phone. This visual reminder helps you stay committed to financial well-being when you’re tempted to spend.

Break Goals Into Achievable Monthly Targets

Big dreams come true with small steps. Turn your big long-term goals into monthly goals that are both challenging and doable. If you want to pay off $12,000 in debt, aim for $1,000 a month.

These smaller goals give you regular “wins” to keep you motivated. Each success builds your confidence in managing your money. Use a simple chart to track your progress—it’s very motivating.

Set reminders to check your goals every week. This keeps you focused when you want to buy something on impulse. Remember, staying on track with your budget is easier when you see how today’s choices help tomorrow.

| Vague Goals (Less Effective) | Specific Goals (More Effective) | Monthly Target Example | Emotional Benefit |

|---|---|---|---|

| “Save more money” | “Save $15,000 for house down payment” | $625 monthly savings | Visualizing your future home |

| “Reduce debt” | “Eliminate $8,400 car loan by December” | $700 monthly payment | Freedom from monthly obligation |

| “Build emergency fund” | “Save 6 months of expenses ($12,000)” | $500 monthly savings | Peace of mind during uncertainty |

| “Improve finances” | “Max out Roth IRA ($6,000) this year” | $500 monthly contribution | Pride in securing future self |

Try this simple trick to connect your goals better: Each time you think about buying something, pause. Think about how it fits with your goals. Ask yourself, “Does this move me closer to or further from my financial dreams?” This quick check helps you make better choices.

When setting savings goals, be clear about how much and when. Say “Save $3,000 for a vacation by June” to guide your spending. This clarity helps you decide if your daily spending matches your priorities.

Remember, your goals might change as your life does. Check your financial targets every three months to make sure they’re what you really want. This keeps your budget exciting and relevant.

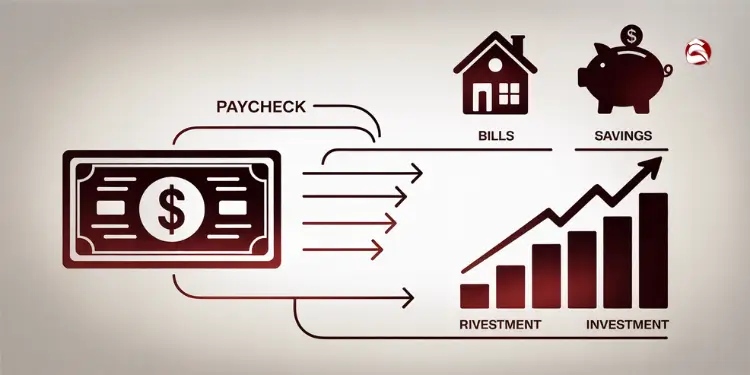

Automate bill payments and savings transfers immediately

Sticking to your 50/30/20 budget is easier with smart automation. Money you don’t see is money you won’t miss. This makes budgeting smooth and easy.

First, figure out your monthly after-tax income. This is what you take home after taxes. For example, if you make $2,000 a month, you can spend $1,000 on needs, $600 on wants, and $400 on savings and debt.

The 50/30/20 method and pay-yourself-first both work well with automation. They help you avoid spending money meant for savings.

Employees who joined the “Save More Tomorrow” automatic-increase program boosted 401(k) contributions from 3.5% to 13.6% of pay within 40 months—proof that automating deposits drives dramatic, sustained savings gains.Ref.: “Thaler, R. H. & Benartzi, S. (2004). Save More Tomorrow™: Using Behavioral Economics to Increase Employee Saving. Journal of Political Economy.” [!]

Schedule Payments Right After Paycheck Deposit

Timing is key when automating your money. Move your money to savings or bills right after you get paid. Try to do it within 24 hours.

Many jobs let you split your paycheck into different accounts. This is the best way to automate your money. It goes straight to where it needs to go without you touching it.

For bills that are always the same, use your bank’s automatic payment. Pick a date that matches when you get paid. This keeps you from overdrafting and saves you from late fees.

“Automation is the antidote to financial procrastination. It ensures your future self gets paid before your present self can spend the money.”

Use Separate Savings Vault to Reduce Temptation

For savings, open a special account at a different bank. This makes it harder to spend money impulsively. It gives you time to think about your spending.

Give your savings account a clear goal. Like “Emergency Fund” or “Hawaii Vacation 2023”. This makes you think twice before spending it on something else.

Split your savings into short-term and long-term goals. For example, you might save:

- 10% for retirement (401k or IRA)

- 5% for an emergency fund (3-6 months of expenses)

- 5% for specific goals like a home down payment or debt

Check your savings plan every quarter. Update it if your income or goals change. This keeps your savings on track with you.

Automation doesn’t have to be all or nothing. Start with a small amount, like $25 to your emergency fund. Small steps build strong financial habits over time.

Use cash envelopes to tame discretionary categories

The cash envelope system makes budget numbers real. It helps you see and feel your spending limits. Digital spending can make money seem less real.

Identify your “wants” categories that take up 30% of your budget. These are things like dining out and shopping. For example, if you make $3,000 a month, you can set aside $900 for wants.

Put this cash in labeled envelopes at the start of each month. When an envelope is empty, you can’t spend in that category until next month. This makes it hard to ignore your spending limits.

This system is simple. You don’t need apps or complicated budget calculators to track your spending. Watching your cash go down helps you spend less and focus on what’s important.

Behavioral studies show paying with cash heightens the “pain of paying,” cutting impulse spending compared with card use—an effect first detailed by Prelec & Loewenstein’s mental-accounting research.Ref.: “Prelec, D. & Loewenstein, G. (1998). The Red and the Black: Mental Accounting of Savings and Debt. Marketing Science.” [!]

Cap Fun Money to Weekly Allowance

Instead of having all your “fun money” at once, divide it into weekly amounts. This stops you from spending too much in the first week. For example, if you have $300 for entertainment, take out $75 each week.

This way, you spend money more evenly throughout the month. It also lets you adjust if you spend too much one week. This way, you can stay on track for the rest of the month.

Don’t like carrying cash? Use a note on your phone to keep track of your envelope balances. Take out the cash as planned, then move it back to your account for card purchases. This way, you stay aware of your spending while being convenient.

Start with just one category, like dining out, to test it out. Many people find that using cash makes them more careful with their money. When you pay with real bills, you think more about where your money goes.

Make your first cash envelope today and see how it changes your spending. Turning budget numbers into real cash can change how you view your wants. It helps you stick to the 50/30/20 rule without constant effort.

Track progress daily with simple habit loops

Tracking your budget daily gets easier with simple habits. I’ve tried many ways and found that simple is best. You don’t need big spreadsheets or lots of data entry.

Successful budgeters don’t rely on willpower. They create systems that make tracking easy, like brushing teeth. This way, you stick to your budget goals without feeling stressed.

Log Purchases Quickly Using Smartphone Widgets

Track your spending right when you buy something. Choose a method that’s easy, like a notes app or a small notebook. Make sure it’s easy to use when you’re spending money.

Make a “10-second habit loop” for every purchase. Log the amount and what you bought right away. This is quick but helps you see your spending.

For online buys, use a browser bookmark for your tracker. Many apps have widgets for easy logging. The simpler it is, the more you’ll do it.

“The best budget tracking system isn’t the most sophisticated one – it’s the one you’ll actually use consistently.”

If the 50/30/20 rule is hard for you, think about changing the percentages. Some people do better with a 60/20/20 split, depending on their needs and goals.

Set Morning Review Reminder For Awareness

Have a daily review that takes less than 2 minutes. Check your tracker with your morning coffee. This helps you stay on track with your spending.

Ask yourself two questions during this quick review: “Am I on target?” and “Do I need to adjust today?” This keeps you on track and prevents big problems.

If you’re spending more than planned, don’t worry. It might mean you need to adjust your budget. The system should work for you, not the other way around.

Track your spending as you go, not just at the end of the month. This helps you catch and fix small problems before they get big. Daily reviews help you understand how your spending affects your money.

- Monday: Review weekend spending and adjust the week’s plan

- Wednesday: Quick mid-week check on discretionary spending

- Friday: Prepare for weekend temptations by reviewing remaining funds

- Last day of month: Complete review of all three categories

Remember, tracking is about being aware, not perfect. Even if you miss a few purchases, keep going. The goal is to manage your money well, not to stress you out.

Start tracking today by logging your last purchase, no matter how small. This small step will help make tracking a natural part of your life, not a constant fight.

Build accountability through partner or community check-ins

The secret to keeping your 50/30/20 budget is not an app or spreadsheet. It’s about connecting with others. When I had trouble with my budget, I found that sharing it with someone made it easier.

Having someone to share your financial goals with is very helpful. This could be your partner, a friend, or family member. The best person is one who understands budgeting & saving without judging you.

If you can’t find someone in your life, online groups are a great option. Sites like Reddit’s r/personalfinance, Facebook groups, and budgeting forums are full of people like you. They’re all trying to improve their finances together.

Share wins and challenges during monthly call

Once you’ve found someone to help you, set up a monthly call. These calls keep you on track with your budget. Make them a regular part of your schedule.

Here’s a simple way to make these calls work:

- Share one thing you did well last month (like saving more money)

- Talk about any problems you faced (like unexpected bills)

- Set a goal for the next month (like saving more or paying off debt)

Fidelity’s 2024 Couples & Money Study found couples who hold regular “money dates” report 86% higher confidence in their financial future—linking scheduled check-ins to measurable well-being.Ref.: “Fidelity Investments. (2024). 2024 Couples & Money Study. Fidelity Viewpoints.” [!]

For couples, weekly “money dates” are great. They help you stay on the same page with your money. These short meetings can prevent misunderstandings.

“The most effective budget isn’t the most detailed one—it’s the one you’ll actually stick with. Accountability provides the structure that makes consistency possible.”

When you talk about problems, focus on the system, not yourself. Say “My budget tracking isn’t working” instead of “I’m bad with money.” This way, you can find solutions without feeling ashamed.

Online groups also help with accountability. Sharing your goals online can motivate you to stay on track. For example, posting about saving for emergencies can help you stay focused.

Remember, accountability is about support, not judgment. Your partner or community will help you see where you can improve. They’ll also celebrate your successes in managing your money.

Take action today: Find someone to be your accountability partner and plan your first meeting. This simple step could be the key to keeping your budget on track.

“Explore This: How to make 50/30/20 budget with clear practical step by step“

Reward milestones without derailing long-term percentages

Sustainable budgeting is not about giving up. It’s about finding a balance. While 83% of Americans find traditional budgeting hard, those who succeed add rewards to their money management system. The trick is to celebrate without losing sight of your goals.

Read also:

Plan small treats inside lifestyle category

When you reach a financial goal, like saving $1,000 or keeping your budget for three months, treat yourself. Use money from your “wants” category (30% in the 50/30/20 method). This way, you save for retirement and celebrate your success.

Make a “reward ladder” with treats for each milestone. For example, after saving $5,000, spend $50 on a special dinner. Make sure it’s within your after-tax income percentages.

For big wins, choose free rewards that make lasting memories. Enjoy a day outdoors, dive into a hobby, or cook a special meal. Use a budget calculator to make sure it fits your take-home pay.

Remember, the journey itself is rewarding. You’ll feel less stressed and have more choices. By balancing needs and wants, you create a budget that works for the long haul.