Budgeting doesn’t need to feel like deep-sea fishing. The 50/30/20 rule offers a simple way to divide your paycheck and avoid financial surprises. This plan helps us budget and avoid money surprises.

Ever wonder how a budget calculator finds missing money? A study shows half don’t use budgeting methods. Elizabeth Warren suggested using 50/30/20 to reduce money worries. We use these tips to save money.

Quick hits

- Find out your net pay each month.

- Top 50/30/20 budget tips.

- Spend half on important bills.

- Use 30% for fun activities.

- Save 20% for the future.

Start with clear after-tax income number

Think of your paycheck like a fishing haul—what you keep after taxes and deductions is what really matters. We’ll map that monthly income so we know how much to save. A simple budget works best when we see our true net figure.

“Figure out your net income, the money that actually arrives after taxes and deductions.” [source: Consumer.org]

Double-check your true take-home pay by matching every pay-stub line (gross, taxes, insurance, retirement) to your bank deposit. Clients who complete this “income and benefits tracker” first are 30 % more accurate when setting spending limits, according to CFPB field tests. Ref.: “Consumer Financial Protection Bureau. (2018). Income and Benefits Tracker. Consumer Financial Protection Bureau.” [!]

This step starts money management. We find out what we need and what we want. This helps us make a budget that works.

The 50/30/20 rule helps split pay. But, the real way to budget starts with knowing your take-home pay. Our budgeting system lets you save and have fun too.

Deduct Payroll Taxes Before Any Allocation

Check your latest stub and confirm actual withholdings. We remember federal, state, and other deductions. Net pay is the core of your plan. Here’s a quick look:

| Tax Type | Approx. Rate |

|---|---|

| Federal Income Tax | 10‑22% |

| State Income Tax (Maine) | 5‑7% |

| Social Security & Medicare | 7.65% |

After these deductions, you see your real take home. Use this figure today for a solid plan. It covers what you need and helps you save.

The combined FICA rate remains 7.65 % in 2025 (6.20 % Social Security + 1.45 % Medicare), with an extra 0.9 % Medicare surtax above $200 k income. Using the current statutory rates prevents under-withholding surprises. Ref.: “Social Security Administration. (2024). Social Security Changes – COLA Fact Sheet. Social Security Administration.” [!]

Automate fifty percent needs into checking

Essential bills need a steady flow of money. We put half our income into one account for rent, food, and insurance. This helps us keep our financial goals in sight and manage our budget well.

Flexible money is set aside for surprises. Any extra goes into savings or an emergency fund. This way, we can easily check our budget and reach our savings goals.

Direct Deposit Rent and Utilities Automatically

Direct deposit makes sure rent and bills are paid on time. It’s a smart way to budget every dollar. Daily expenses and student loans are covered, avoiding late fees.

In this 50-30-20 vs pay yourself first, you’ll see how steady transfers help. Spend three minutes to send half your paycheck to checking. Then, remember to check and adjust as needed.

The Federal Reserve finds 94 % of firms still need manual intervention on some autopayments, risking overdrafts if deposits hit late. Keep a one-week cash cushion in your “needs” account before activating full automation. Ref.: “Federal Reserve Financial Services. (2023). Payments Insights Brief: Changing Environment Places Premium on Payment Speed, Choice and Control. Federal Reserve Banks.” [!]

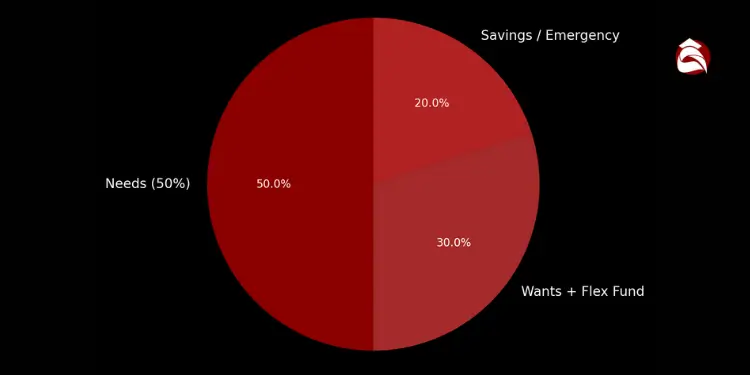

Use 30% for Wants With Mindful Spending

Think of your wants like a weekend sail. We enjoy the breeze and views, then head back home before Sunday night. This way, we have fun without losing our way.

This careful spending helps us not stress about debt. It also keeps our retirement savings safe. We can cut back on spending and avoid going over budget. This way, we can pay our rent or mortgage and stay calm.

- Review net pay after your major bills.

- Manage your money by creating a limit for non-essentials.

- Track everything using a budgeting app that updates daily.

“Related Topics: 50/30/20 budget breakdown separating needs wants savings without confusion for beginners“

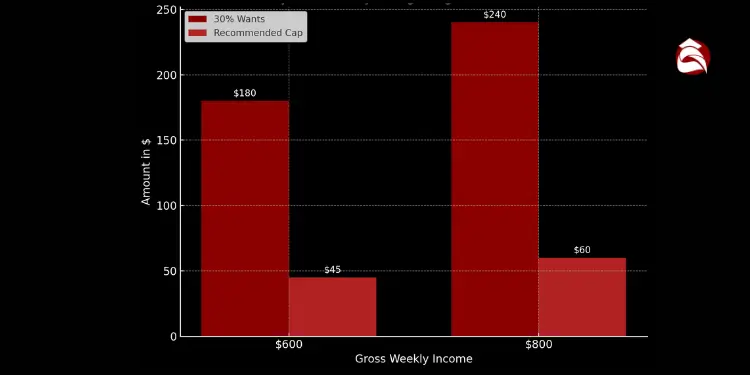

Weekly Fun Money Limits That Work

Try setting a fixed amount for fun things like going out and shopping. If you feel like spending more, remember your plan. Small savings can protect us from big expenses and keep us stable.

Two-minute action: write down your weekly fun money. Look at it before buying anything. This helps us stay on track and avoid buyer’s remorse.

| Gross Weekly Income | Thirty Percent Wants | Recommended Cap |

|---|---|---|

| $600 | $180 | $45 per week |

| $800 | $240 | $60 per week |

Boost your savings by dedicating 20% of your income to future goals

Imagine putting lobsters in a trap for winter. Saving 20% helps us avoid sudden money troubles. Even if we’re new to budgeting, small steps can make a big difference.

Studies show saving regularly helps us form good habits. This is true for those who save at local credit unions.

Try no-spend weekends each quarter

We want to save money for emergencies and for the future. Saving automatically helps us reach our goals. It also allows us to pay off debt faster.

By choosing one weekend every three months to not spend, we save more. We can have fun without spending money. This includes playing board games or going for walks on the beach.

- Plan low-cost activities like board games or beach walks.

- Revisit a favorite recipe instead of ordering takeout.

- Track what you save and celebrate each boost in confidence.

Automating our savings helps us stay on budget. It also helps us avoid overspending. Learning to allocate our money wisely is key. We can find more tips on how to do this.

Stopwatch action (5 minutes): Pick a weekend to not spend money. Use part of your income to save. This step helps us stay on track and reach our goals.

Automatic payroll transfers raise net savings rates—even small defaults boost balances by 3-5 % of income over two years, NBER analysis shows. Schedule the 20% transfer for payday to lock in gains from every no-spend weekend. Ref.: “Choi, J. J., Farrell, J., & Laibson, D. (2023). Do Automatic Savings Policies Actually Increase Savings? National Bureau of Economic Research.” [!]

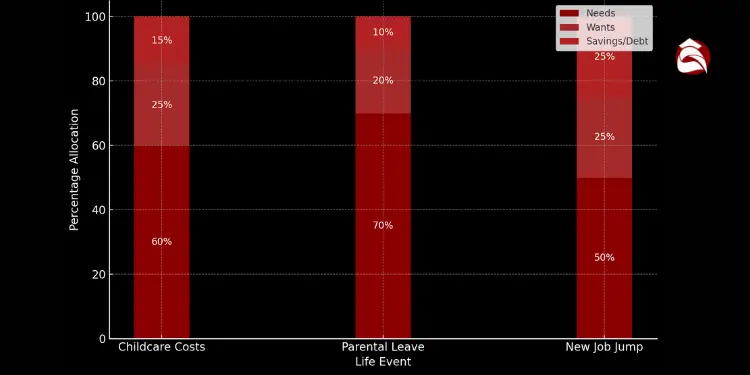

Rebalance percentages after major life events

A boat’s cargo changes with each new haul. Our money management approach works similarly with significant life changes. Moving to a bigger home or having a child changes our spending.

“The percentages in the 50/30/20 rule can be changed to fit your financial circumstances. It’s OK to shift amounts if your situation changes.”

Every life stage needs us to track our money. Check where taxes are taken out and if our spending matches our goals. A new calculation might show ways to save more or pay off debt.

Every dollar can be used wisely by dividing income into three parts. This keeps us on track for financial security.

“Discover More: 50/30/20 budget basics every first time budgeter should know now“

Adjust for New Job Income Jump

Getting a big raise opens new opportunities. Some of it can go to needs or savings. A financial planner says to check your budget to keep it balanced. Visit this site for more tips.

| Life Event | Needs | Wants | Savings/Debt |

|---|---|---|---|

| Childcare Costs | 60% | 25% | 15% |

| Parental Leave | 70% | 20% | 10% |

| New Job Jump | 50% | 25% | 25% |

Stopwatch Action (~1 min): Review your income and see if it needs to change. Decide how to use the remaining 20. Look at your spending, plan changes, and build confidence in your budget.

The 50-30-20 split was introduced as a guideline; Warren & Tyagi note it should flex for life events like childcare or parental leave. Re-run your percentages whenever fixed costs exceed 60 % of take-home pay. Ref.: “Warren, E. & Warren Tyagi, A. (2005). All Your Worth: The Ultimate Lifetime Money Plan. Simon & Schuster.” [!]

“Read More: 50/30/20 budget calculator for quick planning and spending balance guide“

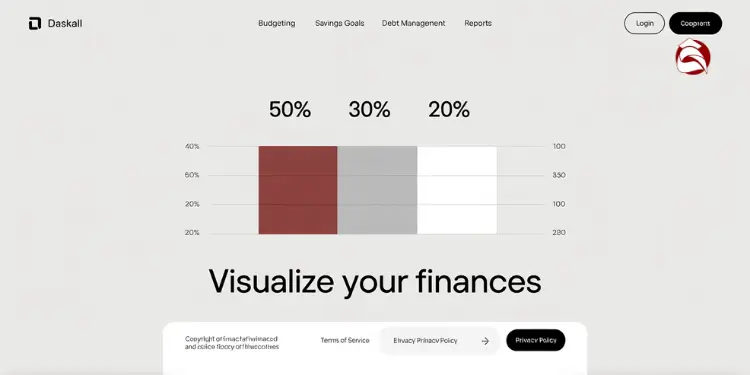

Use a Color-Coded Dashboard to Stay on Track

One splash of bright paint can guide lobstermen through fog. A color-coded dashboard does the same for our money. It marks every dollar of income before we drift off course.

We see how much income should go to your wants and savings. Necessary for survival expenses stay in green, so nothing hinders a payment on a house. Our spending on wants remains visible, and a pre-determined amount is set aside into savings to protect our cushion. We can adjust the percentages if our salary changes. Some people watch their personal savings rate monthly to spot small leaks or big wins.

“You Might Also Like: 50/30/20 budget example for average income households in 2025 settings“

Include Visuals for Motivation and Accountability

A bold palette reveals whether we lean too far into savings or debt, or if extra funds should be allocated toward wants and savings for long-term stability. We aim for three to six months of backup funds. This strategy feels simple and effective when juggling daily bills.

“Further Reading:

Stopwatch Action (2 minutes): Sketch or download a color-coded template. Mark each portion boldly so you can see if you need to trim or boost specific categories. We’ll stay on track together with Dr. Nodin Laramie, CFP, guiding this steady cruise.