Planning to reduce debt before buying a house can really help. It can make lenders more likely to say yes and save you money. Your current debts affect what lenders offer you.

Ever thought about how much a small change in your mortgage rate costs? On a $400,000 loan, a 1% change means an extra $107 a month. That’s $38,520 over 30 years!

Lenders usually want your debt-to-income ratio to be 43% or less for regular loans. “Smart debt management before applying can make all the difference,” I’ve told many clients who were surprised by denials.

First-time buyers can change their financial picture by following a debt repayment strategy. This strategy focuses on paying off high-interest accounts first. You don’t have to get rid of all debt. You just need to manage it well.

For single-income families, keeping your debt-to-income ratio below 36% helps a lot. Knowing your house price to income ratio helps you know what you can afford.

Quick hits:

- Lower DTI means better mortgage rates

- Credit card paydowns boost scores fastest

- Keep credit utilization under 30%

- Don’t close accounts after paying off

- Avoid new debt before mortgage applications

Assess current liabilities and interest rates

Knowing what you owe and the interest rates is key before buying a home. Many people don’t know their total debt by 15-20% until we look at the numbers. This step is not to judge but to start your path to owning a home.

First, get your free credit reports from Experian, TransUnion, and Equifax at AnnualCreditReport.com. This gives you a full picture of your credit card debt, student loan debt, and other loan debt. It affects how much you can borrow for a mortgage.

Then, make a simple spreadsheet with five columns:

- Creditor name

- Current balance

- Interest rate

- Minimum monthly payment

- Payment due date

This might show you debts you forgot about or didn’t know about. Paying off credit card debt is very important because lenders look at it closely when you apply for a mortgage.

“The most dangerous debt is the debt you’ve forgotten about or don’t fully understand.”

Your debt-to-income ratio (DTI) is very important to lenders. It’s your total monthly debt payments divided by your monthly income. For example, if you pay $1,500 a month in debt and make $5,000, your DTI is 30%.

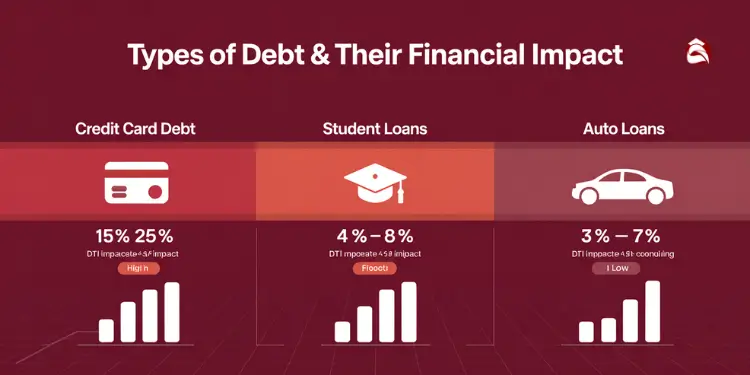

| Debt Type | Included in DTI? | Impact on Mortgage | Typical Interest Range |

|---|---|---|---|

| Credit Cards | Yes | High | 15-24% |

| Student Loans | Yes | Medium | 4-7% |

| Auto Loans | Yes | Medium | 3-10% |

| Medical Bills | No | Low | 0-10% |

| Utility Bills | No | Low | N/A |

Lenders usually want your DTI to be under 42%. But some loans can go up to 50%. For a $5,000 monthly income, try to keep your total debt payments under $1,250. This will help you borrow more for a mortgage.

It’s important to know the difference between debts when you want to buy a home. You might choose to pay off debt or save for a down payment, depending on your finances. Learn more about this at this link.

This first step is your starting point. Be honest about your finances. The clearer you are, the better your plan will be. This will help you reach your goal of owning a home.

Prioritize high cost balances for payoff

Focus on your most expensive debts first to get ready for a mortgage. You’ve listed all your debts. Now, target the ones that cost you the most each month. These debts use up your money and can hurt your credit score.

Many first-time buyers have followed this advice. It helps lower your debt-to-income ratio and credit score. You might see a 15-30 point credit score boost in 60 days. This can save you thousands on your mortgage.

Always make the minimum payments on all debts. Missing payments can hurt your credit score and stop you from getting a mortgage. Try to pay more to specific debts while keeping up with the minimums.

“For More Information: How to buy house on low income successfully“

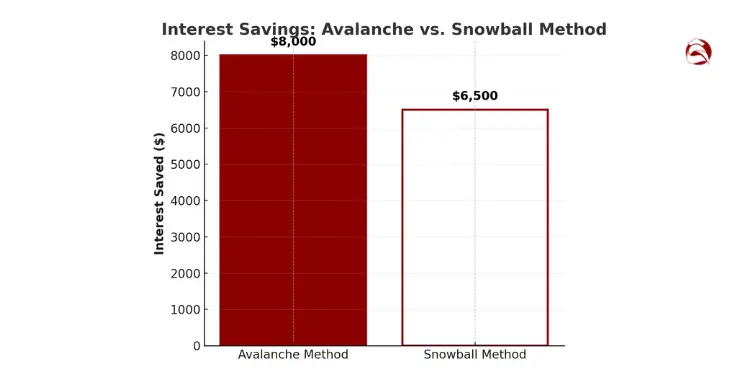

Use Avalanche Method for Efficiency

The “avalanche method” is better for saving money before a mortgage. It focuses on the highest-interest debt first, no matter the balance.

For example, if you have a $2,000 credit card at 22% APR and a $5,000 car loan at 6%, pay the credit card first. Every extra $100 saves you $22 a year, not $6. This saves a lot over time, even with hidden costs of buying a house.

Paying debts from highest to lowest APR (the “avalanche”) minimizes total interest paid compared with balance-size prioritization, according to peer-reviewed evidence.Ref.: “Brown, A. L. & Lahey, J. N. (2014). Small Victories: Creating Intrinsic Motivation in Savings and Debt Reduction. National Bureau of Economic Research.” [!]

Here’s how to use the avalanche method:

- Sort your debts by interest rate, with credit cards first

- Keep up with minimum payments to protect your credit score

- Put all extra money towards the highest-rate debt until it’s gone

- Then, use that money for the next highest-rate debt

Make a 90-day plan with specific payments and dates. Use calendar alerts to stay on track. I’ve seen people pay off $8,000 in high-interest debt in 5 months, saving over $1,700 in interest.

Keep your credit card balances low to improve your credit score. Try to get each card below 30% of its limit, then below 10% for the best score. This helps you pay off debt faster and shows lenders you’re responsible with credit.

“Explore More: Tips for tight budget home buying success“

Negotiate Lower APR with Creditors

Before paying more on high-interest debt, try to get a lower rate. This simple step can save you a lot of money. Just call your creditors and ask for a better rate.

Be clear and confident when you call. Talk about your good payment history and any other offers you’ve gotten. Ask for a rate cut of at least 3-5 percentage points.

Card issuers frequently lower APRs by 3–5 percentage points for long-standing customers who demonstrate timely payments and reference competing offers—one phone call can translate to hundreds in annual savings.Ref.: “White, M. C. (2014). 5 Super Simple Tricks to Lower Your Credit Card Bill. TIME.” [!]

Here’s a script that works:

“I’ve been a cardholder for [X] years with perfect payment history, and I’ve received offers for 0% balance transfers. I’d prefer to keep my balance with you—can you lower my rate from [current rate] to [target rate] or better?”

Write down who you talk to and what they promise. If you don’t get a good rate, call back in 30 days. Different people might say yes.

Even a small rate cut can save a lot of money over time. This is true for credit cards you’ve had for years and paid on time.

| Debt Repayment Method | Best For | Financial Impact | Psychological Benefit | Timeline to Mortgage Readiness |

|---|---|---|---|---|

| Avalanche Method | Maximum interest savings | Highest overall savings | Satisfaction from optimal strategy | Typically 6-18 months |

| Snowball Method | Multiple small debts | Higher interest cost | Quick wins build momentum | Typically 8-24 months |

| Debt Consolidation | Multiple high-rate debts | Moderate savings, simplified payments | Reduced stress from fewer payments | Typically 12-36 months |

| APR Negotiation + Avalanche | Mortgage preparation | Maximum savings with minimal effort | Empowerment from proactive approach | Typically 5-15 months |

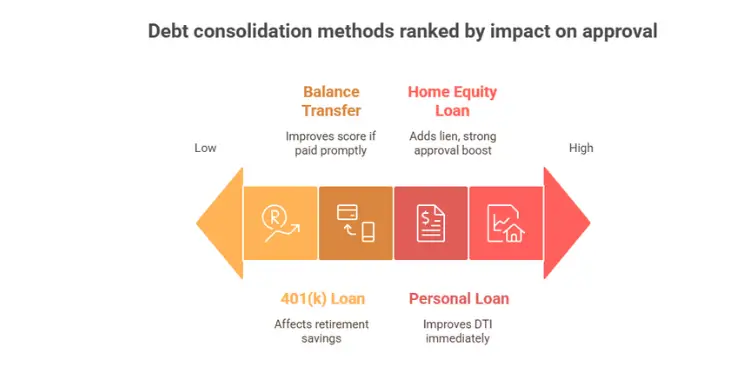

Consolidate loans to lower monthly payments

For those with many payments, consolidation is a great way to simplify finances. It can also help you get a better mortgage. Lenders look at your debt-to-income ratio closely. This ratio is key to getting a mortgage.

By combining debts into one, you can lower this ratio. This makes your financial situation look better to lenders.

I’ve helped many clients with consolidation before they apply for a mortgage. It can cut down monthly payments by $300-400. This makes your finances look simpler to lenders.

This is most helpful 6-12 months before buying a home.

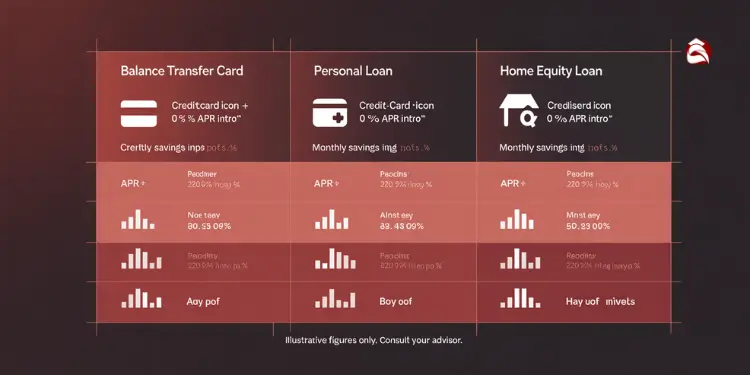

Two Effective Consolidation Strategies

There are two main ways to consolidate debts. Each method works best for different situations.

One way is to use a balance transfer credit card. If your credit score is 680 or higher, you can get a card with no interest for 12-21 months. But, there’s a 3-5% fee for transferring the balance.

0% balance-transfer cards usually charge a one-time 3–5 % transfer fee; if the balance remains when the promo ends, standard (often high) APR applies retroactively, eroding expected savings.Ref.: “Bankrate Editors. (2025). Credit Card Balance Transfer Calculator. Bankrate.” [!]

For example, moving a $10,000 balance from 18% to 0% interest saves about $1,800 a year. But, you’ll pay a $300-500 fee.

Another option is a debt consolidation loan. These loans have fixed rates, usually 7-12% for good credit. They replace many payments with one. This is good for lenders who like seeing one loan payment.

“When I consolidated $22,000 of credit card debt into a single personal loan, my monthly payments dropped from $780 to $430. Six months later, I qualified for a mortgage that previously seemed out of reach.”

Consolidation helps your DTI ratio right away. This makes your finances look better to lenders. It can also mean better mortgage terms and more money for your home.

“Check This Out: Frugal home buying tips for budget conscious buyers“

Calculating Your Consolidation Benefits

Before you consolidate, check if it’s worth it. Here’s a look at how different options can help:

| Consolidation Method | Best For | Typical Interest Rate | Monthly Payment Impact | Effect on Mortgage Approval |

|---|---|---|---|---|

| Balance Transfer Card | Smaller debts ($5K-15K) | 0% for 12-21 months | Reduction of $150-250 | Moderate improvement if paid before applying |

| Personal Loan | Larger debts ($15K-50K) | 7-12% fixed | Reduction of $200-500 | Immediate DTI improvement |

| Home Equity Loan | Existing homeowners | 5-7% fixed | Reduction of $300-700 | Strong improvement but adds lien |

| 401(k) Loan | Emergency situations | Prime + 1-2% | Reduction of $200-400 | Eliminates debt but affects retirement |

Avoiding Post-Consolidation Pitfalls

After consolidating, it’s important not to get into debt again. I’ve seen many clients ruin their chances by getting into debt again. Here are some tips to avoid this:

- Close unnecessary credit accounts or request lower limits

- Store cards securely away from your wallet

- Set up automatic payments for your consolidation loan

- Track spending with a budget app to prevent slippage

Mortgage lenders will check your credit again before closing. New debt can ruin your chances of getting a mortgage. It might even make your monthly payments higher or require private mortgage insurance.

Done right, consolidation can give you more money each month. It also makes you a stronger candidate for a mortgage. Many first-time buyers have gone from almost approved to fully approved in just a few months.

“Learn More About: Zero budgeting vs percentage budgeting deciding the better fit“

Adopt zero based budget for repayment

Attacking high-interest debt is key to quick progress. But, to keep going, you need a zero-based budget. This way, every dollar has a job, helping you pay off debt before buying a home. It’s different from just tracking spending.

Begin by tracking all your spending for 30 days with apps like Mint or YNAB. This shows you where your money goes. Many people find they spend $200-300 on things they don’t need, which could help pay off debt faster.

After tracking, make categories for your homebuying goals. Split expenses into “essential” (like housing and food) and “flexible” (like dining out). This helps you see where you can cut back without hurting your life.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

For those aiming to qualify for a mortgage, try the 50/30/20 rule. Use 50% for essentials, 20% for savings, and 30% for debt. This can cut your debt payoff time by 3-6 months.

Start with small cuts, like canceling unused subscriptions or buying less. Most people can save $200-400 a month without big changes in their life.

Zero-based budgeting makes you accountable. When every dollar is used, you stop wasting money. This speeds up your journey to a good debt-to-income ratio for lenders.

“Read More: How to reduce debt before buying house effectively“

Track Cash Flow Using Envelope System

The envelope system is great for managing cash flow. It’s better than digital budgeting for some. Clients who use cash for fun spending cut their monthly spending by 12-18%.

Here’s how to use it well:

- Take out cash for fun spending at the start of each month

- Put it in envelopes for each category

- Stop spending in a category when the envelope is empty

- Set up automatic transfers for bills and debt

This method helps you pay off debt first. The limit of cash stops you from overspending. When you run out of money for fun, you’ll find cheaper ways to have fun.

Keep track of every purchase in a spreadsheet or app. Label each as “need” or “want.” This helps you see where you spend too much. Check your spending weekly to see what’s working and what’s not.

Most clients find 5-10% more to put towards debt by doing this. The envelope system makes money limits real, changing how you spend.

For those with low credit, this method helps in two ways. You pay off debt faster and your credit score goes up. This can raise your score by 20-40 points in six months, helping you get better mortgage terms.

Lenders check your spending habits when approving mortgages. These disciplined habits show you’re ready to be a homeowner.

“Further Reading:

Increase income dedicated to debt reduction

Boosting your income can cut your debt fast. I’ve seen clients get to homeownership sooner with this plan.

First, work more at your main job. Ask for overtime, get that raise, or look for promotions. Every extra dollar helps you get a mortgage easier.

Second, make some extra money on the side. Work 8-10 hours a week at gigs like food delivery or freelancing. One client paid off $12,000 in credit card debt in seven months with weekend work.

Use a “debt thermometer” to track your progress. Celebrate each $1,000 you pay off. This keeps you motivated to reach your down payment goal.

Lenders check your debt when deciding on loans. Paying off debt makes you a stronger buyer. Services like Rocket Mortgage can help you get better terms.

Not having credit card debt makes buying a home easier. Your good credit and lower payments make you a strong buyer in the market.