Low income home buyer grants help many Americans buy homes. They offer money that doesn’t need to be paid back. This makes buying a home possible for those with little money.

Did you know only 17% of first-time buyers know about local help? Governor Kathy Hochul just gave out $51 million in grants. This helped over 1,000 families with affordable housing.

“The gap between income and housing costs is growing,” says the Department of Housing and Urban Development. These programs are more important than ever.

In my nine years as a REALTOR®, I’ve seen many families change their lives. Homebuyer assistance programs have helped them a lot. One client got a $7,500 grant. It cut their monthly payment by $210.

Quick hits:

- Federal, state, and local options available

- Many programs operate first-come, first-served

- Eligibility varies by location and income

- Application processes differ between programs

- Timing matters for securing funds

Federal grant options increasing affordability

First-time homebuyers with modest incomes can find help through federal grants. These grants make buying a home more affordable. I’ve helped many clients find their first homes using these grants.

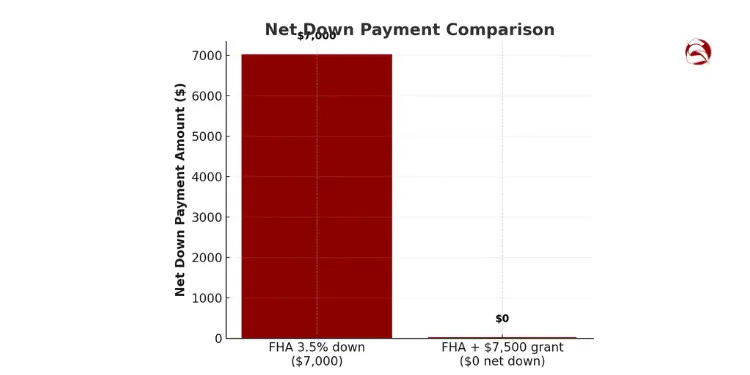

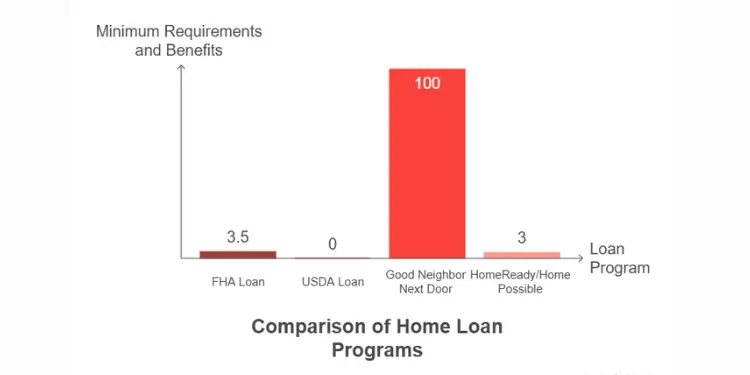

The Federal Housing Administration (FHA) has down payment help. FHA loans need only 3.5% down for those with good credit. This means you can buy a $200,000 home for $7,000 instead of $40,000.

FHA loans can be paired with grants to lower costs even more. Many of my clients use these loans with HUD-approved grants. This way, they can buy a home with little money upfront.

Rural Development Opportunities Through USDA

USDA Rural Development loans and grants are great for those willing to live outside cities. They offer 100% financing, meaning no down payment. Many suburban areas qualify, not just rural ones.

USDA loans need a credit score of 640 or higher. Income limits vary by area but are usually 115% of the median income. I helped a family of four buy a $230,000 home for no money down, just 25 minutes from downtown.

USDA Section 502 Guaranteed Loans offer up to 100 % financing; most lenders require a 620–640 FICO score and household income not exceeding 115 % of area median income. Ref.: “U.S. Department of Agriculture Rural Development (2025). Single Family Housing Guaranteed Loan Program Fact Sheet. USDA.gov.” [!]

HUD’s Good Neighbor Next Door Program

Teachers, law enforcement, firefighters, and EMTs can get a 50% discount on homes. This program helps strengthen neighborhoods by encouraging these professionals to live nearby.

You must live in the home as your primary residence for at least three years. Properties are listed for just seven days on the HUD Home Store website. Quick action is key.

Eligible buyers must occupy the property as their sole residence for 36 months, and HUD lists each home for only 7 days—meaning financing and bid paperwork must be ready before the window opens. Ref.: “U.S. Department of Housing and Urban Development (2024). Good Neighbor Next Door Sales Program Overview. HUD.gov.” [!]

Fannie Mae and Freddie Mac’s First-Time Buyer Programs

Fannie Mae and Freddie Mac offer first-time buyer programs. Their HomeReady and Home Possible programs allow down payments as low as 3%. They also have more flexible income requirements than standard loans.

These programs consider income from all household members, not just those on the mortgage. They also allow rental income from spare rooms or basement apartments. This can save you thousands over the life of your loan.

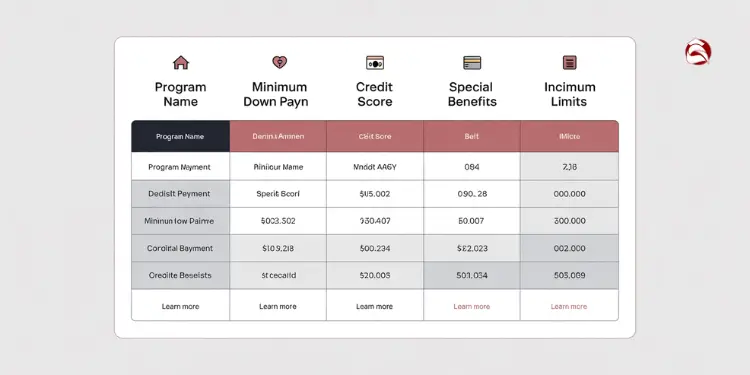

| Program | Minimum Down Payment | Credit Score Minimum | Special Benefits | Income Limits |

|---|---|---|---|---|

| FHA Loan | 3.5% | 580 | Lower credit requirements | None |

| USDA Loan | 0% | 640 | No down payment needed | 115% of area median |

| Good Neighbor Next Door | $100 | 580 (with FHA) | 50% price discount | None (occupation-based) |

| HomeReady/Home Possible | 3% | 620 | Lower mortgage insurance | 80% of area median |

Real-World Example: Teacher’s Path to Homeownership

One of my clients, a teacher earning $45,000, bought her first home. She found a $200,000 house near her school. With an FHA loan, her down payment was $7,000 (3.5%).

She got a $5,000 down payment grant from the Department of Housing. This reduced her down payment to $2,000, plus $3,000 in closing costs. The grant had a five-year residency requirement, fitting her career plans.

Her monthly mortgage payment was $1,350. This was just $150 more than her rent. Now, she builds equity with each payment, not enriching a landlord.

Three Steps to Determine Your Federal Assistance Eligibility

- Check your credit score and income – Most federal programs have minimum credit requirements and income limits. Free credit reports are available at AnnualCreditReport.com.

- Research location-specific programs – Visit HUD.gov and search for programs in your target area. USDA eligibility maps at USDA.gov show which areas qualify for rural development loans.

- Connect with an approved lender – Not all mortgage lenders participate in every federal program. Find HUD-approved lenders through the HUD website or contact me for referrals.

To start your application process, visit Grants.gov for federal grant listings or HUD.gov for program-specific portals. Remember, registration is required at Grants.gov and SAM.gov before applying for most federal funding opportunities.

The Department of Housing and Urban Development announces new funding opportunities through Notices of Funding Opportunities (NOFOs). These contain all application requirements. I recommend setting up email alerts on these sites to stay informed about new or modified programs.

“Federal homeownership programs transformed my financial future. The down payment assistance I received made the difference between continuing to rent and building equity in my own home. Five years later, I’ve built over $40,000 in equity through appreciation and mortgage payments.”

In my nine years helping first-time buyers in Greenville, I’ve seen these federal programs open doors that seemed permanently closed. The key is understanding which programs align with your specific situation and moving quickly when opportunities arise. The extra effort to navigate these programs pays dividends for years to come.

State specific assistance initiatives applicants overlook

Every state has its own housing finance agency with special programs. These programs help first-time buyers a lot. But, many buyers only look at FHA loans and miss out on state help.

State programs offer down payment help, closing cost assistance, and low interest rates. They often have higher income limits and easier rules than federal programs.

Let’s look at three state programs that show the help available:

- New York’s SONYMA DPAL Plus – Offers up to $30,000 in down payment help as a loan you don’t have to pay back

- California’s CalHFA – Gives low interest rates and up to 3.5% of the purchase price in down payment help

- Texas’s My First Texas Home – Offers low mortgage rates and grants up to 5% of the loan amount

States have special programs for heroes like teachers and first responders. They also help rural buyers and those who buy energy-efficient homes. These programs offer more help and easier rules.

The State of New York Mortgage Agency (SONYMA) is a great example. SONYMA helps first-time buyers with mortgage loans and down payment help. They can finance many types of homes.

To get into SONYMA programs, you need to work with approved lenders. SONYMA also connects you with housing counseling agencies. These agencies offer help and classes to prepare you for buying a home.

| State | Maximum Grant Amount | Income Limit (% of AMI) | First-Time Buyer Requirement | Special Features |

|---|---|---|---|---|

| New York | $30,000 | Up to 165% | Yes (with exceptions) | Forgivable after 10 years |

| California | 3.5% of purchase price | Up to 140% | Yes | Extra benefits in high-cost counties |

| Texas | 5% of loan amount | Up to 100% | Yes (with exceptions) | Tax credit option available |

| Florida | $10,000 | Up to 140% | No | Hurricane resistance incentives |

| Illinois | $6,000 | Up to 120% | No | Targeted area enhancements |

To find your state’s housing finance agency, search “[Your State] housing finance agency” or visit the National Council of State Housing Agencies website. Many states have special areas for extra help, like higher income limits and more assistance.

Income Limits and Purchase Price Thresholds

Understanding income limits is key to knowing if you qualify for state help. Most programs look at household income, not just the buyer’s. This can change how you qualify.

Area Median Income (AMI) sets the limits for most programs. State programs usually let you qualify at 80-120% of AMI. For example, a family of four in a big city might qualify with up to $96,000 income. A single buyer might qualify with up to $67,200.

To check if you qualify:

- Find your county’s AMI on the HUD website

- Know your household size (all people living in the home)

- Multiply the AMI by the program’s percentage limit

- Compare your income to this figure

When figuring out your home buying budget, remember purchase price limits too. These limits are based on your county’s median home price. In expensive areas, limits can be over $800,000. In rural areas, they might be as low as $300,000.

SONYMA shows what state programs usually need. You need steady income for two years and good credit. SONYMA doesn’t say what credit score you need, but lenders usually want 580-620.

Many buyers don’t know how income is counted. Some programs use a two-year average, others just your base salary. Retirement accounts are often not counted, but cash gifts might need proof.

Application Timelines and Rolling Deadlines Explained

Applying at the right time is important. State programs have different ways to fund their programs:

- Rolling applications – First-come, first-served until funds run out (most common)

- Fixed application periods – Specific times of the year with open and close dates

- Lottery systems – Randomly choose from qualified applicants (used in high-demand areas)

For rolling applications, apply early in the year (usually July-September). Many programs use up all their money in 6-8 months. This leaves late applicants without help until the next year.

Most programs need you to finish a homebuyer education course 30-90 days before closing. These courses take 4-8 hours and can be done online or in person. Planning ahead prevents last-minute delays.

Be ready to send a lot of documents with your application. Programs usually want:

- Tax returns (2-3 years)

- Recent pay stubs (30-60 days)

- Bank statements (2-3 months)

- Employment verification

- Landlord references

- Proof of homebuyer education completion

A common mistake is applying for help after you’ve made an offer. Many programs need pre-approval before you make an offer. Start your application early to include the help in your offer and avoid financing issues.

If your program runs out of money mid-year, don’t give up. Look at other sources like nonprofit programs, employer help, or community funds. You can also get ready for the next funding cycle by finishing all requirements and staying in touch with program staff.

Remember, loan applications and program applications have different timelines. Your mortgage pre-approval is good for 60-90 days, but program eligibility can last 4-6 months. Plan carefully and keep in touch with your lender and program staff.

Nonprofit programs covering down payment gaps

Many first-time buyers don’t know about nonprofit help. These groups offer the last bit of money needed for a home. In Greenville, I’ve seen nonprofits help families buy homes sooner than they thought.

Nonprofits help in three ways. National groups have programs in many places. Local groups focus on certain areas. Community land trusts offer special ownership models.

National Nonprofit Programs With Proven Track Records

NACA is known for its no-down-payment mortgage. Their “Buy Now” program helps buyers get ready for homeownership. They look at your payment history, not just your credit score.

NeighborWorks America has a network of nearly 250 local groups. They offer grants for down payments, up to $15,000. They help more families than government programs, even those who earn too much.

Habitat for Humanity builds homes for buyers. They offer 0% interest mortgages. Payments are based on your income.

Faith-Based and Community Organizations

Many religious groups help with down payments. The Fuller Center for Housing offers 0% interest loans. You don’t need to be religious to qualify.

Local community foundations help with closing costs. These programs are often more flexible than government ones. You can use these funds with other programs to increase your down payment.

Credit unions work with nonprofits to create special mortgages. They offer matched savings accounts. This means your savings can double.

Finding Local Nonprofit Resources

HUD has a database of housing counseling agencies. Visit HUD.gov or call 800-569-4287 to find local help. These counselors know about programs you might not find online.

When you contact a housing agency, ask about down payment help. Many agencies work with different nonprofits. It’s good to talk to at least three.

Most programs need you to take a homebuyer class. These classes cover budgeting and mortgage options. After finishing, you get a certificate that’s good for 6-12 months.

| Nonprofit Organization | Assistance Type | Typical Amount | Special Requirements | Application Timeline |

|---|---|---|---|---|

| NACA | No down payment mortgage | Full financing | Homebuyer workshops, budget counseling | 3-6 months |

| NeighborWorks America | Down payment grants | $3,000-$15,000 | Income limits vary by location | 30-60 days |

| Habitat for Humanity | Affordable home purchase | Varies by market | Sweat equity hours, need-based selection | 6-18 months |

| Local Housing Trust Funds | Closing cost assistance | $1,500-$5,000 | First-time buyer status, area median income limits | 2-4 weeks |

| Faith-Based Programs | Interest-free loans | $5,000-$20,000 | Community residency, homebuyer education | 4-8 weeks |

Maximizing Nonprofit Counseling Services

Housing counselors offer more than just program info. They help improve your credit and manage debt. Working with them for three months can get you $8,000 more in assistance.

Nonprofit counselors know about special mortgages for first-time buyers. These mortgages can save you thousands. They often have lower fees and interest rates.

The best thing about nonprofit counseling is the ongoing support. They help you after you buy a home. This support lasts 12-24 months.

Homsite’s Mortgage Assistance Program (MAP) is a great example. It offers up to $3,000 for down payments in Auburn. Outside Auburn, they have low-interest loans. This shows how nonprofits can fill gaps in government help.

When applying for nonprofit help, stay organized. Keep all requirements and deadlines in one place. Missing a deadline can delay your homebuying by months. Set reminders for each step.

“read more: Ten smart ways to cut expenses to afford house faster

Employer sponsored housing benefit opportunities

Employers offer special help for homebuyers. This is a big surprise for many. They can help you buy your primary residence with less money down.

Many companies help because of high housing costs. Almost 14% of big employers give housing help. But, not many employees use these benefits.

Types of Employer Housing Benefits

There are four main types of employer help:

- Down Payment Assistance – Grants or loans to help with the first payment

- Matched Savings Programs – Your employer matches your savings for a home

- Mortgage Subsidies – Lower interest rates or monthly help from employers

- Homebuyer Education – Free courses to get ready for owning a home

Big companies like Amazon and Google are helping with housing. They give over $3 billion for affordable homes. Hospitals also help, giving up to $10,000 for nurses.

Universities offer special housing help too. They give loans or access to homes near campus. For example, Stanford helps its employees with low mortgage rates.

How to Discover Your Employer’s Housing Benefits

You need to ask your HR department about these benefits. Ask these questions:

- “Does our company offer any housing assistance or homebuyer programs?”

- “Can tuition reimbursement benefits be applied to homebuyer education courses?”

- “Are there any partnerships with local lenders that provide special rates for employees?”

- “Does our employee assistance program include housing counseling services?”

It’s best to buy a home when your employer gives out benefits. This can be at the start of the year or with bonuses.

Read also: How to avoid overspending on house purchase budget

Tax Advantaged Employer Assistance Benefit Structures

Knowing about taxes on employer benefits is key. Not all benefits are taxed the same. Planning can make your benefits worth more.

Employers can give up to $5,250 a year for education tax-free. This can help you get better mortgage rates. Even though it’s not a lot, it can lead to bigger benefits.

Employer Housing Programs often use loans that become grants. This way, you don’t pay taxes on the forgiven amount. It’s a smart way to get help without paying too much in taxes.

Some employers offer Mortgage Credit Certificates. These give you a tax credit of up to $2,000 a year. This can save you a lot of money over time.

Employer-matched savings programs are great too. They let you save for a home with your employer’s help. First-time buyers can use this money without the usual penalty, but you’ll have to pay income taxes.

| Benefit Type | Typical Amount | Tax Treatment | After-Tax Value* | Key Advantage |

|---|---|---|---|---|

| Direct Grant | $10,000 | Taxable income | $7,800 | Immediate funds, no repayment |

| Forgivable Loan | $15,000 | Taxable as forgiven | $11,700 | Tax impact spread over years |

| Mortgage Credit Certificate | $2,000/year | Direct tax credit | $2,000/year | Dollar-for-dollar tax reduction |

| Matched Savings | $5,000 | Taxable upon withdrawal | $3,900 | Encourages disciplined saving |

| Education Benefit | $5,250 | Tax-free benefit | $5,250 | Improves borrower qualifications |

*After-tax value calculated for 22% tax bracket

Lenders need specific documents for employer help. You’ll need a letter from your employer. This letter should show how much help you get and any rules.

Using employer help with government programs can help more. For example, you can use employer help with FHA loans that need only 3.5% down. But, some programs can’t be used together.

Your credit score is important even with employer help. Most programs need a score of 620 or higher. Check your credit report early to fix any problems.

Employer help often comes with rules. You might have to stay with the company for a few years. Make sure you understand these rules before accepting help.

As your real estate agent, I can help you use these benefits. The right mix of employer help and regular financing can make buying a home easier.

Read more: Frugal home buying tips for budget conscious buyers

Steps to qualify and maximize grant awards

Getting ready for home buyer assistance programs takes a clear plan. Start 12 months before you buy. I’ve helped many first-time buyers get ready. This way, you can get the most help and money.

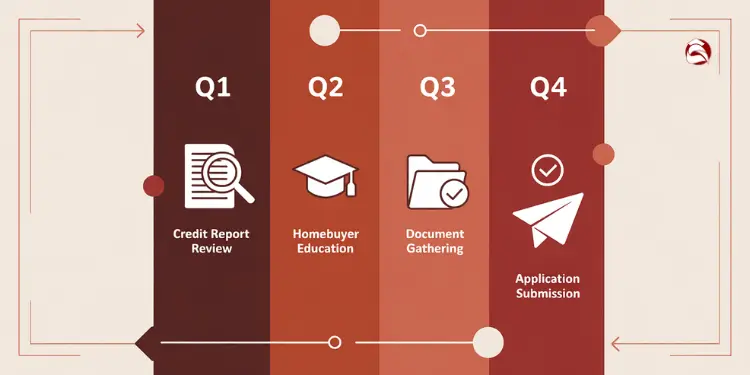

The 12-Month Preparation Timeline

First, work on your credit score. Most programs want scores between 620-640. You can get a free report from all three big credit places. Fix any mistakes right away.

Pay down debt to boost your score. Try to lower credit card balances and pay off small debts. Even $500 can help a lot.

| Months Before Application | Priority Actions | Common Mistakes to Avoid |

|---|---|---|

| 10-12 Months | Pull credit reports, dispute errors, begin debt paydown | Closing old accounts, applying for new credit |

| 7-9 Months | Complete homebuyer education, research program options | Changing jobs, making large purchases |

| 4-6 Months | Gather documentation, stabilize income reporting | Large bank deposits without documentation |

| 1-3 Months | Apply for pre-approval, submit program applications | Starting home search before securing approvals |

Financial Decision Timing

The six months before applying are your “quiet period.” Avoid new credit, job changes, and big deposits. Lenders and grant programs watch your money closely.

If you get money from family, move it three months early. Each big deposit over $500 needs a letter explaining it. This helps avoid hidden costs when buying a house.

Documentation Strategies

Good grant applications need good documents. Start a digital folder now. It should have:

- Income verification: Last two years’ tax returns, recent pay stubs, W-2s

- Asset documentation: Bank statements (all pages, even blanks)

- Identity documents: IDs, Social Security cards, residency proof

- Program-specific forms: Organized by program name

Self-employed buyers need extra care. Keep your income steady and work with an accountant. Two years of steady income helps a lot.

Read also: Essential single income home buying budget strategies

Homebuyer Education Requirements

Almost all programs need you to take a HUD-approved course. These certificates last 6-12 months. Do it 7-9 months before you plan to buy.

There are free and cheap options:

- Framework Online ($75, often reimbursable)

- eHome America ($99, accepted by most programs)

- Local housing authorities (often free)

- HUD-approved counseling agencies (free or sliding scale)

A Freddie Mac study of 38,000 affordable-mortgage borrowers found pre-purchase counseling reduced 90-day delinquency rates for first-time buyers by 29 %, confirming the payoff of completing HUD-approved education early. Ref.: “Avila, G., Nguyen, H., & Zorn, P. (2013). The Benefits of Pre-Purchase Homeownership Counseling. Freddie Mac.” [!]

Choose courses with one-on-one counseling. These sessions can help you find more help.

Layering Multiple Assistance Programs

Maximizing your benefits means using more than one program. You can mix state down payment help with federal tax credits. Or use nonprofit grants with employer help.

The Q1 2025 Homeownership Program Index counts 2,509 active assistance programs—up 55 year-over-year—making strategic “program stacking” increasingly feasible for well-prepared buyers. Ref.: “Peck, E. C. (2025). Making the Most of Down Payment Assistance Programs. The MortgagePoint.” [!]

Each program has its own rules and times. Keep track of them all with a spreadsheet.

Working with Experienced Lenders

Not all lenders know about these programs. Ask them about their experience. Find out which programs they know and how they handle money at closing.

Getting pre-approved is key. Do it 3-4 months before you plan to buy. This gives you time to fix any problems.

Timing Your Home Search

Don’t start looking for houses before you’re approved. Sellers won’t wait for grant approval.

Apply for all grants first. Then, you can shop with confidence. Sellers will see you’re ready to buy.

“The most successful first-time buyers I’ve worked with spent 9-12 months preparing their finances before ever stepping foot in an open house. Their patience paid off with an average of $12,500 in combined assistance.”

Follow this plan to get the most help and money. It may take time, but it’s worth it.

Alternative financing solutions when grants insufficient

When grants don’t cover everything, other financing options can help. Many first-time buyers use different sources to buy a home. This is because they don’t have enough money for down payments and closing costs.

Shared Equity Options Partnering With Nonprofits

Shared equity programs are a new way to afford a home. They let you and a nonprofit share the ownership. This means you only pay for the home itself, not the land.

This can lower the home’s price by 20-30%. It keeps the home affordable for a long time. And you can start building equity.

But, you’ll have to share some of the home’s value when you sell it. Yet, it’s better than renting. You’ll get to keep some of the home’s value and pay down the mortgage.

“read also:

Lease Purchase Paths Building Ownership History

Rent-to-own deals are a way to get closer to owning a home. They help when you can’t get a mortgage right away. You pay rent that also goes toward your down payment.

These deals help you improve your credit score. Look for clear rules on the purchase price, option fees, and who does the maintenance. Nonprofit groups often have these programs with financial advice to help you qualify for a mortgage.

FHA and VA loans can also help. They offer lower interest rates and smaller down payments when you’re ready for a mortgage.