Adopting the 50/30/20 budgeting method can initially feel challenging, akin to navigating unfamiliar territory. You use half for needs, thirty percent for fun, and the rest for saving.

Does this idea make you wonder? According to the Federal Reserve, 37% of U.S. adults would cover a $400 emergency expense using cash or its equivalent, indicating reliance on credit or borrowing for unexpected costs. “Money should make life easier, not harder,” said Joe Dominguez, a personal finance writer.By implementing the 50/30/20 budgeting strategy, I successfully eliminated $80,000 in debt.

Quick hits:

- Keep track of your monthly money coming in

- Use half for bills you must pay

- Set aside 30% for things that make you happy

- Save 20% for emergencies

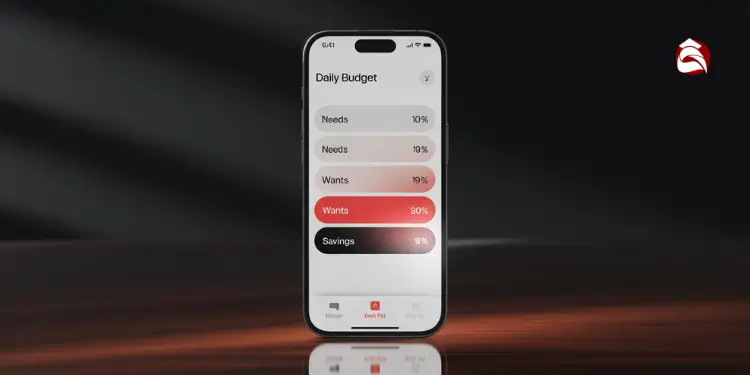

Embed Budget Numbers Into Daily Decisions

It’s always there, like our budget. We keep our budget numbers in mind every day. This way, every dollar we spend helps us reach our goals.

We do micro-checks often. Studies show that regular expense tracking enhances financial self-regulation, leading to reduced discretionary spending. We want to enjoy things like eating out or celebrating birthdays. But we don’t let these wants control our money. For more on balancing needs and wants, check out this guide.

Expense-tracking as a self-regulatory behavior is empirically linked to a significant reduction in discretionary spending, supporting greater budget adherence in real-world contexts. Ref.: “Zhang, Y. (2023). Financial Self-regulation: How Does Expense-Tracking Inform Financial Behaviors? Consumer Interests Annual, 69.” [!]

Check Balances Before Every Spending Choice

Before we buy something, we check our money. This habit stops us from spending too much. It keeps us on track with our budget.

Use Wallet App Widgets For Awareness

Using smartphone widgets offers real-time visibility into budget allocations, reinforcing daily financial mindfulness. Having your budget app on your home screen is helpful. It reminds us of our 50/30/20 plan every day.

1-Minute Action: Turn on a wallet or banking widget in your phone settings now. Look at it every time you use your card.

WidgetKit defines three standard widget families—systemSmall, systemMedium, and systemLarge—allowing budgets to be displayed in compact 1×1, 2×1, and 2×2 grid configurations on the Home Screen. Ref.: “Apple Inc. (2024). WidgetKit Framework: WidgetFamily. Apple Developer Documentation.” [!]

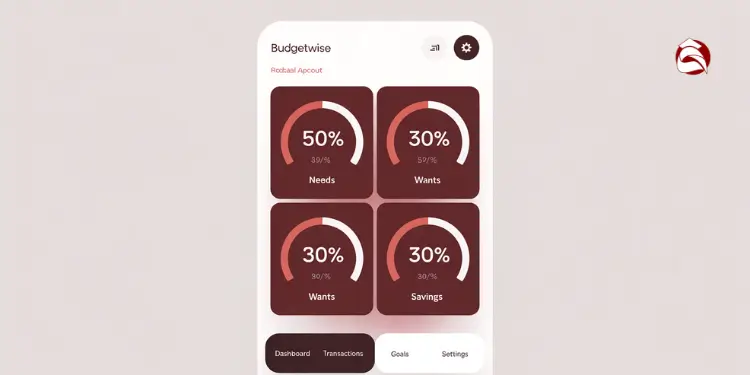

Use Envelope Method To Reinforce Discipline

Imagine allocating your funds into distinct categories, similar to organizing items into labeled containers. Each crate is for a spending area you want to keep safe. We use envelopes, whether digital or physical, to ensure every dollar has its own designated place.

Creating multiple digital envelope accounts may increase monthly bank fees, since the average checking account incurs $7.69 in fees; using five envelopes could cost over $38 per month. Ref.: “Bankrate. (2020). Survey: People Stick With Same Checking Account For 14 Years. Bankrate.” [!]

Set Digital Envelopes For Wants Category

Having a special account for each want, like weekend trips or birthday dinners, makes spending clear. We can use a zero-budget envelope approach. We label each account and check balances before spending. This helps us reach our big goals.

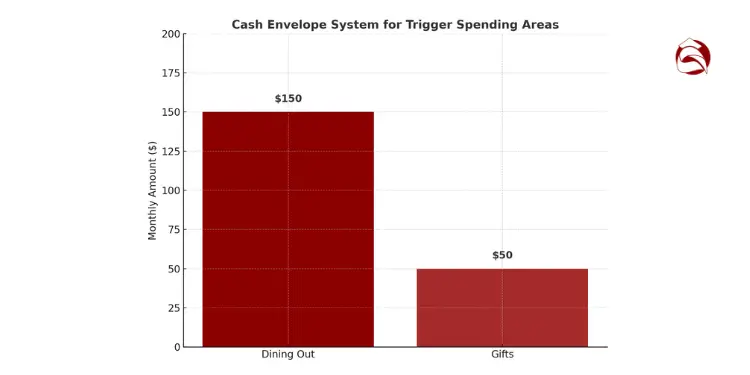

Carry Cash For Trigger Spending Areas

Research suggests that using cash for purchases can lead to spending reductions of 12% to 18% compared to card usage. Using cash in an envelope for things like coffee or craft supplies gives us instant feedback. This simple change stops us from buying on impulse and keeps us on track.

| Envelope Category | Monthly Amount | Key Benefit |

|---|---|---|

| Dining Out | $150 | Reduces surprise takeout costs |

| Gifts | $50 | Maintains friendly generosity |

Harness Accountability Partners For Extra Motivation

Like a boat crew ready to pull lines when they snag, we stay on course by leaning on trusted supporters. An accountability partner helps us dodge overspending and keeps our progress real. U.S. Federal Reserve data shows 40% of Americans lack $400 for emergencies, so we’ll work together to ensure our 50/30/20 plan sticks.

“Understand Operation: How does 50/30/20 budget work for you“

Share Weekly Progress With Trusted Friend

We can start by briefing a friend who respects our goals and checks in on highs and lows. A quick text about last week’s wins fosters steady momentum. They remind us to trim the sails on spending when waves of temptation hit. This routine often transforms day-to-day decisions, giving us the nudge we need to stay in the clear.

Join Online Groups For Fresh Ideas

Virtual communities spur creative tips on keeping needs, wants, and savings balanced. Budgeting forums and Facebook groups discuss safe ways to handle looming bills or juggle mortgage payments. Tapping into different voices reveals new angles on cutting expenses, as explained in our budget-friendly guide.

Maine Metaphor: When we holler for help, our crew jumps aboard fast.

Timed Action (2 minutes): Send that first progress text, then mark your calendar for the next friendly check-in.

Prepare Contingency Plan For Financial Emergencies

Imagine a hidden life vest under every seat on a lobster boat. We hope we never need it, but it’s there when disaster strikes. This thinking keeps our budget safe.

Consumers with at least one month of emergency savings reduce their use of high-cost credit (payday or auto-title loans) from 16% to just 3%, an over 80% relative reduction in reliance on expensive borrowing. Ref.: “Consumer Financial Protection Bureau. (2022). Emergency Savings and Financial Security. CFPB.” [!]

“Budget Basics: 50/30/20 budget basics for first time budgeters“

Tap Emergency Fund Before Touching Budget

An emergency fund is like a shock absorber for sudden expenses. It helps when jobs change, cars break down, or medical bills surprise us. Saving for these moments keeps our big goals on track.

Data from the Fed shows 65% of Americans struggle to track their spending. This can lead to bigger problems. Having extra money helps us stick to the 50/30/20 plan.

“Saving for emergencies gave me confidence that my paycheck could cover long-term needs,” says a local finance coach.

“Discover Benefits: Why use 50/30/20 budget for your personal finances“

Pause Discretionary Spending Until Crisis Passes

We stop spending on non-essentials. This protects the 20% we save. A guide on 50/30/20 vs. pay yourself first shows why saving regularly is key, even when money is tight.

Just take one minute to open a special account, even if it starts with $25. This simple step helps us face life’s challenges without losing our financial security.

“Real-Life Example: 50/30/20 budget example for a typical monthly income“

Review Budget Trends Monthly And Quarterly

We watch our spending like a lighthouse watches the sea. Monthly checks show if we’re spending too much. It’s like checking if the tide is high or low.

It’s good to see how much we spend on food, gyms, and home decor. A quick look at our statements helps us see if we’re on track. We use a useful guide to make sure we’re not spending too much on wants.

- Track each category: see if you paid more than planned on treats or travel.

- Mark any debt payments above the minimum to help you be free sooner.

- Note any new surprises, from holiday tickets to self-care splurges.

“Quick Planning: 50/30/20 budget calculator for quick planning and spending balance guide“

Spot Pattern Shifts And Adjust Quickly

We look for changes every month and confirm them every quarter. This keeps us on track before spending gets out of hand. Making quick changes helps us avoid big problems.

“Navigate Change: 50/30/20 budget breakdown of needs, wants, and savings“

Celebrate Improved Ratios With Small Treats

We should celebrate when we keep wants under 30%. A small treat, like local chowder, can be a reward. Just five minutes to review last month’s spending and make a change for the better.

Recalibrate Percentages After Major Life Changes

Our money is like Maine’s weather. It can change fast. A new job, a bigger family, or moving can change how we spend.

We spend less when we need to. We put more money towards big expenses when we can.

“Low-Income Stretchers: 50/30/20 budget for low income households that stretches every dollar“

Handle Job Changes With A Temporary Split

At first, we might stick to 50/30/20. But then, we might change to 55/25/20. This helps us adjust to new money coming in.

We wait to see how taxes, commuting, and insurance affect us. Some families use 60/20/20 for bigger needs like childcare or car repairs.

“Beginners’ Guide:

Adapt For Marriage, Parenting, Or Relocation

Getting married or having a baby changes things. One parent might work less. We adjust our budget to fit our new life.

When we move, costs can go up. So, we save less for a while until we settle in.

Set a timer for four minutes. Choose one small change to your budget. It could be saving a bit more or spending less. Then, see how it changes and adjust as needed.