To set good investment goals, you need clear plans, not just wishes. I’ve helped many investors start strong. They turned their assets into powerful tools for growing wealth.

Did you know 65% of Americans who build wealth write down their financial goals?

“The difference between a wish and a goal is simply a deadline and a number,” my first mentor said. This advice has helped Phoenix investors for 12 years.

When I started investing, I chased returns without goals. My portfolio was all over the place, not helping my life.

Goals-based investing is about meeting your financial needs, not just beating the market. It helps you live the life you want, not just grow your portfolio.

Quick hits:

- Link investments to life priorities

- Create measurable, time-bound financial targets

- Develop specific aims, not general ones

- Match investing basics with personal needs

- Build your customized financial roadmap

Assess Current Financial Situation Fully

First, take a good look at your money situation. Knowing where you are now helps plan for the future. Many people make better choices after understanding their finances.

Think of this as taking a financial photo. It shows what you have and what you owe. This helps you make a plan that’s just right for you.

Understanding four key things is important. These are what you own, what you owe, your income, and your expenses. Let’s look at how to do this step by step.

Documenting your financial objectives boosts achievement likelihood by more than 40%, underscoring the value of writing down each investment goal. Ref.: “Matthews, G. (2007). The Impact of Commitment, Accountability, and Written Goals on Goal Achievement. Dominican University of California.” [!]

To understand the importance of goal-based investing, Goal Based Investing Explained for New Investors

List Assets Debts Income Obligations

Make a simple spreadsheet with four columns. This helps organize your money. It often shows surprising things and helps with future choices.

| Assets | Debts | Income | Obligations |

|---|---|---|---|

| Checking accounts | Mortgage balance | Salary (after tax) | Housing payment |

| Savings accounts | Auto loans | Bonus/commission | Utilities |

| Investment accounts | Credit card balances | Investment income | Insurance premiums |

| Property (market value) | Student loans | Side business | Minimum debt payments |

| Valuable personal items | Personal loans | Rental income | Subscriptions/memberships |

When listing assets, use today’s market values. This gives a clear picture of your wealth. Include all accounts and investments that can be quickly sold.

Because average U.S. credit-card rates exceed 24% APR, paying down high-interest debt typically delivers a higher net return than most investment portfolios, and should precede new asset purchases. Ref.: “Beers, B. (2025). Should I Pay Off Debt or Invest Extra Cash? Investopedia.” [!]

For debts, list every obligation with current balances and payments. This helps spot high-interest debt to tackle first.

Your income column should show all steady income after taxes. Be honest here – only include income you can rely on. This is the base for your monthly investment.

The obligations column tracks fixed monthly costs. It’s not about tracking every small expense. It’s about understanding your basic living costs. The difference between your income and expenses is how much you can invest.

This process often reveals surprising facts. I’ve seen clients realize they spend 35% on housing, thinking it’s 25%. Others find small subscriptions eat up a lot of their budget, making it hard to save.

Calculate your net worth by subtracting debts from assets. This number is just a starting point. It helps set realistic goals for your investments.

Having an emergency fund is key if you don’t have one. Aim for 3-6 months of expenses in easy-to-access accounts. These funds provide security and prevent selling investments at bad times.

The more detailed your assessment, the better your investment plan. Understanding your finances well helps choose the right risk level and set goals. Do this before setting personal objectives.

For practical examples of common investment goals, Examples of Common Investment Goals for Beginners illustrates how to set and prioritize financial targets effectively.

Define Clear Personal Life Objectives

Your journey with money starts with clear goals. In over 12 years, I’ve seen how goals linked to life events keep investors focused. It’s not just about money; it’s about your mind.

First, list 3-5 big goals that need money. Think about what’s important to you. Do you want to save for retirement or buy a house soon?

Many people aim to:

- Retire by 65 with a certain income

- Save for a house in 3-5 years

- Save for college with a set amount

- Leave a legacy of a certain value

- Start a business with a specific amount of money

For each goal, write down three key things. First, say what you want to achieve exactly. Second, pick a deadline. Third, decide how important it is compared to other goals.

The SMART model—Specific, Measurable, Achievable, Relevant, Time-bound—emerges from decades of goal-setting research and consistently correlates with higher performance outcomes. Ref.: “Locke, E. A. & Latham, G. P. (2002). Building a Practically Useful Theory of Goal Setting and Task Motivation. American Psychologist.” [!]

Being clear makes your financial dreams real. Instead of just wanting to save for retirement, aim to have $1.2M by 62 for $5,000 monthly.

The difference between a wish and a goal is a deadline and a number.

Right after college, you might focus on an emergency fund or paying off loans. New parents often save for college and retirement at the same time. Your goals depend on your life.

Financial regulators recommend holding an emergency fund equal to **three to six months of essential expenses** to avoid forced investment liquidations during market stress. Ref.: “Federal Deposit Insurance Corporation. (2023). Tax Season and Your Refund Options. FDIC Consumer News.” [!]

Write your goals as if you’ve already done them. Say “I have saved” instead of “I will save.” This makes you more committed and it feels easier to reach your goal.

Knowing your goals helps you choose the right investments. Whether it’s for retirement by 45 or college savings, pick investments that match your timeline and needs.

Use the SMART method for your goals. Make them Specific, Measurable, Achievable, Relevant, and Time-bound. This way, your goals are clear and you’ll stay on track with every investment choice.

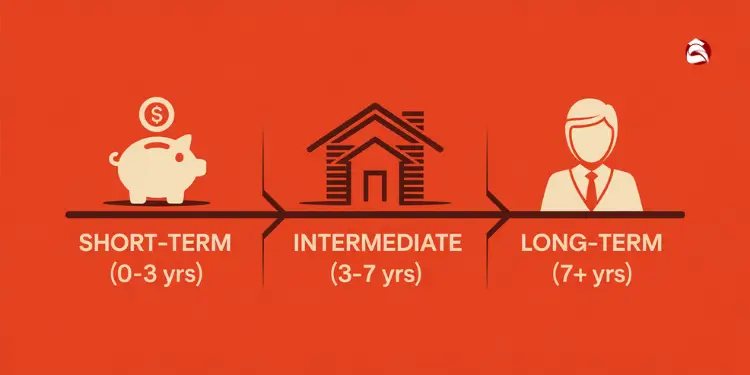

Estimate Time Horizons For Goals

The clock for your financial goals is called your time horizon. It affects every part of your investment plan. In 12 years of helping investors, I’ve seen time horizon matter more than almost anything else. Knowing when you need your money helps you choose between growth and caution.

I divide investment goals into three time frames. Each needs a different strategy:

| Time Horizon | Timeframe | Primary Focus | Typical Goals | Risk Considerations |

|---|---|---|---|---|

| Short-term | 0-3 years | Capital preservation | Emergency fund, vacation, tax payments | Minimal volatility acceptable |

| Intermediate-term | 3-7 years | Balanced growth | Home down payment, education funding | Moderate volatility acceptable |

| Long-term | 7+ years | Growth maximization | Retirement, legacy planning | Higher volatility acceptable |

For short-term financial goals (3 years or less), keeping your money safe is key. You need it to be stable and easy to get. Volatility is a big risk when you don’t have time to recover losses.

Short-term investments are safe but don’t grow much. Think of high-yield savings, money market funds, and short bonds. They’re stable and liquid, perfect for now.

When I need money within three years, I focus exclusively on capital preservation. Growth becomes a secondary consideration when your timeline doesn’t allow recovery from market dips.

Intermediate-term goals (3-7 years) offer a balance. You can handle some risk for better growth. Goals like saving for a home or education fit here.

For these goals, mix bonds, dividend stocks, and balanced funds. It’s about finding growth without too much risk.

Long-term investments (7+ years) get the most from compound interest. With time, market ups and downs don’t matter as much. Your retirement account can handle big swings.

Compound interest grows your money faster over time. A 30-year investment grows more than a 10-year one, even with the same returns. This makes long-term goals great for growth.

Match each goal with the right time frame. This decides the best investments and how much risk you can take.

- Short-term goals (0-3 years): Focus on liquidity and stability

- Intermediate-term goals (3-7 years): Balance modest growth with reasonable stability

- Long-term goals (7+ years): Prioritize growth over short-term stability

Life can change your plans. Make your strategy flexible. Keep some money in easy-to-get places for unexpected needs.

Before you start, assign each goal to its time frame. This step makes sure your investments match your needs perfectly. It’s key to a good investment plan.

For a foundational understanding of investment goals, consider reading Investment Goals Explained in Simple Terms for Beginners, which offers a step-by-step guide to setting achievable financial objectives.

Calculate Required Returns And Contributions

First, figure out how long you have to reach your financial goals. Then, find out how much you need to earn and contribute. This makes your goals real and shows you how to get there.

To reach each goal, you need two numbers. You must know the return your investments need to make. And how much you must contribute each time.

These numbers work together. If you can’t earn much, you might need to contribute more. But if your investments do well, you can save less.

I’ve helped many investors with this. It’s key to how investment goals shape your portfolio.

Use Online Goal Calculator Tools

Online tools are the best way to do these calculations. Vanguard’s Goal Calculator and Bankrate’s Investment Calculator are good choices. They are easy to use and accurate.

To use these tools, you need four things:

- How much you already have saved for this goal

- How long you have until you need the money

- How much money you need in total

- The inflation rate (use 2.5% for safe planning)

Put in these details, and the tool will tell you how much you need to earn and save each month. This gives you clear goals for saving and investing.

If you need an 8-9% return for long-term goals, you have three choices. You can save more, wait longer, or lower your goal. Expecting too much return is a common mistake.

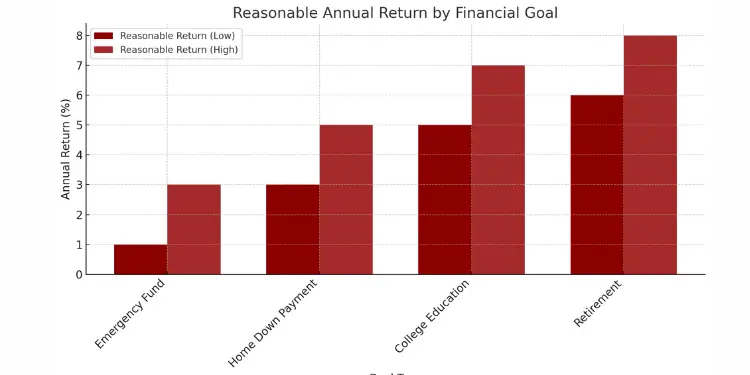

| Goal Type | Typical Time Horizon | Reasonable Annual Return | Contribution Strategy |

|---|---|---|---|

| Emergency Fund | 0-2 years | 1-3% | Aggressive until funded |

| Home Down Payment | 2-5 years | 3-5% | Consistent monthly |

| College Education | 5-18 years | 5-7% | Monthly with annual increases |

| Retirement | 15-40 years | 6-8% | Percentage of income |

Adjust For Inflation And Taxes

Calculator results aren’t the whole story. Inflation and taxes affect your money over time. Not accounting for these can ruin your plans.

Inflation makes your money worth less over time. For goals over 15 years, add 2% to your target each year to keep up with costs. Education goals need even more, like 5-6% annual increases.

Taxes also matter, depending on your investments. For goals over 5 years, consider your tax rate when planning returns. Tax-advantaged accounts like 401(k)s and IRAs can boost your after-tax earnings.

“The most dangerous words in investing are ‘this time it’s different.’ Historical returns provide context, but your personal required return is the only benchmark that truly matters for meeting your goal.”

After figuring out your needed return and monthly savings, write them down. They are your goals’ benchmarks. If the market changes, you might need to adjust your investments or savings.

These numbers also guide how to spread your investments. Higher returns often mean more growth assets. Shorter goals or lower returns might mean safer choices.

Remember, all investments carry risk. Diversification helps, but it’s not a guarantee. Knowing your needed return helps avoid too much or too little risk.

Match Risk Tolerance To Strategies

Aligning your investment strategy with your risk tolerance is key to success. Many investors leave good plans behind when markets get tough. They do this because their portfolios are too risky for them.

Your investment strategy should match your goals and how you feel about risk. High net worth investors must think about all their money, not just investments. Institutional investors have to balance what’s best for them with what others want.

Those who can handle more risk might choose stocks or alternative investments. But, if you’re more cautious, bonds or safe strategies might be better. Knowing how you feel about losing money is important.

“read also: Investment Goal Planning Basics for Beginner Investors“

Complete Standardized Investor Risk Questionnaire

A risk questionnaire is a good way to know your comfort with risk. These tools help you understand your risk tolerance better than just guessing. Most brokerages offer these, or a financial advisor can help you.

Good risk questionnaires look at a few things:

- Your feelings about market drops

- How long you can wait for your money to grow

- How quickly you need your money

- Your past investing experience

- How much money you can afford to lose

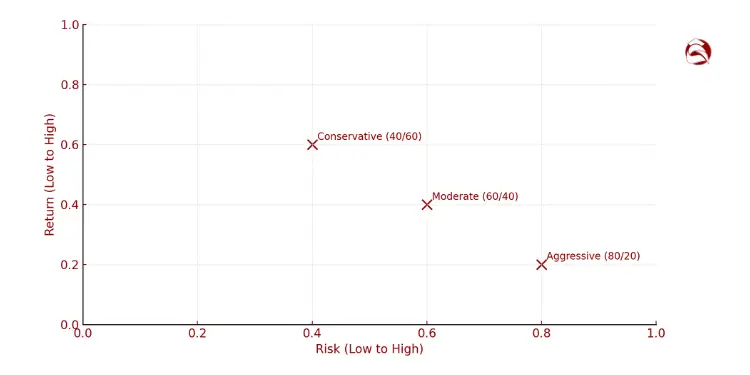

After taking the questionnaire, you’ll know where you stand. Investors are usually seen as Conservative, Moderate, Growth-oriented, or Aggressive. This helps figure out the right mix of investments for you.

For example, a Moderate investor might choose 60% stocks and 40% bonds for a 10-year goal. A Conservative investor might pick 40% stocks and 60% bonds. These choices help make a portfolio that fits your goals and comfort level.

If your needed returns are too high for your risk, you have a few options:

- Save more money to need less return

- Wait longer for your money to grow

- Set a more realistic goal

The worst thing is to ignore this problem. I’ve seen investors set unrealistic goals that lead to bad choices. When markets drop, they panic and lose money, ruining their plans.

Write down your risk profile and investment plan. This helps you stay on track when markets are shaky. It’s like a guide that keeps you from making emotional choices.

Read More:

Document Plan And Track Progress

The last step in your investment journey is to make a investment plan. This plan will guide your money choices. It’s like a map for your money, helping you stay on track even when the market changes.

Your plan should list each goal with its target amount and date. Include saving for college, retirement, and an emergency fund. Say how much you need to save each month for each goal. Also, show your investment targets and how much they can change.

Set reminders every three months to check your progress. During these checks, see if you’re saving as planned. Remember, the market goes up and down. Keep saving as planned.

Life changes can change your financial goals. Marriage, kids, or a new job might mean you need to adjust your goals. Check your plan at least once a year to make sure it fits your life now.

If you’re not sure about your investments, think about getting help from a financial expert. Even if you manage your money yourself, getting advice now and then is good. Many brokerages have tools to help you plan for both taxable and tax-advantaged accounts.

Remember, investing always carries some risk. But with a good plan, you can handle market ups and downs. Your plan helps you stay disciplined and secure your financial future.