The 50/30/20 rule makes money management easy. It splits your income into three parts. This helps you decide how to spend your money wisely.

Ever wonder why some people handle money better than others? It’s not just about how much they earn.

A Federal Reserve survey found that 40% of Americans can’t afford a $400 surprise without borrowing. This shows why budgeting is key. Senator Elizabeth Warren says, “Getting your money right is the first step to getting your life right.”

In eight years, I’ve helped many with their finances. The 50/30/20 rule works for everyone. It’s flexible and fits any income.

Some people prefer zero-based budgeting for more control over spending. It’s great for managing what you want to spend on.

Quick hits:

- Allocate half your earnings to necessities

- Reserve 30% for personal enjoyment items

- Dedicate 20% toward future financial security

- Adjust percentages based on personal circumstances

- Start with your actual take-home pay

Defining needs under the 50 percent slice

It’s key to know the difference between needs and wants when using the 50/30/20 budget. Many people confuse what they need with what they want. The 50% slice should only cover true needs, like health and safety costs.

True needs are things you must have to live. They are like the base of your financial life. If you spend more than half your income on needs, you might need to change your lifestyle.

Ask yourself if not paying for something would cause big problems. If yes, it’s a need. Needs are the basic version of things, not the fancy one.

HUD classifies households spending more than 30 % of income on housing as “cost-burdened,” reinforcing the article’s guideline to keep essential housing costs below this threshold. Ref.: “U.S. Department of Housing and Urban Development. (2014). Rental Burdens: Rethinking Affordability Measures. PD&R Edge.” [!]

Housing, Food, Healthcare, Transportation Basics

Housing costs usually take up most of your needs budget. Try to keep housing costs under 30% of your income. This is hard in some places, but it’s key to avoid being “house poor.”

Harvard researchers find that 49 % of renter households in high-cost metropolitan areas already devote more than 30 % of income to housing, so your “needs” slice may exceed 50 % until structural fixes—downsizing, shared housing, or higher earnings—become possible. Ref.: “Harvard Joint Center for Housing Studies. (2024). Renter Cost-Burden Shares Remain High. America’s Rental Housing 2024.” [!]

Food is a must, but you can choose how to buy it. Basic groceries are needs, but fancy food or takeout are wants. Meal planning can help save money on food.

Healthcare costs are a must. This includes insurance, meds, and check-ups. Skipping these can lead to bigger problems later, like I learned with dental care.

Transportation that gets you to work and important places is a need. This could be a car payment, bus passes, or rideshare. The important thing is to know the difference between need and want.

Utilities like electricity and phone plans are also needs. Watch these costs for a month to figure out your needs budget. Many people are surprised by how much these costs can change.

Minimum Debt Obligations and Protections

Minimum debt payments are non-negotiable needs. This includes credit cards, loans, and more. Not paying enough can hurt your credit and lead to legal trouble.

While paying more on debt is good, only the minimum payments are needs. Extra payments are savings.

Basic insurance is also a need. This includes health, auto, and renters insurance. These protect you from big financial losses.

An emergency fund is a need, even though it’s savings. It helps avoid debt when unexpected costs come up. I tell all my clients to save for emergencies and pay off debt.

Keep track of your debt each month to see your progress. This keeps you motivated on your way to financial freedom. Remember, extra debt payments are savings, not needs.

“The difference between a want and a need is often just a matter of perspective. True needs keep you alive, healthy, and able to work. Everything else—no matter how important it feels—is ultimately a want.”

Check your needs list every month. Changes in your life can change what you need. Keeping a clear list of needs helps you save and enjoy wants.

Typical wants fitting the 30 percent bucket

Enjoying life and being responsible go hand in hand. The 30% wants category lets you have extras without ruining your budget. Unlike needs, wants are things you can live without but choose to spend on to make life better. This part of the 50/30/20 rule says you can have fun, not just survive.

Many people feel bad about spending on wants or don’t know how much they spend on non-essentials. The 30% rule helps keep spending in check while letting you enjoy life’s comforts.

Wants are things you can do without without hurting your basic needs. When I started using this system, I found many things I thought were needs were actually wants.

Streaming, Coffee, Gadgets and Upgrades

Small, regular expenses in your wants category can add up fast. These costs can take a big chunk of your 30% if not watched closely.

Subscription services are a big example. Those $9.99 monthly streaming platforms and $4.99 premium app subscriptions seem cheap but add up. I once found I was spending over $200 monthly on services I barely used!

Going to the coffee shop is a want. Basic groceries are needs, but that $5 coffee is a want. The same goes for impulse snacks and convenience foods that you can make at home.

Buying new gadgets and tech upgrades is usually a want unless you really need it. The latest smartphone or gaming system makes life better but isn’t necessary. Premium services like super-fast internet when basic is enough also belong here.

I recommend implementing a 24-hour rule for non-essential purchases over $50. This simple waiting period helps reduce impulse spending and ensures you’re making conscious choices about the things you want.

Try tracking these expenses for a month with a spending app. You might be surprised to find that small, frequent purchases often outpace the occasional larger splurge in their impact on your financial well-being.

Dining, Travel, Hobbies, Styling Budget Lines

Big wants like travel and hobbies need more planning but give more joy per dollar. These big expenses happen less often but cost more.

Travel and vacations are big wants many people love. Saving a little each month for your next trip lets you travel without worrying about money.

Dining out is a want, but it’s important for social and fun times. Budget for these experiences instead of spending on impulse.

Hobbies and fun activities, like sports or crafts, make life better but should fit in your wants budget. Styling expenses, like salon visits or new clothes, are also wants.

Make sub-categories in your wants budget for different spending areas. This stops one area, like dining out, from using up all your wants money.

| Want Category | Examples | Budget Impact | Management Strategy |

|---|---|---|---|

| Subscriptions | Streaming services, premium apps, memberships | High cumulative impact | Quarterly audit and elimination |

| Daily Luxuries | Coffee shop visits, convenience foods | Moderate recurring impact | Weekly spending limit |

| Technology | Gadgets, upgrades, premium services | Periodic large impact | Planned replacement schedule |

| Experiences | Travel, dining out, entertainment | Variable large impact | Dedicated sinking funds |

| Personal Style | Clothing, accessories, salon services | Moderate variable impact | Seasonal budget allocation |

The 30% guideline is a maximum, not a goal. Spending less on wants can help pay off debt or save for the future. Check your wants spending every quarter to make sure it matches your priorities.

The 50/30/20 approach is simple and works well. It lets you spend on wants while keeping your finances in check. This way, you can enjoy now and plan for later.

“Explore This: How to make 50/30/20 budget with clear practical step by step“

Gray area expenses deciding with judgment

When you budget, you’ll find gray area expenses. These are not just needs or wants. They fall somewhere in between, needing careful thought.

Ask yourself, “What’s the minimum I need?” This helps decide if it’s a need or a want. This rule works for any budgeting method.

What’s a need for one person might be a want for another. For example, some training is a need, but others are wants.

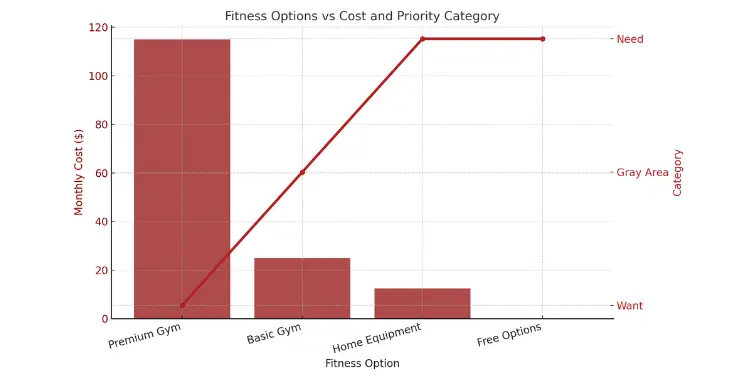

Gym Membership Versus Home Workouts

Health and fitness expenses need careful thought. Basic activity is a need, but how you do it is up to you.

Gym memberships are a gray area. They might be a need if your doctor says so. But for most, they’re wants because cheaper options exist.

Home workouts can be just as good without the cost. Clients have found cheaper ways to stay fit, like using resistance bands and YouTube videos.

| Fitness Option | Monthly Cost | Category | Considerations |

|---|---|---|---|

| Premium Gym | $80-150 | Want | Amenities, classes, social aspect |

| Basic Gym | $10-40 | Gray Area | Equipment access, weather protection |

| Home Equipment | $5-20 | Need | One-time purchase, space required |

| Free Options | $0 | Need | Walking, bodyweight exercises, free videos |

The real question is, is your fitness method the best value? This question applies to many gray area expenses.

Brand Name Clothing: Essential or Luxury

Clothing is a common gray area expense. Basic clothes are needs, but choices are endless.

Brand name clothes show the gray area. A waterproof coat is a need, but the choice between a $100 and a $500 coat is a want.

Professional appearance can make this choice hard. What’s the right standard for you?

For some professionals, higher-quality business attire might legitimately qualify as a need, while for others working in casual environments, it would be a clear want.

When buying clothes, ask if a cheaper option works. If yes, the extra cost is a want.

This rule helps with many products. It’s not about cutting out wants but making smart choices.

By thinking about each gray area expense, you can make better budget choices. This way, your money goes where you want it to.

Thoughtful decisions about gray area expenses help your budget reflect your priorities. This way, you avoid spending without thinking.

“Check This Out: 50/30/20 budget example for a typical monthly income“

Quick tests separating necessity from desire

Figuring out what you really need versus what you want is easy with these five tests. When I help people with their budgets, these tools are super helpful. They make it clear what’s important and what’s not.

The first test is the Survival Test. Ask if you can live without it. Things like food, a home, and health care are must-haves. Anything else is something you want, even if it feels important.

The Substitution Test is next. Think if a cheaper option works just as well. If yes, it’s a want. For example, a car is a need, but a fancy car is a want.

The Frequency Test looks at how often you need something. Daily meds are needs, but buying things you don’t need often is a want. This test helps you see what you really need versus what you just want.

The Without It Test asks what happens if you don’t have it. If it doesn’t hurt your health or safety, it’s a want. This test helps you focus on what’s really important for your financial well-being.

Lastly, the Prior Existence Test asks if you were okay before buying it. If yes, it’s a want. This test is great for figuring out if you really need a service or product.

When in doubt, think of it as a want. This makes your budget safer and helps you save for emergencies.

Let’s use a gym membership as an example. It’s not a must-have, but you might need it for health. It’s not a must-have, but you might need it for health.

If you’re unsure about an expense, write it down. Then, use all five tests. If it fails one, it’s a want.

This method makes sure you save for what you really need first. It helps you set financial goals and save for retirement. By knowing what you really need, you can enjoy life more while saving for emergencies.

Start today by checking one expense you’re unsure about. You might learn a lot about your spending habits.

Adjusting ratios when wants creep upward

Budget ratios often need to be checked often. This is true when “wants” start to take more of your money. Over eight years, I’ve helped many create budgets that fit their needs.

Most people don’t start with the 50/30/20 plan right away. It’s not a sign of failure. It’s a chance to make things better.

“Wants creep” is when you spend more on fun things than planned. This can sneak up on you. Before you know it, saving less than you want.

If your spending doesn’t match the 50/30/20 plan, don’t worry. First, figure out where you are now. Are you spending too much on wants and not enough on savings?

“Learn More: 50/30/20 budget breakdown of needs, wants, and savings“

Identifying Imbalance Sources

Then, find out what’s causing the problem. It’s often small things that add up. Not one big expense.

For spending too much on needs, look for ways to cut costs. Maybe get better insurance or a cheaper phone plan.

For too much on wants, wait 48 hours before buying something fun. This can help you spend less.

I’ve found that checking my subscriptions every quarter helps. It’s surprising how many small charges add up!

Making Gradual Adjustments

Don’t try to change everything at once. Aim to improve by 2-3 percentage points each month. This way, you won’t get discouraged.

Here are some ways to adjust when you’re spending too much on wants:

- Recategorize thoughtfully: Some things you think you need might really be wants. Be honest about what’s essential.

- Trim flexible necessities: You can often find better deals on things you need.

- Set specific limits: Instead of cutting out wants, set limits. Like eating out only twice a week.

- Use cash for problem categories: For areas where you spend too much, use cash. It makes it easier to stick to your limits.

The 50/30/20 rule is a guide, not a strict rule. Life changes might mean you need to adjust. If you live in a very expensive area, you might need to spend more on needs.

Using a percentage-based budget is flexible. It changes with your income. This makes it easier than a zero-based budget where every dollar is assigned.

Tracking Progress Effectively

To keep your spending in check, track it every month. Many tools can help you see your spending percentages. Check these numbers at least once a month.

Every little improvement is worth celebrating. Moving from 40% to 35% on wants is a big deal. It means you’re saving more for the future.

The key is progress, not perfection. Every small change helps build good financial habits for the long term.

“Explore Further:

Printable checklist for weekly spending review

Make the 50/30/20 budget rule a habit with regular checks. My printable weekly review checklist makes this budgeting method real.

The checklist tracks your spending in all three categories. It focuses on your wants, that 30% where spending can get out of hand. Wants include things like eating out, Netflix, shopping, vacations, and hobbies.

This simple tool includes:

• Space to record weekly expenses by category

• Running totals showing your current percentages

• A decision framework for upcoming purchases

• A “wins” section to celebrate smart choices

Put this checklist where you can see it. Spend 10 minutes each Sunday evening to fill it out. Writing down your expenses helps you stay aware more than digital tracking does.

For couples, take turns filling out the weekly review. This helps you both understand where your money goes.

Use this budgeting method checklist for four weeks. You’ll see your spending change naturally without feeling like you’re missing out. The 50/30/20 categories will become clearer, making spending choices easier.

Download the printable checklist below and start your first weekly review today. Your future self will be grateful for this simple but powerful habit.