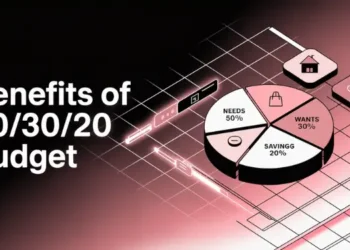

50/30/20 Budget Pros And Cons help us budget better. It’s like the Maine tides shaping our money into three parts. This way, we can save more.

Do you think 50/30/20 could work for you? In the US, many renters spend too much on housing. Senator Elizabeth Warren said budgets show our true priorities. I’ve seen families feel better when they try this budget.

The 50/30/20 rule allocates after-tax income into three fixed categories—50% for essential expenses, 30% for discretionary spending, and 20% for savings or debt repayment. This structure enhances visibility into core costs, enforces a cap on lifestyle inflation, and automates the growth of an emergency reserve. By aligning each segment with specific financial goals, users can monitor housing, utilities, and food costs against the 50% threshold, control non-essential spending within 30%, and build a cash cushion or reduce liabilities at a predictable rate.

Fixed percentages may not suit all circumstances, particularly in high-cost regions or for households with significant loan obligations. Rigid adherence can restrict flexibility when essential costs exceed the prescribed share or when aggressive saving targets are required. Adapting the ratios or combining this rule with alternative budgeting methods—such as zero-based budgeting or tiered savings targets—can address local cost pressures and individual debt-service needs while maintaining the core benefit of structured allocation.

Quick hits

• Split your after-tax income into three.

• Align your spending with financial goals.

• Embrace consistent Budget Design Methods now.

The 50/30/20 rule simplifies complex budgeting into intuitive percentages, making it an accessible framework for beginners. Ref.: “Rachel Cribby (2023). Pros & Cons of the 50/30/20 rule. WealthRocket” [!]

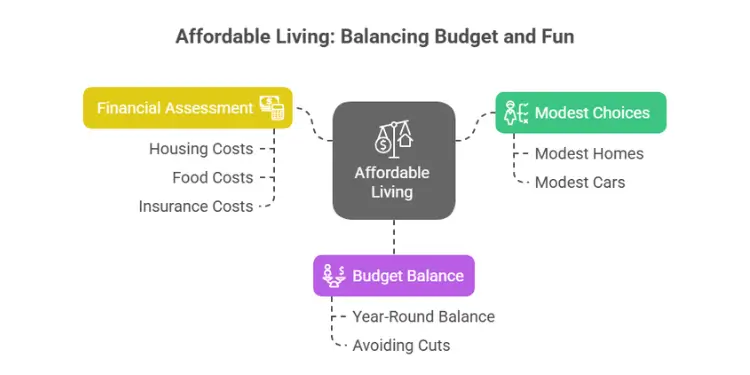

Needs Split Highlights Key Expense Awareness

Think of needs like lighthouses guiding ships. They keep our finances safe by covering rent, groceries, and utilities. We set half of our monthly after-tax income for these items.

This helps us avoid overspending and protect our money plan. It’s a popular budgeting method that lowers stress. It lets us allocate resources where they count most.

Many families use three categories to organize spending. They aim to spend no more than 50% on needs. This keeps a house or car essential but not too big.

This rule work helps avoid spending too much. It encourages making smart choices. In Maine, housing costs are often near 30%, fitting within the 50% target.

If needs grow too high, we might adjust or create a budget differently. Like using a zero-based budget. Here’s an alternative budgeting guide to compare both.

“Needs” are precisely defined as up to 50% of after-tax income covering essentials like housing, utilities, groceries, insurance, and minimum debt payments. Ref.: “Eric Whiteside (2024). The 50/30/20 Budget Rule Explained With Examples. Investopedia” [!]

Predefined Cap Prevents Lifestyle Inflation

We cap spending at about 50% to save for long-term goals. Spending too much on a big house or car takes away from our future. A simpler lifestyle means more money for savings.

Guides Housing Vehicle Choices Toward Affordability

Choose modest homes and cars. This helps us meet our goals without cutting out fun. It’s a small change that keeps our budget balanced all year.

Stopwatch Step: Take 10 minutes to add up your housing, food, and insurance costs. If they’re more than half your income, adjust your spending to stay on track.

“You Might Also Like: how to track zero budget“

Wants Allowance Balances Enjoyment And Guilt

Wants in a Maine budget are like summertime lobster rolls—fresh indulgences that brighten our day. A part of our monthly income for fun can make us feel good and happy.

This way, we can enjoy local outings or a quick treat. We also keep up with savings and debt. It lets us have small rewards that make us feel good about taking care of ourselves.

Freedom To Spend Within Safe Threshold

Imagine a 30% limit for wants without spending too much. It lets us adjust our spending as needed. We can have fun within that limit.

A wants allowance can make us feel free. We can go out to eat or see a new movie. At the same time, we can work on paying off a student loan. For more details, check out this guide.

May Miss Experiences Above Allocation Limit

Staying within this ratio might mean missing out on big splurges. We might choose to pay off debt or save for emergencies instead. Big events could cost more than we can spend.

Our choices depend on our goals. Some of us might put extra money into credit cards or save more. A good plan helps us balance our dreams with everyday wants. It helps us save for emergencies or tackle future needs.

Read More:

Savings Mandate Accelerates Emergency Fund Growth

Think of your emergency fund like a Maine buoy. It keeps your budget safe in rough times. We save a part of our income before we spend too much. This builds a strong cash cushion for unexpected costs.

It’s important to save the right amount. This depends on your needs and wants. Where you live and how much you earn play big roles.

We put money straight into a special checking account. This helps us pay for things like rent and food. It keeps us from spending too much each month.

Use a formula to guide your savings. Include payments for debts. This habit helps us save regularly. A study suggests saving 20% if it fits your budget.

Builds Habit Of Paying Yourself First

Some people save more to pay off credit card debt. This can help but leaves less for wants. It’s good if your needs and wants are balanced.

Save more for a stronger safety net. But, a fixed rate might slow growth. Check your savings plan if your situation changes.

Fixed Percentage Can Hinder Aggressive Goals

- Find a savings goal to protect you from job loss or medical bills.

- Set up automatic deposits to grow your savings each payday.

- Check your savings plan every six months for better flexibility.

Stopwatch Step: Save 10% of your next income after taxes. Do this every payday to build a solid safety net.

“Related Topics: zero budgeting app for couples“

One Size Ratio May Not Fit All

Imagine a Maine lighthouse guiding ships in a rocky harbor. Our 50/30/20 budgeting system might seem strong. But, some people find it doesn’t work when costs go up.

Families often change the percentages if living costs are higher than expected. Or, they find the usual splits don’t fit their needs.

Putting after-tax income into three parts can feel too strict. We can use a budgeting app to check our net income and expenses. Then, we can decide if we can save for retirement.

A flexible approach can help us stay on track while aiming for long-term security. For more tips, see this resource on adjusting each part of our budget.

The 50/30/20 rule may not suit high-cost living areas where essential expenses consume more than 50% of income, requiring substantial adjustments. Ref.: “Dana Ronald (2022). 50/30/20 Rule: Pros, Cons, Examples, and Is It for You? The Muse” [!]

High Cost Cities Require Needs Adjustment

In expensive coastal towns, housing and food can take up more than half our income. This leaves less for savings and paying off debts. A standard plan might not save enough if our earnings don’t keep up with rising costs.

So, we need to find a way to adjust our budget to stay afloat.

Debt Heavy Households Need Custom Approach

Big loan balances can throw us off track. A single ratio might not help us save for the future or pay off debts quickly. Each budgeting system should be flexible to meet our unique needs.

So, every dollar should have a purpose that helps us move forward.

Relying on fixed percentages can leave you underprepared for unexpected high expenses, exposing a vulnerability in your financial safety net. Ref.: “Money Bites Editorial Team (2024). Pros and Cons of the 50-30-20 budget method. Money Bites” [!]

Simple Framework Eases Budget Adoption For Beginners

Imagine a lobster boat in calm waters. That’s how we feel with clear finances. The 50/30/20 rule is a simple start for beginners.

If your needs are more than 50 percent or you have student loans, adjust your budget. We help each other with these steps. This method keeps us moving forward.

Our spending fits into big categories with this rule. Half goes to needs, some to wants, and a part to savings. Saving 20 percent helps us plan for the future.

This rule makes budgeting easier and less guesswork. But, you might need to tweak it for big expenses or life changes.

Quick Math Reduces Setup Analysis Paralysis

Beginners like simple budgeting without complex worksheets. This rule offers clarity. It’s easier to see progress with simple formulas.

For more on its benefits and downsides, check this resource.

Lack Detail Could Miss Micro Improvements

Broad strokes might miss small costs. We find hidden expenses with careful review. Spend a few minutes on small expenses, like streaming fees, to save.

Small changes add up over time. They help us stay on track for the long run.

Oversimplifying budget categories risks obscuring vital micro-expenses—small costs that, when unchecked, can derail your entire plan. Ref.: “BudgetPlanPro Editors (2025). The 50/30/20 Budget Rule Explained. BudgetPlanPro” [!]

“Read Also: 50/30/20 budget calculator“

Decide Whether Tradeoffs Match Personal Priorities

In Maine, making money choices can be tricky. The 50/30/20 rule helps by dividing your money into three parts. It says to spend 50 on needs, 30 on fun, and 20 on savings.

This plan helps us balance wants and needs. But, it might not fit every family. It’s a good start, but we all have different needs.

I’m Dr. Nodin Laramie at Pine Coast Bank. I help families with budgeting. We try a simple way without tracking every penny.

This method groups wants and savings together. It works for some, but not all. We all have different financial paths.

“Related Articles: best zero budgeting tools“

List Financial Goals To Test Alignment

First, write down what you need from your money. List your top three goals, like paying rent or saving for the future. If these goals don’t fit the 50/30/20 rule, change it.

We want each dollar to serve its purpose. Not just follow a rule.

Pilot Budget For Thirty Day Trial

Try this plan for a month. Spend at least half on needs, 30 on fun, and save the rest. See how it feels.

If it works, keep it. If not, adjust and keep moving forward.