50/30/20 budget myths often scare off first-time savers. They distort what should be a solid guide.

Curious if percentages can adapt fast? About 44% of Americans feel underprepared for emergencies (CNBC, 2023). “Structure makes all the difference,” says Suze Orman. I am Dr. Nodin Laramie, CFP, and we’ll map these cash currents together. I once cleared $80k debt by trusting this formula.

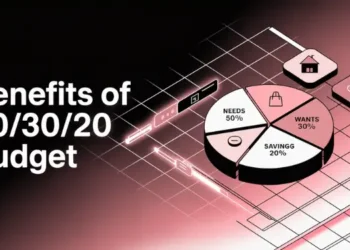

The 50/30/20 budgeting rule is often mischaracterized by rigid myths—such as rent being a “want,” fixed percentages that can’t adjust, and an insufficient savings share—that deter first-time savers. In practice, you begin by calculating your after-tax income, allocate up to 50 percent for essential needs (including rent and debt payments), cap discretionary spending at 30 percent, and reserve 20 percent for savings and long-term goals.

This framework remains effective when applied flexibly: scale allocations to fluctuating income (for example, averaging seasonal earnings), rebalance annually to reflect changing objectives (such as new expenses or debt payoff), and treat student-loan payments as part of needs. Regular reviews and automated transfers ensure technical accuracy, maintain emergency reserves, and support consistent progress toward financial security.

Key Takeaways:

- Calculate after-tax income before budgeting.

- Allocate 50% to essential needs.

- Limit discretionary spending to thirty percent.

- Reserve 20% for savings and debt.

- Adjust percentages based on income fluctuations.

- Rebalance allocations annually to match goals.

Myth rent cannot fit needs category

Imagine a lobster boat with a big hull. That’s what rent can feel like in Maine’s coastal towns. Some think rent is just a want, but it’s not. We can make rent fit into our needs by adjusting other costs.

Todd Gardner’s data shows focusing too much on monthly costs can cause stress. Instead, find your fixed bills and save for what’s really important. Cutting back on streaming or takeout can help. Check out the 50/30/20 budget for a better way to manage your money.

Rent is unequivocally categorized as a “need” within the 50/30/20 budgeting framework, encompassing essential expenses like housing, utilities, and groceries. Adjusting other discretionary expenses can help accommodate higher rent costs without compromising financial stability. Ref.: “Money Bliss. (2025). The 50/30/20 rule: Breaking down your budget categories. Money Bliss.” [!]

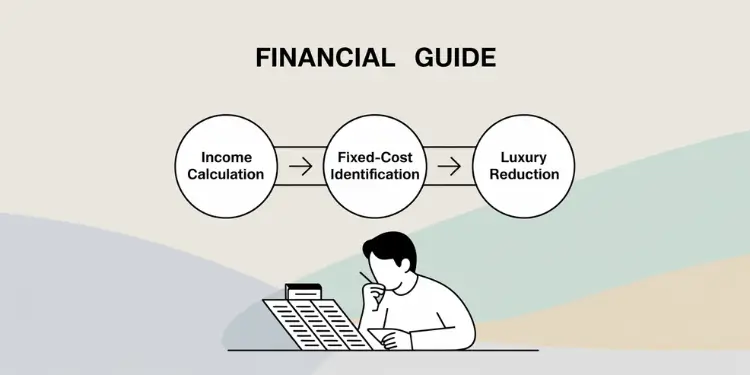

Adjust housing share then trim wants

Families often spend 60% or more on rent, leaving little for other needs. Cutting back on extras can bring financial peace. Here’s how:

- Calculate your after-tax income.

- Find your fixed costs (like rent, food, and transport).

- Reduce one luxury by half for two months.

Stopwatch Action (2 minutes): Choose three things you don’t really need. Cut one in half and use that money for debt or savings.

In high-cost living areas, allocating only 50% of income to needs may be challenging. It’s advisable to adjust the budgeting percentages to reflect personal circumstances, ensuring essential expenses are met while maintaining financial goals. Ref.: “Huntington Bank. (2025). The 50/30/20 Budget Rule and How to Use It. Huntington Bank.” [!]

Myth income level makes rule useless

Tides around Portland’s bay change every day. So do incomes. Some think the 50/30/20 plan doesn’t work if money changes. But that’s not true.

The Bureau of Economic Analysis (2022) found that flexible saving works. We adjust our budget when money goes up or down.

Our income might be less in winter or more in summer. Being flexible with our budget helps us stay on track. We don’t stick to one plan all the time.

The 50/30/20 rule serves as a flexible budgeting guideline adaptable to varying income levels and financial situations. Adjusting the allocations can help accommodate income fluctuations, ensuring essential needs and savings goals are still prioritized. Ref.: “Investopedia. (2025). The 50/30/20 Budget Rule Explained With Examples. Investopedia.” [!]

Scale percentages to earnings fluctuation

Freelancers or those with seasonal jobs often look at three pay stubs. They average these to find a steady monthly income. Needs, wants, and long-term goals get their own funds. This way, we avoid big surprises.

- Reduce needs when hours drop.

- Keep a stable savings slice by scheduling auto-deposits.

- Bump wants up if overtime kicks in.

Stopwatch Action (1 minute): Look at your last few paychecks. Add them up. Then, save 20% of that amount for savings or debt this month.

Employing the 50/30/20 rule with adjustments based on income variability, such as averaging income over several months, can enhance budgeting effectiveness for freelancers and those with irregular earnings. Ref.: “Smartly Spent. (2025). 50/30/20 Rule Explained: Build a Budget That Works for You. Smartly Spent.” [!]

Myth percentages must stay forever fixed

Think of your money like a Maine harbor clock. Each tide makes you adjust to stay steady. Life changes, like a new job or marriage, can change how you spend.

We’ll explore ways to adjust those 50/30/20 rules. This way, they match your new goals.

Rebalance annually to match goals

Don’t believe budgets never change. Maybe you need to spend less on wants to pay for preschool. Some use an envelope system or zero-based budget to track every dollar.

After paying off a credit card, you might save more. PayPal’s research shows checking your budget often helps avoid overspending. This keeps your financial future bright by making timely changes.

Mark an annual budget check in your calendar. It’s a quick way to stay on track. This keeps your finances stable and your mind at ease.

Read More:

Myth savings share too small always

Imagine a tight lobster trap catching more than it looks. That’s what a 20% savings portion can do with the 50/30/20 rule. Elizabeth Warren said this method helps keep budgets flexible and tackle high-interest bills.

Some people think 20% is too little for their needs. But looking closer at budgeting myths shows small steps add up. Paying off debts first frees money for retirement or index funds. Monthly bills feel lighter when we cut expenses and spend smarter.

Increase investments once debts cleared

Our coaching shows faster growth after paying off credit cards. Some like the “pay yourself first” method from this guide. It saves money first, building an emergency fund before unexpected expenses.

- Check your interest rates and estimate a realistic payoff date.

- Use new income or raises for investments when debts are paid off.

- Keep track with regular budget reviews and simple charts.

Stopwatch Action (3 minutes): Write down your current debt total. Make a quick plan to pay it off, then aim higher with future savings.

Myth student loans ruin calculations

Imagine a stormy tide in Portland, where big student loans seem like hidden reefs. We can stay safe if we follow one steady plan.

Many think student loans mess up the 50/30/20 rule. But, loan payments are like rent and food. They keep our budget steady.

Incorporating student loan repayments into the ‘needs’ category of the 50/30/20 budget ensures essential obligations are met. However, significant loan amounts may necessitate adjustments in other categories to maintain financial balance. Ref.: “Paidly. (2025). The 50-30-20 Rule for Student Loan Repayment? Paidly.” [!]

Factor repayment into needs percentage

Student loans are part of your essentials. A 2025 article suggests using autopay for easy math. Census data shows Mainers keep emergency funds, even with big balances, by planning well.

Trimming non-essentials helps if your total gets too big. A small change can free up money for what really matters. We stay afloat by adjusting our wants without losing our budget.

Stopwatch Action (1 minute): Put your student loan into your “needs” category. Then, look at your extras and cut one small thing. This small step protects your savings and keeps your finances steady.