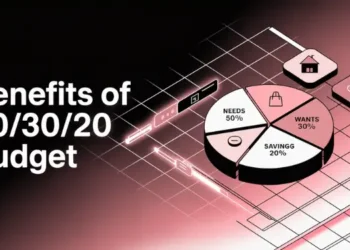

Many beginners make mistakes with the 50/30/20 budget. These errors can slow down progress. It’s important to understand each part of the budget.

Do you know if you’re losing money? Many people don’t track their money well. Elizabeth Warren says, “Budgeting ensures every dollar meets a job.” Small mistakes can lead to big problems. Learn more about zero-based budgeting to improve your budget.

Many budgeters misclassify discretionary spending as essential, omit irregular obligations from the needs category and rely on gross rather than net income, leading to imbalanced allocations and unexpected shortfalls. Skipping periodic percentage reviews and treating the savings portion as a variable buffer further undermines the 50/30/20 framework’s integrity and can erode long-term financial goals.

Accurate implementation requires precise categorization of wants versus needs, incorporation of sinking funds for annual or irregular bills, and calculation based on actual post-tax income. Establishing automated transfers for the savings slice and conducting monthly audits of allocation percentages ensure adherence to the 50/30/20 rule and maintain budgetary discipline.

Quick hits

- Carefully clarify wants and needs precisely.

- Track every net dollar intentionally.

- Auto-transfer savings to protect goals.

- Review percentages monthly after changes.

- Stay consistent while new habits form.

Automating transfers ensures consistent savings contributions and frees users from manual processes. Ref.: “Vanguard Researchers (2025). Emergency savings may hold key to financial well-being. Vanguard.” [!]

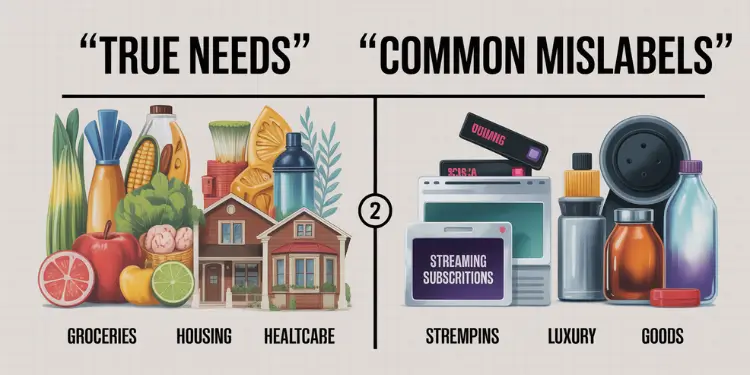

Mislabeling wants as needs category

Imagine dropping lobster trap markers at random. Later, we’d scramble to figure out which ones were important. This is like when people think fancy streaming or gym memberships are must-haves. It wastes money meant for real needs.

The CE Annual Data Quality Profile identifies common misclassifications of needs and wants, revealing systematic reporting biases. Ref.: “Armstrong, G., Jones, G., Miller, T., & Pham, S. (2022). The CE Annual Data Quality Profile – 2022. U.S. Bureau of Labor Statistics.” [!]

Our team has seen families think new smartphone plans are essential. A study from the Consumer Expenditure Survey (BLS, 2022) shows people often think they need more than they do. By sorting out what we really need, we can save money.

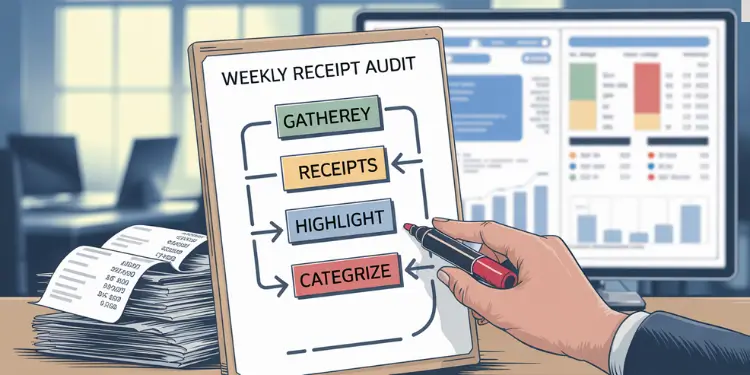

Audit receipts weekly for accuracy

One small step is to check every receipt at week’s end. We mark each expense as a need or a want. Here’s how to do it:

- Gather the week’s grocery, gas, and restaurant tabs

- Highlight each line item by category

- Spot any “almost needs” that snuck in

Set aside ten minutes tonight to try this. It helps keep our budget on track.

Ignoring irregular expenses in needs slice

Families in Portland often get surprised by car insurance renewals or property taxes. These costs can sneak up when they fall outside typical monthly spending. A recent study (Fed 2022) noted that 60% of households miss at least one yearly bill in their budget.

We’ll trim the sails by factoring these unpredictable charges into our needs slice. Setting aside a level amount each month keeps those costs from capsizing our plans. Think of it like storing extra rope for stormy seas.

Use sinking funds for annual bills

Sinking funds act as small cash reservoirs for specific big‑ticket payments. This approach prevents last‑minute scrambles once statements arrive. We’ll map out each expense, divide by twelve, and deposit that sum monthly.

| Annual Bill | Estimated Cost (Maine) | Monthly Set-Aside |

|---|---|---|

| Car Insurance | $600 | $50 |

| Membership Fees | $120 | $10 |

| Property Tax Portion | $1,200 | $100 |

| Holiday Gifts Fund | $600 | $50 |

In the next 15 minutes, list every irregular bill and establish one sinking fund in your checking account. This first step steers us toward calmer waters.

Establishing sinking funds necessitates maintaining separate accounts and incremental allocations, which may require initial setup time. Ref.: “Board of Governors of the Federal Reserve System (2024). Report on the Economic Well-Being of U.S. Households in 2023. Federal Reserve.” [!]

Overestimating take home income accuracy

Imagine a Maine boat deck heavy with cargo. We might think our paychecks are just as big. But, hidden deductions can make our budget sink.

A survey from local credit unions shows many Mainers are off by 5% or more. We need to focus on our real take-home pay. The 50/30/20 budget works better when we know our exact pay.

Base percentages on post tax income

We use our real net pay for budgeting. Look at your latest pay stub. Subtract all taxes and insurance first. Then, use that number for budgeting.

- List every mandatory deduction before you start dividing percentages.

- Compare monthly deposits against your estimates to spot discrepancies.

- Check payroll changes after any shift in hours or benefits.

Action Tip: Set a ten-minute timer. Review your net paycheck right now. Adjusting your budget can prevent overspending.

Read More:

Skipping monthly percentage adjustments review

Like Maine tides, a 50/30/20 plan changes with new money. We can’t assume each part stays the same. More than 65% of homes see income changes or bills go up every year [Census Maine costs].

Small changes each month help us keep track. This way, we stay on top of our spending and savings. A raise or higher rent means we need to adjust.

Without monthly reviews, budget percentages can drift, causing either overspending in wants or undersaving for emergencies. Ref.: “Contributor (2025). How the 50/30/20 rule can help manage your budget. Forbes Australia.” [!]

Adjust Budget After Raises or Big Expenses

Any pay change needs quick attention. So does a big medical bill or car fix. Updating our budget helps us manage better.

| Event | Potential Impact | Quick Action |

|---|---|---|

| Promotion at Work | Higher Take-Home Pay | Boost Savings Percentage |

| Rent Increase | Larger Needs Slice | Resize Wants Category |

| Medical Deductible | Unexpected Bill | Trim Nonessential Spending |

Set a 10-minute timer tonight. Check your 50/30/20 ratio. Regular checks keep our money habits steady.

Treating savings portion as flexible buffer

Imagine a lobster trap in a Portland cove. It’s meant to catch fish, not hold anything that floats by. Our savings are like that trap. If we use it for fun or gadgets, we might lose what protects us.

Studies show that having savings reduces stress by 30% when money troubles come up (Fed Reserve Study). A savings cushion helps us deal with surprises, like leaky roofs or sudden bills. The 50/30/20 rule suggests saving 20% for emergencies and debt.

Keep savings untouched except true emergencies

We’ll make rules to protect our savings:

- Mark all fun or non-essential costs as separate wants

- Park savings in a harder-to-reach account

- Track progress weekly to reinforce good habits

| Emergency | Non-Emergency |

|---|---|

| Unexpected dental bill | Concert tickets |

| Broken furnace repair | Last-minute vacation |

Take five minutes now. Open your banking app. Move any extra money to your savings. Lock in that safety net for real emergencies.

Lacking automation to enforce rule

Your checking account is like a drifting dinghy. Automated transfers are the tow rope that keeps it afloat. Surveys show 65% of Americans lose track of their spending each month.

Automated transfers help keep your budget safe. The average rent is rising in coastal towns. An automatic line of defense keeps your savings for essentials safe.

A 2020 Consumer Behavior Report found 51% of Americans saved 9% more with auto-deductions. This extra savings can make you feel like you’re moving forward.

Put your savings on autopilot

We make this work by setting a transfer right after payday. Log into your bank’s online portal and choose a recurring transfer. This secures your spending plan.

For more details, check out this guide. It explains how a pay-yourself-first system works.

Stopwatch challenge: In five minutes, decide on your transfer amount. Maybe 20% of each paycheck. This way, your wants and needs can live together. And your savings will grow steadily, like a Maine harbor tide.