Did you know that 66% of all bankruptcies in America are due to medical bills? Most of these people had some kind of insurance. This shows a big gap in how we think about protection versus what we really need.

“The true measure of security isn’t just avoiding illness, but being prepared when it inevitably arrives,” says Dr. Amelia Chen, a healthcare policy expert at Johns Hopkins. She has helped many Idaho families choose the right coverage. She sees how good medical protection brings peace of mind, both physically and financially.

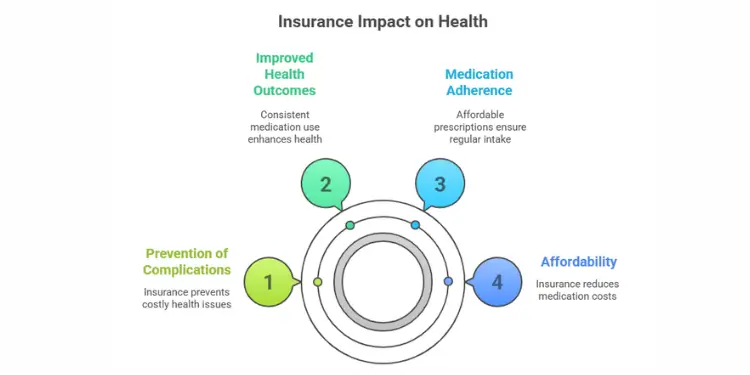

Good health coverage opens the door to preventive care. This makes catching problems early and cheap. When medical emergencies happen, insurance helps keep costs down. This way, it doesn’t empty your savings or lead to debt.

Studies show that people with good medical care do better and live longer. It’s not just about health. It also stops the financial disaster that hits millions of Americans every year.

- Health coverage provides dual protection for both physical wellbeing and financial stability

- Insured individuals demonstrate better health outcomes and access to preventive services

- Proper coverage significantly reduces the risk of medical bankruptcy and financial hardship

Protect Yourself Against High Medical Costs

Healthcare costs in America are very high. Even simple medical emergencies can quickly use up your savings without insurance. Over the last decade, I’ve seen how a sudden medical event can hurt a family’s finances. Health insurance is more than just a monthly bill; it’s a shield against huge medical costs.

Medical debt is the main reason for personal bankruptcy in the U.S. Without good coverage, you face all healthcare costs, which have grown faster than inflation. Let’s look at how this affects your family’s money safety.

Securing a comprehensive health plan with defined cost-sharing limits is a proven safeguard against medical bankruptcies; research shows 66.5 % of U.S. filings cite illness or medical bills as the primary cause. Ref.: “Himmelstein, D. U. & Woolhandler, S. (2019). Medical Bankruptcy: Still Common Despite the Affordable Care Act. American Journal of Public Health.” [!]

Understand Unexpected Emergency Medical Expenses

Medical emergencies don’t warn you in advance. They come suddenly, leaving you little time to get ready financially. The costs for these emergencies can be very high.

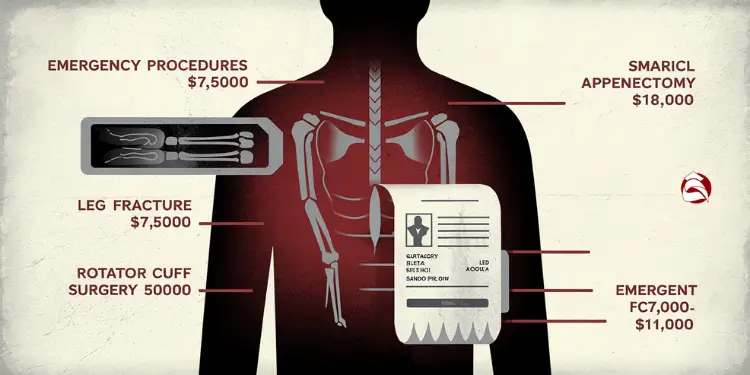

Breaking your leg in an accident might cost about $7,500 without insurance. A torn rotator cuff, a common shoulder injury, can cost over $50,000 to fix. Serious conditions like cancer can lead to bills of hundreds of thousands of dollars, a sum few families can handle.

Insurance changes the game. For those with insurance, the company usually pays 90-95% of emergency and hospital costs. This big difference shows why health insurance is key for keeping your finances stable.

Your health plan sets limits on what you’ll pay, no matter the bill. This protection comes from several key parts:

- Deductibles: The first amount you pay before insurance kicks in

- Copays: Fixed amounts for specific services

- Coinsurance: Your share of costs after meeting your deductible

- Out-of-pocket maximums: The highest amount you’ll pay in a year

These parts work together to make big, unpredictable costs into something you can plan for. Think of health insurance like home or auto insurance—it’s not just an expense, but a must-have for financial safety.

| Medical Scenario | Cost Without Insurance | Typical Cost With Insurance* | Potential Savings |

|---|---|---|---|

| Emergency Room Visit | $1,500 – $3,000 | $150 – $300 | $1,350 – $2,700 |

| Broken Leg | $7,500 | $750 – $1,500 | $6,000 – $6,750 |

| Torn Rotator Cuff Repair | $50,000+ | $2,500 – $5,000 | $45,000+ |

| 3-Day Hospital Stay | $30,000 | $1,500 – $3,000 | $27,000+ |

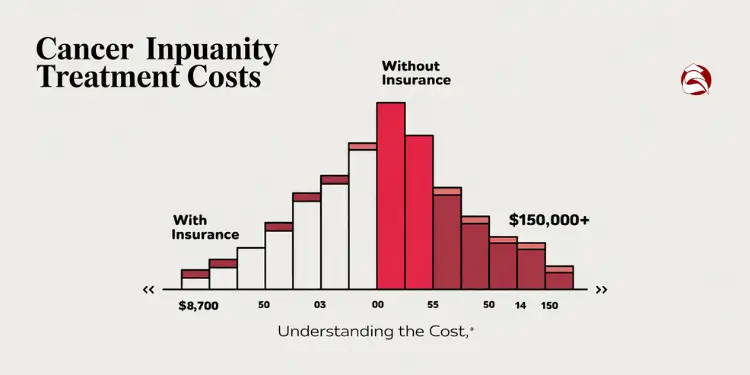

| Cancer Treatment | $150,000 – $300,000+ | $8,700 (max out-of-pocket) | $141,300 – $291,300+ |

*Based on average Silver-tier health insurance plan with $1,500 deductible and $8,700 out-of-pocket maximum. Actual costs vary by specific health insurance plan.

The Affordable Care Act caps annual out-of-pocket spending at $9,100 per individual ($18,200 per family) for 2023 Marketplace plans, ensuring catastrophic protection once that threshold is met. Ref.: “Centers for Medicare & Medicaid Services. (2021). Premium Adjustment Percentage & Maximum Out-of-Pocket Limit for 2023 Benefit Year. U.S. Department of Health & Human Services.” [!]

The numbers are clear. Without insurance, fixing a broken leg costs about $7,500 out-of-pocket. With insurance, it might be just $750 to $1,500, depending on your plan. The financial safety it offers is crucial, especially for serious conditions.

Next, take 15 minutes to check your financial safety net. Can your savings handle an unexpected $7,500 medical bill? Or $50,000? If not, looking into health insurance options is not just wise—it’s essential for your financial health.

“read also: What is the purpose of boat insurance?“

Gain Access to Preventive Care Services

Health insurance does more than just cover emergencies. It also gives you access to preventive care. This can catch health problems early, when they’re easier to treat. I’ve seen how regular check-ups have saved my clients from serious conditions and expensive treatments.

Thanks to the Affordable Care Act, many preventive services are free. You don’t have to pay extra for them, even if you haven’t met your deductible. This means you can get important health screenings and treatments without extra cost.

Not having insurance can be very costly. A simple physical exam might cost $200-300. But screenings like mammograms or colonoscopies can be over $1,000. With insurance, these services are free, helping you stay healthy without breaking the bank.

Regular screenings detect issues early

Early detection through screenings can greatly improve your health and save money. For example, catching high blood pressure early might just need medication and lifestyle changes. But waiting until it causes a stroke could lead to huge hospital bills and lifelong disability.

Health insurance covers many preventive services for free:

- Annual wellness visits and physical examinations

- Blood pressure, cholesterol, and diabetes screenings

- Cancer screenings including mammograms, colonoscopies, and Pap tests

- Vaccinations for flu, pneumonia, and other preventable diseases

- Mental health screenings for depression and anxiety

- Substance use disorder assessments and counseling

- Prenatal care for expecting mothers

Marketplace and employer health plans must cover USPSTF-recommended screenings and routine vaccinations with zero cost-sharing when delivered in-network, removing financial barriers to early detection. Ref.: “HealthCare.gov. (2025). Preventive Health Services Coverage.” [!]

Mental health services are also covered. This includes screenings for depression, anxiety, and substance use disorders. These conditions affect millions of Americans. Early treatment can prevent serious problems and improve your overall health.

| Age Group | Recommended Screenings | Frequency | Potential Savings |

|---|---|---|---|

| 18-39 | Blood pressure, depression, STI testing | Annual | $300-500/year |

| 40-49 | Above plus cholesterol, diabetes, mammograms (women) | Annual | $800-1,200/year |

| 50-64 | Above plus colorectal cancer screening, lung cancer screening (smokers) | Annual with some tests every 3-5 years | $1,500-3,000/year |

| 65+ | Above plus bone density, hearing tests | Annual with some tests every 2 years | $2,000-4,000/year |

Many of my clients are surprised to learn about these free services. One family saved over $2,800 in a year by using their preventive care benefits.

Preventive care isn’t just for physical health. It also includes mental health and substance use disorder screenings. These services help find problems early, saving thousands in treatment costs later.

“An ounce of prevention is worth a pound of cure.”

This saying is especially true with health insurance. Regular screenings can prevent more serious and expensive treatments. So, schedule a preventive screening you’ve been putting off. Your wallet and future self will appreciate it.

Maintain Consistent Care for Chronic Conditions

Almost half of Americans need regular medicines for chronic conditions. Health insurance is key for ongoing care. Over 45% of the U.S. population uses prescription drugs to manage illnesses and prevent disease.

Without insurance, managing chronic conditions like diabetes, asthma, or hypertension is hard. I’ve seen clients save hundreds of dollars on medication costs. This is thanks to the right insurance coverage.

Health insurance does more than just cover emergencies. It also helps with ongoing care for chronic conditions. This includes:

- Affordable access to maintenance medications

- Regular appointments with specialists

- Coverage for necessary medical equipment

- Therapy and rehabilitation services

- Monitoring tests and screenings

Medication adherence improves health outcomes

One big way insurance helps is by making medication affordable. When prescriptions are cheap, people are more likely to take them. This leads to better health and fewer problems.

For example, a diabetic might spend over $300 a month on insulin without insurance. With coverage, this cost drops to $25-$40. This big difference can mean the difference between taking medication or not.

| Chronic Condition | Monthly Cost Without Insurance | Typical Cost With Insurance | Potential Complications If Untreated |

|---|---|---|---|

| Diabetes (Type 2) | $300-$500 | $25-$50 | Kidney failure, blindness, amputations |

| Hypertension | $130-$200 | $5-$30 | Stroke, heart attack, heart failure |

| Asthma | $175-$400 | $15-$60 | Emergency room visits, respiratory failure |

| Rheumatoid Arthritis | $1,000-$3,000 | $30-$100 | Joint destruction, disability, increased pain |

According to national survey data, affordable prescription coverage reduces cost-related non-adherence: only 6.5 % of privately insured adults skip medications versus 22.9 % of the uninsured. Ref.: “Mykyta, L. & Cohen, R. (2023). Characteristics of Adults Who Did Not Take Medication as Prescribed to Reduce Costs. National Center for Health Statistics Data Brief.” [!]

Even healthy people can suddenly develop chronic conditions. A routine check-up might show high blood pressure. Or an illness could trigger an autoimmune response. Having insurance means you can start treatment right away without worrying about money.

Managing a chronic condition with insurance is much cheaper than paying out-of-pocket. It also prevents expensive problems. A $40 monthly medication that prevents a $30,000 hospital stay is a smart investment in health and money.

The most expensive healthcare is the care you can’t afford to receive. Insurance makes treatments affordable, keeping patients healthy instead of waiting for emergencies.

When looking at insurance plans, check the prescription drug coverage. Make sure your medications are on the plan’s list and know the copay tier. This affects how much you pay.

Also, make sure specialists for your condition are in-network. Check that any needed equipment or therapies are covered. These details can greatly improve your health and finances.

Consistent care for chronic conditions is key to staying healthy. It also protects your wallet by avoiding expensive hospital stays. This preventive care is one of the best benefits of health insurance.

Avoid Penalties and Eligibility Gaps

Staying insured is more than just protecting your health. It also helps you avoid costly penalties and navigate complex rules. Many people don’t know that not having coverage can lead to big financial problems. In California and some other states, health insurance is not just a good idea—it’s the law.

In 2020, California started requiring all adults and their dependents to have health insurance. If you don’t get coverage, you’ll face a big penalty at tax time. For 2023, a family of four without insurance could owe at least $2,700 in penalties. This money could have been used for real health care.

“The penalty for being uninsured often costs more than a basic health plan, especially when you factor in available subsidies. It’s essentially paying something for nothing.”

Unless you have a valid reason, not having minimum essential coverage means a tax penalty. Reasons for exemptions include financial hardship, religious objections, or short gaps in coverage. If you’re not sure if you qualify, talking to a tax expert or insurance navigator is a good idea.

California imposes a minimum state tax penalty of $800 per uninsured adult, meaning a family of four could owe $2,400 or more when continuous coverage is not maintained. Ref.: “Franchise Tax Board. (2024). Franchise Tax Board 2023 Tax Season Begins – Health Care Coverage Penalties. State of California.” [!]

Review enrollment periods and subsidies

One big mistake is missing enrollment times. Health insurance has specific times when you can sign up. Missing these times can leave you without coverage for months, facing both health and financial risks.

Most people can only sign up during certain times:

| Enrollment Type | When It Occurs | Who Qualifies | What You Need |

|---|---|---|---|

| Open Enrollment | Nov 1 – Jan 31 (CA) | Everyone | Basic personal information |

| Special Enrollment | Within 60 days of qualifying event | Those with life changes | Documentation of qualifying event |

| Medi-Cal | Year-round | Income-eligible residents | Income verification |

| Employer Coverage | Upon hiring/annual period | Eligible employees | Employment verification |

Don’t ignore financial help that’s available. Many without insurance qualify for big subsidies. After the American Rescue Plan, about 57% of uninsured Americans could get health plans for free. Yet, many didn’t sign up because they didn’t know.

If you’re looking at plans through Covered California, your costs might be lower than you think. A family of four making $85,000 could get subsidies that cut their monthly premium by over $1,000.

Life changes can cause gaps in insurance. Job changes, moving, turning 26, or getting divorced can all affect your coverage. Planning for these changes is key.

- Mark your calendar for the next open enrollment period

- Document qualifying life events that enable special enrollment

- Research COBRA coverage options between jobs

- Explore short-term plans as a last resort during unavoidable gaps

Spending just fifteen minutes to learn about your options can save you thousands in penalties. It also gives you peace of mind, knowing you’re covered when you need it most. The goal is more than avoiding penalties—it’s keeping access to healthcare all year.

Secure Financial Stability During Serious Illness

When serious health issues arise, insurance is key to avoiding financial ruin. Serious illnesses can cost more than just medical bills. They can also affect your financial future. A 2019 study found that medical bills are a big reason for bankruptcy, even for middle-class families.

Medical costs can quickly get out of hand. A hospital stay for pneumonia can cost $20,000. Cancer treatment can cost over $150,000. Without insurance, these costs can wipe out your savings and leave you with huge debt.

Health insurance helps by setting a cap on out-of-pocket costs. Once you hit this limit, usually $8,000-$9,000, your insurance covers everything. This makes managing medical costs easier and more predictable.

Cancer treatment costs are significantly higher without insurance coverage

Prevent Medical Debt and Bankruptcy

Those without insurance face a tough fight when they get sick. Without coverage, you have to pay the full price for care. This can lead to a lot of medical debt fast.

Medical debt can cause many problems. It can empty your savings, max out credit cards, and make it hard to pay for basic needs. It can also hurt your credit score and even lead to wage garnishment.

Health savings accounts (HSAs) can help with your insurance. They let you save money for medical expenses before taxes. This can lower your healthcare costs and build a medical emergency fund that grows over time.

“The financial toxicity of a serious illness can be as devastating as the physical symptoms. Insurance doesn’t just pay for treatment—it preserves your family’s future.”

The Affordable Care Act made big changes to help prevent bankruptcy from medical bills. Plans sold through Covered California and other marketplaces must cover essential health benefits. They can’t put limits on these benefits, so you can get the care you need without worrying about cost.

| Financial Impact | With Health Insurance | Without Health Insurance | Difference |

|---|---|---|---|

| Cancer Treatment Cost | $8,700 (out-of-pocket max) | $150,000+ (full cost) | $141,300+ savings |

| Hospital Stay (3 days) | $1,500 (deductible + coinsurance) | $30,000 (full cost) | $28,500 savings |

| Long-term Impact | Manageable expense | Potential bankruptcy | Financial stability preserved |

| Recovery Focus | Health improvement | Financial & health stress | Better health outcomes |

Some health plans also offer disability coverage. This can replace part of your income if you can’t work because of illness. This extra protection helps avoid financial collapse when you’re dealing with big medical bills and lost wages.

Check your current policy’s out-of-pocket maximum. Make sure it fits your financial situation. Also, ensure your plan covers all family members. The plan you choose is your financial safety net when serious illness strikes.

If you’re worried about gaps in protection, consider extra policies. Critical illness insurance or life insurance with living benefits can help. These plans can cover costs your primary insurance might not, adding extra protection against medical debt.

Choose the Right Plan for Needs

Finding the right health insurance plan is like solving a puzzle. I’ve helped many families make this choice. The key is to match your healthcare needs with your budget.

First, think about how often you see doctors and what medicines you take. This helps decide if a plan with higher premiums but lower costs is best for you. All plans must cover basic benefits, but how they cost you differs a lot.

Read More:

Compare Premiums, Deductibles, and Network Quality

When open enrollment comes, compare plans carefully. A plan with a lower monthly cost might have higher deductibles. Make sure your doctors are in-network to avoid extra costs.

Employer plans often cost less than individual plans. If you’re self-employed or without a job plan, see if you get financial help through tax credits.

Even before you meet your deductible, insurance helps a lot. People with coverage usually pay 50% less for services than those without. Plus, you won’t pay for preventive care.

Make a list of your healthcare needs before picking a plan. Include your doctors, medicines, and treatments. This way, you can find a plan that covers you without yearly or lifetime limits.