Every time you drive, you face financial risks that go beyond your car’s worth. Auto insurance acts as a safety net. It stops one accident from ruining your savings and future. Even a small crash can cost over $3,000 in repairs, and serious ones can lead to medical bills over $50,000.

“The first question I ask clients isn’t about their budget—it’s about what they couldn’t afford to lose,” I often tell families during kitchen table conversations about coverage options. After ten years helping Idaho Falls residents navigate policy decisions, I’ve seen how proper protection prevents financial catastrophe.

Without enough coverage, a brief distraction could mean choosing between medical bills or your mortgage. Texas law, like most states, requires drivers to show they can pay for accidents they cause. Most do this by buying liability protection.

Beyond legal needs, your policy protects against theft, weather damage, and crashes. It gives you peace of mind, knowing you won’t go bankrupt from one bad event.

Auto insurance provides a structured financial safeguard against liabilities arising from vehicle operation. It enforces state-mandated minimum liability limits (e.g., 30/60/25 in Texas) to cover bodily injury and property damage, while optional collision and comprehensive modules protect the insured vehicle against at-fault accidents, theft, vandalism, and non-collision perils. Deductibles ($500–$1,000 typical) calibrate premium costs against out-of-pocket exposure.

Additional coverages, Medical Payments (MedPay), Personal Injury Protection (PIP), uninsured/underinsured motorist, roadside assistance, and rental reimbursement—mitigate secondary losses such as medical expenses, lost wages, and mobility interruption. Premium optimization leverages telematics-based usage data, safe-driving discounts, and bundling to achieve 10–40 % cost reductions.

Quick hits:

- Prevents financial ruin after accidents.

- Meets state legal driving requirements.

- Covers theft and unexpected damage.

- Protects against others’ negligence.

- Provides essential peace of mind.

Leverage data showing that the average insurance claim repair cost rose to $4,721 in Q2 2024 to justify higher liability limits.Ref.: “Scott Benavidez, et al. (2024). Fender Bender Car Repair Cost Quiz. Wall Street Journal.” [!]

Meet Legal Requirements in Your Region

Car insurance is more than just a safety net; it’s a legal must-have that changes with your location. In Idaho, I’ve seen how different states’ rules can confuse people. Almost every state (except New Hampshire) requires drivers to have minimum liability insurance to drive legally.

This rule is in place to help pay for damages and injuries if you cause an accident. Your liability insurance acts as a financial shield for you and others. It protects your assets if you’re found at fault in a crash.

Driving without the right insurance can lead to serious trouble. You might lose your license, have your car taken away, face big fines, or even be sued. In some places, police can take your car right then and there if you can’t show proof of insurance.

Understand Mandatory Minimum Liability Limits

When looking at auto insurance, you’ll see three numbers like 30/60/25. These numbers show the max your insurance will pay for different damages you might cause:

- The first number ($30,000) is for bodily injury per person

- The second number ($60,000) is for bodily injury per accident

- The third number ($25,000) is for property damage per accident

For example, Texas requires at least 30/60/25 coverage. If you cause an accident in Texas that hurts people, your insurance will pay up to $30,000 for each person’s medical. It will also cover up to $25,000 in damage to the other driver’s car or property.

Texas mandates minimum 30/60/25 liability: $30K BI per person, $60K BI per accident, $25K PD per accident.Ref.: “Protec Collision (2025). Collision Repair Cost Calculator. ProtecCollision.com.” [!]

I’ve seen families suffer when their insurance wasn’t enough after a serious accident. The minimums set years ago don’t match today’s medical costs and car prices. A hospital stay can cost over $10,000, and new cars often cost $30,000 or more.

| State | Bodily Injury Per Person | Bodily Injury Per Accident | Property Damage | Notation |

|---|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 | 15/30/5 |

| Texas | $30,000 | $60,000 | $25,000 | 30/60/25 |

| New York | $25,000 | $50,000 | $10,000 | 25/50/10 |

| Florida | $10,000 PIP* | $10,000 PIP* | $10,000 | No-fault state |

| Maine | $50,000 | $100,000 | $25,000 | 50/100/25 |

*PIP = Personal Injury Protection, required instead of bodily injury in no-fault states

When looking for auto insurance, start with your state’s Department of Insurance website to check the current rules. Think about if the minimums really protect your assets. If you own a home or have savings, higher liability limits can protect your personal assets from lawsuits.

Remember, liability insurance only covers damage you cause to others. It doesn’t cover damage to your car. For that, you need to add collision coverage to your policy, which we’ll talk about later.

Increasing your liability coverage can be surprisingly affordable. Doubling your liability coverage might only add $10-20 to your monthly premium. This small increase can give you much better protection against today’s high-cost claims.

Read More:

Shield Yourself From Financial Liability Claims

Car insurance does more than meet legal needs. It protects you from huge financial losses. A simple car accident without injuries can cost $6,100 per vehicle. If injuries happen, costs can soar to $162,000 for disabling injuries and $1,869,000 for fatal accidents.

I’ve seen how fast these costs can add up for families. Without enough insurance, your home, savings, and future earnings are at risk. This is a real problem for many drivers.

Liability coverage helps when you’re at fault in an accident. It covers damage to other vehicles and injuries to people involved. Bodily injury claims can be especially costly and unpredictable.

Bodily Injury Lawsuits Can Escalate

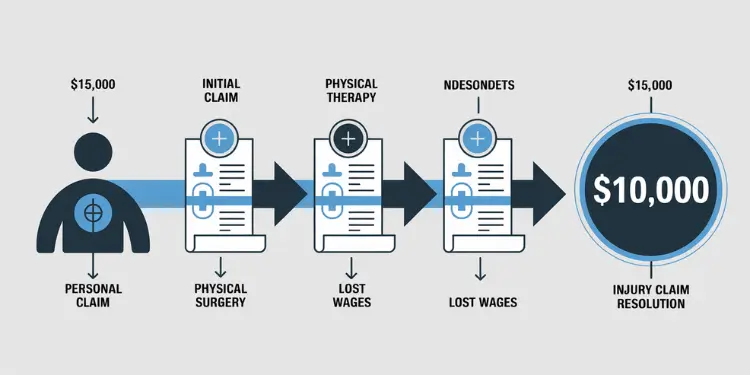

A small medical bill can quickly turn into a huge financial problem. In my insurance career, I’ve helped many clients deal with this. The first medical visit is just the beginning.

Here’s a case from my practice: a driver with only the minimum coverage caused an accident. The other driver had a broken leg. The initial bill was $15,000. But, the driver needed multiple surgeries, therapy, and lost wages for eight months.

The total cost? Over $120,000. With only $25,000 in coverage, my client had to pay $95,000. This was a huge financial hit that threatened their home and took years to settle.

Medical costs from auto accidents can quickly spiral beyond what most families can handle out-of-pocket. The combination of emergency care, surgeries, rehabilitation, lost wages, and pain and suffering creates a perfect storm of financial exposure.

I suggest most families have at least $100,000 per person and $300,000 per accident in liability coverage. Those with more assets might need umbrella policies. Remember, the minimum insurance is often not enough.

Uninsured motorist coverage is also key. It helps if you’re hit by someone without insurance or with not enough. Without it, you might have to pay for repairs and medical bills yourself, even if it wasn’t your fault.

| Liability Component | What It Covers | Minimum vs. Recommended | Financial Impact |

|---|---|---|---|

| Bodily Injury | Medical costs, rehabilitation, lost wages | $25K/$50K vs. $100K/$300K | Protects against six-figure lawsuits |

| Property Damage | Repairs to others’ vehicles, structures | $10K vs. $50K+ | Covers high-value vehicle damage |

| Uninsured Motorist | Your injuries when hit by uninsured driver | Optional vs. Match liability limits | Prevents out-of-pocket medical costs |

Liability coverage does more than just cover the accident. It protects your assets and future earnings. Without it, a serious accident could ruin your finances for years or decades.

When checking your policy, focus on liability limits. A small increase in coverage can save you from huge financial losses. Cutting corners on insurance can be very costly.

Cover Repairs After Accidents or Theft

Your auto insurance policy has a key part for when accidents or theft happen. Liability coverage protects others, but collision and comprehensive coverages protect your car. In my decade of experience, I’ve seen how these coverages help clients avoid financial trouble after unexpected events.

Having the right coverage to help pay for repairs is crucial. It can turn a small problem into a big financial issue. Let’s look at the important coverages that keep your vehicle safe.

Collision and Comprehensive Differences Explained

Many people mix up collision and comprehensive coverage. Knowing their differences helps you choose the right policy. Here’s how they differ:

- Collision Coverage: Covers repairs after an accident, no matter who’s at fault. This includes hitting another vehicle, a guardrail, or a tree.

- Comprehensive Coverage: Deals with damage from non-collision events like theft, vandalism, fire, natural disasters, or hitting an animal.

- Deductible Structure: Both need you to pay a deductible (usually $500-$1,000) before insurance pays.

- Requirement Status: States don’t require them, but lenders do if you have a car loan or lease.

Insurance isn’t just about legal needs—it’s about keeping your finances safe when unexpected things happen. Physical damage coverage is what keeps you driving without breaking the bank.

Auto liability insurance protects others, but collision and comprehensive cover your vehicle. These coverages help pay for repairs that can cost thousands with today’s cars.

Collision and comprehensive coverages require separate deductibles, which may strain budgets after multiple claims.Ref.: “StormWise Hail Repair (2022). How Much Does Average Collision Repair Cost? StormWiseHailRepair.com.” [!]

I always advise my clients that modern cars with advanced parts can cost $2,000-$5,000 to fix after minor accidents. Without the right coverage, you’ll have to pay these costs yourself.

When deciding on these coverages, think about:

- Your vehicle’s current market value

- How much you can afford to replace or repair your car

- If you have a loan or lease requiring these coverages

- The deductible amount you can afford in an emergency

For newer cars, both coverages are key. But if your car is older and worth less than $3,000, saving for repairs might be better than paying for coverage.

Your deductible choice affects your insurance costs. A higher deductible lowers your monthly payments but means you’ll pay more out-of-pocket for claims. Find a balance that fits your budget and emergency savings.

Remember, insurance companies need proof of financial responsibility before paying for repairs. This means you must meet your deductible first. When picking your coverage, think about how much you can afford to pay if you need to drive your car after an accident.

Personal injury protection and underinsured motorist coverage protect people, but collision and comprehensive protect your vehicle. Together, they create a strong safety net for you and your car against life’s surprises.

Receive Assistance During Emergencies On-Road Situations

Car insurance really shows its worth in unexpected roadside emergencies. I’ve seen many clients who didn’t think they needed emergency coverage. But when they got a dead battery or were in an accident far from home, they wished they had it.

Basic liability coverage meets the law but doesn’t protect much in emergencies. These situations are not just a hassle; they can be dangerous and costly without the right coverage.

Emergency assistance is a cheap add-on that offers a lot of peace of mind. Many people overlook it when buying insurance. But it’s very valuable when you need help the most.

Roadside Towing and Rental Reimbursement

Roadside assistance costs just $5-$15 every six months. This small price can save you hundreds if your car breaks down or won’t start.

Standard roadside assistance packages include:

- Towing service to the nearest repair facility (usually up to 15-25 miles)

- Battery jump-start service when you’re stranded with a dead battery

- Flat tire changes when you lack the tools or ability to do it yourself

- Fuel delivery if you run out of gas on the road

- Lockout assistance if you’re locked out of your vehicle

Without this coverage, a single tow can cost $75-$125. That’s more than what you pay for a whole year of protection. I’ve seen clients save over $300 on a single incident because they had this coverage.

Rental reimbursement coverage is also very useful when your car needs repairs. It helps you get around while your car is fixed.

Consider this: repairs after an accident can take 2-3 weeks. Rental costs can add up to $700 or more. Rental reimbursement costs $20-$40 every six months but can cover up to $50 daily in rental expenses.

After my accident last year, my car was in the shop for 18 days. My rental reimbursement coverage saved me over $600 in transportation costs during repairs. It was the best $32 I ever spent on my insurance policy.

When deciding on these coverages, think about your situation:

- Do you drive an older vehicle more prone to breakdowns?

- Do you commute daily and would need immediate transportation if your car was damaged?

- Do you have alternative transportation options if your vehicle is unusable?

- Would unexpected towing or rental costs create financial hardship?

I’ve found these coverages especially helpful for families on a tight budget. They offer great protection against unexpected costs for just a few cents a day.

Some insurance products now offer more than just basic services. They include benefits like trip interruption coverage. This is great for family vacations or business trips, offering extra protection.

| Coverage Type | Average Cost (6-month policy) | Potential Savings Per Incident | Common Usage Scenarios | Limitations |

|---|---|---|---|---|

| Roadside Assistance | $5-$15 | $75-$125 (single tow) | Battery failures, flat tires, lockouts | Towing distance limits (typically 15-25 miles) |

| Rental Reimbursement | $20-$40 | $600-$800 (2-week rental) | Vehicle repairs after accidents | Daily reimbursement caps ($30-$50) |

| Trip Interruption | $10-$25 | $300-$500 (hotel/meals) | Breakdowns 100+ miles from home | Maximum benefit limits ($500-$1000) |

| Ride-Sharing Coverage | $15-$30 | $200-$400 (multiple rides) | Short trips during vehicle repairs | May require receipts for reimbursement |

Many drivers think their credit card or auto club memberships are enough for roadside help. But insurance-based services usually offer faster help and more comprehensive coverage.

Driving without insurance that includes emergency help is risky. When you’re stuck on a dark road or need to fix your car after an accident, these coverages are lifesavers.

Insurance details on these coverages vary by provider. Always ask about emergency assistance when getting quotes. Compare their costs and benefits before choosing.

Protect Passengers With Personal Injury Coverage

Most drivers worry about their car getting damaged, but personal injury coverage is about the people inside. Medical bills can pile up fast, even with good health insurance. Families often face unexpected costs after accidents.

Auto coverage that covers injuries adds an extra layer of protection. It helps you and your passengers get medical care without worrying about money. This is true, no matter who caused the accident.

Medical Payments Coverage Bridges Gaps

Medical payments coverage, or MedPay, is a great addition to your health insurance. It pays for medical bills for you and your passengers, no matter who’s at fault. It’s available if you’re driving, a passenger, or hit by a car while walking.

What’s great about MedPay is it’s ready to help right away. It doesn’t have deductibles or network rules like health insurance does. So, you can focus on getting better without worrying about medical costs.

MedPay covers important medical services like:

- Emergency room visits and hospital stays

- Doctor appointments and specialist consultations

- X-rays, MRIs, and other diagnostic tests

- Surgeries and follow-up treatments

- Dental repairs needed due to an accident

For families with high-deductible health plans, MedPay is especially helpful. It fills the gap between an accident and meeting your health insurance deductible. This can save thousands of dollars.

Personal Injury Protection (PIP) offers even more coverage than MedPay. Personal Injury Protection covers medical bills and other accident-related costs that health insurance won’t cover. In Texas, all auto policies include PIP by default, but you can decline it in writing if you prefer.

Beyond medical costs, PIP also covers:

- Lost wages if injuries prevent you from working

- Childcare expenses when you can’t perform these duties

- Essential household services you can’t handle while recovering

- Funeral expenses in worst-case scenarios

In “no-fault” states, PIP is the main coverage for injury claims, no matter who’s at fault. This makes the claims process smoother and ensures faster payment compared to waiting for liability determinations.

| Coverage Feature | Medical Payments (MedPay) | Personal Injury Protection (PIP) | Regular Health Insurance |

|---|---|---|---|

| Medical Expenses | Covers all accident-related costs | Covers all accident-related costs | Subject to deductibles and networks |

| Lost Wages | Not covered | Typically covers 80% up to limits | Not covered |

| Additional Services | None | Childcare, household help | None |

| Typical Cost | $5-$25 per 6 months | $15-$50 per 6 months | N/A (separate premium) |

| Coverage Limits | $1,000-$10,000 | $2,500-$50,000 | Varies by plan |

Both coverages are affordable. MedPay adds $5-$25 to your six-month premium, while PIP costs $15-$50. Given the wide range of protection they offer, they’re a great value.

I highly recommend these coverages if you:

- Have a high-deductible health plan

- Regularly transport passengers in your vehicle

- Live in an area with high medical costs

- Want to ensure immediate medical care without financial barriers

Remember, collision and comprehensive coverage pay for car damage. But these personal injury coverages focus on the people inside. When reviewing your auto policy, don’t overlook these important protections for your health and well-being.

Lower Premiums Using Safe Driving Habits

Your driving habits affect your auto insurance costs. I’ve seen clients save 10-25% by keeping their driving records clean for 3-5 years. Insurance companies give discounts to those who are less likely to file claims.

There are more ways to save than just traditional discounts. Insurers also offer savings for cars with safety features. Features like anti-theft devices, airbags, and antilock brakes can lower your costs.

Telematics Programs Reward Cautious Drivers

Telematics programs offer the biggest savings. They track your driving habits through apps or devices in your car. This includes how you brake, accelerate, and drive.

Telematics looks at your real driving, not just stats. Safe drivers can cut their premiums by 20-40%. This is a big deal when insurance costs are going up.

I helped a family with a $4,200 annual premium for two teens. After six months in a telematics program, their premium fell to $2,940. They saved $1,260 a year just by driving safely.

Check out the below:

Most big insurers have telematics programs now. If you drive well, try it at your next renewal. It’s a smart way to avoid paying more based on averages.