Before you start looking for a house, make a solid financial plan. This is the biggest investment you’ll ever make. Good money management helps avoid being “house poor.”

Did you know 44% of Americans regret buying a home? They often face unexpected costs they didn’t plan for.

“The difference between financial stress and building equity often comes down to the planning you do before you start viewing properties,” I tell my clients during our first meeting.

When buyers plan well, they feel relieved. Their budget covers the mortgage, maintenance, utilities, and closing costs that differ between starter and forever homes. This way, they have room in their finances.

Quick hits:

- Calculate total housing costs, not just mortgage

- Plan for maintenance and unexpected repairs

- Consider future lifestyle changes and expenses

- Build emergency savings alongside down payment

Setting clear savings goals early

Before you start looking for a house, it’s smart to set clear savings goals. This helps you avoid falling in love with homes that are too expensive. In my nine years helping first-time buyers, I’ve seen how early savings goals make homeownership a reality.

Having a precise savings plan is key, not just a vague idea to save more. Knowing exactly how much you need and by when turns wishful thinking into a real plan. Let’s look at how to figure out your target and make saving automatic.

Calculating Target Deposit and Fees

Your down payment is the base of your home buying budget. Many first-time buyers aim for the minimum 3-3.5% down payment. But I recommend aiming for 5-10% at least, with 20% as the ideal.

Why 20%? It eliminates Private Mortgage Insurance (PMI), saving you $1,500-$3,000 a year on a $300,000 home.

A 20 % down payment on a $300 000 loan avoids PMI charges of roughly $1 500–$3 000 per year—savings that compound over the life of the mortgage. Ref.: “PenFed Credit Union. (2023). Mortgage Insurance: PMI vs. MIP. PenFed Credit Union.” [!]

But your down payment is just the start. Closing costs can range from 2-6% of your loan amount. On a $300,000 home, expect to pay $6,000-$18,000 in closing costs alone.

Don’t forget these extra costs in your savings plan:

- Home inspection fees: $300-$500

- Moving expenses: Average $2,500 for local moves

- Immediate repairs: Typically 1-3% of purchase price

- New furniture and appliances: Varies widely based on needs

- Emergency fund: 3-6 months of housing payments

The national average buyer closing cost in 2024 was $6 905 (including transfer taxes) and typically falls between 2 % and 5 % of the sale price, according to CoreLogic ClosingCorp data summarized by Bankrate. Ref.: “McMillin, D. (2024). Average Closing Costs on a House in 2024. Bankrate.” [!]

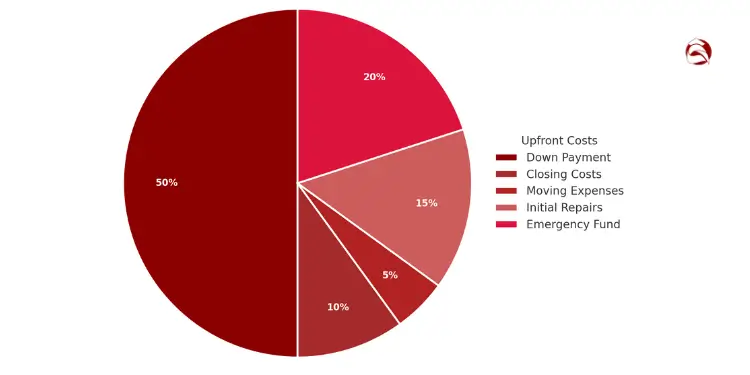

To figure out your total savings target, use this formula:

Down payment + Closing costs + Moving expenses + Initial repairs + Emergency fund = Total savings needed

For example, on a $300,000 home with 10% down, you might need:

$30,000 (down payment) + $9,000 (3% closing costs) + $2,500 (moving) + $3,000 (1% repairs) + $6,000 (emergency fund) = $50,500 total

Automating Transfers for Steady Progress

Once you’ve set your target, make saving automatic. Buyers who automate their savings reach their goals twice as fast. In my experience, this makes a big difference.

Set up an automatic transfer from your checking to a high-yield savings account for your house fund. Do this the day after your paycheck arrives, like any bill.

How much to transfer? Start by looking at your income and spending. Most successful first-time buyers save 15-25% of their take-home pay. This might mean spending less, but the benefits of homeownership last a long time.

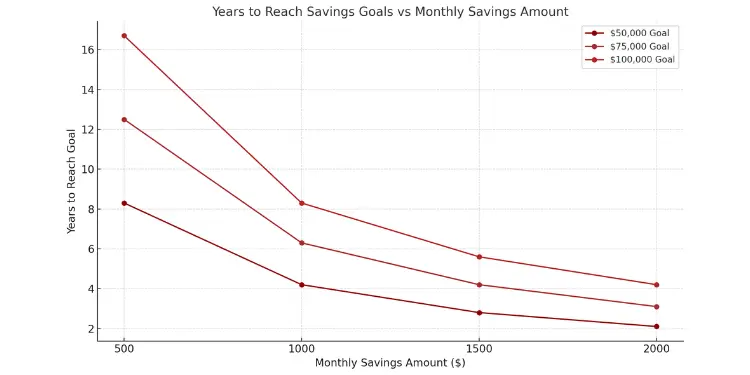

Use this timeline calculator to see how long it will take to reach your goal:

| Monthly Savings Amount | $50,000 Goal | $75,000 Goal | $100,000 Goal | Savings Tips |

|---|---|---|---|---|

| $500 | 8.3 years | 12.5 years | 16.7 years | Cut streaming services, make coffee at home |

| $1,000 | 4.2 years | 6.3 years | 8.3 years | Reduce dining out, find cheaper rent |

| $1,500 | 2.8 years | 4.2 years | 5.6 years | Take on side gig, eliminate car payment |

| $2,000 | 2.1 years | 3.1 years | 4.2 years | Live with family, sell unused items |

Small changes in spending can make a big difference. Cutting $100 weekly on dining out adds $5,200 a year to your savings. This could shave a year off your house-buying timeline.

Consider these strategies my clients have used to boost their savings:

- Temporarily downsize to a smaller rental

- Find a roommate to split housing costs

- Redirect annual bonuses and tax refunds to your house fund

- Sell items you no longer need on marketplace platforms

- Take on temporary side work for your down payment

Remember, your financial situation can change. As your income grows, increase your automatic transfer amount. This helps you avoid lifestyle inflation and speeds up your path to homeownership.

By setting clear savings goals early and automating your progress, you can turn homeownership into a reachable goal. This financial planning ensures you’ll be ready when the right house comes along.

Estimating true upfront purchase costs

Buying your first home costs more than just the down payment. There are many upfront expenses that can surprise you. In Greenville, I’ve seen many first-time buyers overspend by focusing only on the down payment.

When you create a budget for buying a home, remember to include every dollar you’ll spend. Let’s look at these costs so you can plan better and avoid financial stress.

The Down Payment: Just The Beginning

Your down payment is the biggest upfront cost. It’s usually 3-20% of the home’s price. For a $300,000 home, that’s $9,000 to $60,000.

But, a smaller down payment doesn’t always mean less money upfront. FHA loans with 3.5% down might have higher closing costs and mortgage insurance. This can offset the initial savings.

Closing Costs: The Hidden Budget Buster

Don’t forget closing costs, which are 2-6% of your loan amount. For a $300,000 home, expect to pay $6,000 to $18,000 in closing costs alone.

These costs include:

- Loan origination fees ($1,000-$3,000)

- Appraisal fee ($300-$600)

- Home inspection ($300-$500)

- Title search and insurance ($500-$2,000)

- Attorney fees ($500-$1,500)

- Recording fees and transfer taxes (varies by location)

- Prepaid expenses like property taxes and homeowners insurance

Many online calculators use old figures that don’t show today’s costs. Expect to pay at least 4% in most markets for conventional loans.

Moving and Immediate Home Expenses

Your budget for buying should include moving costs and making the home livable. Local moves cost $800-$2,500. Don’t forget immediate repairs and furnishings, which can add $1,000-$5,000.

Think about whether to buy a move-in ready home or one needing work. The costs of renovation can quickly go up.

How Loan Types Affect Your Upfront Costs

The loan you choose affects how much cash you need at closing. Here’s a comparison of typical upfront costs for different loan types on a $300,000 home purchase:

| Expense Category | Conventional (5% down) | FHA (3.5% down) | VA (0% down) | USDA (0% down) |

|---|---|---|---|---|

| Down Payment | $15,000 | $10,500 | $0 | $0 |

| Closing Costs | $9,000 | $10,500 | $8,000 | $9,000 |

| Mortgage Insurance | Monthly only | $5,250 upfront + monthly | $6,000 funding fee | $3,000 guarantee fee |

| Total Cash Needed | $24,000 | $26,250 | $14,000 | $12,000 |

Notice how the FHA loan, despite its lower down payment, actually requires more cash upfront than a conventional loan with 5% down when you factor in the upfront mortgage insurance premium.

Strategies to Reduce Upfront Costs

When you set a budget for your home purchase, consider these strategies to reduce your upfront expenses:

- Negotiate seller concessions to cover closing costs (typically up to 3-6% of purchase price)

- Request a closing credit for repairs instead of a price reduction

- Schedule your closing at the end of the month to reduce prepaid interest

- Shop lenders for credits or promotional programs that offset costs

- Investigate down payment assistance programs in your area

When making an offer, try language like: “Seller to contribute 3% of purchase price toward buyer’s closing costs” instead of reducing the offer price by that amount. This approach keeps your loan-to-value ratio lower while reducing your cash needed at closing.

By accurately determining your budget with all these factors in mind, you’ll avoid the financial strain that catches many first-time buyers by surprise. Remember that a complete budget for buying a house accounts for every expense, not just the down payment and monthly mortgage.

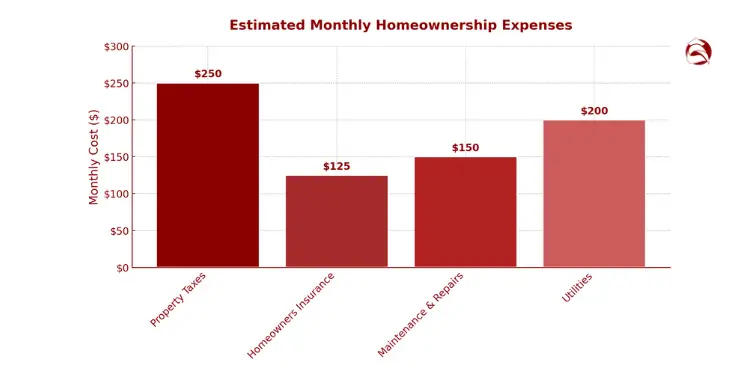

Factoring ongoing ownership expenses carefully

Many first-time homebuyers focus on down payments and mortgages. They overlook the ongoing expenses that affect long-term affordability. When I talk to clients, they often get surprised by the full monthly cost of owning a home.

Creating a budget for these expenses before buying helps avoid financial stress later. Your mortgage payment is just the start. Homeownership costs have many hidden expenses that can be overwhelming if ignored.

A good homeownership budget includes more than just your mortgage payment:

- Property taxes – usually 0.5% to 2.5% of your home’s value each year, based on where you live

- Homeowners insurance – about $1,200-$1,500 a year for a typical home

- Private Mortgage Insurance (PMI) – needed if your down payment is less than 20%

- HOA or condo fees – if you live in a community with these fees, they’re usually $200-$400 a month

- Maintenance and repairs – a big surprise for many new homeowners

- Utilities – often more than what you paid as a renter

Let’s look at how to estimate these costs before you buy.

“Explore More: How to reduce debt before buying house effectively“

Including Maintenance and Utility Bills

Maintenance surprises many first-time buyers. Unlike renting, where the landlord fixes things, you’re now in charge of repairs.

I suggest setting aside 1-3% of your home’s value each year for maintenance and repairs. For a $300,000 home, that’s $3,000-$9,000 a year, or $250-$750 a month. Newer homes might need less, while older homes might need more.

Fannie Mae recommends budgeting 1 % to 4 % of your home’s value annually for maintenance and repairs—newer homes trend near 1 %, older properties toward the upper end. Ref.: “Fannie Mae. (2024). How to Build Your Maintenance and Repair Budget. Fannie Mae.” [!]

This fund isn’t just for emergencies. It also covers regular expenses like:

- HVAC system servicing twice a year

- Gutter cleaning and roof inspections

- Appliance repairs and replacements

- Lawn care equipment and services

- Pest control treatments

Utility costs often go up when you move from renting to owning. To estimate these costs, ask the seller for recent utility bills. Most sellers are happy to share this with serious buyers.

For a detailed utility budget, include:

- Electricity and gas

- Water and sewer

- Trash collection

- Internet and cable

- Security system monitoring

Remember, utility costs change with the seasons. In many places, heating costs go up in winter and cooling costs go up in summer. Your budget should account for these changes, not just a flat monthly average.

When creating a budget for homeownership, compare your current rental costs to what you’ll pay as a homeowner. Make a simple table with two columns: your current rental costs and what you’ll pay as a homeowner. This will show you the real financial impact.

| Expense Category | Current Monthly Rental | Projected Monthly Ownership | Difference |

|---|---|---|---|

| Housing Payment | $1,500 (rent) | $1,800 (PITI) | +$300 |

| Utilities | $200 | $350 | +$150 |

| Maintenance | $0 | $375 | +$375 |

| HOA/Other Fees | $0 | $250 | +$250 |

| Total | $1,700 | $2,775 | +$1,075 |

This example shows why many first-time buyers feel “house poor” even if they can afford the mortgage. The lender only looks at the mortgage payment, not the extra expenses.

To avoid this, I suggest adding these expenses to your budget for 3-6 months before buying. Save the difference between your current housing costs and what you’ll pay as a homeowner in a separate account. This helps you see if you can really afford homeownership.

This practice run helps beginners understand the financial impact of homeownership. If you can’t save this money each month, it might mean you need to adjust your budget or timeline.

Remember, your budget protects your ability to make mortgage payments and keeps your finances healthy. The goal is to enjoy homeownership without constant financial stress.

“For More Information: Cost breakdown buying house for first time buyers“

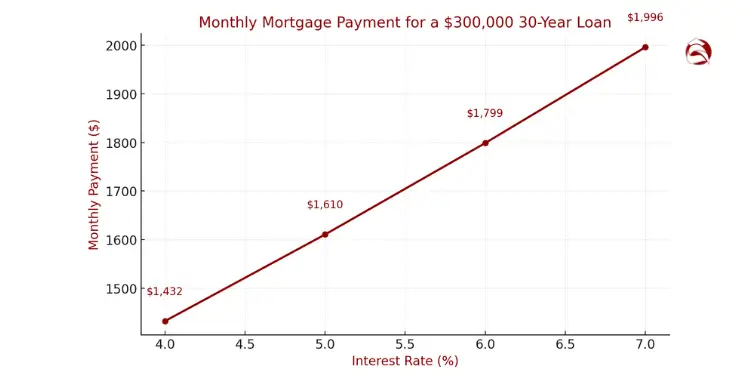

Preparing for interest rate fluctuations

When you’re buying your first home, thinking about interest rate changes is key. In Greenville, I’ve seen many families face surprise when their mortgage payments go up. Interest rates change with the economy, which you can’t control.

Going from a 4% to a 5% mortgage rate isn’t just a small change. On a $300,000 loan, that 1% difference means a $175 more each month. Over 30 years, you’ll pay $63,000 extra in interest. So, your home buying budget needs to be ready for rate changes.

Most buyers I work with are surprised by these numbers. They focus on saving for the down payment but forget about interest rate changes. Let’s talk about how to protect yourself from these changes.

Stress Testing Payments Under Increases

A stress test is when you figure out what your mortgage payment would be if rates go up. This helps see if your budget can handle higher payments without trouble. I suggest testing at 2% above your expected rate to be safe.

For example, if rates are 4.5%, see what your payment would be at 6.5%. Can your budget handle that? If not, you might need to look at a different price range or decide whether to buy now or later.

Here’s a simple way to check your budget: Double your current rent payment. If that feels too tight, you might be stretching too far. This simple check can help avoid big financial problems later.

For those thinking about adjustable-rate mortgages (ARMs), stress testing is even more important. ARMs start with lower rates but can change a lot after the initial period. Let’s look at how different rates might affect your payment:

| Loan Amount | Interest Rate | Monthly Payment | Payment Increase | Annual Cost Difference |

|---|---|---|---|---|

| $300,000 | 4.0% (Initial) | $1,432 | Baseline | Baseline |

| $300,000 | 5.0% (After Adjustment) | $1,610 | $178 | $2,136 |

| $300,000 | 6.0% (After Adjustment) | $1,799 | $367 | $4,404 |

| $300,000 | 7.0% (After Adjustment) | $1,996 | $564 | $6,768 |

This table shows how small rate increases can lead to big payment changes. A $564 monthly increase at 7% means less money for other things. When buying a car or planning big purchases, remember these possible payment increases.

Mortgage rates have changed a lot over time. In the early 1980s, rates were over 18%. While we won’t see that again, even small increases can affect your budget a lot. The Federal Reserve, inflation, and the economy all play a part in mortgage rates.

To protect yourself from rate changes, consider these strategies:

- Rate locks: Lock in your interest rate after finding a home. This usually lasts 30-60 days.

- Buying points: Pay extra upfront for a lower rate. This makes sense if you’ll stay in the home a long time.

- Fixed-rate mortgages: These might be higher than ARMs at first but keep your payments the same for the whole loan term.

- Budget buffers: Plan your home buy with a payment that’s lower than your max. This gives you room for unexpected changes.

One client, a young software developer, was approved for a $400,000 loan but chose a $350,000 home. This gave him a $250 monthly buffer. When he took a lower-paying job, that buffer helped him avoid financial trouble.

Preparing for rate changes isn’t about guessing the market. It’s about making sure your budget can handle changes. No one can predict interest rates perfectly, but you can plan for reasonable changes.

Before making an offer, do a final budget check. Include your mortgage payment at current rates, plus 2% for safety. Add in other housing costs like taxes, insurance, and maintenance. If you can save and meet your other financial goals, you’re ready to buy.

Avoiding budget creep during search

‘Budget creep’ can ruin your homebuying dreams. It quietly raises your target price with each house you see. Over nine years, I’ve seen buyers start with a $250,000 limit. Then, they look at $275,000 homes and eventually offer on a $310,000 property. This leads to years of financial stress.

Our brains get used to higher prices quickly. Seeing ten homes at your max budget, then wanting a pricier house with a perfect kitchen is common. But these small changes can lead to big financial problems.

Stopping budget creep isn’t just about willpower. It’s about using systems that keep you on track. Let’s look at three ways to help you stay within budget, even in competitive markets.

“Check This Out: House price to income ratio rule for buyers“

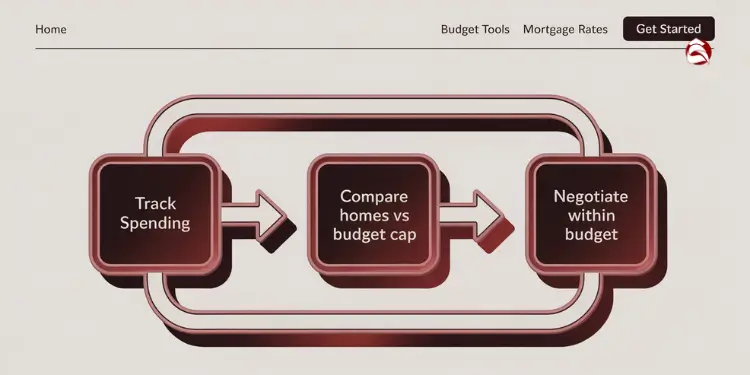

Tracking Spending Categories With Apps

Digital tools help you stay accountable. The right app tracks your savings and keeps you from straying from your budget.

I tell my clients to use zero-based budgeting tools. These tools make you think about what happens if you go over budget. You’ll see how it affects your other financial goals.

The best apps for homebuyers alert you when you search above your budget. Setting these limits takes minutes but saves you from financial regret later.

| App Name | Best Feature for Homebuyers | Price | Learning Curve | Integration with Mortgage Tools |

|---|---|---|---|---|

| YNAB | Goal tracking with visual progress bars | $99/year | Moderate | Excellent |

| Mint | Property search budget alerts | Free | Easy | Good |

| EveryDollar | Sinking funds for closing costs | $129.99/year (Plus) | Easy | Fair |

| PocketGuard | Automated “safe to spend” calculations | $4.99/month | Easy | Good |

| Goodbudget | Shared envelope system for couples | $8/month | Moderate | Limited |

Comparing Homes Against Preset Ceiling

Emotions can cloud your judgment when house hunting. A structured system helps you compare homes objectively against your budget.

Make a worksheet with your max budget at the top. For each house, calculate the total monthly cost. This includes principal, interest, taxes, insurance, and HOA fees. This total is what matters for your finances.

One client, Melissa, used this method in a competitive market. Agents showed her homes $50,000 over her budget. Her worksheet had a “budget variance” field. This kept her focused until she found a home that fit her budget and needs.

“I printed my budget ceiling in bold red at the top of every worksheet. When agents tried pushing me toward higher-priced homes, I’d point to that number and say, ‘This isn’t arbitrary—it’s calculated based on my financial goals for the next five years.'”

Negotiating Extras Without Breaking Set Limits

During negotiations, sellers might offer extras like appliances or furniture. These extras can tempt you to go over budget. But they rarely justify the extra cost.

When faced with these offers, say: “I appreciate the offer of [specific extra], but I need to maintain my purchase ceiling of [your max]. Would you consider including [the extra] within that price point, or should we focus our negotiation elsewhere?”

This approach keeps your budget in check while keeping the conversation positive. Sellers respect buyers who stick to their budget.

Two clients show the difference. James stayed within his $280,000 limit, even when offered furniture that would have pushed him to $292,000. By saying no, he kept his emergency fund and avoided a big monthly payment. Carlos, on the other hand, went over budget for a similar deal. Six months later, he faced a major plumbing repair with no savings.

The last tool I give clients is a decision framework. It helps them know when to adjust their budget and when it’s too risky:

- Justified adjustment: You find extra costs (like repairs) that weren’t in your original budget but don’t raise your monthly payment.

- Justified adjustment: Your financial situation improves (like a promotion or debt payoff) during your search.

- Dangerous overreach: You stretch your budget because you emotionally love a property.

- Dangerous overreach: You cut back on other important financial goals (like an emergency fund or retirement savings) to afford a more expensive home.

Staying disciplined with your budget isn’t about limiting choices. It’s about making sure your home purchase improves your finances. By using these tools, you can control your finances while finding a home you love.

“Related Topics:

Building financial resilience post purchase

After buying a home, the real work starts. First, rebuild that emergency fund that might have been used for closing costs. Try to save 3-6 months of money for things like your mortgage and other bills. This fund helps keep your home safe from unexpected costs.

Make a plan for home upkeep that spreads out costs over the year. This way, you won’t be surprised by big bills. Experts say setting aside 1-2% of your home’s value each year for repairs and updates is a good idea.

After buying a home, you need to plan your money wisely. Start saving for retirement again if you had to stop during the buying process. Financial planning means paying off high-interest debts and thinking about refinancing loans to save money.

Try making small extra payments on your mortgage. Even $50-100 extra each month can save a lot of money in the long run. Use budget apps to track your spending and find ways to save.

Lastly, make a 5-year plan for your homeownership. The first year might be tight, but by year three, things usually get easier. This planning helps your home purchase make your finances stronger, not weaker.