Creating a solid home buying budget is more than just dreaming. Many people don’t know the real costs, leading to money troubles after buying.

Did you know that 44% of Americans regret buying a home because of surprise costs? This shows why sticking to a budget is so important.

“Your home buying budget is not just a suggestion; it’s your financial guardrail,” I tell my clients at our first meeting. I’ve helped many first-time buyers, and I see how good planning helps.

The best homebuyers I’ve worked with do something simple. They figure out all costs before they start looking, not just the mortgage. This includes closing costs that are usually 2-5% of the price, plus moving costs, repairs, and an emergency fund.

Quick hits:

- Save 15-25% of take-home pay

- Calculate true monthly ownership costs

- Build a 3-6 month emergency fund

- Automate savings for faster results

- Stress-test your payment calculations

Define realistic maximum purchase price

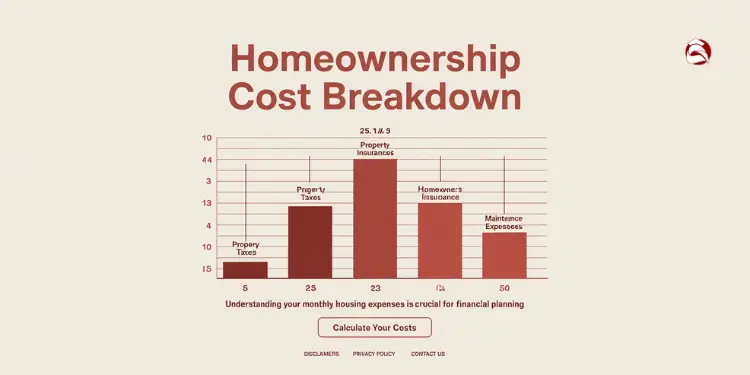

Buying a home starts with knowing how much you can spend. Many first-time buyers only look at the price tag. They forget about all the extra costs that come with owning a home.

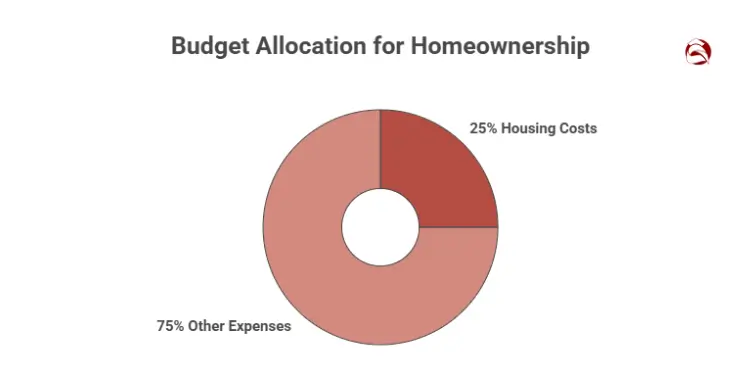

To know how much house you can buy, remember this rule: Your monthly housing costs should not be more than 25% of your take-home pay. This includes your mortgage, property taxes, insurance, and more.

Financial planners recommend **capping total housing expense at 25 % of net income** to maintain sufficient cash flow for savings and emergencies—an approach endorsed by leading personal-finance educators. Ref.: “Ramsey Solutions (2025). How Much House Can I Afford? Ramsey Solutions.” [!]

Let’s use an example. If you make $5,000 a month after taxes, you can spend up to $1,250 on housing. This includes all costs, not just your mortgage.

“The purchase price is just the beginning. The true cost of homeownership includes numerous expenses that can add hundreds to your monthly payment.”

To find out how much you can spend on a home, start with your housing budget. Then subtract these costs:

- Property taxes (1-2% of home value annually, divided by 12)

- Homeowners insurance ($100-200 monthly)

- PMI if your down payment is less than 20% (0.5-1% of loan amount annually)

- HOA fees if applicable ($100-500 monthly depending on amenities)

- Maintenance reserve (budget 1% of home value annually)

What’s left is what you can afford for your mortgage. Use a mortgage calculator to find your maximum purchase price.

Include Taxes, Insurance, and Maintenance

Setting your home buying budget means thinking about all costs. For a $300,000 home, property taxes could add $250-500 to your monthly costs. These hidden costs of buying a house can change how much you can afford.

Homeowners insurance is also a must. Rates vary, but expect to pay $100-200 monthly. This must be part of your budget.

The 1 %–4 % maintenance rule advises homeowners to set aside at least 1 % of a home’s value annually for repairs, with older or larger properties requiring up to 4 %. Ref.: “State Farm Staff Writers (2024). How to Budget and Save for Home Maintenance. State Farm.” [!]

Maintenance is often overlooked. The 1% rule suggests saving 1% of your home’s value annually for repairs. For a $300,000 home, that’s $3,000 a year or $250 monthly. Without this, even small repairs can be a financial strain.

| Expense Type | Typical Monthly Cost | Annual Percentage | Example on $300,000 Home |

|---|---|---|---|

| Property Taxes | $250-500 | 1-2% of home value | $3,000-6,000/year |

| Homeowners Insurance | $100-200 | 0.4-0.8% of home value | $1,200-2,400/year |

| Maintenance Reserve | $250 | 1% of home value | $3,000/year |

| HOA Fees (if applicable) | $100-500 | Varies widely | $1,200-6,000/year |

When working with clients, we figure out these costs first. This avoids the disappointment of loving a home that’s too expensive. A realistic price isn’t just what the bank says you can get. It’s what you can really afford.

By planning for all these costs, you can avoid being “house poor.” This means owning a home but having no money left for other things. Take the time to figure out how much you can really afford. You’ll be glad you did for years to come.

Establish all inclusive monthly payment limit

Setting a realistic monthly payment limit is key to keeping your finances safe when buying a home. I’ve helped many first-time buyers. They often face unexpected costs that blow their budget.

The rule is simple: your housing costs should not be more than 25% of your take-home pay. This rule helps keep homeownership enjoyable, not stressful.

“If more than a fourth of your paycheck goes to your house each month, your house payment can easily turn into a source of constant stress,” warns Dave Ramsey, financial expert and author.

When I meet with first-time buyers, I create a “True Monthly Cost Sheet.” It shows all the money you’ll spend on housing each month. This goes beyond what most lenders show.

Calculate Principal, Interest, Property Taxes

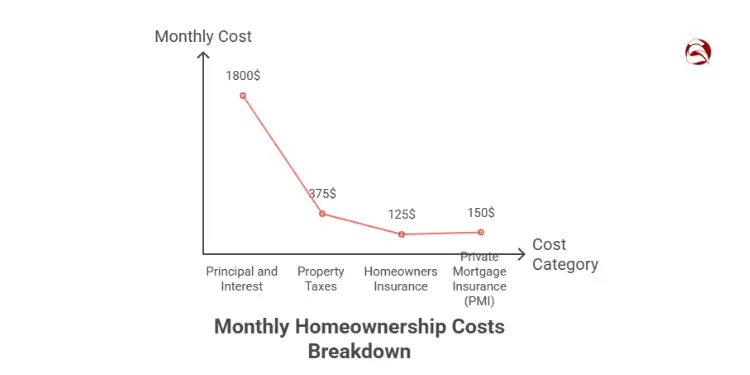

Your monthly mortgage payment includes more than just principal and interest. These are the base costs of your loan.

Principal and interest are the main parts of your payment. They help pay down your loan and cover borrowing costs. For example, a $300,000 home with 5% down at 6.5% interest on a 30-year loan has a base payment of about $1,800.

Property taxes add a big chunk to your costs. They vary by location but are usually 0.5% to 2.5% of your home’s value each year. For our $300,000 home, this could add $375 monthly to your payment when escrowed.

Homeowners insurance is another cost, adding $100-150 monthly. And don’t forget Private Mortgage Insurance (PMI), which adds another $150 monthly until you have enough equity.

These costs are usually put into your monthly payment through an escrow account. Knowing the full picture is key when analyzing the cost breakdown of buying a home.

Factor Homeowner Association Fees Upfront

HOA fees are often overlooked in a homebuyer’s budget. They can range from $100 to over $1,000 monthly, depending on the community and amenities.

What makes HOA fees tricky is that lenders don’t count them in your debt-to-income calculations for loan approval. This creates a blind spot in your budget planning.

Under Fannie Mae’s Selling Guide, monthly HOA dues are included in PITIA and fully factored into the borrower’s debt-to-income (DTI) calculation, so overlooking them can invalidate affordability estimates. Ref.: “Fannie Mae (2025). Selling Guide B3-6-02 – Debt-to-Income Ratios. Fannie Mae.” [!]

Let’s keep our example: On that $300,000 home, a $300 monthly HOA fee makes your true monthly payment jump to about $2,775. This includes taxes, insurance, PMI, and HOA fees.

Some properties may need extra insurance for floods, earthquakes, or wind damage. These can add $50-200 monthly to your costs.

The difference between the base mortgage payment and your true monthly cost can be shocking. This approach helps avoid payment shock after closing and keeps your budget safe.

Remember: lenders often approve you for more than you should spend. They focus on your loan repayment ability, not your lifestyle. Set your own payment limit based on the 25% rule to keep your finances flexible.

By knowing your true monthly housing costs upfront, you’ll find a realistic price range. This avoids the stress of being house-rich but cash-poor. This careful approach to your mortgage payment makes homeownership a financial boost, not a burden.

“Related Articles: How to make home buying budget step by step“

Track pre approval figures consistently

Keep an eye on your pre-approval numbers to avoid surprises. Surprises can mess up your home buying plan. In nine years, I’ve seen many deals fall apart because of unexpected changes.

Your pre-approval is not just a number. It changes with the market. A small interest rate hike can cut your buying power by thousands. So, it’s key to track these changes.

Make a spreadsheet to watch four important things: your max pre-approval, monthly payment, interest rate, and down payment. Update it every week. These numbers can change due to the market and your finances.

Stay in touch with your lender often. I suggest talking to them every two weeks. Even if nothing’s changed on your side. These talks help you know about changes in your house price to income ratio that might affect your budget.

Your debt-to-income ratio is at risk during your search. Avoid big purchases and new credit. A new car loan or credit card can cut your pre-approval by $20,000 or more.

Keep records of all talks with your lender. Ask for emails after calls. This helps you understand any changes to your pre-approval and how they affect your budget.

Your credit score affects your mortgage type and rate. Small changes can affect your pre-approval. Check your score monthly with free services from credit card companies.

Watch out for private mortgage insurance (PMI) if you put down less than 20%. PMI costs 0.5% to 1.5% of your loan each year. You need to include this in your budget.

Remember, your pre-approval is the max you can borrow, not what you should. Lenders might say yes to more than you can handle. Stick to your budget to avoid money troubles later.

By tracking these numbers, you stay in control of your home buying journey. This way, you avoid surprises that could break your budget.

Control discretionary spending during search

When you’re looking for a home, it’s key to spend wisely. I’ve seen many buyers spend too much and end up with less than they wanted. By controlling your spending, you save for your down payment and learn good habits for homeownership.

Pause Unnecessary Subscription Services Temporarily

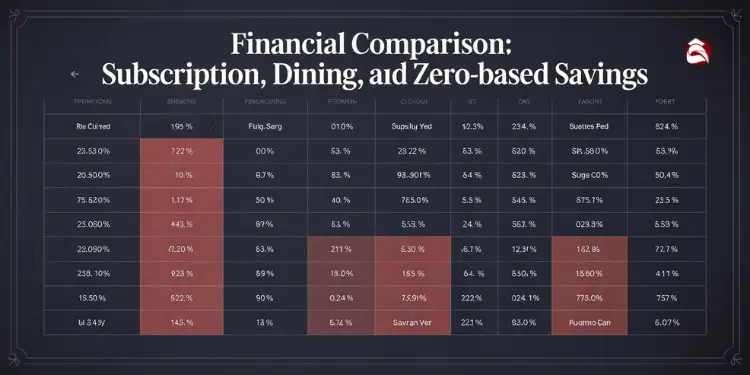

Many people are surprised by how much they spend on subscriptions. The average household pays $219 a month for services they don’t use much. Spend an hour reviewing your bank and credit card statements from the last three months.

Make a “Subscription Pause Checklist” with three columns: service name, monthly cost, and pause/cancellation date. Look at streaming services, gym memberships, and app subscriptions you don’t use. Note any fees for canceling or restarting.

One buyer in Greenville saved $273 a month by stopping her subscriptions. This extra money helped her save nearly $2,200 during her 8-month search.

“Discover More: How to stick to home buying budget without fail“

Set Weekly Dining Out Allowance

Dining out is a big budget leak when buying a home. The excitement of house hunting can lead to spending more on meals. Instead of cutting out dining out, set a weekly cash limit.

I suggest $50-75 per person each week for dining out. Take out this cash each Monday. When it’s gone, stop spending. This makes it easier to stick to your limit than using a credit card.

Save your restaurant money in a “House Fund” account. Seeing your savings grow motivates you to stay disciplined during your search.

“You Might Also Like: Free home buying budget worksheet for download“

Implement Zero-Based Spending Method

Traditional budgeting often leaves money unaccounted for. Zero-based budgeting gives every dollar a job at the start of the month. This can cut discretionary spending by 15-20% without feeling too strict.

Make three savings categories for your home: down payment, closing costs, and post-purchase needs. Every payday, move your set amounts to these accounts before paying bills.

The rest of your money goes to needs like food, transport, and utilities. Any extra goes to your home-buying categories, not your checking account.

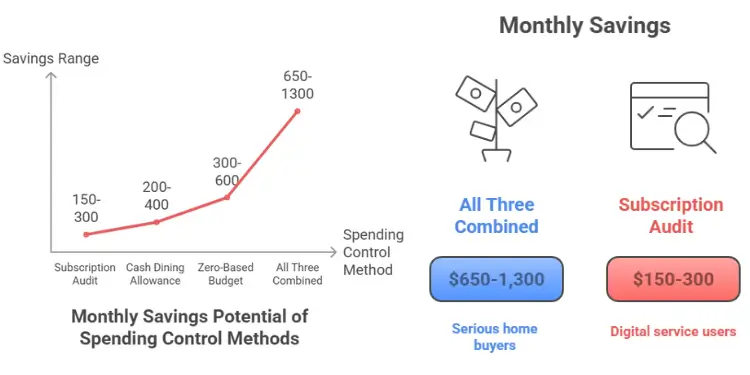

| Spending Control Method | Typical Monthly Savings | Implementation Difficulty | Best For | Success Tips |

|---|---|---|---|---|

| Subscription Audit | $150-300 | Easy | Digital service users | Set calendar reminders to reactivate essential services post-purchase |

| Cash Dining Allowance | $200-400 | Moderate | Frequent restaurant diners | Keep envelope in car to prevent impulse spending when hungry |

| Zero-Based Budget | $300-600 | Challenging | Detail-oriented planners | Use budgeting app that connects to bank accounts for real-time tracking |

| All Three Combined | $650-1,300 | Moderate | Serious home buyers | Weekly check-ins with accountability partner to maintain discipline |

Home searches often take longer than expected. These spending controls help you save for a home without cutting back too much. They prepare you for successful homeownership budgeting.

Corporate studies show that **zero-based budgeting can permanently reduce fixed and semifixed costs by 10 %-25 % within a year**, underscoring its power for accelerating down-payment savings. Ref.: “Duhalde, R. & colleagues (2023). Zero-Based Budgeting Then and Now: Technology Remakes the ZBB Rules. McKinsey & Company.” [!]

“Related Topics: How to determine home buying budget for beginners“

Compare homeownership costs with renting

Looking at rent versus buy shows hidden costs that affect your budget. I’ve helped many clients before they buy a house. They often find surprises.

It is currently cheaper to rent than buy a starter home in all 50 of the largest metros in the United States. Almost everywhere, the cost to own a home is more expensive than renting. But, there’s more to think about than just monthly costs.

A 2025 Redfin analysis finds that **buyers now need an 82 % higher income than renters to afford the median U.S. home**, confirming that ownership premiums have widened across every major metro. Ref.: “Katz, L. & de la Campa, E. (2025). Homebuyers Need to Earn Over $50,000 More Than Renters to Afford Monthly Payments—And the Gap Is Widening. Redfin.” [!]

This doesn’t mean you should give up on buying a home. It shows why comparing costs is key. You need a budget that won’t hurt your wallet.

To compare, make a two-column chart. List all costs for renting and buying. This helps avoid surprises when buying a home.

| Renting Costs | Homeownership Costs | Long-Term Considerations |

|---|---|---|

| Monthly rent | Mortgage payment | Building equity vs. no asset accumulation |

| Renter’s insurance | Property taxes + homeowner’s insurance | Tax benefits of homeownership |

| Security deposits | Closing costs (amortized) | Rent increases vs. fixed mortgage |

| Annual rent increases (3-5%) | Maintenance (1% of home value annually) | Freedom to modify vs. landlord restrictions |

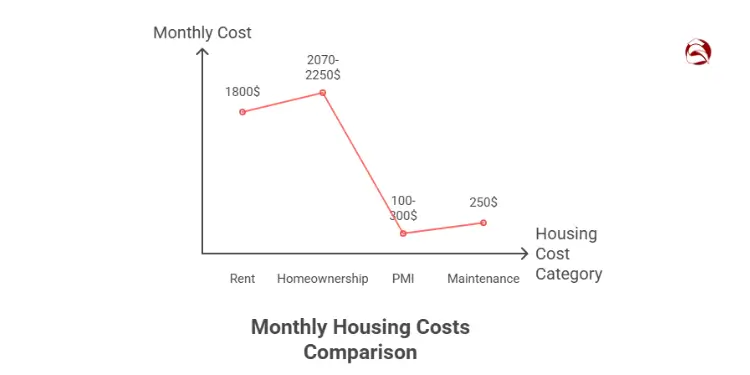

This comparison often shows surprising facts. Homeownership costs are 15-25% more in the first years. This is important to know when planning your budget.

For example, if you pay $1,800 in rent, buying might cost $2,070-$2,250 monthly. This difference affects your daily money.

Remember PMI if your down payment is less than 20%. This can add $100-$300 monthly to your payment.

Setting aside 1% of your home’s value annually for maintenance is a must. For a $300,000 home, that’s $3,000 yearly or $250 monthly.

When comparing, think about whether you want a new home or a fixer-upper. Maintenance and repair costs differ a lot.

The good news? Equity building and tax benefits can make up for higher costs over time. Each payment builds ownership, unlike rent. Also, mortgage interest and property tax deductions can save you money.

But, your monthly cash flow must cover the difference now. If the gap is more than 25%, you might need to adjust your budget or timeline. This doesn’t mean giving up on owning a home—it’s about making sure it fits your finances.

I’ve seen clients make three choices:

- Go with their original budget, knowing the true costs

- Lower their target price range to stay financially comfortable

- Wait to buy to save more for a smoother transition

All these choices can lead to successful homeownership. The key is making an informed decision, not finding out later.

This comparison helps avoid financial strain by ensuring you’re ready for the cost difference. It’s not about stopping you from owning a home. It’s about making sure it’s right for you and your finances.

“Read More: Essential home buying budget checklist for new buyers“

Maintain emergency fund and reserves

In my nine years helping first-time buyers, I’ve seen many budgets fail due to unexpected repairs. A strong financial base needs separate funds before, during, and after buying a home.

Allocate Post-Closing Repair Contingency

Even with a detailed home inspection, surprises can happen in your first two months. Save 2-3% of your home’s price for quick fixes. For a $300,000 home, that’s $6,000-$9,000 for things like HVAC or plumbing issues.

Also, have a utility buffer of $1,500-$2,500 for fees, deposits, and first maintenance costs. This keeps your emergency fund safe from regular bills.

“Explore More:

Refill Savings After Major Expenses

After settling into your home, start an automatic savings plan. Move 3-5% of each paycheck to refill your reserves. Homeownership means planning for regular upkeep and repairs, costing 1-2% of your home’s value each year.

First, rebuild your emergency fund to 3-6 months of expenses. Then, focus on your repair and utility buffers. This three-step plan helps you enjoy your home without financial stress from repairs.