Looking at short term investment goals can change how beginners think about money. At my Phoenix office, new investors often ask about quick money wins. Have you ever wondered why some people reach their money goals easily, while others struggle?

Studies show that 65% of Americans who set clear financial targets do better than those without goals. These goals aren’t just for retirement. They’re for reaching milestones in months or a few years. The time it takes depends on your goal, how much money you need, and how often you save.

Warren Buffett said, “Someone’s sitting in the shade today because someone planted a tree long ago.” Even small starts can lead to big things. I’ve helped many clients through ups and downs using simple, effective methods that don’t need a lot of money.

These steps help in many ways. Each example has steps you can follow, based on today’s interest rates and what’s likely to happen with your money.

Quick hits:

- Emergency fund completion within months

- Home down payment acceleration strategy

- Debt elimination with targeted approach

- Education funding with minimal risk

- Vehicle replacement without financing costs

Criteria defining valid short term goals

Understanding what makes a good short-term goal is key to investing wisely. Over 12 years in Phoenix, I’ve helped many investors. Not every goal is right for short-term investing. This choice affects how you pick investments and manage risks.

When you invest for short-term and long-term goals, think about the returns you want. Short-term investments usually earn less because they focus on keeping your money safe. This choice is your first step.

Good short-term goals have three things: a clear reason, a specific time frame, and the right risk level. Your goals need to be well-defined, like saving for a trip or a down payment. Without clear goals, you might pick the wrong investments.

| Short-Term Goal Type | Typical Timeline | Risk Tolerance | Appropriate Vehicles |

|---|---|---|---|

| Emergency Fund | 0-6 months | Very Low | Savings accounts, Money market |

| Major Purchase | 6-24 months | Low | CDs, High-yield savings |

| Tax Payments | 3-12 months | Very Low | Savings accounts, T-bills |

| Education Expenses | 1-3 years | Low to Moderate | Short-term bond funds, CDs |

The time limit for short-term goals is strict. I call anything needing to be liquidated in three years short-term. This tight time frame limits your investment choices, making market ups and downs a big risk.

Liquidity Requirement For Capital Safety

Liquidity is essential for short-term investing. When your investment goal time horizon is under three years, keeping your money safe is more important. I’ve seen investors lose money because they needed it too soon.

For short-term goals, you need to be able to get your money back when you need it. This means choosing investments that promise you can get your money back easily. This choice limits how much you can earn, but it’s a necessary trade-off.

The need for liquidity means keeping your capital safe is more important than making a lot of money. Your investments should let you get your money back without losing it to penalties. This is how you protect your money.

“The cardinal rule of short-term investing is simple: if you need the money by a specific date, don’t put it somewhere it might not be available in full when that date arrives.”

High-yield savings accounts are a good example of this. They offer easy access to your money with little risk. While they might not earn as much as other investments, they ensure you can meet your goals on time. This stability is often more valuable than trying to earn a little extra.

Before investing for short-term needs, check these important liquidity factors:

- Withdrawal restrictions or limitations

- Early redemption penalties

- Market-dependent liquidation values

- Settlement periods for accessing funds

- Minimum balance requirements

Less-risky investments like CDs or savings accounts usually earn less. But, they are safer. For short-term goals, it’s better to have a little growth and be sure you can get your money back.

Remember, short-term and long-term goals need different strategies. What works for long-term wealth can harm short-term goals. Your short-term investments should focus on keeping your money safe, not just earning more.

Read More:

Savings targets within twelve month window

Setting financial goals for the next year makes money dreams real. This time frame is perfect for new investors. It’s long enough to save a lot but short to see progress.

Start with an emergency fund for 3-6 months of living costs. It’s key for investing. Without it, small problems can stop your big plans.

Many savings goals fit in a year:

- Vacation fund: $2,000-5,000 for fun trips without debt

- Major appliance replacement: $1,000-2,500 for new fridge or stove

- Professional certification costs: $500-3,000 to grow your career

- Holiday and gift reserves: $1,200-2,400 for holiday cheer

Reaching these goals is easy. For example, saving $3,600 means just $300 a month. Many can find this in their budget.

Save for each goal in its own account. This helps avoid mixing up money for different goals. Most savings apps let you do this for free.

Saving for a vacation or goal means being regular, not perfect. Regular saving is more important than finding the best interest rate.

Focus on saving regularly, not just on high interest rates. When saving for a year, being consistent is more important than the rate. But, don’t miss out on high-yield savings accounts for extra money.

Check your savings every three months. This helps you stay on track and make changes if needed. For goals that last a bit longer than a year, just adjust your savings plan.

Success in short-term investing builds confidence for long-term goals. Every time you hit a goal, you’re not just saving money. You’re also learning to make wealth over time.

Income generation aims under three years

Investors with a three-year goal have great chances today. The interest rates are good for those who want to earn money now but not too much risk. It’s a good start for beginners to learn about making money without big risks.

For goals between one and three years, you need special tools. I’ve helped many clients with this. They learn to make money and keep their money safe at the same time.

The market now is better for short-term investors. Treasury bills and CDs offer high yields not seen in over a decade. This is a rare chance for safe investments to make good money.

Optimal Instruments for Short-Term Income

For investment goals focused on income, I suggest a few key tools:

- 3-month to 2-year Treasury bills (currently yielding 4-5%)

- Bank CDs with staggered maturities

- Short-duration bond funds with average maturities under 2 years

- High-yield money market accounts at online banks

These tools are good because they are predictable. They give steady income without the big risks of longer-term investments. You know exactly how much you’ll earn and when you’ll get your money back.

Building Your Income LadderCreating an “income ladder” means using different maturity dates. For example, if you have $12,000 for two years, put $1,000 in each month’s investment. This way, you get income and can use the money when you need it.

This method is flexible and can get you good interest rates. It also helps protect your money from rate changes. When an investment matures, you can reinvest or use the money as needed.

“The biggest mistake I see with 1-3 year income goals is investors reaching for yield through inappropriate instruments. An extra 0.5% isn’t worth risking your principal when your timeline is this short.”

What to Avoid for Short-Term Income GoalsRetirement accounts like IRAs are not good for short-term goals. They have rules and penalties. Also, dividend stocks are too risky for short-term goals because of their volatility.

Long-term bonds can lose value when interest rates go up. With a short time frame, you might not have enough time to recover from these losses.

It’s better to pay off credit card debt first. The interest on your debt will likely be more than what you can earn from these investments.

Aligning With Your TimelineSuccess with these strategies depends on matching your goals with the right investments. If you need money in 18 months, choose investments that mature just before then.

If your goal is flexible, you can aim for higher interest rates. But remember, each step out increases the risk to your principal.

Online banks often offer the best rates for money market accounts and CDs. They can beat traditional banks by a lot. The FDIC insurance makes these investments very safe up to certain limits.

By using these short-term strategies, you’ll learn to match investments with your goals. This is a key skill for more complex investing later.

| Instrument | Current Yield Range | Liquidity | Principal Risk |

|---|---|---|---|

| Treasury Bills | 4.0-5.0% | Medium (secondary market) | Very Low |

| Bank CDs | 3.5-4.5% | Low (early withdrawal penalties) | Very Low |

| Short-Duration Bond Funds | 3.5-4.5% | High | Low-Medium |

| Money Market Accounts | 3.0-4.0% | Very High | Very Low |

Protecting principal while seeking returns

Short-term investors face a big challenge. They must keep their money safe without losing out on gains. This is very important when inflation can make money worth less.

Keeping your money safe is the main goal for short-term goals. Unlike long-term investments, short-term money needs to stay stable. But, you don’t want your money to lose value because of inflation.

Leveraging High Yield Savings Accounts

High yield savings accounts (HYSAs) are key for short-term investing. They offer a rare mix: FDIC insurance and high interest rates. Online banks often have rates between 4-5% APY.

The FDIC insurance is very important for short-term investors. It means your money is safe, even if the bank fails. This is great for money you’ll use in the next year or two.

When picking HYSAs, look at more than just the interest rate. Check these things:

- Fee structures (monthly fees can eat into your returns)

- Minimum balance requirements (some accounts need $10,000+)

- Withdrawal limitations (some banks limit how often you can take money out)

- Mobile app functionality (it’s important for easy transfers)

- Rate guarantee periods (some rates only last a few months)

Online banks usually offer the best rates, often 1-2% higher than traditional banks. This can make a big difference for short-term goals like a down payment or emergency fund.

Considering Low Duration Bond Funds

For those who like a bit more complexity, low-duration bond funds are a good choice. They hold bonds with maturities of 1-3 years. This can offer yields better than savings accounts.

The key thing to know about these funds is duration. It shows how sensitive they are to interest rate changes. For goals under three years, I suggest keeping duration under 2. This helps avoid big price swings.

Bond funds aren’t FDIC insured, so they carry more risk. Treasury funds are very safe because they’re backed by the U.S. government. But, corporate bond funds offer higher yields and more risk.

Some investors use a mix of HYSAs and bond funds. They put money in HYSAs for the next year and bond funds for 2-3 years. This can help get better returns while keeping risk in check.

| Investment Option | Current Typical Yield | Liquidity | Principal Protection | Best For Goals Within |

|---|---|---|---|---|

| Traditional Savings Account | 0.01-0.25% | Immediate | FDIC insured | 1-3 months |

| High Yield Savings Account | 4.00-5.25% | 1-3 business days | FDIC insured | 3-24 months |

| Treasury Bills | 4.75-5.50% | At maturity (4-52 weeks) | Government backed | 6-12 months |

| Low Duration Bond Fund | 5.00-6.00% | 1-3 business days | Minimal price fluctuation | 12-36 months |

Choosing between these options depends on your personal finance situation. If you have high-interest debt, paying it off is usually a better investment. Also, having an emergency fund for 3-6 months of living expenses is more important than other short-term goals.

Short-term investing isn’t just about making money. It’s about keeping your money safe and ready when you need it. This is different from long-term investing, like saving for retirement, where you can take more risks.

Building sample short term goal portfolio

Let’s build a short-term goal portfolio that works today. Unlike long-term investment strategies, short-term ones need a balance. They must be safe, liquid, and earn modest returns.

This way, you can reach your financial goals in 1-3 years. You won’t risk too much of your money.

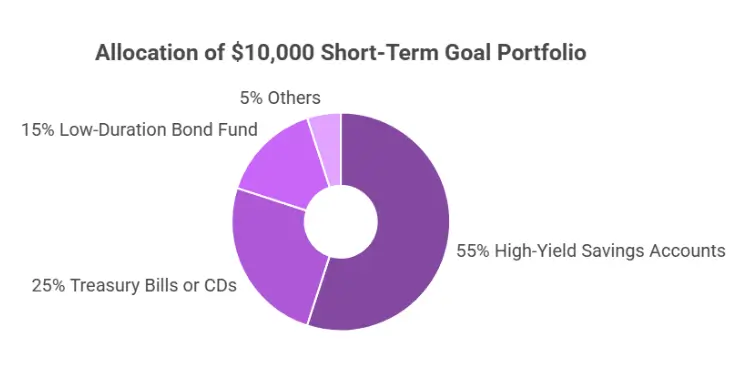

For a $10,000 short-term goal portfolio, here’s a good plan:

- 50-60% in high-yield savings accounts for quick access and no risk

- 20-30% in Treasury bills or CDs that fit your time frame

- 10-20% in a low-duration bond fund for a bit more yield

This mix can earn about 4-5% today while keeping your money safe. It’s simple to manage with just 2-3 accounts.

Allocating Cash Versus Market Assets

Choosing between cash and market assets is key. Cash gives you certainty but lower yields. Market assets like bond funds offer more yield but with some risk.

How long you have to reach your goal decides your mix. For goals under 12 months, stick to FDIC-insured products. This keeps your money safe from market ups and downs.

For example, saving for a house in 18 months, you might use:

| Time Remaining | Cash Components | Market Assets | Expected Yield |

|---|---|---|---|

| 18-24 months | 70% | 30% | 4.2-4.7% |

| 12-18 months | 80% | 20% | 4.0-4.5% |

| 6-12 months | 90% | 10% | 3.8-4.3% |

| 0-6 months | 100% | 0% | 3.5-4.0% |

This is different from long-term goals like retirement. For short-term goals, keeping your money safe is more important.

If you have many goals, like paying off debt and saving for a vacation, make separate portfolios. This keeps your money right where it’s meant to be.

Don’t use health savings accounts for short-term goals. They have rules and are meant for the long run. Stick to easy-to-use, liquid options to keep your money ready when you need it.

The best short-term portfolio is one that keeps your money safe and ready when you need it.

Reviewing outcomes and adjusting strategy

Setting great short-term financial goals is just the start. The real battle is in regular review and adjustment. I’ve found that checking in every three months is best for most investors.

This simple habit keeps you on track with your goals. It also lets you adjust when life gets in the way.

During each review, ask yourself four key questions. Has your timeline changed? Has your target amount changed? Has your ability to fund this goal changed? Are your investments doing well?

These questions help spot when you need to make changes to your goals.

Make a one-page dashboard for each goal. It should track your target balance, planned contributions, and expected returns. For goals tied to checking and savings, check if they’re covered by the federal deposit insurance corporation limits.

A Vanguard study found that beginners with 2-4 specific goals are 68% more likely to stick with their plans.

When reviewing accounts like 401(k)s, align your review with any changes in employer matching. This helps you make the most of contributions while keeping your focus on immediate needs.

If you reach a goal early, use the “completion redirect” strategy. Move those funds to your next goal. This way, you build up your emergency fund before investing in stocks for the long term.

By regularly reviewing and adjusting, you turn short-term goals into stepping stones for lasting financial security.