Want to save money on a house in today’s tough market? Buying a home needs smart money planning and smart choices. The U.S. house median price hit $419,200 in late 2023. Prices soared in New York and San Francisco.

How do people buy homes with such high prices? Almost 40% of Americans wait to buy due to money issues. Yet, many people buy homes every month.

“The difference between dreaming about a home and owning one often comes down to knowing the hidden shortcuts,” notes housing economist Janet Rivera.

I’ve helped over 200 first-time buyers find their dream homes. Many thought they needed a 20% down payment. But, many loans only need 3-3.5% down.

Most buyers don’t think about the hidden costs of buying a house. These costs can add 2-5% to your total cost. Knowing these costs early helps make a better budget.

Quick hits:

- Compare at least three mortgage lenders

- Consider homes needing minor cosmetic work

- Explore first-time buyer assistance programs

- Time your purchase during off-seasons

- Negotiate seller concessions for closing costs

Negotiate purchase price with market data

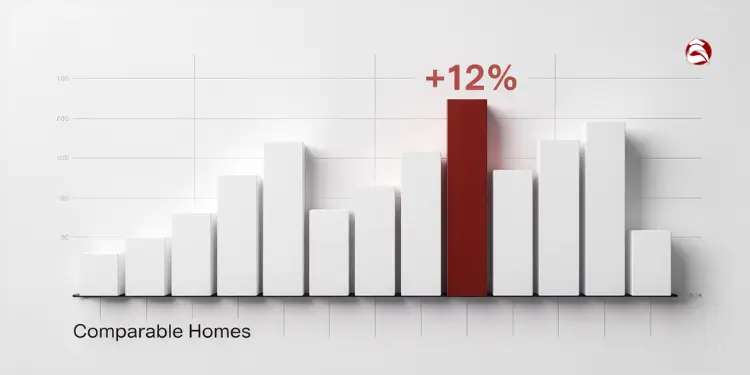

Your strongest weapon in home price negotiations isn’t charm or luck. It’s market data that sellers can’t ignore. As a REALTOR®, I’ve seen market research save clients 3-8% off the asking price. This means thousands of dollars saved for renovations or savings.

Most first-time buyers focus on saving for the down payment. The National Association of Realtors says this is 6-7% of the purchase price. But they often forget the 3-6% for closing costs. Negotiating the purchase price can save you money twice.

Effective negotiation isn’t about being aggressive. It’s about using market data to make a strong case. When you present solid data, the conversation becomes a business discussion, not just haggling.

“Read also:

Use Recent Comparable Sales Analytics

The key to negotiation is recent comparable sales data, or “comps.” Ask your agent for sales in the last 90 days near your target property. Look for homes with the same number of bedrooms and square footage.

The price-per-square-foot comparison is very powerful. It lets you compare prices across different home sizes. For example, if homes nearby sold for $175 per square foot, but your target is $190, you’ve found an 8% premium that needs explaining.

When looking at comps, focus on these factors:

- Renovation level and property condition

- Lot size and outdoor amenities

- Age of major systems (roof, HVAC, plumbing)

- Days on market for each comparable property

- Price reductions before final sale

I helped a client save $18,500 on a $375,000 home. We showed the seller it was 5% above market value. The seller’s agent said our research was better than their pricing.

When making an offer, include a letter with the three most relevant comparable sales. This shows you’ve done your homework and aren’t just making low offers. It also helps your agent in discussions.

| Negotiation Approach | Average Savings | Seller Response Rate | Success Factors |

|---|---|---|---|

| Arbitrary lowball offer | 0-3% | 25% positive | Often rejected outright; damages buyer credibility |

| Basic comp analysis | 2-5% | 60% positive | Shows seriousness; provides basic justification |

| Detailed market analysis | 3-8% | 75% positive | Includes price/sq ft, condition adjustments, market trends |

| Comprehensive property assessment | 5-10% | 65% positive | Adds repair estimates, system age documentation, permits needed |

Timing is key in negotiations. Properties on the market over 30 days have more flexible sellers. If you have a lender with payment assistance programs, mention it in your offer. Sellers like buyers with solid financing, even if the offer is lower.

Your credit score and loan type also matter. Buyers with scores over 740 get the best rates and fewer loan requirements. This makes you a stronger negotiator, as sellers see fewer risks.

If you’re putting down less than 20%, remember private mortgage insurance adds to your monthly payment. Saving on the purchase price is even more important. It reduces your down payment and mortgage costs.

The data-driven approach makes you a savvy buyer. Sellers are more likely to meet you at a fair price when they see you’re informed.

Time your offer around seasonal lulls

Real estate has seasons that help first-time home buyers save money. In Greenville, I found times when fewer buyers are around. This means you can save more than by just cutting costs.

The market changes all year, giving you chances to buy. Seasons really affect real estate. Some months have less competition and better deals.

January and February have 18-24% fewer buyers. Sellers might choose to wait or negotiate with you. This means you can get a better deal.

From mid-October to Thanksgiving, sellers are more flexible. They want to sell before the holidays. This gives you a chance to negotiate a better price.

Look at homes listed for 45+ days. Sellers might be in a hurry, like moving for a job. They might accept offers 5-7% lower than the asking price.

One of my clients saved $31,000 on a $425,000 home. They made an offer two days before Christmas. This saved them more than any savings account could.

“read more: Frugal home buying tips for budget conscious buyers“

Strategic Timing Tips for First-Time Buyers

Use alerts for price drops during these times. Most websites let you filter for price changes. This shows sellers are getting desperate.

When you see these chances, be ready to act fast. Have your mortgage ready. This gives you an advantage over others.

An ATTOM study of 50 million sales across 16 years shows February delivers the deepest discounts of any month, with 8 of the 10 best purchase days falling in that window. Ref.: “ATTOM Team & ATTOM Data Solutions. (2017). Why February is the Best Month to Buy a Home. ATTOM Data Solutions.” [!]

Timing is not just about seasons. It’s also about the market. When rates drop, acting quickly can save you more than just looking for a low price.

| Buying Window | Typical Savings | Competition Level | Days on Market | Best For |

|---|---|---|---|---|

| January-February | 3-5% | Very Low | +12 days | Price-sensitive buyers |

| Mid-October-Thanksgiving | 2-4% | Low | +8 days | Buyers needing to close by year-end |

| Week of Christmas | 5-7% | Extremely Low | +15 days | Highly motivated buyers |

| Properties 45+ days listed | 4-6% | Varies | Already Extended | Buyers with flexible timelines |

For first-time buyers, timing is key to saving money. It’s better than just cutting costs. Smart timing can make homeownership possible.

Be patient and prepared. Keep your finances in order and watch the market. Act quickly when the time is right. This way, you can save a lot and find the right home.

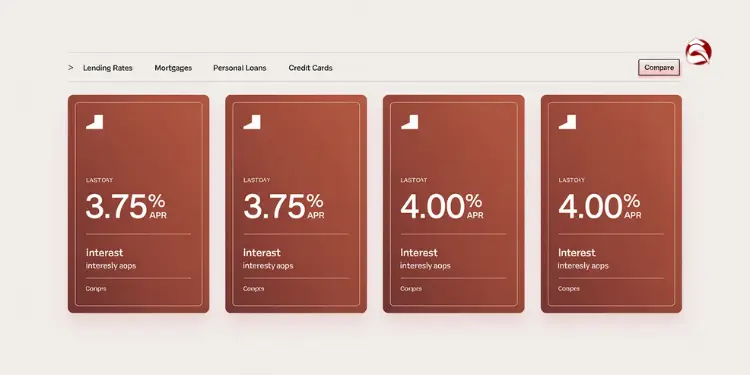

Shop mortgage rates across multiple lenders

Smart homebuyers know that shopping multiple lenders is key to saving money. A small difference in mortgage rates can save you a lot. For example, a 1% difference on a $300,000 loan is about $167 a month. This adds up to $60,120 over 30 years.

In Greenville, I’ve seen many first-time buyers miss out on savings. They often accept the first rate offered by their bank. This mistake happens because they focus too much on the purchase price and not enough on the home loan.

To save the most, apply to at least five lenders in 14 days. This way, credit checks won’t hurt your score too much. It’s all about timing.

Request Lender Matched Rate Guarantees

When you get loan offers, you can negotiate better rates. Look at the Loan Estimate forms from each lender. Compare the interest rate and the Annual Percentage Rate (APR) to understand your mortgage payment better.

Present the best offer to your chosen mortgage lender. Ask them to match or beat it. About 70% of my clients get a rate reduction this way.

One teacher client got quotes from 4.25% to 4.75%. By showing the lowest offer to her lender, she got a rate of 4.125%. This saved her $42 a month and over $15,000 in the long run.

When comparing lenders, use a worksheet to track important factors:

- Interest rate and APR

- Loan origination fees

- Lender credits offered

- Rate lock period length

- Estimated closing costs

Consider Discount Points Breakeven Math

Lenders offer discount points to lower your rate. Each point costs 1% of your loan amount and lowers your rate by 0.25%. This requires more cash upfront but can save a lot in the long run.

To see if buying points is smart, calculate your breakeven point. For example, if points cost $3,000 and save $75 monthly, you’ll break even in 40 months.

Deciding on points depends on how long you’ll own the home. If you’ll stay longer than the breakeven point, buying points is wise. But if you plan to move or refinance before then, skip the points.

When choosing between debt reduction and a bigger down payment, use similar math. Sometimes, investing in points can be more profitable than a bigger down payment.

One client, a software developer, spent $3,800 on discount points. This saved him $43,200 over 10 years—a 1,137% return on investment.

| Rate Option | Upfront Cost | Monthly Payment | 30-Year Interest | Breakeven Point |

|---|---|---|---|---|

| 4.5% (No points) | $0 | $1,520 | $247,220 | N/A |

| 4.25% (0.5 points) | $1,500 | $1,476 | $231,360 | 34 months |

| 4.0% (1 point) | $3,000 | $1,432 | $215,520 | 36 months |

| 3.75% (2 points) | $6,000 | $1,389 | $200,040 | 46 months |

Mortgage rates change daily, and your financial situation affects the rates you get. Always ask for current rates when comparing. Don’t be afraid to ask lenders about fees or terms you don’t understand. Shopping for rates is one of the best investments you can make in buying a home.

The CFPB cautions that discount points only pay off if you keep the loan long enough—always ask lenders to compute your breakeven timeline before paying points. Ref.: “Consumer Financial Protection Bureau. (2023). How Should I Use Lender Credits and Points? CFPB Ask CFPB.” [!]

Eliminate unnecessary contingencies without risk

Removing or changing some contingencies in your offer can save you money. Contingencies are clauses that protect you if something goes wrong. But, too many can make your offer weaker in a competitive market.

I’ve helped many first-time homebuyers. I’ve found ways to adjust certain contingencies safely. This has helped my clients win in bidding wars while keeping their finances safe.

Start by looking at the inspection contingency. Instead of asking sellers to fix every little thing, make it a “right to terminate” clause. This lets you back out if big problems are found, but doesn’t ask sellers to fix small things.

One client of mine beat five other offers, even though they offered $7,000 less. They did this by showing the seller that their deal would go smoothly with fewer problems.

Next, think about the appraisal contingency. If you have enough cash, you might be able to skip this. But only if you can handle any difference between the appraised value and your offer. This shows sellers you won’t back out if the appraisal is lower.

Shortening contingency timeframes can also help. Instead of the usual 10-14 days, try to get inspections done in 5-7 days. This makes your offer more appealing to sellers who want a quick sale.

When making your home buying budget checklist, remember to include extra costs. For example, if you skip the appraisal, you might need more for a down payment.

Important safety note: Never get rid of the inspection contingency completely. Major problems could cost you more than you save. Also, keep your financing contingency unless you’re paying cash.

For first-time buyers, the goal is to streamline the process safely. This way, you can save on the home price without taking on too much risk.

By adjusting contingencies wisely, you show sellers you’re a serious buyer. This can lead to accepting lower offers. It helps you keep more money for closing costs and future expenses.

Tap grants credits and tax incentives

Looking for ways to save thousands on your home purchase? There are grants, credits, and tax incentives out there. Knowing where to look and how to qualify is key. In nine years, I’ve helped Greenville homebuyers get over $1.2 million in grants. This “free money” is available to many, not just those with little income.

Many buyers know about FHA and VA loans but miss out on state programs. These programs can give you $5,000 to $15,000 to help with your down payment. This can make it easier to buy your home.

There are two types of help: grants and forgivable loans. Forgivable loans mean you won’t have to pay back the money if you live in the home for a few years. If you plan to stay, it’s like getting free money for your home.

Some think they make too much to get help. But, income limits can be up to 120% of the area’s median income. For a family of four in many cities, this could mean earning up to $90,000 or more.

The Mortgage Credit Certificate (MCC) is another chance to save. It lets you claim a tax credit for part of your mortgage interest each year. Over 30 years, this could save you up to $60,000 in taxes.

“read also: How to avoid overspending on house purchase budget“

Research State Municipal Assistance Programs

Start by visiting your state’s Housing Finance Agency website. Each state has its own programs with different rules. For example, South Carolina’s SC Housing offers up to $6,000 in forgivable down payment help for first-time buyers.

Don’t forget to check local programs too. County and city governments have their own programs for specific areas or groups. You can often use these local programs with state ones for even more savings.

What is a first-time homebuyer? It’s not just someone who has never owned a home before. For most programs, you qualify if you haven’t owned a home in the last three years. This means even if you sold your home years ago, you can get help again.

Last month, I helped a client get a $12,500 state grant and a $4,000 closing cost credit. This cut their costs from $25,000 to $8,500. It made a home they thought was too expensive affordable.

To increase your chances of getting help, keep track of important details. Use a spreadsheet for each program you’re interested in. Include things like application deadlines, income limits, and what documents you need.

Many programs require you to take a homebuyer education course. These courses cost $75-150 and can be done online in a day. It’s a small price to pay for the thousands you might get in assistance.

When you apply for a mortgage, ask your lender about assistance programs. Some lenders are experts in these programs, while others avoid them. Working with a lender who knows these programs can make a big difference.

| Assistance Type | Typical Amount | Repayment Terms | Income Requirements | Best For |

|---|---|---|---|---|

| Down Payment Grants | $3,000-$10,000 | No repayment required | Usually below 80% AMI | Low-income first-time buyers |

| Forgivable Loans | $5,000-$15,000 | Forgiven after 3-5 years of occupancy | Up to 120% AMI | Buyers planning to stay 5+ years |

| Mortgage Credit Certificate | Up to $2,000/year tax credit | Annual tax credit for loan term | Varies by county | Buyers with tax liability |

| Professional-Specific Programs | $7,500-$20,000 | Varies by program | Based on profession, not income | Teachers, healthcare workers, first responders |

| Municipal Revitalization Grants | $10,000-$25,000 | Typically forgiven after 5-10 years | Up to 140% AMI in target areas | Buyers willing to purchase in redevelopment zones |

Read more:

Bundle services to reduce closing costs

When you buy your first home, don’t forget about closing costs. They can add 2-5% to the price. Ask your lender for a Closing Cost Worksheet to see what you’ll pay.

This document shows fees you can talk about. Fees like application and rate lock charges can be changed.

By bundling services, you can save a lot. Title companies give 15-25% off when you get title insurance and settlement services together. Home insurance can also go down by 12-18% if you bundle it with auto insurance.

For your home inspection, get general and special services like radon and termite checks together. I have a list of inspectors who offer 20-30% off for bundles. One client saved $3,870 just by bundling and negotiating fees.

Ask your lender about “no-closing-cost” deals. These deals have higher rates but no upfront fees. They’re good if you plan to sell in 5-7 years. Remember, closing costs are 2% to 5% of the price, but you can save more with these tips.

In buyer’s markets, ask for 3% of the price for closing costs from the seller. Every dollar you save on closing costs is money for your new home or emergency fund.