Choosing to rent or buy is a big financial decision. What looks cheaper at first might cost more later.

Many think renting is cheaper, but it’s not always true. A 2023 study by the Urban Institute found homeowners have much more wealth than renters.

“Renting or buying depends on your money situation and goals,” says Lawrence Yun, Chief Economist at the National Association of Realtors. I’ve seen how good plans can really help your money.

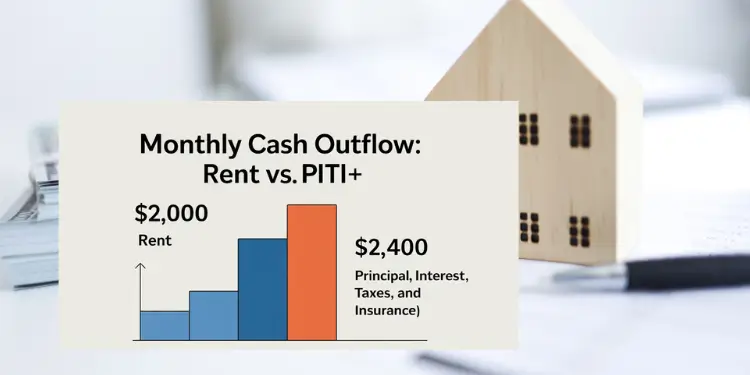

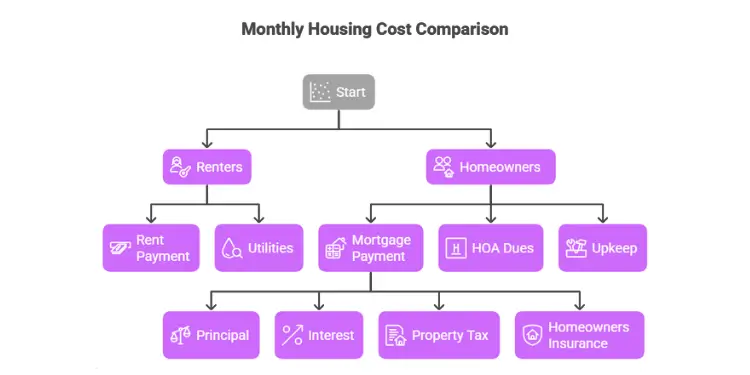

Comprehensive cost modeling is essential before rent-versus-buy analysis: renters pay rent, utilities, and renter’s insurance, whereas owners incur principal, interest, taxes, insurance (PITI), PMI (if down-payment < 20 %), HOA dues, and maintenance reserves (1–4 % of value annually). A 2025 Redfin study shows ownership costs are 15–25 % higher than comparable rents in all 50 major metros; long-term savings stem from mortgage-interest and property-tax deductions (subject to TCJA caps: $750 k mortgage debt) and potential appreciation, historically 3–5 %/yr but variable by MSA.

Decision matrix balances liquidity, flexibility, and portfolio risk: renting preserves mobility and avoids illiquid, undiversified exposure to a single asset class, while buying builds forced equity and hedges rent inflation. Optimal timing requires ≥ 20 % down, DTI ≤ 25 % net income, 6-month emergency fund, credit score ≥ 740 to minimize lifetime interest, and horizon ≥ 5 years to offset transaction costs (≈ 8–10 % round-trip).

Key Takeaways:

- Knowing all costs of renting and buying is key.

- Homeownership often leads to more wealth over time.

- Renting can be smart for now, based on your lifestyle.

Calculate your true monthly housing cost comparison

Knowing all your monthly costs is key when choosing between renting and buying a home. Renters pay for their place and utilities. But homeowners have to plan for more.

Homeowners’ median wealth surpasses renters’ by nearly \$390,000, underscoring long-term equity benefits. Ref.: “Rose, S. & Smith, J. (2023). Wealth Gap Between Homeowners and Renters Has Reached Historic High. Urban Institute.” [!]

Principal interest taxes insurance breakdown

Looking closer at mortgage costs shows the monthly mortgage payment. It includes principal, interest, property taxes, and insurance. These parts add up to the total monthly cost for homeowners.

| Cost Element | Description |

|---|---|

| Principal | The part of the loan that goes towards paying down the balance. |

| Interest | The cost of borrowing money, based on the interest rate. |

| Property Tax | Annual tax on the property’s value, split into monthly payments. |

| Homeowners Insurance | Covers damage or loss to the property, often needed by lenders. |

This shows the real monthly mortgage payment compared to rent. Rent usually doesn’t cover extra fees like HOA dues or upkeep.

The mortgage interest deduction applies only to up to \$750,000 of acquisition debt for loans after December 15, 2017. Ref.: “Internal Revenue Service. (2024). Publication 936 (Home Mortgage Interest Deduction). IRS.” [!]

Landlord obligations versus homeowner responsibilities

Renters don’t worry about property upkeep or repairs. The landlord handles these and sometimes utilities. This is a big difference when you think about owning a home.

Homeowners, on the other hand, are on their own for maintenance, repairs, and unexpected problems. This adds to your monthly costs and changes your budget and long-term plans.

So, it’s important to look at both the monthly costs and the change in responsibilities. This helps you decide if renting or buying is best for you.

Read More:

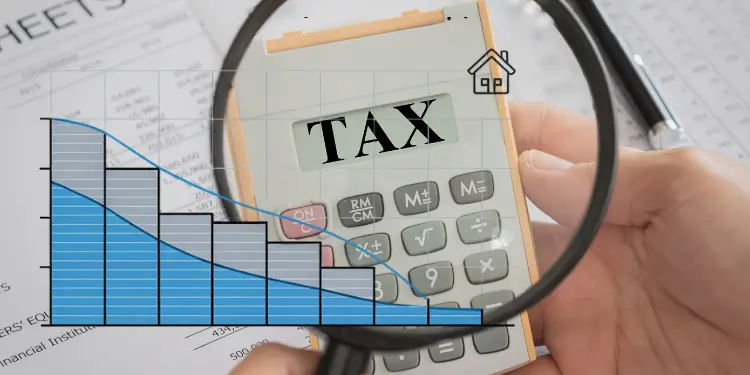

Analyze tax benefits influencing overall affordability

Buying a home comes with tax perks that make it more affordable. One big plus is the mortgage interest deduction. This lets homeowners subtract the interest from their income, which can lower their taxes. Let’s look at how these benefits help homeowners.

Mortgage Interest Deduction Impact on Savings

The mortgage interest deduction is a big financial help for homeowners. It lets them deduct the interest on their mortgage, up to $750,000. This can greatly reduce their taxes. Before 2018, the limit was $1 million, making it even better.

A report says this deduction cost $66.4 billion in lost taxes in 2017. But after tax changes, this number dropped to $30.2 billion in 2020.

The current \$750,000 loan limit and standard-deduction increase under the TCJA expire after 2025, potentially reducing future tax benefits. Ref.: “Keightley, M. P. (2020). An Economic Analysis of the Mortgage Interest Deduction. Congressional Research Service.” [!]

Property Tax Adjustments After Homestead Credits

Homeowners also get help with property taxes and insurance. Homestead credits can lower the taxable value of a home. This means lower property taxes. Property tax rates vary by state, so this can be a big help.

Homeowners insurance isn’t directly deductible. But it’s key in keeping the home’s value safe. This helps keep homeownership affordable in the long run.

In short, tax perks like the mortgage interest deduction and property tax adjustments give homeowners big financial benefits. These advantages aren’t available to renters. By using these deductions, homeowners can make their homes more affordable and plan for the future.

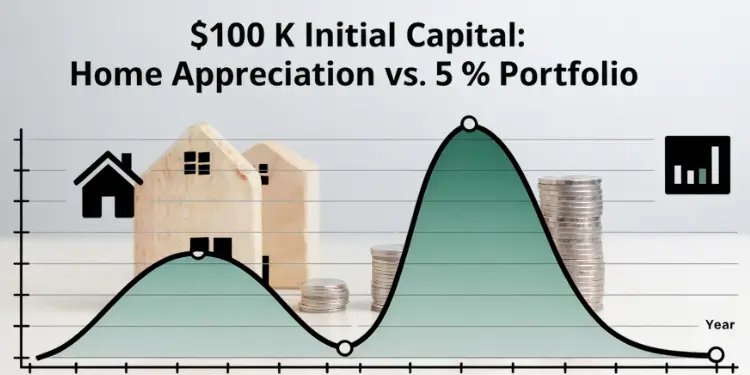

Project equity growth versus rental opportunity cost

Thinking about owning a home means looking at two big things. You can grow your wealth through home equity and value increase. But, renting lets you save money that you wouldn’t spend on a mortgage.

Historical appreciation rates in local market

Looking at how home values have changed in your area is key. It shows how much your home might be worth in the future. This helps decide if now is a good time to buy a home.

For instance, a steady 3-5% annual increase in property values can significantly enhance the value of your home over a decade.

Home equity can make you much more financially secure over time. This is more than what you get from renting, where you don’t see any equity growth.

Savings reinvested yields versus property equity

Using the money for a down payment and upkeep in the stock market might give better returns. Investing in different things can make more money than your home might.

When you plan your money, you compare what owning a home does to other investments. This helps you choose the best way to grow your wealth.

| Scenario | 5-Year Growth | 10-Year Growth | 20-Year Growth |

|---|---|---|---|

| Historical Appreciation Rates in Local Market | 15% | 30% | 60% |

| Invested Savings with 5% Annual Return | 27.63% | 62.89% | 165.33% |

Looking at both options helps you make a smart choice. It’s about deciding if owning a home or renting and investing is better for your future wealth.

Evaluate lifestyle flexibility and relocation considerations

Choosing to rent or buy a home is more than just money. It affects your freedom to move and your lifestyle. Many people value being able to move easily without being tied down by owning a home.

Job mobility prospects affecting ownership appeal

People with jobs that require moving often prefer renting a home. It’s easier to end a lease than to sell a house. This makes renting more appealing for those who need to move around a lot.

Lease termination penalties contrasted with selling

Rental agreements have rules for ending a lease early. These rules are usually easier to follow than selling a home. Rent vs buy choices should think about these differences. Renting can protect you from sudden job changes or moves.

Whether you care more about money or lifestyle flexibility, knowing these points helps. It helps you choose what’s best for your career and personal life.

Build emergency savings before transitioning ownership

Going from renting to owning a home means more than just paying a mortgage. You also need to get ready for unexpected costs that come with homeownership. It’s important to save money for emergencies. Start by saving enough to cover three months of living expenses.

This emergency fund helps you deal with sudden repairs or times when your home might be empty.

Account for Repair Costs and Vacancies

Homeowners face unexpected repair costs over time. Things like a leaky roof or a broken HVAC system can happen. An emergency savings fund helps avoid these becoming big financial problems.

If you plan to rent out part of your home, think about times when it might not be rented. You’ll need to cover your mortgage and any repairs without relying on rental income.

This link explains why an emergency fund is so important.

Set Three Month Cushion for Mortgages

Having a cushion for at least three months’ worth of mortgage payments is also key. Monthly mortgage payments are often a big part of your expenses. Having these funds ready can help avoid defaulting on payments when money is tight.

Getting ready financially makes owning a home less stressful and more sustainable.

Check out the below:

In short, saving a lot for home expenses, including an emergency fund, is key before you own a home. It gives you peace of mind and protects you from financial surprises.