A good rent increase clause in your lease is key in today’s housing market. When Sarah faced a 15% payment jump without warning, I found her lease was missing this important part. It could have saved her from a big financial problem.

Did you know 77% of renters don’t check their lease before signing? This mistake can cost them thousands each year. Housing lawyer Marcus Lee says, “The most expensive words in rental housing are ‘I didn’t read that part of my lease.'”

Without limits, landlords can raise costs with few rules. Knowing how much your rent might go up and when is vital. Proper lease renewal terms can save you about $2,000 a year on unexpected costs.

I’ve seen many tenants have to move because they didn’t have basic protections. These protections take just minutes to check but can save years of money.

Quick hits:

- Caps yearly payment increases effectively

- Requires advance notice before changes

- Prevents surprise financial emergencies

- Creates predictability for budget planning

Maximum allowable percentage annual rent increase

A good rent increase clause limits how much rent can go up each year. This makes your money safer. I’ve helped tenants for nine years and seen many leases without clear rent limits.

Your lease should say “Rent shall not increase by more than X% annually.” This X is usually between 3-5% in most places.

Los Angeles’ Rent Stabilization Ordinance presently limits rent hikes to 4 %—or 6 % if the landlord pays for gas and electricity—showing how many markets standardize annual caps in the 3–5 % range.Ref.: “Wagner, D. (2024). New rent hike limits go into place this week. LAist.” [!]

Watch out for landlords who say “market-based adjustments” instead of a clear number. These vague terms can lead to big surprises. I’ve seen tenants face sudden 15% rent hikes because their leases were too vague.

BLS cautions that escalation clauses must spell out the CPI series (population, geography, reference base); otherwise, “market-based” wording leaves room for excessive, unpredictable hikes.Ref.: “U.S. Bureau of Labor Statistics. (2024). Contract Escalation. U.S. Bureau of Labor Statistics.” [!]

The rent cap is like a shield for your money. In Los Angeles, rent can go up by 3% to 8% a year, depending on inflation. But some say this isn’t fair to tenants.

Good rent increase clauses use things like the consumer price index (CPI) to decide how much rent to raise. This way, rent goes up based on real economic changes, not just guesses.

Binding Landlord to Specific Escalation Formula

The escalation formula is key to keeping rent increases fair. It should be clear in your lease, so there’s no confusion. Always check this part before you sign.

A good escalation formula has three main parts:

- The exact index used (like the national consumer price index)

- How to calculate the increase (like a percentage of the index change)

- Any limits on how much rent can go up, even if the index changes a lot

For example, a good clause might say: “Rent increases shall be 75% of the regional CPI-U change, not more than 5% of the base rent.” This makes sure your landlord follows a clear rule.

Tying rent adjustments to a precisely defined Consumer Price Index (such as 75 % of the regional CPI-U) is the BLS-recommended formula for minimizing future disputes over escalations.Ref.: “Crawford, M. & Stewart, K. J. (2012). Writing an escalation contract using the Consumer Price Index. U.S. Bureau of Labor Statistics: Beyond the Numbers.” [!]

Without clear rules, you might face unfair rent hikes. I’ve helped many tenants fight these hikes when landlords didn’t follow their own rules.

The way we now calculate rent increases is flawed. It makes rent go up because housing costs are high, which then justifies even higher rent increases.

The Economic Roundtable wants to change how we figure out rent increases. They say we should use an index that doesn’t count housing costs. This would stop the cycle of rent increases justifying even more increases.

Before you sign a lease, make sure the rent increase formula is clear. This helps you plan your money better. If your landlord won’t agree to clear rules, it’s a bad sign for future rent hikes.

Notice requirements before rent adjustment

Before your landlord can change your rent, they must send you a formal notice. This notice must follow the rules set by your state’s laws. It’s a rule to help you prepare financially or find a new place if needed.

While helping tenants, I’ve seen many landlords try to raise rent right away. But, they always fail because they didn’t follow the notice rules. Your lease might say something about this, but state law is the final word.

Written Notice: The Only Valid Format

Talking about rent changes isn’t enough. The notice must be in writing to be legal. This makes sure everyone has proof of the notice, avoiding arguments.

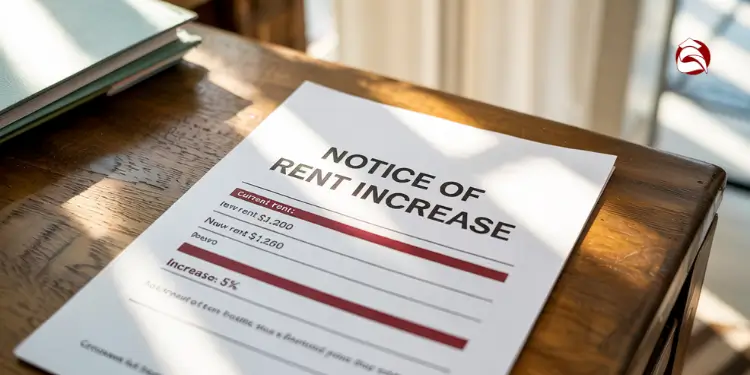

The notice should clearly show your current rent, the increase, the new rent, and when it starts. It should also tell you about your rights regarding rent increases.

As a tenant, always ask for these notices in a way you can prove they were sent:

- Certified mail with return receipt

- Email (if your basic lease agreement terms allow it)

- Hand delivery with a signed receipt

Timing Requirements By Lease Type

The notice time needed depends on your lease type. Month-to-month tenants get less notice than those with fixed-term leases. Here’s what you can expect:

| Lease Type | Typical Notice Period | When Increases Can Occur | State Variations | Documentation Needed |

|---|---|---|---|---|

| Month-to-month | 30 days | Any month with proper notice | 60 days in California for increases over 10% | Written notice with effective date |

| Fixed 1-year lease | 30-60 days before renewal | Only at lease anniversary | 90 days in Seattle for any increase | Written notice with new lease terms |

| Fixed 2-year lease | 60 days before renewal | Only at lease anniversary | 120 days in Portland for increases over 5% | Written notice with renewal options |

| Rent-controlled unit | 90 days typically | Once annually per local ordinance | NYC requires Rent Guidelines Board approval | Notice with rent calculation formula |

If your landlord doesn’t give you the right notice, you don’t have to pay the increase right away. I helped a client who got a 10-day notice for a $200 rent increase. We argued that the increase couldn’t start until 30 days had passed, as the law requires.

State Law Trumps Lease Omissions

Even if your lease doesn’t talk about notice for rent increases, state laws do. These laws set a minimum notice time that landlords must follow, no matter what your lease says.

In Oregon, for example, landlords must give 90 days’ notice for rent increases after the first year. Even if your lease is silent on this, your landlord must follow the state’s 90-day rule.

“The notice provisions for rent increases are among the most commonly violated aspects of landlord-tenant law, yet they’re also among the easiest to enforce when tenants know their rights.”

Proactive Tenant Strategies

Mark your calendar 90 days before your lease ends or anniversary. This gives you time to get ready for a possible rent increase notice. If you get a notice that doesn’t follow the law, write back right away pointing out the problem.

Keep all rent increase notices. If you need to argue about the timing or amount later, this proof will be key. Remember, landlords can only raise rent after they’ve given the correct notice—no exceptions.

If a noticed increase is too high for you, you have the whole notice period to talk about it or find a new place. Use this time well, instead of waiting until the last minute.

Exemptions for new or luxury units

Knowing which rentals are exempt from rent control laws can save you money. I’ve helped many renters avoid big rent hikes by checking if their units are exempt. It’s important to know this before signing a lease.

Not all rentals face the same rent rules. Some places don’t include certain types of housing in their rent control laws. This makes the rental market unfair for some.

The most common exemptions include:

- New construction (usually buildings less than 15-20 years old)

- Luxury units (often defined by rent threshold or premium amenities)

- Single-family homes

- Small buildings (usually those with fewer than 4 units)

In Los Angeles, about 650,000 apartments are protected by rent control. This is 44% of the city’s housing. But, most rentals don’t have these protections. The main reason is when the building was built.

Los Angeles apartments built before October 1, 1978, usually have rent control. But newer buildings don’t.

“The exemption of newer buildings from rent control is based on the economic theory that such regulations might discourage new housing development,” explains housing economist Rachel Mendoza. “Whether this actually stimulates construction remains hotly debated.”

For renters in exempt properties, landlords can charge more than usual. In some cases, there’s no limit on how much rent can go up each year. This can be very hard on renters, making it hard to budget.

To see if your unit is exempt, check your lease. It should say if it’s under rent control or exempt. If it doesn’t, don’t assume it’s protected. Always ask your landlord and get a written answer before signing.

Even in exempt units, landlords must give notice before raising rent. This notice can be 30-60 days, depending on your state laws and the rent increase.

If you’re looking at renting a new or luxury unit, here’s how to protect yourself:

- Negotiate a multi-year lease with fixed increase percentages clearly stated

- Get all verbal promises about future rent levels in writing

- Research the property owner’s history of rent increases

- Budget for potentially significant increases when your initial lease term ends

In exempt properties, your rent is fixed for the first year. But, when it’s time to renew, you might face big increases. I’ve seen luxury apartment renters face 15-20% hikes with little they can do.

The rules on exemptions vary by location. In New York City, buildings built after 1974 are usually exempt. In San Francisco, buildings built after June 1979 are not under rent control. Some cities, like Houston, have no rent control at all.

| City | Exempt Property Types | Key Exemption Date | Percentage of Exempt Units |

|---|---|---|---|

| Los Angeles | New construction, luxury units | After Oct 1, 1978 | Approximately 56% |

| New York | New buildings, high-rent units | After 1974 | Approximately 50% |

| San Francisco | New construction | After June 1979 | Approximately 38% |

| Chicago | All units (no rent control) | N/A | 100% |

Just because a unit is exempt doesn’t mean the landlord can do whatever they want. All rental agreements are legally binding. If your lease says there are limits on rent increases, those rules apply, even if the unit is exempt.

To determine if your area has exemptions, check your local housing authority website or a tenant rights group. This info is important, but often not shared during lease signing. Knowing this can help you plan your finances better.

Units built after 1979 are exempt from L.A.’s Rent Stabilization Ordinance, leaving tenants vulnerable to unrestricted increases unless contractual caps are negotiated.Ref.: “Wagner, D. & Champlin, C. (2020). How to stand up for yourself as an LA Renter: A roadmap. LAist.” [!]

Procedure to dispute unlawful rent increase

Disputing an unlawful rent increase is important. It protects your rights and helps you win. I’ve helped many renters through this. Timing and documentation are key.

Start right away when you get a rent increase notice. You usually have 10-30 days to challenge it. Keep paying your old rent and save the extra in a separate account.

Look at your lease before you act. Check for rules on rent increases and how to solve disputes. Many find their landlord broke the rules, which helps their case.

Gather Comparable Rent Price Evidence

Good evidence is key in a rent dispute. Start by finding similar rentals in your area. Look for places with the same size, number of rooms, and amenities.

- Similar square footage (within 10-15%)

- Matching bedroom and bathroom count

- Equivalent amenities and building features

- Comparable neighborhood location and access to services

- Similar property age and condition

Collect evidence carefully. Take photos of online listings and print out ads. Make a table to show how your rent increase is too high. Date everything and keep it in a folder.

Also, gather evidence specific to your situation. Take photos of any problems with your place. Keep records of all talks with your landlord about the increase.

File Complaint With Local Housing Agency

After you have your evidence, file a complaint with your local housing agency. They help enforce rental laws. The name of the agency might vary, but their purpose is the same.

Contact the agency and ask for their complaint form. You’ll need:

- A completed complaint form with your contact information and property details

- Copies of your lease agreement (highlighting relevant sections)

- Documentation of the proposed increase (notice from landlord)

- Your evidence package of comparable rentals

- Timeline of communications with your landlord

Send your complaint by certified mail and keep the receipt. This proves when you filed. The agency will then look into your case and might hold a hearing.

If the agency agrees with you, they might tell your landlord to lower the rent. If not, you can appeal or go to small claims court.

For complex cases, consider a tenant rights lawyer. They often offer free first meetings. Some legal groups help low-income tenants for free.

Remember, your records are your best defense. Every photo, email, and receipt helps your case. I’ve seen many disputes won because of better records.

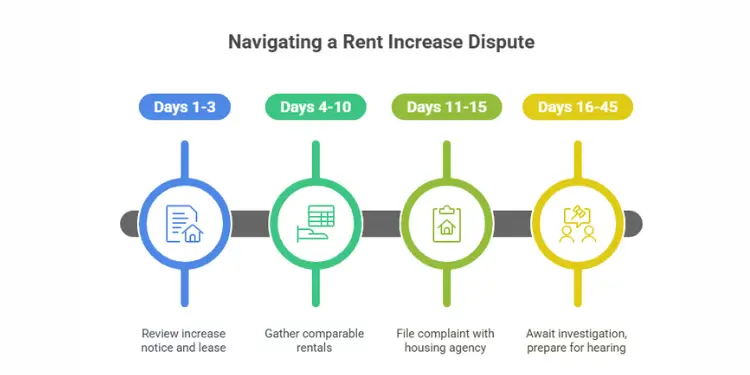

| Dispute Timeline | Action Required | Documentation Needed |

|---|---|---|

| Days 1-3 | Review increase notice and lease | Original lease, increase notice, payment history |

| Days 4-10 | Gather comparable rentals | Screenshots, photos, listings of similar units |

| Days 11-15 | File complaint with housing agency | Completed forms, evidence package, certified mail receipt |

| Days 16-45 | Await investigation, prepare for hearing | Additional evidence, witness statements if applicable |

The process might seem scary, but housing agencies are there to help. By following these steps, you can fight an unfair rent increase and win.

HUD advises tenants to continue paying the original rent and submit a documented complaint; maintained records and timely filing materially strengthen case outcomes.Ref.: “U.S. Department of Housing and Urban Development. (2006). HUD’s Title VIII Fair Housing Complaint Process. HUD.” [!]

Economic hardship clauses limiting rent hikes

When life gets tough, economic hardship clauses can help. They pause rent hikes during tough times. But, many renters don’t know to ask for them.

Research from the Urban Institute shows these clauses help a lot. They are very useful for people who spend a lot on housing.

In nine years helping renters, I’ve seen how these clauses help. They stop people from becoming homeless. In Los Angeles, one-fifth of renters live below the poverty line.

Even small rent hikes can be hard for these people. Hardship clauses help both sides. Tenants stay in their homes, and landlords avoid losing money.

Understanding Economic Hardship Provisions

A good hardship clause has three key parts. It says what counts as a hardship, like job loss. It also says what proof you need, like a letter from your job. And it explains how long rent won’t go up.

These clauses aren’t common, but I’ve helped many renters get them. It’s all about working together, not fighting.

Here’s what a good hardship clause might say:

“In the event Tenant experiences qualifying economic hardship (job loss, medical emergency exceeding $2,000, or death of household income provider), Tenant may request temporary rent relief. Upon providing documentation of hardship within 7 days of occurrence, Landlord agrees to freeze rent at current rate for up to 90 days. Tenant must provide monthly updates on financial recovery progress.”

Request Temporary Freeze After Job Loss

If you lose your job, act fast. Write to your landlord within 7 days. Include your job loss letter and a plan for when you’ll pay rent again.

Even without a clause, you can ask for help. Many landlords prefer to keep good tenants. The best way is to talk face-to-face.

- Bring documents showing your new situation

- Offer a specific solution

- Show how you plan to get back on your feet

- Keep a record of all talks

Your letter should say you’re a good tenant. Offer a clear plan, like “I need 90 days to find a new job, with updates every week.”

Landlords don’t have to agree without a clause. But, many find it cheaper to help tenants than to find new ones.

| Comparison Point | Standard Lease | With Economic Hardship Clause | Financial Impact |

|---|---|---|---|

| Job Loss Protection | None; full rent due regardless | 3-6 month freeze on increases | Saves $50-150/month during crisis |

| Medical Emergency | No provisions for relief | Payment plan options available | Prevents eviction costs ($3,000+) |

| Documentation Required | Not applicable | Termination letter, medical bills | Minimal administrative burden |

| Landlord Benefit | None specified | Tenant retention, reduced vacancy | Avoids $1,500+ turnover costs |

| Implementation Method | No formal process | Written request with timeline | Creates clear expectations for both parties |

If you’re struggling, act fast. Write a letter, call your landlord, and keep records. If they agree, make sure it’s in writing.

When you’re signing a new lease, ask for a hardship clause. It’s a smart move in today’s economy. It helps you stay in your home when things get tough.

Quick action checklist: Request hardship relief within 7 days of job loss → Document everything → Propose specific timeline → Get any agreement in writing → Follow through on your recovery plan.

Rent control statutes and city ordinances

I’ve seen many tenants pay too much when landlords raise the rent too high. Rent control laws in your area can protect you more than your lease. In New Jersey, cities can set their own rules for rent increases.

If you live in a rent-controlled area, your landlord must follow certain rules. These rules usually limit rent hikes to 2-10% a year. They also require landlords to give you notice before raising your rent. In New Jersey, they must give you 30 days’ notice for month-to-month leases.

Read More:

To see if your place is rent-controlled:

1. Check your city’s housing department website

2. Call your local tenant rights group

3. Ask your housing authority for proof

Even with a new lease, the rent must follow local laws. The length of your lease doesn’t change this. If your landlord raises the rent too much, keep records and report it to your local rent board.

Also, remember that security deposits can’t go up too much. In New Jersey, they can’t be more than 1½ times your monthly rent. Don’t think a rent hike is okay because your landlord says it is. Knowing your rights can save you a lot of money.