The rent grace period clause gives tenants a break when paying rent. I’ve seen many renters find this lifeline after worrying about missed deadlines. Did you know almost 40% of American renters have paid a late fee at least once in the past year?

This important clause acts as a buffer. It keeps you safe from penalties until the grace period ends. One client said, “That five-day window saved me hundreds when my paycheck was delayed.”

Think of this clause as your financial safety net. If your lease says “payment due on the 1st,” the grace period means you’re not late. You can’t face penalties until the grace period ends. Most lease agreements contain several important clauses like this that protect tenants from unfair practices.

In my nine years helping tenants, I’ve seen this clause save people from debt. But, it’s not for everyone. It must be written in your rental agreement.

Quick hits:

- Typically spans 3-5 days after deadline

- Must be written in your agreement

- Prevents immediate financial penalties

- Varies by state and landlord

- Worth negotiating at renewal time

Standard grace window length for payments

Knowing how long your rental grace period is is key. It helps avoid late fees and keeps your landlord happy. Most leases give you 3-5 days after rent is due to pay without penalty.

In nine years at Ogden legal clinics, I’ve seen grace periods vary a lot. Some landlords give just 24 hours, while others give 10 days. The average is five days, which is good for many reasons.

Tennessee’s Uniform Residential Landlord & Tenant Act bars any late-fee assessment until a full five-day grace period has passed, and if the fifth day falls on a Sunday or legal holiday the deadline shifts to the next business day. Ref.: “Tennessee General Assembly. (2023). Tenn. Code Ann. § 66-28-201(d). State of Tennessee.” [!]

This five-day grace period works well because of weekends and paychecks. Many people get paid at the end of the month. This makes the five-day grace period fit their financial plans well.

“Your lease should say: ‘Tenant shall have a grace period of five (5) days after the rent due date before late fees apply.’ Without this, you might face penalties right away.”

If your lease says rent is due on the 1st but doesn’t mention a grace period, you might not have one. In many places, landlords don’t have to give extra days. Always check your lease for payment details.

State laws about grace periods vary a lot. Some states require a certain number of days, while others don’t. But some states have laws that help tenants:

| State | Mandated Grace Period | Late Fee Restrictions | Special Provisions |

|---|---|---|---|

| Tennessee | 5 days | Reasonable amount only | Must be specified in lease |

| Delaware | 5 days | Capped at 5% of monthly rent | Applies to all residential leases |

| Maine | 15 days | 4% of monthly rent maximum | Most tenant-friendly in nation |

| Connecticut | 9 days | Limited to $25 or 5% | Extends for elderly/disabled tenants |

| Oregon | 4 days | Reasonable amount only | Weekends/holidays extend period |

You can talk about changing the grace period when you sign a lease. Some landlords might agree, depending on your payment history or rent amount.

INDUSTRY BEST PRACTICE:

Maine sets a 15-day statutory grace period before any late fee can be levied—triple the typical window—demonstrating a tenant-centric model that sharply reduces fee disputes. Ref.: “Maine Legislature. (2025). Title 14 § 6028 Penalties for Late Payment of Rent. Maine Revised Statutes.” [!]

Remember, a grace period doesn’t change when rent is due. Rent is due on the 1st, as your lease says. The grace period just gives you extra time before late fees start.

If you’re close to the end of your grace period, keep good records of your payments. Save emails, get receipts, or take photos of checks. This can help if there’s a dispute about payment timing.

- Check your lease for the specific grace period length

- Research your state’s laws regarding mandatory grace periods

- Document all payments made within the grace period

- Don’t confuse the grace period with an extension of your actual due date

The standard grace period for rent payments is five days. But your situation might be different. Check your lease and local laws to know how many extra days you have before penalties kick in.

Conditions triggering grace clause protections

Not all delays in payment get you out of trouble. Knowing when you’re safe is key. Your grace period isn’t a free pass to pay late whenever you want. It kicks in only when you have a good reason for the delay.

I’ve helped many tenants who didn’t know when they could pay late. This confusion can lead to extra fees and bad feelings with landlords. Let’s figure out when you’re safe from penalties.

Weekends and Holidays Shifting Due Date

If your rent is due on a weekend or holiday, you get extra time. This is because banks and offices are closed. You can’t pay then.

Your lease might say: “If the rent due date falls on a weekend or legal holiday, the due date shall be extended to the next business day.” Even without this, courts often agree it’s fair.

I helped a tenant who was charged late fees on a Sunday, January 1st. She paid Monday morning but was charged late. We proved she couldn’t pay in person on the due date.

This rule applies no matter how you pay:

- Check payments: The postmark date proves you paid on time

- Electronic transfers: When you start the transfer matters, not when it settles

- Online portals: System receipts show you paid on time

This rule doesn’t make the grace period longer. It just moves the due date. Keep records if your landlord tries to charge late fees on the first business day after a weekend or holiday.

Bank Delays Excused Under Force Majeure

Delays in the banking system that you can’t control might get you out of trouble. This is called “force majeure” [unforeseeable circumstances preventing fulfillment of contract]. If the banking system fails without your fault, you shouldn’t be penalized.

Your lease might say: “Tenant shall not be penalized for delays in payment processing outside Tenant’s control.” Even without this, you can often fight late fees by showing you paid early enough for normal processing.

I’ve helped tenants avoid late fees in several cases:

- Bank system outages that delayed electronic transfers

- Unexpected processing holds on large payments

- Mail delays due to severe weather events

- Payment portal technical failures with documented error messages

This protection has limits—it won’t excuse your own mistakes like not having enough money or wrong account numbers. You must prove the delay was truly beyond your control.

Always save screenshots of payment confirmations. Most courts agree that paying three business days before the due date is reasonable, even if the landlord’s receipt is delayed.

| Triggering Condition | Protection Typically Provided | Required Documentation | Common Exceptions |

|---|---|---|---|

| Weekend/Holiday Due Date | Automatic extension to next business day | Calendar showing holiday/weekend, payment receipt | Leases explicitly requiring payment before due date |

| Bank Processing Delays | Excused late payment without penalty | Transaction confirmation, bank statements | Insufficient funds, incorrect account information |

| Natural Disasters | Extended grace period during emergency | Official emergency declarations, evacuation orders | Pre-disaster delays, ability to pay electronically |

| Payment System Failures | Waiver of late fees for system issues | Error messages, support ticket numbers | User error, failure to try alternative payment methods |

To use your grace period well, pay early to account for delays. Set reminders five days before your due date. This gives you time to handle any unexpected payment issues.

But, remember, paying late too often can lead to not renewing your lease. The grace period is for occasional delays, not to extend your due date forever.

Landlord notice procedures during grace period

The rent grace period is a special time. Landlords must follow certain rules during this time. Knowing these rules can help avoid stress and protect your rights.

When rent is due on the first, landlords can contact you. But they can’t send a “Pay or Quit” notice yet. This is because the grace period is meant to protect you.

Landlords can send reminders about the deadline. These reminders should be clear they are not formal notices. This helps keep you from feeling harassed.

“A grace period is not merely a courtesy—it’s a legally protected window during which a tenant cannot be penalized for non-payment. Any landlord action that treats the tenant as delinquent during this period potentially violates tenant protection statutes.”

Credit reporting rules also apply during this time. Your landlord can’t report late payments yet. This helps keep your credit score safe.

If you get a notice during the grace period, document it right away. Take photos of the notice and the date. This evidence is important if you need to fight back later.

Some landlords might try to scare you during the grace period. They might say the rent is late when it’s not. Remember, the grace period is there to protect you from these tactics.

| Communication Type | Allowed During Grace Period? | Proper Format | Tenant Response |

|---|---|---|---|

| Courtesy Reminder | Yes | Clearly marked as “reminder” only | No action required |

| Pay or Quit Notice | No | N/A – Should not be issued | Document and potentially file complaint |

| Late Fee Notice | No | N/A – Cannot charge late fee amount yet | Contest in writing citing grace period |

| Credit Bureau Reporting | No | N/A – Payment not yet late | Dispute with bureau if reported |

According to Law Insider, sending formal notices during the grace period is wrong. It can be seen as harassment in many places. This rule applies even if you pay on time later.

When landlords try to collect rent during the grace period, they often break the law. These violations can help you if you have a dispute later.

Save all communications from this time. Keep them in a folder, either physical or digital. This helps show a pattern if your landlord keeps sending wrong notices.

If your landlord sends scary notices, don’t argue. Instead, write back (email is good for a timestamp) saying you know your rights. Mention your lease’s grace period clause.

The grace period is more than extra time to pay. It’s a time when landlords can’t do certain things. Knowing this helps you keep your rights while paying rent.

Read more: Late fee clause explaining charges after missed payments

Tenant strategies for timely rent submission

Grace periods help, but the best way to avoid late fees is to pay on time. I’ve worked with renters for nine years. They often worry about rent deadlines too much. Grace periods are meant for emergencies, not regular payments.

Smart renters make grace periods almost unnecessary. When you pay rent on time, you show your landlord you’re reliable. This way, you avoid late fees and feel less stressed.

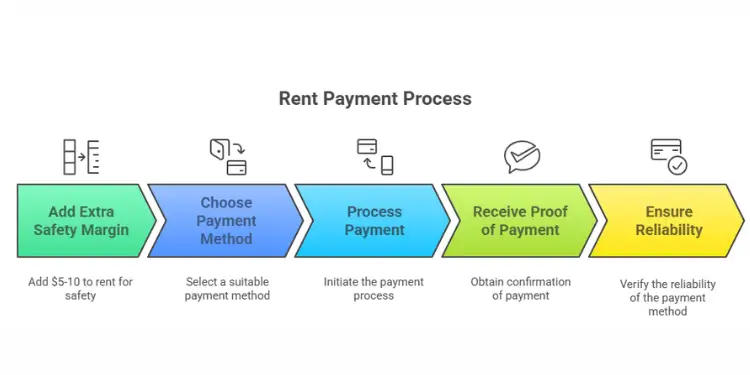

Set Automatic Transfers Before Penalty Threshold

Setting up automatic payments is the best strategy. It helps avoid bank delays and forgetfulness. Here’s how to do it:

- Find out when you get money each month (usually after payday)

- Make transfers 5-7 days before rent is due

- Get alerts when payments go through

- Keep payment confirmations as proof

This method protects you with a double safety net. Your payment goes through early, and you have a grace period as backup. Most apps and portals let you set up transfers months ahead.

For extra safety, add $5-10 to your rent. This covers fees or unexpected increases. It helps avoid shortfalls that might cause late fees.

| Payment Method | Processing Time | Proof of Payment | Reliability Rating |

|---|---|---|---|

| Automatic Bank Transfer | 1-3 business days | Electronic receipt | Excellent |

| Landlord Payment Portal | Immediate to 24 hours | Portal confirmation | Excellent |

| Physical Check | 3-7 days (mail + processing) | Check copy + tracking | Good |

| Money Order | 3-5 days (mail + processing) | Receipt stub | Good |

If automatic payments are hard, try a dedicated rent account. This way, you save for rent all month. It makes paying rent less stressful.

If you pay by check, use a calendar to remind you 7 days before. This gives you time to mail it. Use certified mail with tracking for strict landlords to prove you paid on time.

“The most expensive rent payment is the one that triggers late fees. Setting up automatic payments is like buying insurance against those fees for free.”

Use online payment portals if your landlord offers them. They provide receipts that prove you paid. Platforms like Avail show when your money will be deposited.

If your income varies, talk to your landlord early. They might waive late fees if you’re honest and communicate well.

Always check your lease for payment rules. Know when rent is late and what fees apply. Unpaid rent can lead to eviction.

By following these tips, you’ll rarely worry about late fees. Knowing your rent is paid automatically brings peace of mind. It’s worth the small effort to set up these systems.

Read more: No smoking lease clause maintaining a healthy environment

Consequences of missing grace period window

Missing your rent grace period can lead to big problems. I’ve helped many tenants deal with these issues. The problems start with late fees and can get much worse.

When your grace period ends, your landlord can charge late fees. Most leases say rent is due on the 1st. The grace period is a chance to pay without extra fees. But if you miss it, you’ll face financial trouble.

“The grace period is not an extension of your due date—it’s merely a penalty-free window after your actual due date has passed. Missing this window activates all remedies available to the landlord under state law.”

Late fees can be a flat amount or a percentage of your rent. They usually cost between $25-$120. A $1,200 apartment costs an extra $60-$120 for just one day late.

Missing your grace period lets your landlord send you a “Pay or Quit” notice. This notice says you must pay rent with fees or leave the place. Depending on your state’s laws, you usually have 3-7 days to do this.

Missing your grace period also hurts your rental history. Landlords often report late payments to tenant screening services. This can make it hard to find a new place to live for a long time.

Colorado’s 2024 statute bars any late fee until rent is at least seven calendar days overdue and caps the charge at the greater of $50 or 5 %; ignoring this rule can void the fee and trigger tenant remedies. Ref.: “Colorado General Assembly. (2024). Colo. Rev. Stat. § 38-12-105. Colorado Revised Statutes.” [!]

Some leases have “three strikes” rules. You might lose your lease if you miss the grace period three times. Paying late but within the grace period is okay. But missing it can risk your housing.

| Consequence Type | Typical Timeline | Financial Impact | Long-Term Effect |

|---|---|---|---|

| Late Fee Application | Immediate (Day 1 after grace period) | $25-$120 depending on lease terms | Increased monthly housing costs |

| Pay or Quit Notice | 1-3 days after grace period | Potential court costs if unresolved | Beginning of eviction process |

| Credit Reporting | 30-60 days after missed payment | None immediate | Reduced credit score for 7 years |

| Rental History Record | Immediate in landlord’s system | None immediate | Difficulty securing future housing |

If you think you’ll miss your payment, talk to your landlord right away. They might forgive late fees if you explain your situation. This is true if you’ve always paid on time before.

Some places limit how much landlords can charge in late fees. But, you must try to solve the problem first. If you ignore the issue, you lose your chance to fight the fees.

Remember, while late fees are legal, some places have limits. If your landlord tries to charge too much, you might be able to fight it. But, you must act fast.

The worst thing is if you ignore a “Pay or Quit” notice. This can lead to an eviction filing. This can make it very hard to find good housing for years.

Set reminders a few days before your payment is due and the grace period ends. This way, you’ll never miss this important payment window.

Read more: Overnight guest clause restricting long term visitors

State regulations mandating minimum grace period

Your lease might say how long you have to pay rent late. But, many states have laws that say you get more time. These laws make sure landlords give you at least a certain amount of time, even if your lease doesn’t say so.

Compare Five Day Rule Across States

The five-day grace period is common, but it’s not the same everywhere. In Tennessee, you get extra time because Sundays and holidays don’t count. If your rent is due on the 1st, you get more time.

Delaware gives you eight days if your landlord doesn’t have an office in your county. Colorado says you have 7 days before late fees kick in. Maine lets you wait 15 days before late fees start, even though it says 5 days.

Some places count business days, while others count regular days. It’s important to know how your state works.

Read More:

Special Protections For Subsidized Housing Leases

People living in subsidized housing get extra help. HUD rules are stricter than regular rentals. Most places don’t charge late fees until at least 5 business days after rent is due.

Late fees in these places are usually $25 or 5% of what you pay. If your rent is due on the 1st but benefits come on the 3rd, you might get more time. This is because of how benefits are paid.

HUD’s Model Lease (Form 90105a) allows only a $5 late fee on the 6th day of the month—and $1 for each day thereafter—if rent remains unpaid past the 5-day grace window, setting strict federal limits for Section 8 properties. Ref.: “U.S. Department of Housing and Urban Development. (2023). HUD Form 90105a Model Lease for Subsidized Programs. HUD.” [!]

People with Housing Choice Vouchers can’t be kicked out for one late payment in 12 months. Always ask your property manager for written rules about grace periods.

Remember, state and federal laws can’t be changed in a lease. If your landlord tries to charge late fees too soon, you can fight it. You have the right to do so under the law.