Workers compensation insurance helps both workers and bosses when accidents happen at work. It’s like a safety net for businesses. It makes sure injured workers get the care they need.

But why did states make this coverage a must for most businesses? It’s all about keeping everyone safe.

Did you know that over 2.8 million workplace injuries happen every year in America? The Bureau of Labor Statistics says so. Without this insurance, small businesses could go broke fast.

“Workers comp makes it clear how much workplace injury costs,” says Sarah Chen, an insurance expert. “It gives businesses a fixed cost instead of scary lawsuits.”

Business owners find out it saves them money. They don’t have to worry about huge legal costs. They just pay a set amount for protection.

This system is good for everyone. Workers get medical help and money right away. Bosses don’t have to worry about lawsuits and know what costs are coming.

Quick hits

- Covers medical costs and wages

- Protects employers from injury lawsuits

- Required by law in most states

- Helps workers return to jobs faster

Legal requirement for workplace injury coverage

Knowing your legal duties under workers compensation laws can save your business. I’ve helped many employers understand these rules. They are simpler than most think.

In the U.S., almost all businesses must have this insurance by law. Texas is the only state where employers can choose not to. All other states and Washington D.C. require workers compensation for most businesses with employees.

State Mandates and Employer Obligations

Your needs depend on where you are, how many people you have, and what they do. Each state has its own rules through Workers’ Compensation Boards.

Some states need coverage from the start. Others don’t for small businesses with few employees. The rules usually cover full-time and part-time workers but not independent contractors or family members.

I always tell employers to check their state’s Workers’ Compensation Board website first. These agencies handle compliance and help with disputes between employers and injured workers.

| Business Size | Most States Requirement | Common Exemptions |

|---|---|---|

| 1-2 employees | Coverage required | Family members, contractors |

| 3+ employees | Always required | Agricultural workers (varies) |

| High-risk industries | Required from first hire | Very limited exemptions |

Penalties for Non-Compliant Businesses

Not having workers compensation can destroy a business fast. I’ve seen small companies face huge penalties that forced them to close.

Fines start at hundreds but can go up to thousands per employee. Some states fine you daily until you get coverage. Criminal charges can happen if you ignore the law and an employee gets hurt.

Without insurance, you could be personally responsible for medical costs and lost wages. A serious accident can lead to bills of hundreds of thousands of dollars.

One construction company owner told me he faced $50,000 in fines plus $200,000 in medical bills after a worker fell from scaffolding. His business never recovered from those combined costs.

State agencies watch for compliance through payroll audits and surprise inspections. They check tax records and insurance filings to find non-compliant employers.

Check your state’s Workers’ Compensation Board website today to see what you need. Don’t risk your business on guesses about compensation laws.

Read More:

Financial protection for injured employees

When accidents happen at work, injured workers need help right away. Workers compensation insurance gives them this help. It lets them heal without worrying about money.

Medical costs are fully covered by workers comp. There are no extra fees or co-pays. Every medical cost related to the workplace injury gets paid in full.

This includes emergency room visits and surgeries. Prescription drugs and physical therapy are covered too.

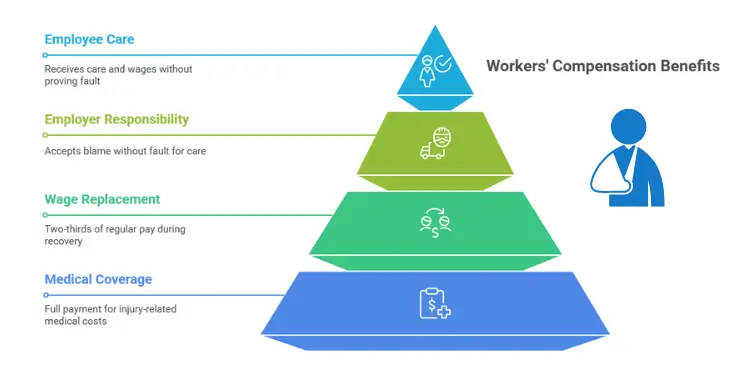

Workers’ compensation is a deal between employers and employees. Employers accept blame without fault for medical care and wages. Employees get care and wages without proving fault.

Wage replacement helps workers pay bills while they heal. Most get about two-thirds of their regular pay. This help lasts until they can go back to work.

How much they get is easy to figure out. If they earn $900 a week, they get about $600. This helps with rent, food, and other needs.

| Benefit Type | Coverage Amount | Duration | Restrictions |

|---|---|---|---|

| Medical Expenses | 100% of costs | Until maximum recovery | Must be work-related |

| Wage Replacement | 66⅔% of average weekly wage | During disability period | Maximum weekly limits apply |

| Permanent Disability | Varies by impairment rating | Lifetime or scheduled period | Based on medical evaluation |

| Death Benefits | Burial expenses plus survivor payments | Until dependents reach age limits | Must prove dependency |

Severe injuries can cause permanent disabilities. Workers compensation helps with long-term benefits. These benefits replace lost earning capacity for years.

Temporary disabilities get different benefits. These benefits stop when the worker can go back to their job. Permanent benefits may last a lifetime, depending on the injury.

Vocational rehabilitation helps severely injured workers find new jobs. These programs offer job training and help finding work. The goal is getting employees back to work in roles that match their new physical capabilities.

Families of workers who died on the job get help too. The insurance pays for funeral costs and gives ongoing support to spouses and kids.

Survivor benefits are about two-thirds of the worker’s average weekly wage. Spouses get payments until they remarry or retire. Kids get support until they’re 18 or finish college.

Workers compensation doesn’t just pay bills. It lets workers see any doctor approved for workers compensation cases. This fast care helps them heal faster.

This care speeds up recovery times. Faster healing means workers can go back to work sooner. It also stops minor injuries from getting worse because of delayed treatment.

The system removes financial barriers to care. Workers don’t have to choose between treatment and paying rent. This peace of mind helps with both physical and mental healing.

“Learn More About: What is the purpose of general liability insurance?“

Employer liability mitigation and compliance

Workers comp policies offer a big protection for business owners. They turn uncertain lawsuit risks into known insurance costs. This gives you peace of mind, knowing claims follow a set process.

Workers compensation is a no-fault system that helps you and your employees. Workers who are injured get quick medical care and money to live on without proving fault. They also can’t sue you for their injury.

This rule protects your business from huge lawsuits. Without workers comp, one big accident could cost you everything. Lawsuits can ask for millions, including for pain and suffering, which could ruin your business.

Shield Against Costly Litigation Claims

Your insurance policy stops most injury lawsuits from reaching you. The insurance company deals with all claim details, medical costs, and legal defense. This includes injuries from work over time, like repetitive stress or illnesses.

Smart business owners know workers comp gives them set costs instead of surprise bills. Your yearly premiums replace the worry of huge judgments. The insurance also defends you if an employee tries to sue outside the comp system.

Think about how this helps your money planning. You don’t save for unknown lawsuit costs. Instead, you budget for fixed insurance costs. This lets you provide workers a safe place while keeping your business safe financially.

This protection covers many injury types that could lead to expensive lawsuits. It includes slips, falls, injuries from equipment, and stress from work. This wide coverage means workplace issues won’t hurt your business’s future.

Compensation benefits and medical expenses

Knowing about compensation benefits helps protect your workers and manage costs. When an employee gets hurt at work, workers’ compensation insurance coverage starts right away. It aims to cover all financial needs without leaving any gaps.

Medical costs are fully covered by your insurance policy. This means no extra costs for your injured worker. All medical needs, like emergency visits and surgeries, are paid for.

Physical therapy and specialist visits are also fully covered. Your worker won’t have to worry about medical bills. This lets them focus on getting better without stress.

“Workers’ compensation removes the financial barrier to quality medical care, ensuring injured employees get the treatment they need when they need it most.”

Compensation for lost wages helps during recovery. Most programs pay about two-thirds of what the worker usually earns. These payments are tax-free, which helps a lot.

The amount of lost wages is based on the 52 weeks before the injury. For new employees, it’s based on their whole time working. This insurance also covers medical costs, giving full support.

For permanent disabilities, benefits are based on the body part affected. Losing an arm might get 312 weeks of payments. Finger injuries get fewer weeks. This ensures fair benefits for everyone.

Temporary total disability benefits keep going until your worker can return to work. This support helps during long recovery times. Compensation helps fill the gap until full recovery.

Death benefits help families if a worker dies on the job. Survivors get two-thirds of the worker’s average weekly wage. These payments last for a certain time, based on state rules.

Funeral costs are also covered up to certain limits. This extra help makes it easier for families during tough times. Compensation also helps dependents who lost income from the worker.

Your insurance policy automatically covers all these benefits. No extra forms or claims are needed. It all works together to protect your workers fully.

“Dive Deeper: What is the purpose of an insurance policy?“

Impact on business productivity and morale

Smart business owners see how worker’s compensation boosts output and loyalty. It’s more than just medical bills. It builds confidence in the workplace, leading to better work.

When your team feels protected, they focus more on their work. Insurance workers are happier when they feel safe. This happiness leads to better work and fewer accidents.

Reduced downtime through quicker recovery

Quick medical care makes a big difference in recovery times. Insurance provides medical help right away after an injury. Employees don’t wait weeks or worry about costs.

Return-to-work programs keep your team working while they recover. They do tasks that fit their current abilities. For example, a worker with a back injury might track inventory.

Vocational rehabilitation helps workers learn new skills. This way, they can work in different roles. It keeps your team stable and helps injured workers.

| Recovery Approach | Average Return Time | Productivity Impact | Employee Satisfaction |

|---|---|---|---|

| Immediate medical care | 2-3 weeks | Minimal disruption | High confidence |

| Modified work duties | 1-2 weeks | Partial productivity maintained | Feeling valued |

| Delayed treatment | 6-8 weeks | Complete work stoppage | Financial stress |

| Vocational retraining | 3-6 months | New role productivity | Career growth opportunity |

Employee trust and retention boost

Comp insurance shows you care about your team’s well-being. Employees notice when you invest in their safety. This builds loyalty and reduces turnover costs.

Secondary injury funds in some states offer extra protection. They let you hire workers with past injuries. This expands your talent pool and provides extra coverage.

Workers who feel safe are more likely to report hazards. They help keep the workplace safe. This prevents injuries and keeps your business running well.

Related Topics:

Premium costs versus claim expenses

When I talk to families who own businesses about workers comp, they often wonder. What’s the real cost of protection versus not having it? Your workers comp premiums are like a monthly safety net. They keep you safe from huge financial shocks.

Premium rates change a lot based on where you are and how risky your job is. In New York, office workers pay just 7 cents for every $100 of payroll. But construction jobs cost $29.93 per $100. California charges 40 cents for safe jobs but $33.57 for dangerous ones. Florida is in the middle, with 26 cents for safe jobs and $19.40 for risky ones.

Think about what happens without insurance. Work-related injury costs hit $171 billion in, with each medical treatment costing $42,000. A big accident could cost your business $100,000 or more in medical and lost wages.

Workers comp does more than just cover medical costs. It also covers lost wages, training, and legal help. This wide coverage helps both sick workers and those hurt on the job. It makes sure they get all the income they lost.

When you compare your yearly premiums to the cost of one big claim, it’s easy to see why. The numbers add up fast.