When disaster hits your apartment, your landlord’s insurance won’t cover your lost laptop or stolen jewelry. A renters insurance policy acts as a financial safety net. It helps you when unexpected events shake your living situation. Have you ever thought about what would happen to your stuff after a burst pipe floods your rental?

According to the Insurance Information Institute, nearly 60% of renters don’t have the right coverage. Yet, the average policy only costs $15-30 a month. One of my clients lost everything in a kitchen fire but said, “That small premium saved me from losing everything.”

In my ten years helping Idaho Falls families, I’ve seen how the right policy can prevent financial disaster. It’s crucial when the unexpected happens.

Renters insurance establishes a contract between policyholder and insurer to indemnify against loss or damage to personal property within a leased dwelling. For a typical premium of $15–30 per month, it reimburses replacement or actual cash value for covered perils (fire, theft, vandalism, water damage from burst pipes), up to preset limits (often $20,000–30,000). Policies also include liability protection—usually $100,000–300,000—that covers medical expenses, legal defense, and judgments if a visitor is injured or if you are deemed responsible for third-party property damage. Additional living expense (ALE) coverage reimburses incremental housing and living costs incurred when a rental unit becomes uninhabitable.

Beyond standard provisions, renters can tailor policies through endorsements—scheduled personal property riders for high-value items, higher liability limits, or flood/earthquake add-ons—typically at minimal additional cost. Bundling renters insurance with auto or other lines yields multi-policy discounts (15–25%), lowering aggregate premiums. Proper documentation (home inventory videos, receipts) and periodic coverage reviews ensure adequate limits, while policy comparisons across carriers help optimize cost versus protection.

Quick hits:

- Protects personal belongings from theft/damage

- Covers liability if someone gets injured

- Provides temporary housing after disasters

- Fulfills most lease requirements affordably

- Creates peace of mind for pennies daily

Protect Personal Property Against Common Perils

Renters insurance is key for protecting your personal items from everyday dangers. Your landlord’s policy covers the building, but not what’s inside. Without renters insurance, you’d have to pay out of pocket to replace your belongings after a disaster.

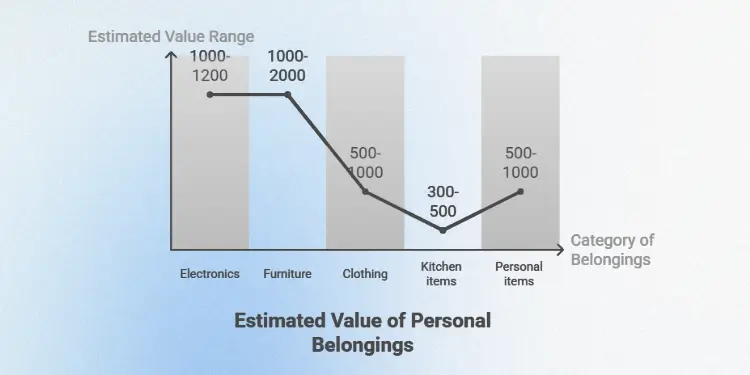

Many renters don’t realize how much their stuff is worth. Think about your phone, which could cost $800-$1,200. Your laptop might be worth $1,000 or more. Add in your TV, gaming systems, and other electronics, and you’re looking at thousands of dollars.

It’s smart to make a list of your belongings before disaster hits. Go through each room and list your items in categories like electronics, furniture, and clothing.

- Electronics: Smartphones, laptops, tablets, TVs, gaming systems

- Furniture: Sofas, beds, tables, chairs, mattresses

- Clothing: Everyday wear, shoes, coats, specialty items

- Kitchen items: Appliances, cookware, dishes

- Personal items: Jewelry, sports equipment, musical instruments

Many renters underestimate the total value of their possessions, often overlooking items like electronics, furniture, and clothing, which can collectively amount to tens of thousands of dollars. Ref.: “Risman Insurance. (2025). How Much Personal Property Coverage Do I Need on My Renters Insurance Policy? Risman Insurance.” [!]

I’ve helped many clients do this, and most are surprised to find they have $20,000-$30,000 worth of belongings. This makes the $15-$20 monthly premium for renters insurance seem like a great deal.

“Read More: Purpose of Renters Insurance Safeguarding“

Fire Theft and Vandalism Scenarios

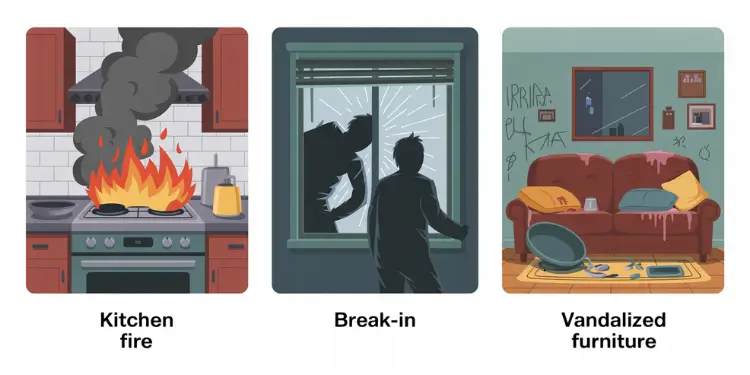

Understanding how renters insurance works in real-life situations shows its value. Let’s look at three common scenarios I’ve seen clients face:

Scenario 1: Kitchen Fire – A fire breaks out in your kitchen, caused by your neighbor’s carelessness. Smoke damages your furniture, electronics, and clothes. Without renters insurance, you’d have to pay thousands to replace these items. With coverage, you can file a claim and get funds to restore your belongings.

Scenario 2: Break-in – You come home to find your door open and your laptop, TV, and jewelry gone. Police reports are helpful, but they can’t replace your stolen items. Renters insurance usually covers theft, giving you funds to replace what was taken.

Scenario 3: Vandalism – Vandals damage your furniture and personal items during a break-in attempt. Renters insurance often covers repairs or replacement for damaged items, saving you from unexpected costs.

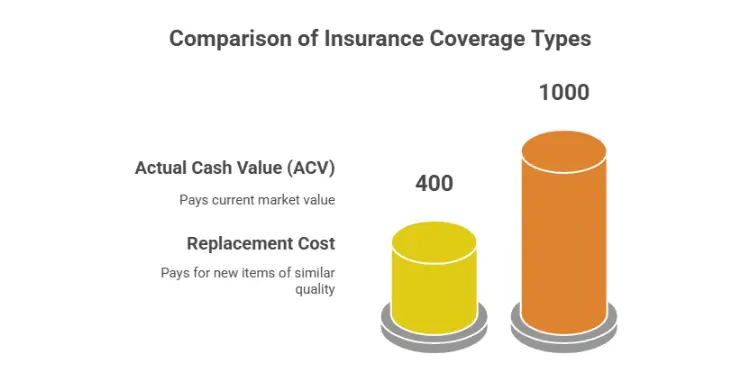

When insuring your personal property, you’ll need to choose between two coverage types:

| Coverage Type | How It Works | Example Payout | Cost Difference |

|---|---|---|---|

| Actual Cash Value (ACV) | Pays what items are worth today (purchase price minus depreciation) | 3-year-old $1,000 laptop: $400 payout | Lower premium |

| Replacement Cost | Pays what it costs to buy new items of similar quality | 3-year-old $1,000 laptop: $1,000 payout | 10-20% higher premium |

| Coverage Limits | Maximum amount insurer will pay | Typically $20,000-$30,000 for belongings | Higher limits increase premium |

In my experience, replacement cost coverage offers better protection, even with a slightly higher premium. The difference in payout can be thousands of dollars for a single claim.

Opting for replacement cost coverage increases premiums by approximately 10-20% but ensures full reimbursement for new items, unlike actual cash value policies that factor in depreciation. Ref.: “Investopedia. (2025). 6 Good Reasons to Get Renter’s Insurance. Investopedia.” [!]

To ensure you have enough insurance, take these three simple steps:

- Walk through each room with your smartphone, recording video of your belongings

- Open drawers and closets to document contents

- Store these videos in cloud storage (like Google Drive or iCloud)

This documentation proves ownership if you need to file a claim and helps you calculate the true value of your personal property. Most importantly, it ensures you’ll have adequate coverage when you need it most.

Remember, standard policies have limits for high-value items like jewelry or collectibles. If you own specialty items, ask your agent about additional coverage options we’ll discuss later.

Read More:

Cover Liability For Injuries And Damage

Renters insurance does more than just protect your stuff. It also offers vital liability coverage. This part of your policy acts as a safety net when accidents happen at home. Many tenants learn the value of liability protection the hard way, after facing a big claim.

Liability coverage kicks in when you’re legally responsible for injuries or damage to others. It covers medical bills, legal costs, and settlements if you’re sued. Most policies have $100,000 in liability protection, but I often suggest higher limits based on your situation.

Slip-and-Fall Injury Claims from Visitors

Slip-and-fall accidents are a common liability issue I see. Last year, a client was worried after her friend tripped and broke a wrist in her apartment. The medical bills were nearly $8,000, and there were talks of a lawsuit for lost wages.

Fortunately, her renters insurance covered the medical costs through liability protection. Without it, she would have had to pay the bills herself and possibly more if the case went to court.

The true value of liability coverage isn’t fully appreciated until you’re facing a claim. For the cost of a few takeout meals each month, you’re protecting yourself from financial hardships that could follow you for years.

Your liability coverage isn’t just for slip-and-fall accidents. It also covers damage caused by your child or pet, like a broken window. Even accidental damage, like water damage to the unit below, is covered.

Here’s what standard liability coverage usually pays for:

- Medical payments for injured visitors (regardless of fault)

- Legal defense costs if you’re sued

- Court judgments and settlements up to your policy limit

- Property damage you cause to others

But, liability coverage doesn’t cover everything. Intentional damage, business-related incidents, and car accidents are usually not covered. Knowing what your policy doesn’t cover is important.

| Liability Scenario | Typically Covered? | Average Claim Cost | Recommended Coverage |

|---|---|---|---|

| Guest slip-and-fall injury | Yes | $20,000-$50,000 | $300,000+ |

| Dog bite to visitor | Yes (most breeds) | $35,000-$45,000 | $300,000+ |

| Water damage to neighbor’s unit | Yes | $5,000-$15,000 | $100,000+ |

| Child damages property | Yes | $2,000-$10,000 | $100,000+ |

| Home business incident | No | Varies widely | Separate business policy |

When choosing how much liability coverage you need, think about your lifestyle and risks. Do you often have guests over? Do you have pets or children who have friends over? These factors increase your liability risk and might mean you need higher coverage limits.

For most renters, I suggest at least $300,000 in liability protection. The cost difference between standard and higher limits is usually just a few dollars a month. It’s a small price for extra protection.

Medical payments coverage is also important. It pays for minor injuries to guests, even if it’s not your fault. Most policies have $1,000-$5,000 in medical payments coverage. Increasing this limit is usually very affordable.

Remember, liability claims can happen unexpectedly and might cost more than your coverage limits. If you have a lot to lose, consider an umbrella policy for extra protection beyond your renters insurance limits.

“Further Reading: Essential purpose of flood insurance“

Pay Additional Living Expenses During Repairs

Imagine being forced out of your apartment due to a fire. This is where “loss of use” coverage in your renters policy shines. When disaster makes your rental uninhabitable, you need somewhere to stay and eat while repairs take place. Without proper coverage, these unexpected costs can quickly drain your savings.

Additional Living Expenses (ALE) coverage in renters insurance typically covers 20-30% of your personal property limit, aiding in temporary housing and related costs during displacement. Ref.: “The Zebra. (2025). Additional Living Expenses Coverage. The Zebra.” [!]

Renters insurance includes a provision for these situations. Your policy covers “additional living expenses” or ALE. This is the extra costs you incur when you can’t stay in your home due to a covered loss.

Hotel and Meal Costs Reimbursements

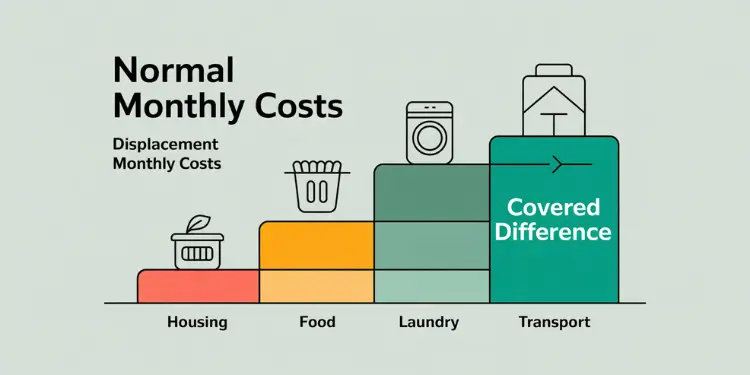

When disaster strikes, like fire or storm destruction, additional living expenses coverage kicks in. It helps with temporary housing costs. This coverage pays for the difference between your normal living expenses and what you’re now spending while displaced.

For example, your typical monthly expenses might include:

- Rent: $1,500

- Groceries: $400

- Utilities: $200

After a fire, your temporary expenses could jump significantly:

| Expense Category | Normal Monthly Cost | Displacement Cost | Difference (Covered) |

|---|---|---|---|

| Housing | $1,500 (rent) | $3,600 (hotel at $120/night) | $2,100 |

| Food | $400 (groceries) | $1,800 (restaurants at $60/day) | $1,400 |

| Laundry | $0 (in-unit) | $120 (laundromat) | $120 |

| Transportation | $100 (normal commute) | $300 (increased distance) | $200 |

| Total | $2,000 | $5,820 | $3,820 |

In this scenario, your rental insurance policy would pay the $3,820 difference. Without this coverage, that amount would come directly from your pocket.

Beyond hotel and restaurant bills, your policy covers other necessary expenses like:

- Storage fees for your belongings

- Furniture rental for temporary housing

- Moving or relocation costs

- Pet boarding if your temporary housing doesn’t allow animals

- Increased transportation costs to work or school

It’s important to understand the limitations of this coverage. Most policies cap additional living expenses at 20-30% of your personal property coverage limit. If you have $25,000 in personal property coverage, your ALE limit would typically be $5,000-$7,500.

“The single biggest mistake I see renters make with ALE claims is failing to keep detailed receipts. Without proper documentation, you might miss out on thousands in reimbursements you’re entitled to receive.”

To maximize your benefits, maintain a displacement expense log from day one. Save every receipt and note how each expense differs from your normal spending. Most insurers require this documentation before processing reimbursements.

Remember that only expenses beyond your normal costs qualify for reimbursement. If you typically spend $400 monthly on groceries but now spend $900 eating at restaurants, your policy covers the $500 difference—not the entire $900.

Also, coverage only applies when displacement results from a covered peril. If your apartment becomes uninhabitable due to a flood and you don’t have flood insurance, typical renters insurance won’t cover your additional living expenses.

Before disaster strikes, review your policy’s ALE coverage limits and understand what documentation your insurer requires. This preparation ensures you can access these benefits quickly when you need them most, turning a potential financial crisis into a manageable situation.

“Related Articles: Vital purpose of earthquake insurance“

Meet Landlord Lease Insurance Requirements

Understanding your landlord’s insurance needs is key to securing your rental home. Renters insurance is not a legal requirement in any state. Yet, many landlords now make it a must-have in lease agreements. This change has happened over the last five years as landlords try to reduce their risks.

Most tenants are surprised to find out that their landlord’s insurance doesn’t cover their stuff. This means your personal items are at risk unless you get your own insurance.

“We require all tenants to have renters insurance,” says Maria Sanchez, property manager at Westview Apartments. “It makes our community safer. When people have the right coverage, they’re less likely to face financial problems after unexpected events.”

“Related Topics: Purpose of Homeowners Insurance Covering Propertys“

Verify minimum coverage amounts early

When looking for an apartment, ask about insurance needs early. Don’t wait until the lease is signed. Most landlords want you to have at least:

- $100,000 in personal liability coverage

- $10,000 to $15,000 in personal property coverage

- Sometimes, specific deductible maximums (often $500 or $1,000)

Your landlord might ask for proof of insurance before giving you the keys. This proof usually includes a Certificate of Insurance or a declarations page. Many insurance companies can send this to your landlord by email.

If your lease renewal includes new insurance rules, don’t worry. You can find affordable policies that meet these requirements. I’ve helped tenants find basic coverage for as low as $15 a month by comparing different providers.

Remember, your landlord’s insurance doesn’t cover your stuff. It only covers the building, built-in appliances, and common areas. This is why many landlords want tenants to have their own insurance.

| Coverage Element | Landlord’s Insurance | Renter’s Insurance | Who Benefits |

|---|---|---|---|

| Building structure | Covered | Not covered | Landlord |

| Personal belongings | Not covered | Covered | Tenant |

| Liability for injuries | Common areas only | Inside rental unit | Both parties |

| Additional living expenses | Not covered for tenant | Covered | Tenant |

When looking at policies, don’t just check the minimum coverage. Think about how much it would cost to replace everything you own. I’ve seen tenants underestimate their belongings’ value by 20-30%.

Even if your lease doesn’t require renters insurance, I still recommend getting it. Policies usually cost between $15-$30 a month. This is a small price for the protection it offers. Your rental home is your personal space with everything important to you. It’s worth protecting, even if your lease doesn’t require it.

“Dive Deeper: why get umbrella insurance for expanded personal“

Bundle Policies To Reduce Monthly Premiums

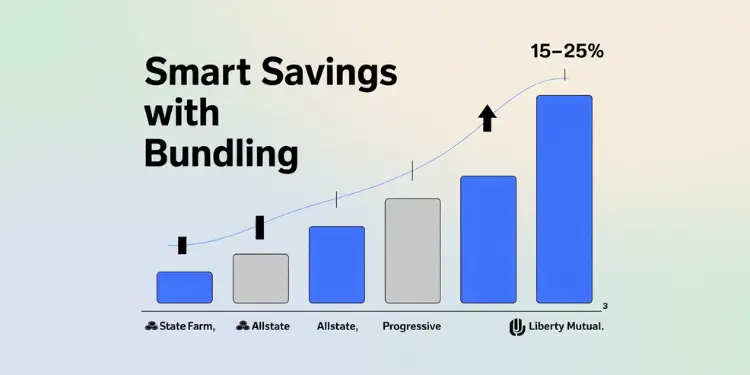

Want to cut down on insurance costs without losing coverage? Policy bundling is a simple way many renters miss. In the U.S., renters insurance costs between $15 and $30 monthly. This depends on where you live, the size of your rental, and what you own.

Over the last decade, I’ve seen bundling as a top way to lower insurance costs. When you bundle policies with the same company, they give you discounts. This benefits both you and the insurer.

The idea is straightforward. Insurers get more of your business and save on costs. You pay less for all your policies. It’s a rare win-win in finance.

The Auto-Renters Combination Advantage

Combining renters and auto insurance usually saves the most. Insurers offer discounts of 15-25% for bundling these policies. This means you could save $150-300 a year.

Let’s look at savings from major insurers:

| Insurance Company | Separate Policies Cost (Annual) | Bundled Cost (Annual) | Annual Savings | Savings Percentage |

|---|---|---|---|---|

| State Farm | $1,450 | $1,160 | $290 | 20% |

| Allstate | $1,580 | $1,264 | $316 | 20% |

| Progressive | $1,390 | $1,182 | $208 | 15% |

| Liberty Mutual | $1,620 | $1,215 | $405 | 25% |

These figures are national averages for standard coverage. Your savings will depend on your location, driving record, and coverage levels. But bundling almost always lowers your costs.

You can compare the best auto-renters insurance bundles to find what fits your needs and saves you money.

Many ask how bundling works behind the scenes. In most cases, your policies stay separate but are billed together. This means you can still claim on one policy without affecting the other.

If you’re worried about filing a claim on one policy but not the other, don’t be. Most insurers handle claims on each policy separately. Still, it’s good to ask your agent about their claim procedures when you get a quote.

“Check Out: defining the purpose of dental insurance“

Beyond Bundling: Additional Discount Opportunities

Beyond bundling, you can get more discounts. Many policies offer rate cuts for:

- Security systems and smoke detectors (5-15% savings)

- Good credit scores (up to 20% with some insurers)

- Claim-free history (typically 5-10% after several years)

- Professional organization or alumni group memberships (5-15%)

- Automatic payment enrollment (often 5-10%)

When looking at bundles, ask for quotes from your current insurer and at least two others. This ensures you get the best rate. Insurers often give big discounts to new customers with multiple policies.

To figure out your savings, use this simple formula:

- Add up your current annual premiums for separate policies

- Subtract the bundled annual premium quote

- Divide the difference by your current total to find your savings percentage

Spending a few minutes on bundle options can save you years of premium costs. Most renters save enough in the first year to cover nearly half their renters insurance cost.

While saving money is important, don’t forget about coverage quality. The best bundle should save you money and still protect you well. Your insurance info should clearly show how each policy covers you while offering discounts.

Customize Coverage Through Affordable Optional Riders

Your basic renters policy might not fully protect your valuables. I’ve seen many clients surprised when their $2,000 laptop was only covered for $1,500 after a theft. Standard policies usually cap payments at $2,500 for business items, $1,000 for electronics, and just $500 for jewelry.

Add Electronics and Valuable Items Endorsements

For just $10-25 a year, you can add riders to boost coverage for specific items. A scheduled personal property rider lets you list valuable collectibles with their appraised values. My client Sarah added a $15 jewelry rider that increased her coverage from $500 to $3,000—protecting her engagement ring without buying a separate policy.

Standard insurance policies don’t cover all types of damage. Water damage from burst pipes might be covered, but flood damage needs special coverage through the National Flood Insurance Program if you live in a risk zone.

“For More Information: clear purpose of mortgage life insurance“

Review your home inventory to find where you need more coverage. Electronics, musical instruments, sports equipment, and art often need riders. The small premium increase is worth it when you need to file a claim for items that exceed standard policy limits.

Standard renters insurance policies often cap jewelry coverage at $1,000 to $1,500, necessitating additional riders for adequate protection of high-value items. Ref.: “Policygenius. (2022). Does Renters Insurance Cover Jewelry? Policygenius.” [!]

Call your agent today to check your coverage gaps. Most companies let you add riders mid-policy without waiting for renewal. This gives you immediate protection for your most treasured belongings.