Medicare supplement insurance helps cover what Original Medicare doesn’t. This can save thousands of dollars each year for seniors and disabled people. Did you know only 41% of Original Medicare users had Medigap in 2022?

For those without Medigap, healthcare costs can quickly grow. “Many gaps in Medicare leave beneficiaries paying thousands of dollars a year,” says Kelli Jo Greiner, Minnesota State Health Insurance Assistance Program director.

In my decade helping Idaho Falls families with health insurance choices, I’ve seen the damage of unexpected medical bills. One client got over $50,000 in bills after surgery without coverage. This could have been avoided with Medigap.

Medigap policies work with Original Medicare, not replace it. They cover deductibles, copayments, and coinsurance that Medicare Parts A and B don’t.

Quick Hits:

- Covers what Original Medicare doesn’t pay

- Reduces unexpected out-of-pocket healthcare costs

- Provides predictable monthly premium structure

- Offers peace of mind during illness

- Helps protect retirement savings intact

What Medigap insurance does and why

Medigap policies help protect you from big costs with Medicare. Original Medicare covers a lot, but not everything. This can lead to big money problems, mainly for those who see doctors a lot.

Medigap insurance fills in the gaps. It pays for things like deductibles and copays. It’s like a safety net for your wallet.

Bridging Original Medicare Part A Costs

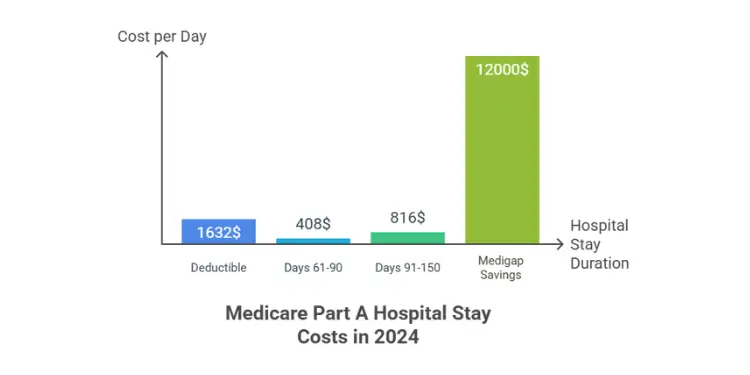

Hospital stays can cost a lot under Medicare Part A. In 2024, the deductible is $1,632 per stay, not per year. If you have more than one stay, you’ll face this cost many times.

“Just one hospital stay, you’re going to be paying that $1,632 deductible — so, really fast, your costs can add up,” explains Joanne Giardini-Russell, CEO of Giardini Medicare, an independent insurance agency.

Most Medigap plans cover this deductible. But there’s more. If you stay in the hospital over 60 days, Medicare charges more:

- Days 61-90: $408 per day in 2024

- Days 91-150: $816 per day (using lifetime reserve days)

- Beyond 150 days: You pay all costs

Medigap plans usually cover these extra costs. For a 100-day stay, this could save over $12,000.

Reducing Part B Coinsurance and Copayments

Medicare Part B has big gaps that can hurt your wallet. After a $240 deductible in 2024, you pay 20% of most outpatient costs.

This 20% can add up fast. Without Medigap, you could face huge bills:

| Medical Service | Total Cost | Medicare Pays | You Pay (20%) |

|---|---|---|---|

| Cancer Treatment | $100,000 | $80,000 | $20,000 |

| Joint Replacement | $50,000 | $40,000 | $10,000 |

| Cardiac Procedure | $75,000 | $60,000 | $15,000 |

Most Medigap plans cover this 20% coinsurance. For example, Plan G covers 100%, while Plan K covers 50%. This makes healthcare costs more predictable.

Medigap also covers other Part B costs. It helps with excess charges from doctors who charge more.

For those who see doctors often, these savings are huge. Even simple care is cheaper without the 20% copay.

Read More:

Standardized Medigap benefits across plan letters

Medigap plans are grouped into letters A through N. Each letter has its own set of benefits. This makes it easy to compare Medicare supplement insurance plans.

In Idaho Falls, I tell clients that Medigap plans are the same everywhere. Plan G from Company X is the same as Plan G from Company Y. They both have the same benefits.

The only things that change are the price and how well the company serves you. This makes it easy to pick the best plan for you.

| Plan Letter | Part A Coinsurance | Part B Coinsurance | Part B Deductible | Foreign Travel Emergency |

|---|---|---|---|---|

| Plan A | 100% | 100% | No | No |

| Plan G | 100% | 100% | No | 80% |

| Plan N | 100% | 100%* | No | 80% |

| Plan F | 100% | 100% | Yes | 80% |

*Plan N requires copayments for some office visits and emergency room visits.

Plan F is only available to beneficiaries eligible for Medicare before January 1, 2020.

Plans C and F are no longer new for people starting Medicare after January 1, 2020. This change was made to stop plans that cover the Medicare Part B deductible. But, if you already have Plan C or F, you can keep it.

Supplemental insurance plans give you freedom. Unlike Medicare Advantage, Medigap lets you see any doctor or hospital that takes Medicare. This makes it easy to get care anywhere.

When picking an insurance plan, the standardization helps a lot. Once you know what you need, you can find the best value for that plan letter.

Some plans just fill basic gaps, while others offer more. For example, Plan G covers almost everything except the Part B deductible. It’s popular for its good coverage and predictable costs.

“The standardization of Medigap plans is one of the most consumer-friendly aspects of the Medicare system. It allows beneficiaries to make apples-to-apples comparisons when shopping for coverage.”

This way of doing things makes choosing Medigap easy. You don’t have to be an expert. The letter system helps you find the right coverage and price for your needs.

Who benefits most from Medigap coverage

Knowing who benefits from Medicare supplemental insurance is key. It helps decide if this extra coverage is right for you. Medigap policies help nearly all Medicare users, but some groups find them very useful. They offer financial protection when you need a lot of healthcare.

“Original Medicare without Medigap would be risky,” said Michael Dayoub, a certified financial planner in Savannah, Georgia. Medicare Part A and Part B don’t have out-of-pocket limits. This means you could owe a lot of money for copays and coinsurance.

This risk is big for anyone on Original Medicare. A single hospital stay can cost thousands. For many, the monthly Medigap premium is worth it for the peace of mind.

Frequent Medical Visits and Chronic Conditions

If you see doctors often or have ongoing health issues, Medigap is very helpful. Original Medicare’s 20% coinsurance for Part B services adds up fast. Without Medigap, these costs keep going up with no end.

Think about the costs for someone with diabetes or heart disease. They might need regular visits and tests. These costs add up and Medigap helps cover them.

Let’s look at how Medigap can save money in different health situations:

| Health Scenario | Estimated Annual Costs Without Medigap | Typical Annual Medigap Premium | Potential Annual Savings | Additional Benefits |

|---|---|---|---|---|

| Minimal healthcare usage (1-2 doctor visits yearly) | $300-$500 | $1,500-$2,000 | -$1,000 to -$1,700 | Peace of mind, predictable costs |

| Moderate usage (quarterly specialist visits, occasional tests) | $1,200-$2,500 | $1,500-$2,000 | -$300 to +$500 | Cost predictability, reduced paperwork |

| Chronic condition management (monthly visits, regular tests) | $3,000-$5,000 | $1,500-$2,000 | +$1,000 to +$3,500 | Significant savings, financial protection |

| Major health event (surgery, hospitalization) | $5,000-$15,000+ | $1,500-$2,000 | +$3,000 to +$13,000+ | Protection from catastrophic costs |

The table shows that those with more healthcare needs save money with Medigap. Even for moderate users, the cost predictability is worth the premium. This is even more true when facing unexpected health issues.

Travelers also benefit from Medigap, thanks to its foreign travel emergency coverage. All Medigap plans offer nationwide coverage, so you can see any doctor in the country without network issues.

Many people also like Medigap for its simplicity in budgeting for healthcare. With a fixed monthly premium, you can plan your retirement expenses better. This is very helpful for those on fixed incomes.

For those with chronic conditions like arthritis or diabetes, Medigap is essential. These conditions need ongoing care and treatments. The costs not covered by original Medicare can be very high, making Medigap a good choice.

Remember, Medicare Advantage plans also have out-of-pocket limits. But they have network restrictions and approval needs that Medigap doesn’t. For those who value provider choice and flexibility, Medigap might be a better option, even with higher premiums.

Related Posts:

Premium pricing factors and rate stability

Medigap premiums have a complex structure. They determine your costs today and in the future. Understanding these factors can help avoid financial surprises.

Plan G, the most popular Medicare supplement, costs $100-$150 monthly at age 65. These costs can rise due to factors many overlook.

The Three Pricing Methods That Shape Your Costs

Insurance companies use three methods to set Medigap premiums. Each method affects your costs differently:

| Pricing Method | How It Works | Initial Cost | 10-Year Outlook | Best For |

|---|---|---|---|---|

| Community-Rated | Everyone pays the same regardless of age | Higher initially | Most stable, predictable increases | Long-term planning, age 65+ |

| Issue-Age-Rated | Based on your age when you buy (doesn’t increase due to aging) | Medium | Moderately stable, some increases | Those buying before age 70 |

| Attained-Age-Rated | Increases as you age each year | Lowest initially | Significant increases over time | Short-term budgeting, limited funds |

Low-priced attained-age plans might seem good today. But they could become a big budget problem in five years. I’ve seen clients face 8-10% annual increases, much higher than community-rated plans.

Beyond Age: Other Factors Affecting Your Premium

Insurance companies consider more than age when setting premiums. Your location greatly affects costs. I’ve seen the same plan cost twice as much in some ZIP codes compared to others just 30 miles away.

Gender-based pricing is common, with women often paying less. Tobacco users face surcharges of 15-25%. Many insurers offer discounts of 5-12% for spouses buying together.

“It comes down a lot of times to the psychology and peace of mind. Are you willing to pay $150 per month for peace of mind?”

Many clients value the peace of mind Medigap offers. It’s like car insurance—you pay monthly hoping never to need it, but grateful for the protection when you do.

Evaluating Rate Stability Before You Buy

Look at the insurance company’s rate increase history to predict future costs. Ask these questions before signing:

- What has been your average annual rate increase for this specific plan over the past 5 years?

- How many rate increases have you implemented in the past 3 years?

- What factors triggered your most recent rate increase?

- How large is your enrollment pool for this Medicare supplement plan?

- Does your company offer any rate guarantees or caps on future increases?

Larger insurance pools tend to have more stable rates. A company with 100,000 Medigap policyholders can better handle cost changes than one with 5,000.

Check your state insurance department website for historical rate data. It offers unbiased info on companies’ pricing history.

Balancing Premium Costs Against Benefits

Medicare supplement insurance covers costs Original Medicare doesn’t. The monthly premium is a big expense, but it offers predictability many retirees value.

Consider your health spending when deciding if Medigap is worth it. If you see doctors often or have chronic conditions, the predictable premium might be cheaper than Original Medicare’s unlimited costs.

Changing your Medigap plan later can be tricky. You might lose your guaranteed issue rights and face higher premiums or coverage denials. So, your initial choice is very important.

Comparing Medigap and Medicare Advantage choices

The Medicare landscape offers two main paths for coverage: Medigap policies and Medicare Advantage plans. Each has its own benefits and drawbacks. Knowing these differences helps you choose the best option for your health, budget, and lifestyle.

Both options aim to lower your out-of-pocket costs. But they do it in different ways. Medigap supplements Original Medicare, while Medicare Advantage plans replace it with a private alternative. Let’s look at how these differences impact your healthcare.

Network Limitations Versus Nationwide Acceptance

One big difference is provider access. With Original Medicare and a Medigap policy, you can see any doctor or hospital in the country. This includes over 90% of providers nationwide.

Medicare Advantage plans, on the other hand, limit you to a specific network of providers. This can be a problem for people who travel a lot or have homes in different states. They might find it hard to get care from their preferred doctors.

“The freedom to see any Medicare provider nationwide is often the deciding factor for my clients who split time between seasonal homes or who travel frequently. They value knowing they can receive covered care wherever they go without worrying about network restrictions.”

If you travel a lot or have homes in different states, Medigap’s nationwide acceptance is a big plus. Understanding the difference between Medicare Advantage and network structures is key before you decide.

Some Medicare Advantage plans offer out-of-network coverage, but it costs more. HMO plans usually don’t cover out-of-network care except in emergencies. PPO plans offer some out-of-network coverage but cost more.

Spending Caps Versus Predictable Premium Costs

Medicare Advantage plans have annual out-of-pocket maximums (usually $6,000-$8,300 for in-network services in 2023). This helps protect against very high costs.

Medigap plans, like Plan F or G, cover most costs not covered by Original Medicare. This means higher monthly premiums but more predictable costs overall.

Think about how these options affect your budget:

| Feature | Medigap | Medicare Advantage | Best For |

|---|---|---|---|

| Monthly Premium | Higher ($100-$300+) | Lower (Some $0 premium plans) | Advantage: Those on tight monthly budgets |

| Out-of-pocket Maximum | No cap on what Medicare doesn’t cover | Annual cap ($6,000-$8,300) | Advantage: Protection against catastrophic costs |

| Cost Predictability | Very predictable year-round costs | Variable based on service usage | Medigap: Those who prefer consistent expenses |

| Additional Benefits | Rarely included | Often includes dental, vision, hearing | Advantage: Those needing these services |

| Foreign Travel Coverage | Some plans cover emergency care abroad | Rarely covered | Medigap: International travelers |

Medicare Advantage plans often include benefits not covered by Original Medicare or Medigap. This includes dental, vision, hearing care, and fitness memberships. If you need these services, consider the cost of separate policies with Medigap.

Your health and expected medical needs should guide your choice. If you have chronic conditions, Medigap’s predictable costs might be better. If you’re generally healthy, Medicare Advantage’s lower premiums might be more appealing.

You can switch from Medicare Advantage to Medigap during the Annual Enrollment Period. But, you might face medical underwriting if you’re outside your Medigap Open Enrollment Period. This could lead to higher premiums or denial of coverage based on pre-existing conditions.

The right choice depends on your individual situation. Some people choose Medicare Advantage for its lower premiums, while others prefer Medigap for its predictability and flexibility.

Take your time to think about your healthcare needs, finances, and lifestyle before making a decision. Consider talking to a licensed Medicare advisor for personalized advice.

Check out the below:

Steps to enroll in suitable Medigap plan

Timing is key when looking for medicare supplement insurance plans. Your six-month Medigap open enrollment starts when you’re 65 and signed up for Medicare Part B. During this time, insurance companies must sell you any plan they offer, no matter your health.

To get the right coverage, follow these steps:

First, sign up for original Medicare (Parts A and B) through Social Security. Then, compare the Medigap plans to see which ones fit your needs. The Medicare.gov website helps you compare all plans side by side.

After picking a plan letter, look for the best rates from different insurance companies. Prices for the same coverage can vary a lot. Also, check each company’s complaint record and financial health.

If you miss your open enrollment, getting a medicare supplement plan might be hard or expensive. Some states offer special enrollment rights if you lose coverage or have certain health issues.

For help, contact your State Health Insurance Assistance Program (SHIP) or an independent agent. They can help you find the best plan. Start looking about three months before you turn 65 to make a good choice.