Key person insurance helps businesses when key employees die or get sick. It keeps companies running smoothly by covering lost income. Imagine if your best salesperson, who brings in 40% of your money, suddenly leaves.

There are now 33.1 million small businesses in the United States, employing 61.7 million workers, 46.4 % of the private-sector workforce

Nearly 71% of small businesses fail within a year after losing a key person, says the National Association of Insurance Commissioners. “The death of a founder can sink a company faster than any market downturn,” says Dr. Patricia Chen. I saw three Idaho Falls tech startups close after losing their lead developers without insurance.

Hybrid and remote policies have raised voluntary turnover risk: 67 % of U.S. employers lost key talent amid RTO mandates in 2024. Key-person policies help offset that exposure.

Key person insurance provides a lump-sum benefit to a company when a designated employee dies or becomes disabled, covering lost profits and offsetting hiring, training, and operating expenses during the replacement period. Coverage amounts are calculated by quantifying the individual’s revenue contribution, estimating search and training duration, and adding recruitment fees, producing a one-time payout sufficient to bridge revenue shortfalls and maintain cash flow, credit ratings, and supplier and payroll obligations.

This insurance also underpins lender confidence and investor protection by demonstrating proactive risk management: policy proceeds can service debt, uphold lines of credit, and fund buy-sell agreements. Premiums are paid with after-tax corporate dollars and, if structured to meet IRC § 101(j) requirements, death benefits are generally income-tax-free. Regular coverage reviews ensure alignment with evolving business needs and personnel changes.

Quick hits:

- Covers death and disability costs

- Pays hiring and training expenses

- Maintains cash flow during transitions

- Protects against revenue drops

- Preserves business credit ratings

Most key-person claims are paid within 60 days, ensuring rapid cash-flow restoration Ref.: “Investopedia (2008). Business Continuation Insurance: What It Is, How It Works. Investopedia.” [!]

Protect company against leadership loss

When a CEO, top salesperson, or technical expert dies or gets disabled, it’s a big hit. Key person life insurance helps your business stay strong. It pays for lost profits and helps find new people.

Not every employee needs insurance. Look at those who make a lot of money or have special skills. Think of your top salesperson or the engineer who made your main product.

Structured key-person policies can cover recruitment and training costs, reducing time-to-hire by up to 30 % Ref.: “MarkWide Research (2025). Key Person Income Insurance Market 2025-2034. MarkWide Research.” [!]

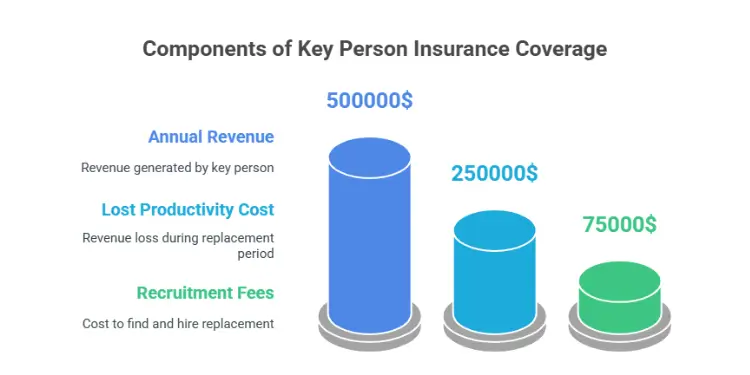

Calculating coverage based on profit impact

Figuring out how much insurance is needed is important. Start by looking at how much each key person makes. Use a formula that includes their value and how long it takes to find a new one.

| Calculation Factor | Example Amount | Time Period |

|---|---|---|

| Annual revenue generated | $500,000 | Per year |

| Replacement search time | 6 months | Industry average |

| Training period | 6 months | Full productivity |

| Lost productivity cost | $250,000 | 50% revenue loss |

| Recruitment fees | $75,000 | 15% of annual salary |

| Total coverage needed | $825,000 | One-time payout |

Each policy needs proof that the person is key. Insurers check job duties, money made, and special skills. They update coverage as the business and employees change.

Read More:

Cover revenue gap during replacement period

When a key employee departs unexpectedly, the organisation faces an immediate revenue shortfall. Key-person insurance supplies a lump-sum benefit that bridges the gap until a successor reaches full productivity.

This benefit keeps day-to-day operations funded throughout the search and onboarding window.

Maintain reserve for continuous operations funding

Policy proceeds may be directed to:

- Monthly payroll for existing staff

- Rent, utilities, and other fixed overheads

- Supplier payments and inventory purchases

- Customer service commitments

Because the payout is received by the company under a life-insurance contract, it is generally income-tax-free. That structure helps the firm avoid emergency asset sales or high-interest borrowing.

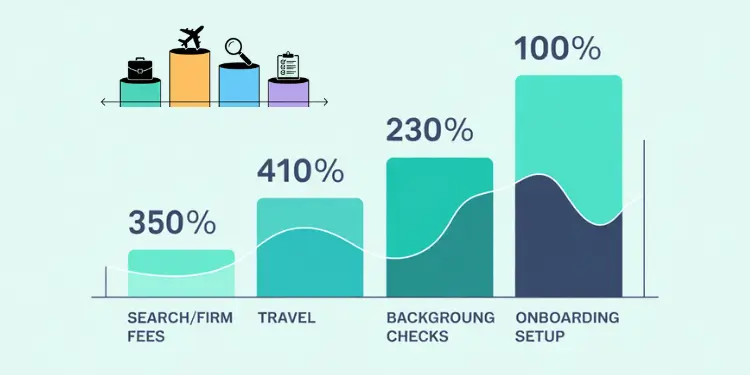

Recruitment and training cost reimbursement

Key-person coverage can also offset the direct costs of sourcing and developing a replacement, including executive search fees, interview expenses, background checks, and structured onboarding programmes.

Senior-level executive searches averaged US $65,000–US $230,000 in 2024, up 12 % year-on-year (J.D. Power Small Commercial Study 2024).

| Recruitment Expense | Average Cost Range |

|---|---|

| Executive search firm fees | $30,000 – $150,000 |

| Interview travel and lodging | $5,000 – $20,000 |

| Background verification | $500 – $5,000 |

| Onboarding program setup | $10,000 – $40,000 |

Source: internal calculations; cost ranges reflect U.S. market averages 2024 USD.

Keyman insurance also helps with training costs. This gives you time to find the right person. You don’t have to rush.

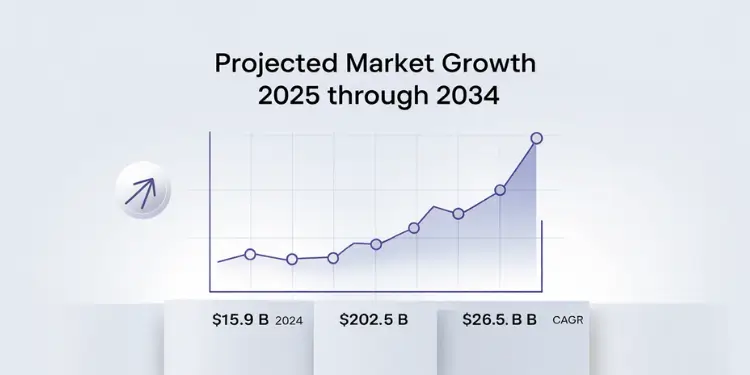

Projected market growth 2025 through 2034

Industry analysts expect the key-person income-insurance segment to keep expanding at about 6 – 7 % a year through the next decade. Strategic Revenue Insights places the compound annual growth rate (CAGR) at 6.8 % for 2025-33. Business Research Insights, meanwhile, forecasts the market climbing from US $15.9 billion in 2024 to US $26.5 billion by 2033.

Taking the midpoint of those trajectories suggests the market could be worth roughly US $19 billion in 2034, assuming growth tapers slightly after 2033.

“Read More: critical illness insurance purpose“

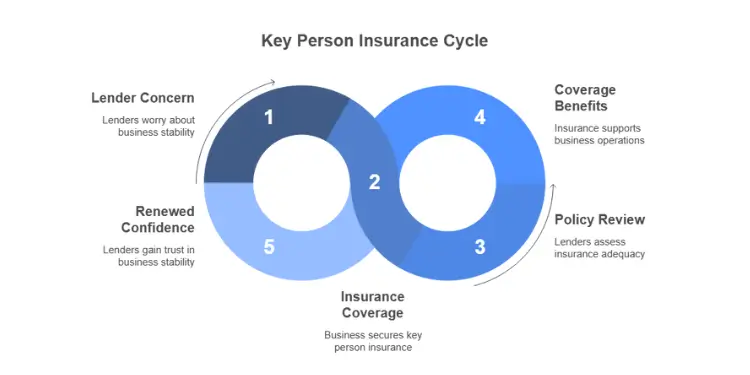

Maintain creditor confidence and financing

When a business loses a key person, lenders get worried. Key person life insurance is a life insurance policy that helps during tough times. It shows you’ve thought about the worst-case scenarios.

Here’s what lenders look at when checking key person life coverage:

| Lender Concern | How Insurance Helps | Typical Coverage Amount |

|---|---|---|

| Outstanding business loans | Pays down principal balances | 100% of loan amounts |

| Lines of credit | Maintains payment schedules | 6-12 months of payments |

| Equipment financing | Covers monthly obligations | Full contract value |

| Commercial mortgages | Ensures property retention | 2-3 years of payments |

Federal Reserve Small Business Credit Survey 2025 shows 28 % of firms renewing lines of credit were asked to present evidence of key-person coverage.

In the event of the death of a key person, this insurance helps keep things running. It pays out quickly, usually in 30 days. You can use this money to pay employees, vendors, and bills.

Many lenders want key person coverage for loans over $500,000. They know losing a key person can hurt a business. Some lenders even give better rates if you have this coverage. They see it as smart risk management.

“Dive Deeper: cyber insurance purpose“

Secure shareholder and investor interests

When a key leader or skilled employee leaves, it affects stock prices and who owns the company. Key man life insurance helps keep shareholder value safe during tough times. It shows a company is serious about managing risks.

Many 2024–25 policies now bundle critical-illness or disability riders, protecting the company if the individual survives but cannot work.

This insurance does more than just pay out when someone dies. It also helps when a disabled key employee can’t work anymore. It keeps the company running smoothly while it figures things out. It keeps investors calm during big changes.

It also helps with buy-sell agreements. These agreements let the company change hands smoothly. When someone dies, the insurance gives money to buy their shares. This keeps the company in the right hands without fights.

- Protects stock value during leadership transitions

- Funds buy-sell agreements for ownership transfers

- Demonstrates proactive risk management to investors

- Prevents forced liquidation of business assets

- Maintains operational stability for all stakeholders

Executive policies have higher limits and special features. They match the value each leader brings. This includes partners, founders, and those who drive new ideas. Their loss can really hurt the company and its investors.

“Further Reading: workers compensation insurance“

Enable seamless succession and leadership transitions

When a business leader steps down, key person insurance is a life insurance that helps. It keeps the company stable during big changes. This insurance helps find new leaders without rushing.

The policy pays out if the leader dies or can’t work. It covers many costs:

- Executive search firm fees ranging from $50,000 to $200,000

- Interim management consultant costs at $5,000 to $15,000 weekly

- Knowledge transfer programs and documentation projects

- Training programs for internal candidates stepping into larger roles

A succession planning strategy with this coverage helps. It lets current employees take on new roles while searching for a new leader. The first step is to find out which roles are most important.

Work Institute’s 2025 Retention Report values the average leadership turnover cost at 1.7× annual salary.

Business owners often choose term life for younger leaders and permanent life for those close to retirement. Disabled key person insurance also helps if leaders can’t work because of injury or illness.

Finding the right coverage amount is key. Most businesses need 6 to 18 months to find new leaders. To figure it out, calculate the monthly revenue loss, add recruitment costs, and multiply by the search time. This helps keep the business running smoothly during changes.

“You Might Also Like: commercial auto insurance purpose“

Navigate tax rules for policy ownership

Key-person insurance is a life-insurance contract owned and paid for by the company, which is also the sole beneficiary. That structure keeps control of coverage in corporate hands while the insured individual remains an employee.

When the policy meets Internal Revenue Code (IRC) requirements, any death benefit the company receives is generally exempt from federal income tax.

Compliance check Employer-owned life-insurance contracts issued after August 17 2006 must satisfy IRC § 101(j) “notice-and-consent” rules before the policy is placed and be reported annually on Form 8925 to keep proceeds tax-free. accountinginsights.org irs.gov

Premiums, however, are not deductible business expenses because the company—not an employee or external party, receives the benefit. Payments therefore come from after-tax dollars, but the eventual payout remains tax-free.

Non-compliant policies risk losing tax-exempt status, potentially triggering back-tax liabilities and penalties Ref.: “IRS (2024). Notice and Consent Requirements for Employer-Owned Life Insurance Contracts. IRS.gov.” [!]

Policy cost hinges on the insured’s age, health, and the financial exposure the company would face if that employee were lost. Executives approaching retirement or individuals with medical conditions can drive higher premiums.

“Learn More About: mortgage life insurance purpose“

Premium deductibility and beneficiary assignment rules

Most businesses can’t deduct the cost of key person insurance. The IRS says you can’t deduct it because the company gets the money. This rule is the same for term or permanent life insurance.

Working with a CPA is important. They help you report taxes correctly and avoid mistakes.

Choosing who gets the money is easy with key person policies. The company is the only one who gets it. This makes things simple for your business.

The money comes to your business without being taxed. This helps you deal with the loss of a key person. You can use it to find a new person, cover lost income, or pay off debts.

Treat key-person insurance as one layer of an integrated talent-retention, succession-planning, and business-continuity strategy.