When a sudden windstorm hits your neighborhood or a kitchen fire damages your home, homeowners insurance is crucial. Your house is more than just walls and a roof. It’s your biggest investment and the heart of your family’s life.

What if disaster strikes without coverage? The Insurance Information Institute says about one in 20 homes file a claim each year. These claims average over $13,000 in damage.

“Insurance isn’t just an expense—it’s protection for all you’ve worked for,” I tell families in Idaho Falls during our kitchen-table talks.

Over ten years, I’ve helped hundreds of homeowners choose the right coverage. The right policy shields your home from fires, storms, and other disasters. It also protects your belongings and offers liability coverage.

Unlike auto insurance, home protection is key to your family’s financial security. It goes beyond just the house. It safeguards your future against unexpected losses.

Homeowners insurance serves as a contractual risk-transfer mechanism that protects the insured dwelling and attached structures against specified perils. Standard policies indemnify damage from wind, hail, fire and smoke up to the dwelling limit, extend to personal property (typically 50–70 % of the dwelling value), and include liability coverage, commonly $100 000–$500 000—to defend and settle third-party injury or property-damage claims without a deductible. Policyholders choose between actual-cash-value and replacement-cost valuations for both structure and contents; replacement-cost coverage incurs higher premiums but ensures full cost recovery for like-kind repair or replacement. Separate endorsements are required for perils excluded from standard coverage, such as earthquake and flood, while scheduled-property endorsements cover high-value items beyond standard limits.

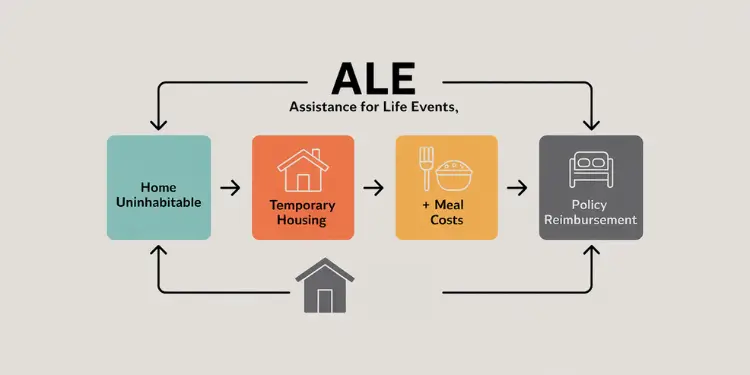

The policy’s additional living expenses (ALE) provision reimburses increases in housing, food and transportation costs when a covered peril renders the home uninhabitable, generally capped at a percentage of the dwelling limit and subject to both time and monetary thresholds. Mortgage lenders mandate minimum coverage equal to the loan balance or replacement cost, often collected via escrow to prevent lapse. Policy limits should be reviewed annually to account for changes in construction costs, home improvements and personal-property acquisitions. Select endorsements—sewer-backup, home-systems protection or flood—align coverage with localized risk profiles and regulatory requirements.

Quick hits:

- Protects your largest financial investment

- Covers personal belongings against covered perils

- Provides liability protection for accidents

- Creates financial stability during disasters

- Offers peace of mind for families

Protect Structural Investment From Natural Disasters

Protecting your home from natural disasters is key. Your home is more than a place to live; it’s a big investment. When disasters hit, your insurance helps a lot.

I’ve helped many Idaho homeowners after storms. They didn’t know what their insurance covered until then.

Your home’s structure is covered by your policy. This includes walls, roof, and floors. Even your garage and deck are protected. Most policies cover damage from many causes, but not all.

Wind Hail and Wildfire Damage Coverage

Wind and hail damage are usually covered. These are common reasons for insurance claims. Your policy will help pay for repairs or rebuilding.

Wildfires are also covered. This includes smoke damage, even if your home isn’t on fire. It’s important to know this.

Fire and lightning events comprised 21.9% of homeowners insurance claims in 2022, highlighting wildfire riskRef.: “Vukelich, L. (2024). Homeowners insurance statistics and facts. Bankrate.” [!]

But, some things aren’t covered. Earthquakes and floods need special policies. I’ve seen how upsetting this can be for homeowners.

The difference between replacement cost coverage and actual cash value can mean tens of thousands of dollars in your pocket after a disaster.

Check how your policy handles replacement costs. Some pay actual cash value, others replacement cost. Replacement cost is better but costs more.

Check your coverage limit every year. Construction costs change, and you might not have enough coverage. Your coverage should be enough to rebuild your home, not just its value.

| Disaster Type | Standard Coverage | Coverage Limits | Special Considerations |

|---|---|---|---|

| Wind/Hail | Yes | Up to dwelling limit | Higher deductibles in high-risk areas |

| Fire/Wildfire | Yes | Up to dwelling limit | Includes smoke damage |

| Earthquake | No | N/A | Requires separate policy |

| Flood | No | N/A | Requires separate policy |

Read More:

Safeguard Personal Belongings Within The Home

Your personal belongings make a house a home. Insurance coverage keeps these items safe. Many homeowners don’t realize how much their stuff is worth until they lose it.

Personal property includes things like furniture, clothes, and electronics. Most homeowners’ policies cover these items, even when they’re not at home.

For example, if your laptop gets stolen from your car or a hotel, your insurance might cover it. This protection goes with you, but some limits might apply for second homes.

The coverage for your belongings is usually 50% to 70% of your home’s value. So, if your home is insured for $300,000, you could get between $150,000 and $210,000 for your stuff.

Determine Replacement Cost Versus Actual Cash

When insuring your belongings, you have to choose between replacement cost and actual cash value. This choice affects how claims are paid.

| Coverage Type | What You Receive | Cost Factor | Best For |

|---|---|---|---|

| Replacement Cost | Funds to buy new items of similar quality | Higher premium | Most households with standard belongings |

| Actual Cash Value | Original cost minus depreciation | Lower premium | Budget-conscious homeowners with minimal possessions |

| Scheduled Property | Full agreed value for specific items | Additional premium per item | Owners of high-value jewelry, art, or collectibles |

I always suggest choosing replacement cost coverage, even if it costs a bit more. Actual cash value might not cover the cost of replacing items, especially after a big loss.

In Idaho Falls, a family lost almost everything in a fire. They had replacement cost coverage, so they got enough to furnish their new home. Their neighbors, who had actual cash value, got much less and had trouble replacing their items.

Creating a detailed home inventory is key to protecting your belongings. Without it, proving what you owned can be hard after a disaster. Here’s how to make a good inventory:

- Take photos or videos of each room, including closets and storage areas

- Document serial numbers for electronics and appliances

- Save receipts for major purchases

- Store your inventory in the cloud or another off-site location

- Update your inventory annually or after significant purchases

Standard policies often have limits for high-value items like jewelry and art. If you have valuable items, you might need to schedule them separately or add extra coverage.

Your policy might also cover things like food spoilage during power outages and trees on your property. Talk to your agent to see what else is covered.

The difference between replacement cost and actual cash value isn’t just dollars and cents—it’s the difference between fully recovering after a loss and starting over with less than you had before.

Provide Liability Protection For Household Incidents

Your homeowner’s policy has a key part that protects you from lawsuits and injury claims. This part, called liability coverage, goes with you and your family almost everywhere. In Idaho Falls, I’ve seen it save families from big financial losses after small accidents.

Liability coverage helps when you’re legally to blame for someone’s injury or property damage. If your kid breaks a neighbor’s window or your dog bites someone, your policy might cover the costs. This protection is for everyone in your home, including pets.

Most policies offer between $100,000 and $500,000 in liability protection. I suggest at least $300,000 for most homes, especially if you have a pool or host parties. If you have a lot of assets, you might need more coverage.

The Insurance Information Institute recommends raising liability coverage limits to at least $300,000 to protect homeowners from potentially costly injury or property damage claims.Ref.: “Experian Staff. (2023). What effect do home renovations have on home insurance costs?. Experian.” [!]

What’s great about liability coverage is it usually has no deductible. Your insurance starts paying right away for covered claims. This is different from property coverage, which often requires you to pay first.

| Liability Coverage Amount | Recommended For | Typical Annual Cost | Protection Level |

|---|---|---|---|

| $100,000 | Basic coverage (minimum) | $0 additional | Minimal protection for small claims |

| $300,000 | Average homeowners | $15-30 additional | Standard protection for most incidents |

| $500,000 | Higher-risk properties | $30-50 additional | Enhanced protection for serious incidents |

| $1,000,000+ | High net worth individuals | $150-300 (umbrella policy) | Maximum protection for major lawsuits |

Your liability coverage also pays for legal defense if someone sues you. This is very valuable, as lawyer fees can be very high. The insurance company will handle the legal process for you.

Liability coverage excludes incidents from business activities and automobile accidents, potentially leaving home-based professionals underinsuredRef.: “Policygenius (2023). Homeowners insurance exclusions: 13 things not covered by home insurance. Policygenius.” [!]

But, your policy doesn’t cover criminal acts or harm done on purpose. It also doesn’t cover car accidents or business-related incidents if you work from home.

“Learn about: Essential insurance for newlyweds starting out together“

Guest Medical Payments Prevent Lawsuits

Medical payments coverage works with your liability protection but is different. It pays for medical bills no matter who’s at fault. This coverage usually ranges from $1,000 to $5,000 and helps with small medical expenses when someone is hurt on your property.

I’ve seen this coverage stop many lawsuits. If a guest gets hurt on your porch, your insurance can quickly pay for their medical bills. This often stops the injured person from suing you.

For example, if a neighbor’s child falls off your swing set and breaks an arm, your insurance can help with the emergency room bill. Without this coverage, the neighbor might sue you to get the costs covered.

Medical payments coverage typically applies to:

- Immediate medical expenses like ambulance rides

- Emergency room visits and treatments

- X-rays and diagnostic tests

- Necessary surgeries resulting from the injury

- Follow-up medical appointments

The standard $1,000 medical payments limit is often not enough for today’s healthcare costs. I usually suggest increasing this to at least $5,000, which adds only $15-20 to your annual premium. This small investment can prevent big liability claims later.

When someone is injured on your property, document the incident well. Take photos of the area and get contact info from witnesses. Then, contact your insurance company right away to report the incident.

Remember, medical payments coverage only applies to people who don’t live in your home. If a family member is injured, their health insurance will cover the costs instead.

Both liability and medical payments coverages are key parts of your homeowner’s policy. They protect your financial future from lawsuits. Make sure you understand these coverages and have enough limits.

Cover Additional Living Expenses After Loss

Loss of use coverage helps keep your standard of living when disaster makes your home uninhabitable. It’s a crucial but often overlooked part of insurance. It can save families thousands of dollars during stressful times.

This coverage is also known as “additional living expenses” coverage. It pays for the extra costs of living elsewhere while your home is being repaired. It covers the difference between your usual living expenses and the higher costs during this time.

For example, if you normally spend $300 a week on groceries but now spend $500, your policy covers the $200 difference. This applies to housing, transportation, and other living expenses too.

When my clients lost their home to fire damage last year, they were shocked by how quickly temporary living expenses added up. Their additional living expenses coverage meant the difference between financial stability and debt during six months of rebuilding.

Most policies offer about 20% of your home’s value for loss of use coverage. For a $300,000 home, that’s about $60,000. But, if repairs take a long time or cost a lot, you might use up all this money.

Understanding Loss of Use Limits

There are also time limits on loss of use coverage. Most policies cover you for up to 12 months. Some premium policies may cover you for 24 months, which is important for long rebuilds.

This coverage only applies if your home becomes uninhabitable due to a covered peril. If flooding forces you out and you don’t have flood insurance, your policy won’t cover your living expenses.

When disaster hits, it’s important to document everything. I always tell homeowners to:

- Take photos of damage before leaving your home (if safe)

- Save all receipts for temporary housing, meals, and other expenses

- Track your normal monthly expenses for comparison

- Communicate regularly with your claims adjuster

- Request advance payments if immediate funds are needed

Your policy may also cover lost rental income if you rent out part of your property. This applies when a covered disaster makes the rental part uninhabitable. It compensates you for lost income during repairs.

| Expense Category | Normal Cost | Temporary Cost | Covered Amount |

|---|---|---|---|

| Housing | $1,500 mortgage | $2,200 hotel/rental | $700 |

| Food | $600 groceries | $1,100 restaurants | $500 |

| Transportation | $200 gas | $350 gas/rideshare | $150 |

| Laundry | $25 home utilities | $120 laundromat | $95 |

| Pet Boarding | $0 | $450 | $450 |

Some policies include “fair rental value” coverage. This applies when you can’t rent out part of your insured property due to a covered loss. It ensures you don’t lose rental income while repairs are underway.

When reviewing your policy, pay special attention to how loss of use coverage is calculated. Some insurers offer actual loss sustained (with no specific dollar limit) but still impose time restrictions. Others provide a specific percentage of your dwelling coverage with both time and financial caps.

In my experience helping Idaho Falls families navigate claims, those who understand their loss of use coverage before disaster strikes recover more smoothly. Take time now to review your policy limits and discuss any concerns with your agent. The small effort today can prevent significant financial stress during an already challenging time.

“Read Also: 5 important types of insurance for self employed people“

Comply With Mortgage Lending Requirements

Mortgage lenders always require homeowners insurance. This is not just a rule—it’s to protect your and your lender’s investment in your home. Understanding these rules early can save you a lot of trouble later.

When you buy a home with a loan, your home is collateral. Until you pay off the loan, your lender has a stake in your home. That’s why homeowners insurance is required by mortgage, not optional.

Lenders want coverage that’s at least as much as your loan or the home’s replacement cost, whichever is less. This includes protection against common dangers like fire, wind, and hail.

Escrow Arrangements and Proof of Coverage

Most lenders use escrow accounts to keep your insurance up to date. Your mortgage payment includes a part for insurance. The lender pays your insurance bill directly.

This system is good for both you and your lender. You don’t have to worry about a big annual payment. And your lender knows the policy won’t lapse because of missed payments. Your insurance cost will show on page one of your Loan Estimate.

Before you close on your home, your lender needs proof of insurance. This is usually a declarations page from your insurance company. It shows coverage amounts, premium costs, and policy dates. Your lender will check this to make sure it meets their requirements.

| Payment Method | How It Works | Advantages | Disadvantages | Lender Preference |

|---|---|---|---|---|

| Escrow Account | Monthly insurance portion collected with mortgage payment; lender pays annual premium | Spreads cost over 12 months; automatic payments; lender ensures coverage | Less control over timing; may require initial deposit at closing | Strongly preferred or required for most loans |

| Direct Annual Payment | Homeowner pays insurance company directly once yearly | More control; potential for discounts; no escrow fees | Large annual expense; must budget carefully; must provide proof to lender | Sometimes allowed with 20%+ down payment or excellent credit |

| Direct Monthly Payment | Homeowner pays insurance company monthly installments | Direct control of payments; no escrow needed | Usually includes installment fees; higher risk of missed payments | Rarely accepted; may require larger down payment |

Throughout your loan term, your lender will check if you have insurance. If they find out you don’t, they’ll send notices asking for proof of new coverage. Ignoring these notices can lead to serious problems.

If you don’t have insurance, your lender can buy “force-placed insurance” for you. This insurance costs 2-3 times more than what you could get yourself. It also only protects the lender’s interest, not your personal belongings or liability.

I’ve helped many clients deal with this issue, and it can be very costly. Force-placed insurance can increase your mortgage payment by hundreds of dollars each month. To get out of it, you need to get your own policy and show proof to your lender.

When looking for homeowners insurance, remember that the minimum your lender requires might not be enough for you. You should also think about coverage for your personal property, liability, and living expenses after a loss.

If you have questions about lender requirements or feel your lender is being too strict, your state’s department of financial services can help. They have divisions for insurance consumer protection.

Check out the below:

Optimize Policy With Important Optional Endorsements

Standard homeowners insurance doesn’t cover everything. I’ve seen many Idaho Falls families find out too late. Their basic policy doesn’t protect against many risks.

Flood, Earthquake, And Sewer Backup

Flood insurance is a must-have. Basic policies don’t cover water damage. You can buy flood coverage from the National Flood Insurance Program or private insurers.

Earthquake protection is also not standard. If you live in an earthquake zone, this add-on is vital. It protects your home from damage caused by earthquakes.

Sewer backup coverage is another key add-on. It covers damage from clogged drains or failed sump pumps. This coverage is affordable and crucial.

Other great options include coverage for home systems and underground utilities. You can also get extra protection for valuable items not fully covered by your basic policy.

Check these endorsements every year as your home gets older. They might cost a bit more, but they’re worth it. They ensure your policy covers everything important. The extra cost is a small price to pay for peace of mind.