Condo insurance is key to protecting what’s yours. It fills gaps left by your condo association’s policy. Sadly, 73% of condo owners in America are unaware of what their HO-6 policy covers. This lack of knowledge can lead to big financial surprises when disaster hits.

As a condo owner, you might ask: “What if a pipe bursts and damages my furniture?” Your condo’s policy usually only covers up to your walls. This leaves your stuff at risk without the right insurance.

“The right coverage creates a safety net that transforms uncertainty into peace of mind,” says the National Association of Insurance Commissioners. This is very important because your condo unit likely has personal items worth $25,000-$50,000.

In my decade helping Idaho families, I’ve seen how condo insurance helps. It protects owners from unexpected losses that could be very hard on their finances.

Quick hits:

- Protects belongings your association doesn’t cover

- Shields against liability for accidents

- Provides living expenses after disasters

- Covers improvements to your unit

- Fulfills mortgage lender requirements easily

Condo insurance basics and policy foundations

Condo insurance is different from a house policy. It’s a two-policy system. This can make it hard to know what’s covered and who pays for what.

As a condo owner, you need your own insurance policy, called an HO-6 policy. This policy works with your association’s master policy. Before you buy, know what your association covers and what you need to cover.

Nearly half (47%) of U.S. condominium associations now mandate that every unit owner maintain an HO-6 policy—evidence that personal condo coverage is no longer optional in many communities.Ref.: “Foundation for Community Association Research. (2023). Insurance Coverage Trends in Community Associations Snap Survey. Community Associations Institute.” [!]

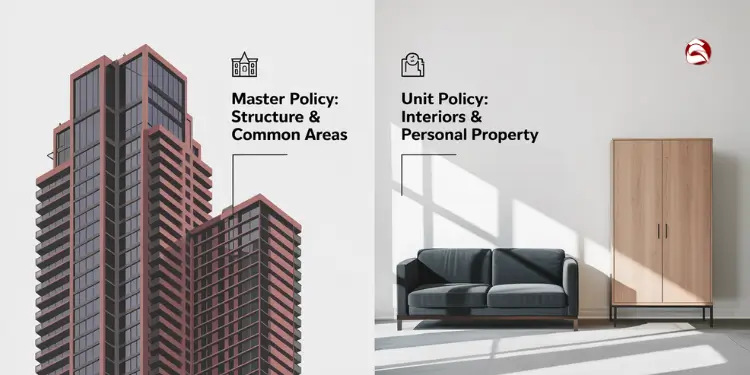

HOA Master Policy Versus Unit Policy

The master policy covers common areas and the building’s structure. This includes hallways, roofs, and exterior walls. But, it doesn’t cover everything in your unit.

Your individual policy covers your personal stuff, interior changes, and liability. It also covers living expenses if you can’t live in your unit. The coverage you need depends on your association’s master policy.

Master-policy deductibles often range from $5,000 to $10,000 and can reach $25,000 or more, meaning a single incident could leave the unit owner responsible for a sizeable out-of-pocket payment before HOA coverage applies.Ref.: “Voss Law Firm. (2014). Understand How Condo Master Policy Insurance Deductibles Work. The Voss Law Firm, P.C.” [!]

| Master Policy Type | What It Typically Covers | What Unit Owner Must Insure | Common in |

|---|---|---|---|

| All-Inclusive/All-In | Original fixtures, appliances, walls, flooring, and improvements made by current or previous owners | Personal belongings, liability, additional living expenses | Newer luxury developments |

| Single Entity | Original fixtures, appliances, walls, and flooring as initially built | Personal belongings, improvements/upgrades, liability, additional living expenses | Most standard condominiums |

| Bare Walls | Only the exterior structure and common areas | All interior elements (walls, flooring, fixtures, cabinets), personal belongings, liability, additional living expenses | Older developments, budget-conscious associations |

Get a copy of your association’s master policy before buying your policy. This shows what your building is covered for. Many agents say to bring this to your meeting to get the right coverage.

If your association has a bare walls policy and you’ve renovated, you’ll need more coverage. With an all-inclusive policy, you might need less for your unit but more for your stuff.

Common Misconceptions About Condo Policy Scope

Many think their HOA fees cover everything. But, this is not true. HOA fees help with the master policy, but it’s not complete.

Some think the association covers everything inside. But, it depends on your policy. With a bare walls policy, you cover everything inside, like walls and floors.

- Myth: “My personal belongings are covered by the HOA master policy.” Reality: Personal property is never covered by the master policy and requires individual coverage.

- Myth: “Improvements I make to my unit are automatically covered.” Reality: Only all-inclusive master policies might cover improvements; others require you to insure them separately.

- Myth: “Water damage from another unit is always covered by the association.” Reality: Coverage depends on the source of water and policy specifics; often your individual policy must respond first.

- Myth: “I don’t need liability coverage because I don’t own the building.” Reality: You need liability protection for accidents in your unit or caused by you.

Knowing the difference is key. Wrong assumptions can leave you at risk. For example, if your neighbor’s leak damages your ceiling and furniture, your policy covers your stuff, not the structure.

Don’t forget about loss assessment coverage. It helps with special assessments for big losses. Without it, you might have to pay a lot for repairs.

Homeowners and condo insurance can be confusing. Both protect your stuff and provide liability coverage. But, homeowners insurance covers the whole house, while condo insurance works with the master policy for full protection.

Think about the cost to replace your things and any upgrades. That fancy countertop or custom shower might not be covered by the master policy, even if it’s all-inclusive.

Remember, condo insurance is not just a good idea—it’s often required. Associations and lenders want to make sure everyone is protected. This helps keep the community safe financially.

Key protections condominium policies usually cover

Condominium insurance policies cover four key areas. These protect owners from financial loss. Knowing these areas helps you see if you’re paying the right amount for your needs.

This coverage helps replace your stuff if it gets stolen or damaged. It covers things inside your condo and when you’re away.

Many people don’t think about how much their stuff is worth. Imagine listing everything in your condo. You might be surprised at the total cost.

Most policies offer $25,000 to $50,000 for personal property. But, you can change this based on what you own. Things like jewelry or art might need extra coverage.

“After my client’s condo suffered smoke damage from a neighbor’s kitchen fire, she was relieved to discover her personal property coverage replaced not just her furniture but also clothing that had absorbed the smoke odor.”

Loss of Use Coverage

This coverage is key if your condo is not safe to live in. It helps pay for temporary housing and extra living costs while repairs are done.

For example, if a pipe bursts, this coverage pays for your hotel and meals. Most policies offer about 20% of your personal property limit for this.

Keep all receipts during any displacement. This coverage has helped many avoid using their savings for repairs.

Personal Liability Protection

This coverage helps if someone gets hurt in your condo or if you damage someone else’s property. It covers legal costs and settlements up to your policy limits.

Imagine a delivery person slipping on your wet floor and getting hurt. Your liability coverage would help pay their medical bills and lost wages. This could save you thousands of dollars.

Most policies start with $100,000 in liability protection. But, I suggest at least $300,000 for better coverage. The extra cost is small compared to the protection it offers.

The Insurance Information Institute recommends raising personal liability limits from the standard $100,000 to at least $300,000 – $500,000 to shield assets from costly lawsuits—an upgrade that typically adds only a modest premium.Ref.: “Insurance Information Institute. (2025). How Much Homeowners Insurance Do I Need? Insurance Information Institute.” [!]

Building/Dwelling Coverage

The coverage for your condo’s building depends on your condo association’s master policy. Knowing the difference between “bare walls” and “all-in” policies is important.

With a “bare walls” policy, you need to cover everything inside your unit. But, if your association has an “all-in” policy, you might only need coverage for your improvements.

| Coverage Type | What It Protects | Typical Limits | Common Exclusions |

|---|---|---|---|

| Personal Property | Furniture, clothing, electronics | $25,000-$50,000 | Flood, earthquake damage |

| Loss of Use | Temporary living expenses | 20% of property coverage | Non-covered peril displacement |

| Personal Liability | Injury or property damage claims | $100,000-$500,000 | Business activities, intentional acts |

| Building Property | Interior structures, improvements | Varies by association policy | Normal wear and tear, pest damage |

Most condo policies cover damage from fire, theft, windstorms, and sudden plumbing issues. But, they don’t cover floods, earthquakes, or normal wear and tear. For these, you need separate policies or endorsements.

When looking at your coverage, start with your condo association’s master policy. This shows what your policy needs to cover and where there might be gaps.

Your unit owner’s policy works with the association’s master policy. Together, they protect your investment and personal belongings.

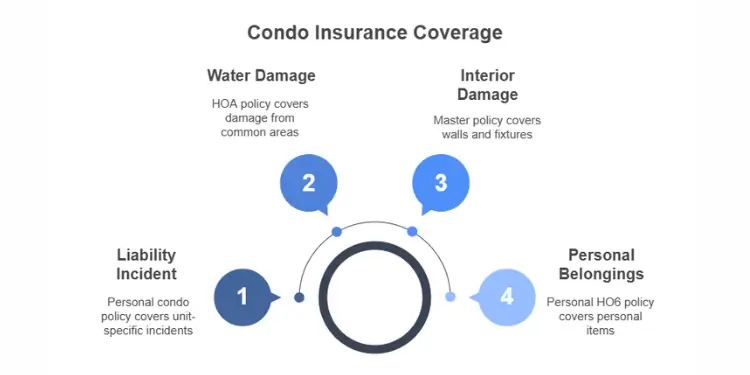

Claims process and coordination with master policy

Filing a condo insurance claim is like a dance. You need to know how your policy and the association’s master coverage work together. Knowing this before a disaster can save you a lot of stress and money.

First, document everything if damage happens to your unit. Take photos, videos, and make a list of what’s damaged. This evidence is key, no matter which policy covers the damage.

Then, decide which policy to contact first. This depends on the damage type:

| Damage Type | First Contact | Why This Order |

|---|---|---|

| Damage to your personal belongings | Your HO6 policy | Master policy won’t cover personal items |

| Damage to interior walls/fixtures | Check master policy first | Depends if “all-in” or “walls-in” coverage |

| Water damage from common areas | HOA policy | Origin of damage determines primary coverage |

| Liability incident in your unit | Your personal condo policy | Liability coverage is unit-specific |

Many condo owners think the master policy covers most damage claims. But, condo master insurance and your policy have different jobs. Knowing this can prevent delays in claims.

If your condo is uninhabitable due to damage, your personal policy’s loss of use coverage kicks in. This helps pay for temporary housing while repairs are made. The association’s policy doesn’t cover this.

Most condo owners don’t know that master policies often have big deductibles. Sometimes, these deductibles are $10,000 or more. If damage starts in your unit, your association might ask you to pay this amount, even if it affects other units too.

“The most common mistake condo owners make is assuming the association’s insurance covers everything. In reality, there’s a clear division of responsibility that every unit owner needs to understand before filing a claim.”

Filing Loss Assessment Claims Efficiently

Loss assessment coverage is often misunderstood. It helps when your association levies special assessments for damages that exceed the master policy’s coverage limit.

For example, if a storm causes $1.5 million in damage but the master policy only covers $1 million, the association might ask each owner to pay their share of the $500,000 shortfall. Your loss assessment coverage helps pay your part of this assessment.

To file a loss assessment claim efficiently, follow these steps:

- Get written proof of the assessment from your association

- Make sure the assessment is for a covered peril

- Call your insurance company right away—most policies have time limits

- Show proof that the assessment is more than the master policy limits

- Keep all communication records

Remember, loss assessment coverage has its own limit in your policy. Standard coverage is often just $1,000. I suggest increasing this to at least $10,000, more so in older buildings where special assessments are common.

Loss assessment coverage also helps when the master policy has a big deductible. If your association splits this cost among unit owners, your coverage can help pay your share, up to your policy limits.

When looking at your personal condo policy, pay close attention to liability coverage for incidents in your unit. If your bathtub overflows and damages units below you, your liability coverage may need to respond first.

Many condo owners think renters insurance is enough. But, renters insurance won’t cover structural elements that are your responsibility as an owner. This is why condo insurance is different and made for your specific situation.

To avoid claim problems, get a copy of your association’s master policy declaration page. This document clearly shows what the HOA policy covers and what your personal policy covers. Keep this with your insurance documents for easy access when filing claims.

Remember, insurance rates for both policies can change based on claims history. Sometimes, it’s better to pay for minor damage yourself to avoid higher premiums later.

By understanding how these two insurance policies work together, you’ll handle claims better. This way, you’ll get the full benefits you’re entitled to when damage happens.

Situations requiring condo coverage for owners

Many condo owners are surprised to learn that they must have insurance. As an experienced insurance agent, I’ve helped many understand the condo insurance process. This coverage is needed in many situations.

Mortgage lenders often require condo owners to have insurance. This is to protect their interest in your property. It’s a rule for all financed condos.

Even if you own your condo outright, you might need insurance. Many condo associations require it. They set minimum coverage levels for all owners, with or without a mortgage.

“Nearly 65% of condo associations in the U.S. have explicit insurance requirements in their bylaws, with minimum liability coverage typically set at $300,000.”

There are many reasons why condo insurance is key. For example, if a pipe bursts above you, your condo’s master policy might not cover your stuff. You might need to move out while repairs are done.

Theft is another big reason for insurance. Your policy can help if someone steals from you. Without it, you’d have to pay for everything yourself.

Fire damage is another reason for individual coverage. The master policy covers the building, but your policy is needed for your condo’s interior. It also covers appliances and your belongings.

| Situation | Master Policy Coverage | Individual Policy Coverage | Financial Impact Without Coverage |

|---|---|---|---|

| Water damage from upstairs unit | Structural walls only | Personal property, interior finishes, temporary housing | $5,000-$25,000+ |

| Theft of belongings | None | Replacement of stolen items | $2,000-$15,000+ |

| Kitchen fire | Building structure only | Interior damage, appliances, belongings | $10,000-$50,000+ |

| Liability incident within unit | None | Legal defense, medical payments | $25,000-$100,000+ |

Liability protection is also key. If someone gets hurt in your condo and sues you, your policy can help. It covers legal costs and damages. Without it, your personal stuff could be at risk.

Special assessments are another reason for coverage. If your condo association needs extra money, they might ask owners for it. Your policy might help if the reason is something covered by insurance.

Standard policies have limits. Things like jewelry or art might not be fully covered. Places in flood or earthquake zones need special policies for those risks.

- Check your mortgage agreement for specific insurance requirements

- Review your association’s CC&Rs or bylaws for coverage mandates

- Consider your personal belongings’ value when selecting coverage limits

- Evaluate your liability exposure based on lifestyle and visitors

- Assess your unit’s location for additional peril coverage needs

As an insurance expert, I see condo insurance as more than a rule. It’s a way to protect your finances. Even if it’s not required, the cost is worth it for the peace of mind it gives.

Remember, condo fees help pay for the association’s policy. But that policy has its limits. Knowing what your policy covers is important for every condo owner.

“read more: What is the purpose of mortgage life insurance?“

Choosing limits deductibles and policy options wisely

Choosing the right coverage limits, deductibles, and policy options is key. It helps tailor condo insurance to fit your needs. I’ve helped many unit owners find the right balance, which is important for financial security.

To figure out how much personal property coverage you need, make a home inventory. Take photos and videos of your belongings. Note the costs of high-value items like electronics and furniture.

For dwelling coverage, first check your condo association’s master policy. This is very important. The coverage you need depends on if the policy is “all-in” or “bare walls.”

Liability coverage usually starts at $100,000. But, this might not be enough. Calculate how much you could lose if someone sues you. Most agents suggest at least $300,000 for condo owners.

Comparing HO6 Quotes from Multiple Carriers

It’s important to shop around for condo insurance quotes. When comparing, make sure the coverage is the same. This way, you can compare fairly.

- Request identical coverage limits across all quotes to make fair comparisons

- Compare deductible options – remember that higher deductibles mean lower premiums but more out-of-pocket costs during claims

- Ask about claim handling processes and average response times

- Check customer satisfaction ratings from independent sources like J.D. Power

- Inquire about multi-policy discounts if you have auto insurance or other policies

When choosing deductibles, think about your emergency fund. Can you afford a $1,000 deductible if you had water damage tomorrow? If not, a lower deductible might be better.

Don’t forget about loss assessment coverage. This helps when your condo association charges extra for shared damage. Most policies include some coverage, but you can increase it for a small cost.

Evaluating Additional Endorsements for Special Items

Standard HO6 policies have limits. Additional endorsements can cover specific risks and valuables. Consider these endorsements based on your needs:

| Endorsement Type | What It Covers | Who Should Consider It | Typical Cost |

|---|---|---|---|

| Water Backup Coverage | Damage from backed-up drains or sewer lines | Units on lower floors or with finished basements | $30-50 annually |

| Scheduled Personal Property | Full coverage for high-value items beyond standard limits | Owners of jewelry, art, or collectibles worth over $1,500 | $10-20 per $1,000 of value |

| Identity Theft Protection | Expenses related to identity restoration | Anyone concerned about online privacy and security | $25-50 annually |

| Extended Replacement Cost | Additional coverage if rebuilding costs exceed policy limits | Units in older or luxury buildings | 10-20% premium increase |

Water backup coverage is very important for condo owners. Standard policies don’t cover damage from backed-up drains or sewer lines. This can cause thousands in damage. For about $40 a year, this endorsement can save you a lot of trouble and money.

TECHNICAL SPECIFICATION:

Sewer- and drain-backup endorsements—vital for multi-unit buildings—are typically excluded from HO-6 policies but can be added for about $40–$50 per year, providing up to $10,000 in extra protection.Ref.: “Insurance Information Institute. (2007). Yuck! Are You Insured for Sewer Backup? Insurance Information Institute.” [!]

For high-value items like jewelry, electronics, or collectibles, scheduled personal property endorsements provide extra coverage. While your typical condo insurance might limit jewelry coverage to $1,500, scheduling these items ensures their full value is protected against loss or theft.

“The most common regret I hear from clients after a claim isn’t that they had too much coverage—it’s that they didn’t have enough of the right kind.”

Additional living expense coverage is also important. If your unit becomes uninhabitable due to a covered loss, this coverage pays for temporary housing and extra costs. Standard policies include some protection, but consider if it’s enough to cover several months in a comparable rental if needed.

Remember, the cheapest policy isn’t always the best value. Look for coverage that addresses your specific risks and provides adequate protection for your lifestyle and possessions. A small premium increase now could save you thousands if you ever need to file a claim.

Read More:

Premium factors and savings opportunities explained

Condo insurance costs vary a lot across the country. The average is $590 per year. Rates range from $325 in North Dakota to $1,206 in Florida. Your location affects these rates, like if your building is in a flood zone.

Your ho6 policy premium depends on several key factors. The type of master policy your HOA has is important. An all-in policy from your condo association can lower your costs. This is because the master policy covers more of the building.

Bundling your condo and auto policies with the same carrier can cut premiums by up to 20%—a widely adopted strategy for offsetting the national average condo-insurance cost of $531 per year.Ref.: “Bankrate Editorial Team. (2025). Condo Insurance: What It Is and What It Covers. Bankrate.” [!]

I’ve helped many condo owners save money without losing protection. Start by comparing rates from different carriers. Rates can vary by hundreds of dollars for the same coverage. Installing security devices like smoke detectors and deadbolts can also get you discounts.

Many insurance companies give discounts if you bundle your condo and auto insurance. Raising your deductible can also lower your premium. But make sure you can afford the deductible if you need to fix your condo after a claim.

Working with an experienced insurance agent makes the process easier. They know about both individual and association coverage. Review your policy every year. This ensures your policy covers what’s important without extra costs.