Many Americans struggle to choose between many financial goals. They worry about saving for retirement, paying off debt, and buying a home. Did you know 73% of US households deal with at least four financial goals at once? But only 18% know how to tackle them.

“The difference between financial success and stress isn’t how much you earn, but how effectively you direct those earnings,” my mentor said. He helped many investors overcome this challenge. A simple plan can turn confusion into action.

Without a clear plan, your financial goals fight each other. But, you don’t need complicated spreadsheets or a degree in economics. What you need is a simple way to organize and prioritize your goals.

This article will show you easy budget plans that work. By the end, you’ll know which goals to focus on first and which can wait.

Quick hits:

- Start by listing all financial objectives

- Categorize goals by timeline and importance

- Allocate resources based on priority levels

- Review and adjust quarterly for success

A nationwide Empower survey shows that 73 % of U.S. adults intend to boost their net worth in 2024, underscoring how common it is for households to juggle multiple financial objectives at once. Ref.: “Empower Research Team. (2025). 2024 Money Plans and Goals Research. Empower.” [!]

Categorize Goals By Time Horizon

Sorting goals by time horizon is key to smart investing. It helps decide how much risk you can take and what investments to use. Your investment goal time horizon tells you which strategies are best and which might fail.

Think of time horizons like organizing your financial goals. You wouldn’t plant tomatoes and oak trees together. Your financial goals need different care based on when you’ll need the money.

“The relationship between time horizon and investment strategy is perhaps the most fundamental principle in finance that individual investors consistently misapply.”

Let’s look at the three main time horizon categories and how they guide your investment choices:

| Time Horizon | Risk Tolerance | Appropriate Vehicles | Volatility Concern |

|---|---|---|---|

| Short-term (0-2 years) | Very low | High-yield savings, CDs, T-bills | Critical concern |

| Mid-term (3-7 years) | Moderate | Bond ladders, balanced funds, some equities | Important but manageable |

| Long-term (8+ years) | Higher | Diversified equities, growth investments | Less concerning with recovery time |

Before investing elsewhere, capture your full 401(k) employer match; the most common formula (100 % on the first 3 % plus 50 % on the next 2 %) delivers an immediate, risk-free return worth roughly 4 % of salary. Ref.: “Shamrell, M. (2025). How Does a 401(k) Match Work? Fidelity Investments.” [!]

Short-Term Goals (0-2 Years)

Short-term goals need quick access to money and keeping it safe. Market ups and downs are a big worry when you need cash soon. Growth is less important than keeping your money safe.

Examples of short-term goals include:

- Emergency fund establishment or replenishment

- Upcoming tax payments

- Vacation funding

- Major appliance purchases

- Wedding expenses within the next year

Mid-Term Goals (3-7 Years)

Mid-term goals let you take on some risk. You can mix growth with stability. You have time to bounce back from market drops, but not too much.

Common mid-term financial objectives include:

- Home down payment accumulation

- Education funding for near-term needs

- Vehicle replacement funds

- Business startup capital

- Major home renovations

Long-Term Goals (8+ Years)

Long-term goals mean you can take more risk. Time helps you weather market ups and downs. Your focus can shift to growth over safety.

Typical long-term financial priorities include:

- Retirement funding

- College savings for young children

- Generational wealth building

- Vacation home purchase in distant future

- Early financial independence goals

By grouping your goals by time, you avoid bad investment choices. This method helps you make better financial decisions. It stops you from using short-term thinking for long-term goals or the other way around.

After sorting your goals, you’ll see which ones can share investment plans. This makes the next steps clearer and avoids the mistake of using the wrong investment for the time frame.

Rank Goals With Weighted Scoring Method

When you have many financial goals, a weighted scoring system helps you choose. It stops you from making choices based on feelings. This way, you focus on what’s really important.

This method turns your feelings into clear plans. It helps you make choices that match your values. Let’s learn how to use it for your goals.

Assign Importance And Urgency Points

First, look at each goal’s importance and urgency. Give each goal a score from 1 to 5 for both:

- Importance (1-5): How key is this goal for your money and happiness? A retirement fund is a 5, while a vacation home is a 3.

- Urgency (1-5): What happens if you wait a year? High-interest debt is a 5, while saving for retirement is a 2.

Then, multiply these scores to rank your goals. This makes sure you focus on the most important ones first. For example:

| Financial Goal | Importance (1-5) | Urgency (1-5) | Initial Score |

|---|---|---|---|

| Emergency Fund | 5 | 4 | 20 |

| Pay Off Credit Card | 4 | 5 | 20 |

| Home Down Payment | 4 | 3 | 12 |

| Kitchen Renovation | 3 | 2 | 6 |

| College Fund | 5 | 2 | 10 |

This method helps you see what’s truly important. It shows you what goals are most critical. It helps you understand your financial situation better.

Weighted matrices work best after you’ve secured an emergency reserve; regulators and consumer advocates recommend keeping three – six months of living expenses in liquid savings before ranking discretionary goals. Ref.: “Federal Deposit Insurance Corporation. (2019). Tax Season and Your Refund Options. FDIC.” [!]

“Explore More: How to Calculate Amount Needed for an Investment Goal“

Incorporate Lifestyle Impact Key Factors

Numbers are just part of the story. You also need to think about how your goals affect your life. These lifestyle factors can make or break your plan.

Adjust your scores based on these factors:

- Cash Flow Impact: How will this goal affect your money each month? Big spending cuts might need a longer time.

- Tax Efficiency: Does this goal save you money on taxes? Health savings accounts offer big tax benefits.

- Health and Wellness Effects: Does this goal make you feel better or less stressed? Goals that protect your money in tough times are extra important.

- Relationship Dynamics: Does this goal match what you and your family want? Goals everyone agrees on are more likely to succeed.

Let’s see how these changes might affect our example:

| Financial Goal | Initial Score | Lifestyle Adjustment | Final Score |

|---|---|---|---|

| Emergency Fund | 20 | +2 (Reduces stress) | 22 |

| Pay Off Credit Card | 20 | +3 (Improves cash flow) | 23 |

| Home Down Payment | 12 | +1 (Family priority) | 13 |

| Kitchen Renovation | 6 | -1 (Disrupts household) | 5 |

| College Fund | 10 | +2 (Tax advantages) | 12 |

After adjusting, paying off credit card debt becomes the top goal. This is because it saves you money each month. The college fund also moves up because of tax benefits.

This method gives you a plan that fits your life and money. It’s like having a financial advisor without the cost. Check your scores every few months or when your money situation changes.

Now that you’ve ranked your goals, it’s time to decide how much money to put into each one. This decision will turn your list into a real investment plan.

“Related Articles: Realistic vs Unrealistic Investment Goals for Beginners“

Allocate Resources Across Goal Buckets

Strategic resource allocation is key to making your financial goals real. You’ve sorted your goals by time and importance. Now, it’s time to put your money where it matters most.

First, figure out how much you can save each month. This is your money for reaching your goals.

For beginners, the 50/30/20 rule is a good start. It helps you make progress on all your goals, not just one:

- 50% to highest-priority goals – Like saving for emergencies or retirement

- 30% to medium-priority goals – Such as paying off debt or saving for a house

- 20% to lower-priority goals – For things like vacations or extra savings

Let’s say you can save $1,000 a month. You’d put $500 toward your top goals, $300 toward the middle, and $200 toward the least important.

| Priority Level | Percentage | Monthly Amount | Example Goals |

|---|---|---|---|

| High | 50% | $500 | Emergency fund, 401(k) match |

| Medium | 30% | $300 | Home down payment, debt reduction |

| Low | 20% | $200 | Vacation fund, extra investments |

This method helps you move forward on many goals at once. For example, saving $500 a month for an emergency fund of $9,000 takes 18 months. You’re also making progress on other goals.

This method works because it’s based on how we really work on goals. When you have many goals, small steps on each goal keep you going.

Choosing the right savings account is important too. Look for ones that automatically transfer money from your checking. This makes saving easier and less likely to stop.

The 50/30/20 rule is a good start, but you might need to adjust it. Some people might need to save more for emergencies before investing in other goals.

The main idea is to spread your savings across different goals. This keeps your financial plan strong and helps you reach your most important goals.

“Discover More: Goal Based Investing Explained for New Investors“

Sequence Investments For Cash Flow Optimization

Getting your investment order right is key to financial success. I’ve seen many miss out on thousands of dollars because of bad sequencing. The order you tackle your goals matters a lot, just like how much you put into each investment goal.

The best investment order is usually this:

- Capture all employer matching contributions (immediate 50-100% return)

- Eliminate high-interest debt (guaranteed return equal to interest rate)

- Build emergency reserves to minimum threshold (3 months expenses)

- Maximize tax-advantaged accounts for appropriate goals

- Address taxable investment accounts for remaining goals

This order helps you grow your money faster and save on interest. For example, paying off a credit card with 18% interest gives you an 18% return right away.

But, following this order too closely can cause cash flow issues. Not saving for emergencies first can lead to unexpected costs and debt.

The fix? Use a mix of both. Put 70% towards your top goal and 30% towards the next one. This way, you’re saving for a home and paying off student loans at the same time.

Use Laddered Accounts For Liquidity

For goals that need quick access to money, use a laddered account. This is great for emergency funds and saving for a home or college.

The ladder has three levels of access:

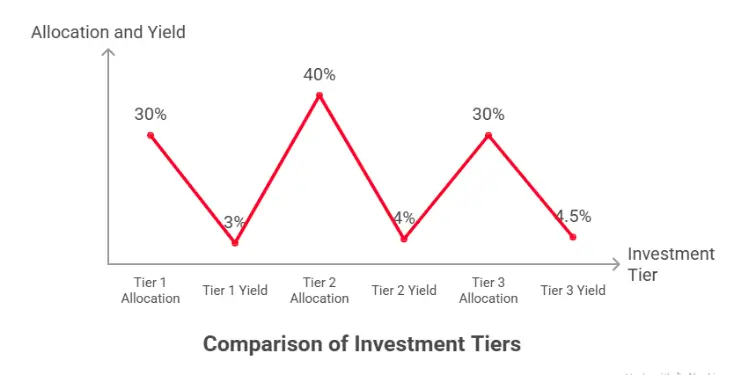

| Tier | Account Type | Allocation | Access Time | Typical Yield |

|---|---|---|---|---|

| Tier 1 | High-yield savings | 30% | 1-2 days | 3-4% |

| Tier 2 | Money market funds | 40% | 2-7 days | 4-5% |

| Tier 3 | 12-month CDs | 30% | Scheduled dates | 4.5-5.5% |

This setup can increase your yield by 0.5-1.5% a year. For a $15,000 emergency fund, you could have $4,500 in high-yield savings, $6,000 in money market accounts, and $4,500 in 12-month CDs.

A cash ladder of high-yield savings (≈ 3.5 %), money-market funds (up to 4.32 %), and 12-month CDs (≈ 4.45 %) can raise idle-cash returns by 0.5 – 1.5 percentage points while preserving liquidity. Ref.: “Goldberg, M. (2025). Best Money Market Account Rates of June 2025. Bankrate.” [!]

As CDs mature, roll them into new ones. Adjust your allocation as needed. This keeps your returns high while keeping money liquid for future goals.

When saving for a home, use this ladder for your down payment. Keep 3 months’ worth in high-yield savings, 3-9 months in money market accounts, and the rest in CDs that mature when you need the money.

Even with other goals, keep saving at least 10-15% for retirement. This way, you’re making progress on all your financial goals at once.

“The sequence of your investments is just as important as your asset allocation. Getting this order right can mean the difference between financial struggle and financial freedom.”

If you’re not sure about your investment sequence, talk to a registered investment advisor. They can help avoid mistakes and create a budget that meets your goals efficiently.

Automate Contributions And Progress Tracking

The secret to achieving goals is not willpower. It’s about automating and tracking consistently. After setting your investment goals, the key is to stay consistent. Automation helps overcome emotional barriers that often stop us.

Automatic transfers to special accounts reduce spending. Money goes straight to your goals before you can spend it. This trick keeps many investors on track, even when they feel unmotivated.

For retirement, your 401(k) already uses this method. It works for other goals too. Set aside 5% of your income for retirement, $200 monthly for emergencies, and $300 every three months for a down payment.

“Automation is to your finances what compound interest is to your investments—a seemingly small change that creates extraordinary results over time.”

A financial advisor can help set up automation for you. Charles Schwab and others offer tools to make it easy. The goal is to create a system that works even when you’re busy.

Tracking your progress is also key. Make a simple dashboard with five metrics for each goal:

- Initial target amount

- Current balance

- Percentage complete

- Projected completion date

- Monthly contribution amount

This makes your goals clear and measurable. Many platforms have tracking tools, but a spreadsheet works too. Citizens Savings Tracker® is another great option for tracking goals.

| Tracking Method | Best For | Effort Level | Visual Impact |

|---|---|---|---|

| Bank/Broker Tools | Single-institution goals | Low | Medium |

| Spreadsheet | Cross-account tracking | Medium | High (customizable) |

| Printable Tracker | Daily visibility | High | High (tangible) |

| Financial Apps | On-the-go monitoring | Low | Medium-High |

For long-term goals like retirement, celebrate milestones. Reach 25%, 50%, and 75% of your goal and reward yourself. These rewards boost your motivation.

Check your tracking dashboard monthly. This keeps you aware without getting too caught up. It helps you spot issues early and keeps you motivated.

This method removes decision fatigue and emotional barriers. With automatic contributions and clear tracking, investing becomes easy. It builds wealth without constant effort.

Start by setting up one automatic transfer today. Even $25 per paycheck helps. Use a simple tracking method you’ll stick to. Small, consistent steps lead to your financial goals.

Review Priorities As Circumstances Shift

Even the best plans need to change sometimes. I suggest checking your plan every three months. Do a big check-up once a year or when your money situation changes a lot.

Adapt To Income Or Expense Changes

If you get a raise, don’t spend more. Put 50-70% of the extra money toward your top goals. If you earn less, cut back on less important goals but keep working on the big ones.

Big expenses shouldn’t stop your plan. Move money from less important goals to keep going. Make a plan to get back on track in 3-6 months.

“Read More:

Reevaluate After Major Life Events

Big changes like getting married or having kids change your money situation. Start by thinking about what’s important to you. New family needs might make you focus more on safety and less on fun.

Update your plans for when you’ll retire or buy big things. Use your new priorities to rate your goals. Do this within 60 days of big changes to keep your plan in line.

Keep records of your old and new plans. This shows how your goals have changed. It helps you stay on track with life’s ups and downs.