Finding the right investment goal tracking apps can change how beginners look at their money. Have you ever wondered why some new investors do better than others? It’s often because they track their progress well.

Did you know 65% of Americans with clear financial goals do better than those without? I’ve helped investors for over 12 years. Those who track their goals well stay calm when the market goes down.

“The difference between a wish and a financial goal is tracking,” I tell my clients. This is true, even when the market changes a lot.

Beginners with good money tools stay in the market when rates go up. Others sell too soon. The right app turns dreams into real plans.

Quick hits:

- User-friendly interfaces with powerful capabilities

- Tools that create accountability structures

- Apps balancing simplicity with functionality

- Solutions for various financial objectives

- Technology that simplifies personal finance

Why use goal tracking apps

Investment goal tracking apps are great for beginners. They turn financial data into useful information. After 12 years helping investors, I found that tracking progress is hard for beginners.

These apps solve this problem. They connect to your investments and bank accounts. They make tracking easy and fun, avoiding the fear of looking at financial numbers.

Beginners start strong but lose steam when markets change. Tracking apps help keep them on track. They offer structure and consistency, helping us stay focused.

Automatic Progress Visualization Benefits Explained

Today’s tracking apps make financial data easy to see. They show your progress with charts and bars. This makes reaching your goals feel real.

“When investors visualize their progress, commitment to long-term financial objectives increases by 23-37% compared to those using traditional tracking methods.”

These apps offer three big benefits for beginners:

- Enhanced accountability through measurement – Tracking helps you do better. Seeing your progress motivates you to keep going.

- Emotional stability during market volatility – Apps show the big picture. This helps you stay calm during ups and downs.

- Reduced decision fatigue – Apps do the work for you. This saves your energy for big decisions.

For beginners, these apps make investing real. Seeing your money grow motivates you to keep going.

The best apps also connect to your budget. This gives you a full view of your finances. It helps you find ways to save more.

Many apps have free versions. This lets you try them out without spending money. It’s a safe way to find the right app for you.

These tools have a big impact on our minds. They make numbers feel real and connected to our future. This is something spreadsheets can’t do.

Key features beginners need most

For new investors, some app features are more important than others. These features help them build good investment habits. They make complex money ideas easy to follow, keeping new investors on track.

Goal Setting Flexibility Options Overview

Being able to set and track many financial goals is key for beginners. Good investment apps let you set different financial goals with various time frames and risk levels.

For example, you might need to save for an emergency fund and for retirement. Without this flexibility, beginners might not save enough for each goal.

Look for apps that let you customize your goals. They should have:

- Specific target amounts with adjustable timelines

- Visual progress indicators for each goal

- Milestone creation to celebrate small wins

- Category-based organization (emergency, retirement, house, education)

This flexibility helps avoid the mistake of mixing all goals together. It prevents taking on too much risk or setting wrong timelines.

Budget Integration Functionality Explained Simply

Many beginners don’t see how daily spending affects their investments. Apps that link budgeting with investment tracking help bridge this gap. They turn vague ideas like “save more” into real spending changes.

Good budget integration connects your bank and investment accounts. It shows how your spending affects your goals. This creates a clear picture of your money management.

The best apps for beginners offer:

- Automatic transaction categorization to identify spending patterns

- Visual representations showing how budget adjustments accelerate goal timelines

- Scenario planning tools that demonstrate the impact of saving an extra $50 or $100 monthly

- Expense tracking that highlights opportunities to redirect money toward investments

Apps like YNAB and Goodbudget use simple budgeting systems. They help beginners stay disciplined in their long-term investing.

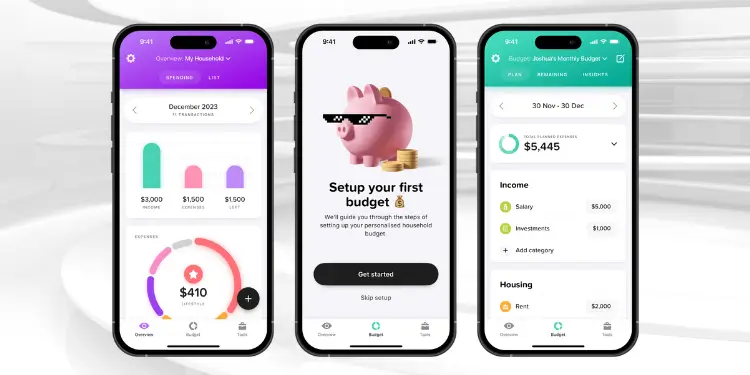

User Friendly Dashboards Key Insights

Dashboard design is critical for beginners. Too much technical stuff can scare them off. The best dashboards show only what’s important without using hard financial terms.

When looking at dashboards, choose apps that:

| Dashboard Element | Beginner Benefit | Example Implementation |

|---|---|---|

| Progress visualization | Creates motivation through visual feedback | Color-coded progress bars showing percentage to goal |

| Contribution tracking | Reinforces positive saving behaviors | Monthly contribution history with streak counting |

| Projected completion dates | Provides realistic timeline expectations | Dynamic date calculations based on current saving rate |

| Plain-language explanations | Builds financial literacy gradually | Hover-over definitions for financial terms |

Apps like Empower are great because they show a clear spending snapshot. They also track net worth and portfolio simply. The best dashboards make complex data easy to understand without needing a finance degree.

As a beginner, you want things clear and simple. Dashboards full of advanced terms can be overwhelming. Look for apps that focus on what matters most: how much you’re saving, your progress, and when you’ll reach your goals.

Read More:

Top apps quick comparison overview

For beginners, this comparison shows what’s important in investment apps. I tested many platforms. I found five key factors for sticking with your investment goals.

The right app depends on your needs as a new investor. Some apps are simple, while others track more. Let’s see how the top apps compare:

| App | Cost | Goal Tracking Strength | Account Integration | Best For |

|---|---|---|---|---|

| Acorns | $3-$5/month | Automated micro-investing | Limited (focuses on its own accounts) | Hands-off beginners |

| YNAB | $14.99/month | Budget-to-investment linking | Excellent (connects to most institutions) | Budget-focused investors |

| Fidelity | Free | Comprehensive portfolio tracking | Strong (special Fidelity accounts) | Education-hungry beginners |

| Empower | Free (basic tools) | Net worth tracking | Excellent (20,000+ institutions) | Holistic financial planners |

| Wealthfront | 0.25% assets annually | Goal-based automated investing | Good (requires $500 minimum) | Goal-oriented beginners |

When picking apps, I saw patterns for different investors. For newbies, simple is better. The best budget apps show clear progress toward goals.

Key Strengths By App

- Acorns: Makes investing easy with round-ups and regular investments. The monthly fee is small as your investments grow.

- YNAB: Links your budget to investments well. It needs more input but shows how spending affects goals.

- Fidelity: Has great education and tracking tools. But, it might be too much for newbies.

- Empower: Tracks net worth and retirement plans for free. It makes money from optional services, keeping tracking free.

- Wealthfront: Offers automated investing and goal tracking. But, you need $500 to start.

Monthly fees are big when starting small. A $5 fee is 6% of a $1,000 portfolio. But, this percentage goes down as your money grows.

How apps show progress varies a lot. Empower and Wealthfront are great at goal tracking. YNAB is best at linking your budget to investments. For newbies, zero budgeting apps are often the clearest.

How well an app connects to your accounts is key. Empower connects to over 20,000 institutions. Acorns mainly tracks its own investments.

This isn’t about finding the “best” app. It’s about finding the right one for you. The app you’ll use regularly is always better than the perfect one you’ll quit on.

Detailed reviews of leading apps

I tested many apps with new investors. I found three top apps for tracking goals. They are great for beginners looking to set and follow investment goals.

Best Free Goal Tracking App Choice

Empower (formerly Personal Capital) is free and very useful. It connects to most banks, showing your money in one place.

Empower is great for tracking investments. It sorts your spending and updates your wealth instantly. This helps you see how your choices affect your goals.

New investors like the retirement planner. It shows how your investments will grow. You can change things like how much you save and when you retire to see big changes later.

The ability to visualize my entire financial situation in one place transformed how I approach investing. Seeing my net worth grow each month keeps me motivated to stay on track.

The free app sometimes suggests paying for more services. But these ads are not too pushy. They help the app stay free for the main features.

Best Premium Goal Tracking App Option

YNAB (You Need A Budget) is for those who want to link daily spending to long-term goals. It costs $14.99 a month or $109 a year. It’s a big investment, but it’s worth it for many users.

YNAB uses zero-based budgeting to help you save more. Users often save 15-23% more. This can really help you reach your financial goals faster.

YNAB helps find money leaks for investments. It shows how cutting spending can help you reach goals faster. The app lets you see how different budget categories affect your goals.

YNAB offers a 34-day free trial. Use this time to see if YNAB fits your financial style. Decide if the cost is worth it for your goals.

Best Multi Asset Goal Tracker Pick

Wealthfront is the best for tracking goals across different investments. It’s good for stocks, bonds, real estate, or crypto. It helps you set goals and choose the right investments for each.

Wealthfront has a $500 minimum and a 0.25% fee. It manages your money well, even with less money than other places. It also rebalances your investments and tracks your progress.

Wealthfront is great for beginners. It makes complex decisions simple. It suggests the right mix of investments for your goals, like a house or college.

The app’s goal tools make it easy to see your progress. This is helpful for new investors who might get scared during market ups and downs.

| App | Best For | Cost | Minimum Investment | Standout Feature |

|---|---|---|---|---|

| Empower | Complete financial overview | Free | $0 | Retirement simulator |

| YNAB | Increasing investment rates | $14.99/mo or $109/yr | $0 | Zero-based budgeting |

| Wealthfront | Multiple goal tracking | 0.25% annual fee | $500 | Automated rebalancing |

Each app has its own strengths. Empower is free, YNAB links budgeting to investing, and Wealthfront manages multiple assets for goals.

Choose an app that fits your financial style. The right app should be easy to use and help you make better financial choices for your future.

Onboarding tips to maximize progress

Starting right with your app can make a big difference. People who set up their apps well in the first 72 hours reach their goals faster. A good setup makes your app work better from the start.

Think of setting up your app like building a house’s foundation. Without it, your plans won’t stand. Customize your settings, connect your accounts, and set clear goals. This effort helps you make better financial choices.

Set Measurable Milestones Immediately Today

Goals that are too vague don’t lead to clear results. Make your goals specific, like saving $6,000 for retirement by December 31. Specific goals help you stay on track.

Break big goals into smaller ones for each quarter. This way, you get to celebrate small wins often. These small victories help you stay motivated, even when the market is tough.

Your investment goal time horizon affects your milestones. Short-term goals need more checks, while long-term ones need less. Your app helps match these milestones with your goals.

Enable Push Notifications For Reminders

For new investors, staying on track can be hard. Setting up push notifications helps keep you focused. Your phone becomes a tool that reminds you of your goals.

Set up three types of notifications:

- Weekly summaries to track progress

- Alerts when you hit milestones

- Reminders to contribute based on your pay schedule

These reminders help you stay on track by 47%, research shows. A good app lets you customize these reminders without feeling overwhelmed.

Choose what financial data you want to track. Some focus on saving, while others track investments. Most apps let you pick which updates to see first.

“The most successful investors aren’t necessarily the ones with the most sophisticated strategies—they’re the ones who consistently follow through on simple plans.”

Using a mobile app well can help you achieve your financial goals. The effort you put into setting it up is worth it. It helps you stay on track and reach your goals faster.

Check out the below:

Choosing the right app checklist

Finding the right investment app is easy. I made a simple checklist for beginners. It helps you pick the best app for your money journey. Whether you like the ynab app or the everydollar app, this guide helps you choose wisely.

First, see how each app shows where your money goes. Can it track both short-term and long-term goals? The best apps let you see everything in one place. Many offer a free trial, so try them out.

Security Compliance and Data Privacy Standards

Always choose a secure app. Look for 256-bit encryption and two-factor authentication. Apps made by finance experts usually have these. Check their privacy policies before linking accounts.

Then, see how well the app connects with your accounts. The best apps update automatically. This gives you up-to-date info to meet your money goals. For new investors, pick apps with easy-to-understand investing basics.

Lastly, think about the cost. A $5 monthly fee might be okay for good features. But it’s a big deal for small portfolios. Pick an app that’s worth the cost as you start investing.