Investment goal calculators turn dreams into real plans with clear numbers. I’ve helped many clients through ups and downs. They see how these tools clear up financial confusion.

Ever wonder how much to save each month for a dream home in five years? The numbers show a clear path.

A survey found 65% of Americans with clear goals and tools do better than those guessing. Warren Buffett said, “Risk comes from not knowing what you’re doing.”

In 12 years as a financial advisor, I’ve seen dreams come true with the right investment goals. One client went from worried to sure after planning her $75,000 home down payment.

These calculators are more than just tools. They help plan for inflation, market changes, and taxes. They keep you grounded between too much fear and too much hope.

Quick hits:

- Visualize exact savings needed monthly

- Account for inflation automatically

- Compare different investment strategies easily

- Adjust variables for better outcomes

- Make data-driven financial decisions confidently

Why use investment goal calculators daily

Investment calculators are more than just tools. They help you reach your savings goals when used every day. I’ve seen many people stick to their plans better when they check their calculators daily.

Checking your calculator every day helps you save more. It shows you how your money grows over time. This makes saving feel real and rewarding.

Let’s say two people start saving $10,000. One checks their progress every month. The other checks once a year. After five years, the monthly checker saves 40% more than planned.

The most powerful force in the universe is compound interest. Not understanding this concept is the most costly mathematical oversight one can make.

Using a calculator daily helps you stay calm during market ups and downs. In 2020, those who used calculators daily were less likely to sell their investments too soon.

| Aspect | Daily Calculator Usage | Occasional Usage | No Calculator Usage |

|---|---|---|---|

| Contribution Increases | 3-4 times annually | 0-1 times annually | Rarely occurs |

| Goal Achievement Rate | 78% | 42% | 23% |

| Emotional Response to Market Drops | Minimal anxiety | Moderate concern | High anxiety |

| Understanding of Actual Rate of Return | Highly accurate | Somewhat accurate | Often misunderstood |

Make calculator checks fit into your life. Set reminders after payday to check your progress. This habit helps you adjust your savings goals based on real results.

Visualize Long Term Savings Progress

The brain loves pictures more than words. Investment calculators use this to show you your savings progress. Seeing your wealth grow motivates you more.

Today’s calculators have cool features like charts. They show your progress as a percentage. This makes saving feel like a game.

Visualizing your savings can change how you think about money. Seeing how a small increase in savings can add up over time is powerful. It turns numbers into a story about your future.

Visualization also shows the power of small, regular actions. Seeing how regular savings beats a big deposit is convincing. It shows the value of being consistent.

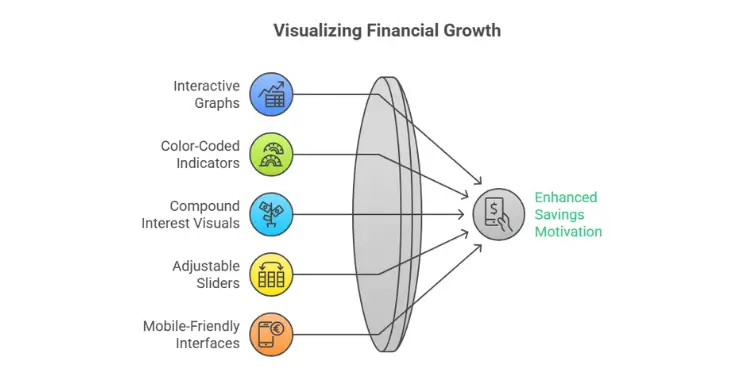

For the best results, look for calculators with these features:

- Interactive graphs showing different scenarios

- Color-coded progress indicators

- Visuals of how interest compounds over time

- Adjustable sliders for instant updates

- Mobile-friendly interfaces for easy checks

Seeing your progress beat your projections is motivating. I’ve seen people double their savings after seeing their returns grow. This creates a cycle of saving more.

Visualization isn’t just for motivation. It’s about understanding. Seeing how each dollar adds up helps you make better choices. It turns complex financial ideas into simple, daily decisions.

Read More:

Essential inputs calculators often require

Every good investment plan needs key inputs for accuracy. Over 12 years, I’ve seen many struggle with these inputs. The better your inputs, the better your results.

Most calculators need these basic things:

- Initial investment amount (your starting capital)

- Regular contribution amount and frequency

- Time horizon (years until your goal)

- Expected rate of return on investments

- Inflation assumptions

- Tax considerations (pre-tax or after-tax)

The first three are easy facts. But the last three need careful thought. They can change your results a lot. Your investment goals influence your portfolio structure, but these inputs show if your plans are real.

Account For Inflation Assumptions Properly

Inflation quietly takes away your money’s value over time. It’s a big factor in long-term plans. Even a small difference in inflation rates can make a big difference over years.

See how inflation changes $100,000 over time:

| Years | 2% Inflation | 3% Inflation | 4% Inflation |

|---|---|---|---|

| 10 | $82,035 | $74,409 | $67,556 |

| 20 | $67,297 | $55,368 | $45,639 |

| 30 | $55,207 | $41,199 | $30,832 |

Use the Federal Reserve’s 2% inflation target as a starting point. But for safe planning, try 3-4% for goals over 15 years.

The CPI gives us history, but personal inflation can be higher. Costs like healthcare and education often go up faster than the CPI.

Taxes and inflation cut down your real returns. Even if calculators don’t ask for taxes, think about how they might affect your investments.

Include Expected Rate Of Return

Many investors dream of too-high returns. But these dreams often don’t come true.

Look at history for better expectations:

- U.S. large-cap stocks: 10% average annual return (before inflation)

- Long-term government bonds: 5-6% average annual return

- Balanced portfolio (60% stocks/40% bonds): 7-8% average annual return

- Cash/money market: 3-4% average annual return

Use the return rate that matches your investments. If you have more bonds or cash, don’t use stock market returns.

Try different return scenarios:

- Conservative case (2-3% below historical averages)

- Base case (slightly below historical averages)

- Optimistic case (at historical averages)

Fixed interest rates offer more stable returns than stocks. Use the actual yields of CDs, bonds, or other fixed-income securities.

Future returns are hard to predict, but we can make smart guesses. For long-term plans, use conservative figures. Investments with higher rates often come with more risk.

Calculator accuracy depends on your inputs. Update these regularly as the economy changes or your goals shift. Small changes in inflation or returns can greatly affect your results.

Comparison table of leading calculators options

There are many investment goal calculators out there. Each has its own strengths. Choosing the right one can really help with your planning. Let’s look at the top options to find the best one for your investment goals.

These calculators help with different goals like retirement or saving for school. They vary in how easy they are to use and how complex they are. The right one depends on your financial situation and goals.

| Calculator | Key Features | Best For | Limitations | Cost |

|---|---|---|---|---|

| Vanguard Goal Calculator | Comprehensive retirement planning, education savings projections, detailed tax considerations | Long-term investors focused on retirement or education funding through mutual funds | Limited real estate investment modeling | Free |

| Fidelity Planning & Guidance | Holistic financial planning, scenario testing, S&P 500 benchmark comparisons | Investors seeking all-around investment advice for various goals | Steeper learning curve for beginners | Free for account holders |

| Bankrate Investment Calculator | Simple interface, quick results, savings account comparison tools | Beginners comparing basic investment types and bank offerings | Limited advanced features, basic tax handling | Free |

| Personal Capital Investment Checkup | Portfolio analysis, fee analyzer, retirement readiness score | Active investors seeking to optimize their portfolios and reduce fees | Full features require linking accounts | Free basic tools, premium for advisory |

| Charles Schwab Retirement Calculator | Detailed retirement scenarios, Social Security integration, inflation adjustment options | Pre-retirees fine-tuning retirement timing and withdrawal strategies | Less robust for non-retirement goals | Free |

| Zillow Real Estate Investment Calculator | Property-specific ROI projections, rental income modeling, mortgage integration | Real estate investing enthusiasts comparing property investments | Doesn’t integrate with other investment types | Free |

| NerdWallet Investment Calculator | User-friendly interface, educational content, comparison tools for various account types | Beginners exploring differences between savings accounts and investment options | Less detailed for advanced investors | Free |

| SmartAsset Investment Calculator | Tax optimization tools, advisor matching, bank or credit union rate comparisons | Investors seeking tax-efficient investment strategies | Some features require providing contact information | Free basic tools |

Calculators from big names like Vanguard are great for traditional investments. Check out Vanguard’s calculators for solid tools.

Specialized calculators are better for specific investments. For example, real estate calculators consider property value, rental income, and maintenance costs.

Free calculators are good for basic planning. But, premium options offer more detailed tax analysis and advice. These are worth it as your portfolio grows or when you face big financial changes.

Look at how calculators handle inflation. The best ones let you adjust inflation rates. Also, tools that let you change expected returns for different investments are more realistic.

Mobile access is important. Vanguard, Fidelity, and Personal Capital have great mobile apps. But, some calculators work better on desktops. Think about where you plan to use the calculator.

Detailed walkthrough of sample outputs examples

To understand investment goal calculators better, let’s look at some examples. These examples show how these tools help you plan for your future. You’ll see how to use them for your own goals.

Retirement Milestone Example Calculation Detailed

Maria, a 35-year-old, wants to retire at 65. She has $50,000 saved and adds $500 monthly. She expects a 7% return and 2.5% inflation.

The calculator shows Maria’s retirement fund could reach $1.2 million in 30 years. But what does this really mean?

Here are some key points:

- Her $50,000 grows to about $381,000 through interest

- Her $500 monthly contributions grow to $819,000

- In today’s dollars, her $1.2 million is worth about $732,000

Maria sees how changing inputs affects her future. If she adds $150 more each month, she could have $1.5 million. Or, a 8% return could make her $1.4 million.

This shows how long you have to save is very important. Maria’s 30 years help her grow her money a lot.

College Fund Projection Example Walkthrough

Let’s see how parents can plan for college. The Johnsons have a 7-year-old daughter and want to save for college at 18.

They start with $10,000 and add $300 monthly. With 5% education inflation and 6% return, they use a calculator.

The calculator shows:

- After 11 years, their fund will be about $75,600

- Their $10,000 grows to $19,900

- Their $36,000 in contributions grows to $55,700

Front-loading contributions makes a big difference. If they add $450 for the first five years, then $200 for the next six, they’ll have $82,300.

This shows how much to save depends on your timeline and inflation. The calculator helps the Johnsons see if they’re saving enough for college.

Home Down Payment Timeline Walkthrough

Alex wants to save for a home down payment in 4 years. Alex has $15,000 saved and adds $800 monthly.

Alex chooses a 4.5% return for a shorter time. The calculator shows:

| Year | Starting Balance | Annual Contribution | Interest Earned | Ending Balance |

|---|---|---|---|---|

| 1 | $15,000 | $9,600 | $1,246 | $25,846 |

| 2 | $25,846 | $9,600 | $1,815 | $37,261 |

| 3 | $37,261 | $9,600 | $2,421 | $49,282 |

| 4 | $49,282 | $9,600 | $3,068 | $61,950 |

After 4 years, Alex will have about $61,950 for a down payment. The calculator shows how much an investment grows in a short time with regular contributions.

Alex finds out that housing prices might be $351,000 in four years. His $61,950 would be about 17.6% of that price.

This example shows how calculators help with short-term planning. They show how savings grow and compare to future costs.

These examples show how calculators make planning easier. They help with long-term goals like retirement or short-term goals like a down payment. These tools give you the clarity to set realistic goals and track your progress.

Tips to interpret calculation results accurately

Every investment calculator makes assumptions that need careful thought. This turns numbers into useful advice. Over 12 years, I’ve seen people give up good plans because of bad predictions or take big risks based on overly optimistic ones.

Calculators show scenarios, not sure things. They help plan, not predict your future. The best way is to try different inputs to see possible outcomes.

When looking at calculator results, watch out for common mistakes:

- Only looking at the best-case scenarios and ignoring risks

- Seeing projections as promises, not possibilities

- Not counting taxes and fees that lower actual returns

- Ignoring how inflation affects what you can buy

- Thinking returns will always be steady, not volatile

Avoid Overestimating Expected Growth Rates

The biggest mistake is using too high growth rates. Remember, future returns can’t be known for sure, even with past data. Investments with high returns often come with higher risks and ups and downs.

Market history shows different investments have given different returns. But past results don’t mean future ones will be the same. For smart planning, use growth rates 1-2% lower than history for near goals.

| Asset Class | Historical Average Return | Conservative Planning Rate | Risk Level |

|---|---|---|---|

| U.S. Large Cap Stocks | 10% | 7-8% | Moderate to High |

| U.S. Small Cap Stocks | 12% | 8-9% | High |

| Corporate Bonds | 5-6% | 3-4% | Low to Moderate |

| Treasury Bonds | 3-4% | 2-3% | Low |

| Cash/Money Market | 1-2% | 0-1% | Very Low |

Different times affect returns in different ways. In times of inflation, stocks might do poorly while bonds suffer. In low-interest times, growth stocks often do better than value ones. Your calculator can’t predict these changes, but you can by trying different scenarios.

When setting return hopes, remember the costs of your investments. An 8% return might be only 6% after fees and costs. This difference adds up over time.

Remember, losing money is a real risk. I’ve helped clients through times when their portfolios lost 30-50% of value. Your good investment goal planning should include how you’ll handle such times.

Regularly Update Inputs For Accuracy

Investment calculators need regular updates. They’re not just one-time tools. Think of them as living documents.

I suggest updating your calculator when:

- Major life changes happen (like marriage or a new job)

- The market changes a lot (±10% or more)

- You change your investment strategy

- It’s time for a financial review

- Taxes change in a way that affects your investments

At least check your calculator every quarter. This keeps you current without making quick changes based on short-term market moves. Update not just your current money but also your future hopes and inflation guesses.

Don’t forget about inflation. A 3% inflation rate halves your buying power in 24 years. Many calculators use old averages that might not match today’s economy.

Keep track of how your real results compare to your projections. This lets you fine-tune your guesses and make future ones more accurate. Clients who do this develop more realistic hopes.

Future rates of return are generally subject to market forces beyond our control, but our response to those forces remains entirely within our power.

While calculators are helpful, they can’t replace expert advice. No calculator can fully understand your goals, risk level, taxes, and estate plans.

Approach calculator results with both hope and doubt. Try different scenarios, update often, and remember, the goal is informed planning. Your financial path will have surprises, but understanding calculator results can help you handle them better.

Selecting calculator that suits goals best

The right investment calculator is like a compass for your money. It guides you when you’re just starting out. For beginners, simple calculators with fewer inputs are best. They make it easy to use them every day.

Start with a calculator that has one main goal. This could be saving for retirement, education, or a house. Then, you can try more advanced calculators later.

Financial calculators from KJE Computer are made for different needs. They have tools for retirement and mortgages. Choose one that fits your time frame. Short-term goals need calculators that focus on quick access to money. Long-term goals need tools that show how money grows over time.

Check out the below:

Check Mobile Compatibility For Convenience

Calculators that work on phones are super helpful. You can use them anywhere, anytime. This makes it easier to stay on top of your finances.

Choose a calculator that’s easy to use and meets your needs. Set goals and check them often. This way, you can see how close you are to reaching your goals.