Seven key insurance policies protect your money. I’ve seen families in Idaho Falls struggle without them.

One in every 20 homes files an insurance claim each year, according to the Insurance Information Institute. Without protection, your savings are at risk. “Preparation is the key to success,” said Alexander Graham Bell. I once skipped a rider and my repairs were very high. For more info, check out this homeowners insurance overview.

Quick hits

- Mitigate risks with smart coverage

- Shield assets from sudden claims

- Consider affordable policy rider options

Term Life Insurance for Family Financial Security

Families feel safer with a policy that lasts through tough times. Term coverage has a fixed price. It helps pay bills if you pass away during the policy time.

This peace of mind helps your family avoid big debts. Experts say to have a death benefit of 10–12 times your yearly income. Despite 85% of Americans agreeing life insurance is essential, 41% still don’t have coverage (NAIC, 2023)

A policy covers daily costs, mortgage, and more. This resource shows even a little coverage can help a lot.

“Life insurance is a shield for the people you love—giving them options, not just a lump sum,” says the National Association of Insurance Commissioners.

Term policies last 20 or 30 years, covering big life events. Rates are often lower when you’re young and healthy. Getting coverage early can save you money later.

Check out the below:

Choosing adequate death benefit amount

- Calculate current expenses and projected debts.

- Estimate future needs, like tuition.

- Multiply income by 10–12 to reach a helpful range.

Next, talk to a licensed agent or use online tools for quotes. A little planning can keep your family safe financially.

Health insurance for medical emergencies

I’ve seen families struggle with huge hospital bills without health coverage. A single night in the ER can cost thousands. Plans from Blue Cross Blue Shield, UnitedHealthcare, or others help a lot.

These plans have high deductibles but lower monthly costs. You can also use an HSA to save for smaller bills. This way, you avoid using credit cards for doctor visits or tests.

“If I’d known how fast those charges add up, I’d have chosen a better plan long ago,” said one policyholder reflecting on an unplanned surgery.

Here are steps to protect your budget:

- Ask your employer about group health plans

- Compare deductibles on the federal marketplace

- Review state DOI data (NAIC, 2021) for insurer ratings

KFF research shows workers in high-deductible health plans are far more likely to delay care or accrue medical debt—ensure your deductible does not exceed readily available savings. Ref.: “Hamel, L., Muñana, C., & Brodie, M. (2019). Kaiser Family Foundation/LA Times Survey of Adults With Employer-Sponsored Insurance – Section 3. KFF.” [!]

Next, check your annual limit and network benefits. This will help your family face unexpected costs.

Read also: What is the purpose of landlord insurance?“

Disability Insurance for Income Protection

Rainy days come without warning. Disability insurance keeps your income steady if you can’t work. It’s key income replacement when you need it most. Families have used it to avoid using up savings or getting into debt.

Short-Term vs Long-Term Disability Coverage

Short-term disability pays for a few months. It helps until you’re back on your feet. Long-term coverage can last years or until you retire.

Insurers might ask for a medical exam. This step helps ensure a safety net. Look at waiting periods and benefit caps. This helps you understand income replacement during long-term setbacks.

- Check your budget to see how many months you can self-fund.

- Compare elimination periods with your emergency savings.

- Review policy definitions for partial or total benefits.

Next, talk to a state-licensed agent or check your workplace benefits. Find the best policy for you.

About 1 in 4 of today’s 20-year-olds will suffer a disabling event before age 67, yet 65 % of private-sector workers lack long-term disability insurance—highlighting the need for income-protection coverage. Ref.: “Social Security Administration. (2025). Social Security Basic Facts. SSA.” [!]

“read also: What is the purpose of burial insurance?

Home and renters insurance for property protection

Owning or renting means you need a plan to protect walls and things. Small problems can turn into big expenses if not fixed. Being proactive helps keep your place safe from many dangers.

Extended replacement cost and endorsements

Some homeowner policies offer extra help if building costs go up. This ensures a rebuild, even if materials or labor prices increase. You can also add riders for special items like jewelry or musical instruments. It’s smart to check these add-ons after any big changes or new purchases.

Loss of use living expense coverage

If a disaster makes your place unlivable, this coverage helps with living expenses. Renters get similar help, but it’s the landlord’s policy that covers personal items. For more on how renters insurance works, see this useful renters guide.

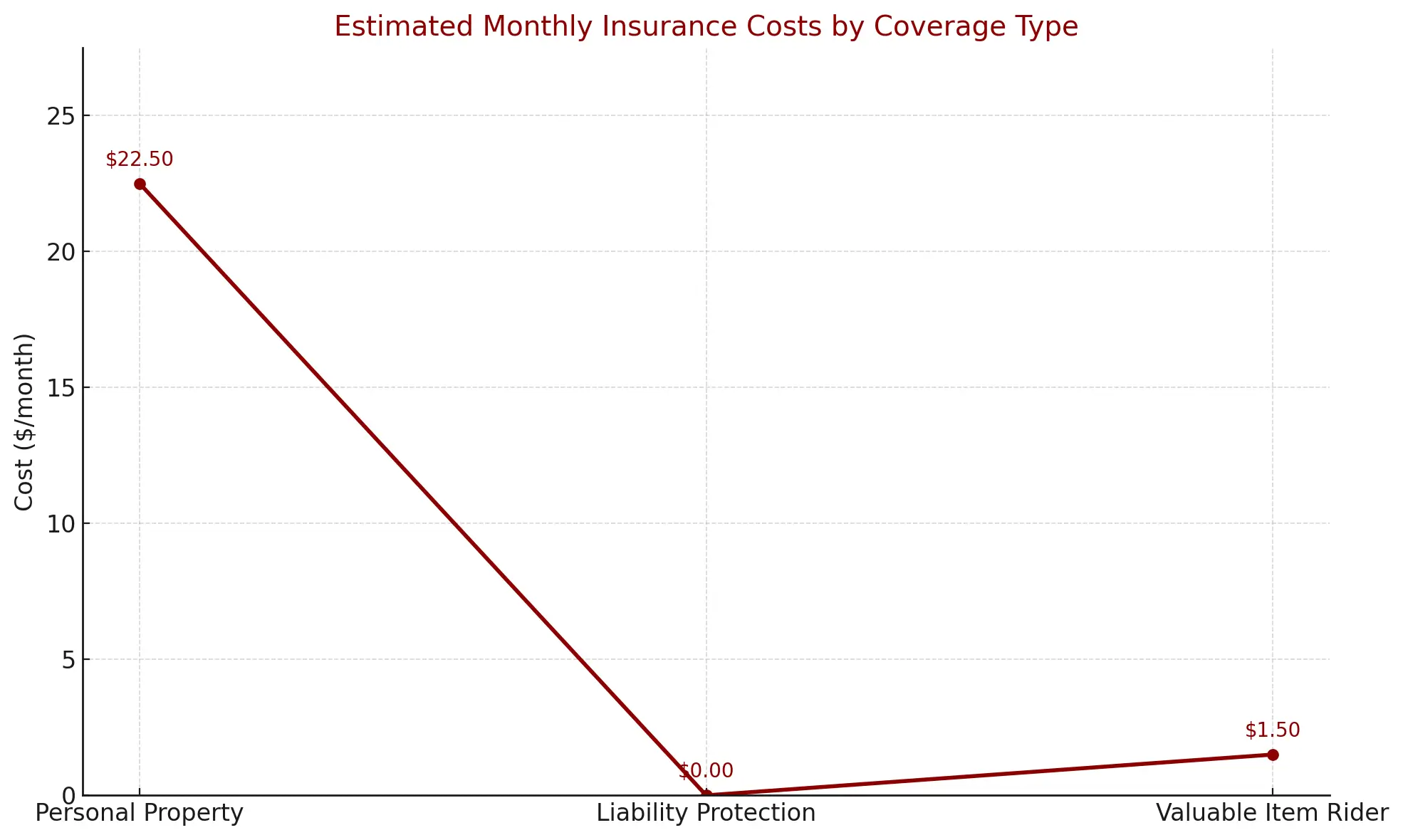

How much coverage you get can vary. Use the table below to compare typical limits and costs.

| Coverage Item | Typical Range | Approximate Cost |

|---|---|---|

| Personal Property | $20,000–$30,000 | $15–$30/month (renters) |

| Liability Protection | $100,000–$300,000 | Included in standard plans |

| Valuable Item Rider | Increases coverage | $10–$25/year |

Review your policy and know where you stand. This step brings real peace of mind.

Auto liability and collision coverage

I’ve seen drivers think their state coverage is enough. But it often isn’t when accidents are serious. You don’t want to face big bills alone.

Liability coverage helps if you’re at fault. It pays for damages so you can keep your home safe. Experts say to raise limits to $500,000. This extra money can really help.

Financial guidance recommends at least $500,000 in auto liability coverage; state minimums often fall short, exposing wages and assets in severe injury lawsuits. Ref.: “Zander Insurance. (2025). What Dave Ramsey Recommends for Auto Insurance. Zander Insurance.” [!]

Collision coverage fixes your car if it’s damaged. A crash can ruin a car fast, costing thousands. Also, check your deductibles for theft, natural disasters, or animal hits.

When comparing policies, look at monthly costs. A little extra might save you a lot. This guide shows why insurance is important for you and others.

Do something today. Call your agent to make sure your coverage fits your needs.

Umbrella policy extending overall limits

Families often worry that big lawsuits will eat into their standard policies. Umbrella coverage helps by protecting your savings and retirement. It’s usually not very expensive but offers a lot of protection.

In the United States, legal claims can grow fast. If you’re new to planning, consult with your agent to discuss the basics.

Discover More:

Asset thresholds for purchasing umbrellas

I suggest getting an umbrella policy if your net worth is over $500,000. It fills gaps left by home or auto insurance. It’s your last line of defense.

Policygenius advises adding a personal umbrella policy—in $1 million increments—once combined assets exceed $500,000 to cover liability gaps after home or auto limits are exhausted. Ref.: “Howard, P. & McGinley, K. (2023). What is personal liability insurance coverage? Policygenius.” [!]

Check out a guide on umbrella insurance. It talks about covering rental cars and other risks. Think about how it can secure your future.