Insurance is essential for small businesses to mitigate significant risks. Without appropriate coverage, incidents like slips or property damage can have severe financial consequences.

Why do the 5 types of insurance for small businesses matter? Insurance requirements and availability vary by state, making it crucial for businesses to understand local regulations. In the U.S., between 36% and 53% of small businesses face lawsuits annually, highlighting the importance of adequate insurance coverage, and 90 % encounter legal issues over their lifespan.

“Small enterprises are the backbone of local economies,” one study says.

key benefits:

- Shield profits from big risks

- Reduce legal liability exposure fast

- Protect property and vital tools

- Tailor coverage to your niche

Small businesses can optimize cost and convenience by choosing a Business Owners Policy (BOP), which bundles general liability, property, and business interruption coverages into a single package. Ref.: “Insurance Information Institute. (2024). Understanding Business Owners Policies (BOPs).” [!]

General Liability Insurance: Protecting Against Customer Injuries

Some owners forget a single mishap can uproot daily operations. Shop owners can incur substantial expenses from incidents like customer slips, underscoring the need for general liability insurance. A good policy keeps personal funds safe and eases your mind in a busy environment. This insurance coverage sits next to health plans and other obstacles you might tackle.

Securing a quote for commercial protection means gauging hazards that come with floor spills or overcrowded counters. I urge you to factor those risks into your business insurance plan.

Commercial general liability policies typically exclude coverage for employee injuries, pollution, and professional services, which require separate endorsements or standalone policies. Ref.: “Insurance Information Institute. (2025). Commercial general liability insurance.” [!]

A robust liability insurance option often proves less costly than unpredictable lawsuits. We all want to keep everyday finances secure. If you add health insurance for employees, be sure it lines up with safety measures you have in place. Watch for any shifts that might trigger an update in your insurance coverage.

Read More:

Set liability limits matching foot traffic

Packed spaces raise the odds of accidents, so consider higher coverage if crowds surge each day. A balanced approach keeps you ready for the unexpected. This mindset reminds you that insurance protects your bottom line and saves you from last-minute scrambling. Track foot counts and adjust if you see steady growth. Talk with a licensed agent about the right limit for your location.

I suggest an annual checkup. It’s a quick chat that might spare you from costly payouts. We want to keep your livelihood sound, not risk panic under legal strain. Keep your plan handy, and reevaluate whenever new services or staff come aboard. A little foresight today can help you sleep better tonight.

Commercial property protects business assets

Commercial property insurance safeguards your business premises, equipment, and inventory against risks like fire or theft. If a fire breaks out, it pays for lost things. I’ve seen shops bounce back thanks to insurance.

It keeps things steady by covering key things. This lets money keep flowing.

Inventory valuation determines coverage amount

Some think other insurances cover everything. But, they don’t. Professional and general liability cover mistakes and injuries. Business insurance is for your stuff.

It’s based on how much you have. Special or fragile items need more. Knowing this helps avoid big problems.

Update policy when assets expand

It’s easy to forget about new orders or better tools. But, insurance can help. It covers new stuff and lots of items.

Inform your insurance provider about any new equipment or locations to ensure your coverage remains adequate. This keeps your insurance right for your risks.

Business interruption replaces lost revenue

Business interruption insurance is vital for small businesses, providing financial support during periods of operational downtime. It helps when damage stops sales. Families often struggle with rent and payroll during closures.

This coverage gives the money to keep running until repairs or a new spot is ready.

It’s a vital type of insurance. It keeps revenue flowing if a disaster forces you to close. Every day without sales hurts the budget.

This insurance stops money troubles from hurting your future plans.

Check your business insurance quote carefully. Make sure it includes business liability insurance. This combo protects you from big expenses during downtime.

Workers might need compensation insurance for injuries. Some need business health insurance for medical needs. Keeping payroll going keeps skilled people on your team.

According to this NAIC guide, a plan can cover rent, utilities, and loan payments. I tell clients to think about limits and the long-term. Good coverage means peace of mind and helps avoid long recovery times.

Two in five businesses have suffered a business interruption loss in the last five years, and 66% of small businesses lack this vital coverage. Ref.: “Insurance Information Institute. (2017). Business interrupted: Celebrate Small Business Week by making sure insurance is part of your business plan, says III.” [!]

I often remind clients, “Having a plan that replaces lost revenue can be the single difference between weathering a disaster and closing forever.”

Review your policy costs every year. Talk to your broker about realistic coverage limits. This step can keep your finances stable until you reopen without big loans. You deserve to keep going, so keep your policy up to date.

“Bundle and Save: What is the purpose of business owners policy?“

Professional liability shields service mistakes

If you give advice or design solutions, you might face unexpected claims. I’ve seen service providers deal with lawsuits over small mistakes. Getting business insurance can help with legal fees and protect your reputation.

This insurance, called errors and omissions, helps when a customer says they were financially harmed or work was not done. It’s smart to get an insurance quote early to know what you might pay. One policy can cover lawyer fees and settlement costs.

Look for insurance that fits the projects you do. There are many insurance products and companies with different rules. Some offer extra protection or legal advice. This means you’re safe if a client complains even after you’ve finished work.

“Cover Manufacturing Risks: What is the purpose of product liability insurance?“

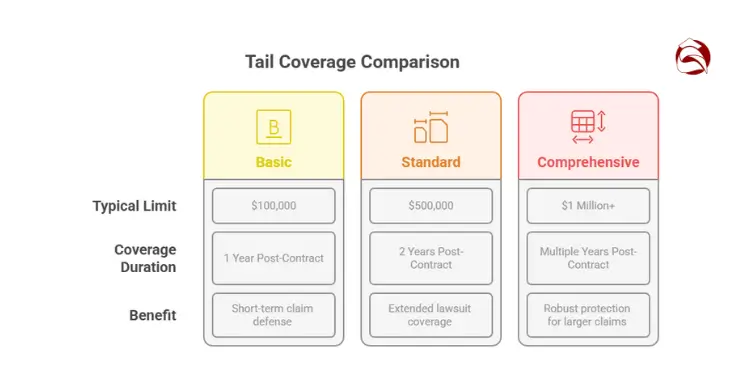

Tail coverage helps after contracts end

Tail coverage, or extended reporting period coverage, protects professionals against claims made after a policy has expired, provided the incident occurred during the policy period. It’s important for consultants, accountants, or creative people. I suggest talking to a broker to understand limits and claim deadlines.

| Coverage Tier | Typical Limit | Coverage Duration | Benefit |

|---|---|---|---|

| Basic | $100,000 | 1 Year Post-Contract | Short-term claim defense |

| Standard | $500,000 | 2 Years Post-Contract | Extended lawsuit coverage |

| Comprehensive | $1 Million+ | Multiple Years Post-Contract | Robust protection for larger claims |

Check your policy and think about changing coverage tiers if needed. It only takes a few minutes. These safeguards are key for your peace of mind. Review your approach now to avoid problems later.

“Tail” coverage (Extended Reporting Period) under a claims-made policy allows reporting of claims made after policy expiration for wrongful acts occurring during the policy period. Ref.: “Insurance Risk Management Institute. (2024). Tail Coverage.” [!]

Cyber insurance mitigates data breach costs

Many small shops think they are too minor to attract hackers. But that’s a risky idea. Hackers often go after the easy targets, thinking they can sneak past defenses.

Cyber insurance helps cover costs associated with data breaches, including legal fees, notification expenses, and system restoration. It covers the costs of fixing the problem.

Insurance to protect digital records is key for small shops to survive. It pays for investigations, legal fees, and fixing things. The best plan includes training on safe email use and quick security updates.

“Protect Your Business: What is the purpose of general liability insurance?“

Spot Phishing Tactics Early

Teach your team to spot bad links and attachments. This helps prevent data leaks. Insurance also covers lawsuits and credit monitoring costs.

Being careful can save you from a lot of trouble. It keeps your business safe from big problems.

“Safeguard Your Assets:

Keep Frequent Backups

Keep copies of important data. This helps you recover quickly from a cyber attack. Insurance also helps if hackers encrypt your network.

Having the right insurance means you can keep your business running smoothly. It helps you stay strong and keep your customers’ trust. Next, talk to a certified advisor to find the right coverage for your business.