5 essential types of insurance for seniors in retirement help keep you safe as you age. They protect your health and money.

Did you know many seniors don’t have insurance? About 41% in the US don’t have life insurance. “The Medicare site says, ‘Your coverage can evolve with age.’” I’ve helped many seniors find peace with insurance. For more info, check out this guide.

The article categorizes retirement coverage into five core policies: Medicare supplements (Medigap), long-term care insurance, guaranteed life insurance, annuity income riders and travel medical plans. It notes that 41 % of US seniors lack life insurance and emphasizes that Medigap policies close Part A/B cost gaps, while Plan G offers near-comprehensive coinsurance protection under carriers like Cigna and Humana.

Key technical considerations include balancing elimination periods (30–180 days) against benefit lengths (2–5 years) for long-term care, selecting simplified-issue life policies to bypass medical underwriting, structuring annuity riders to stabilize cash flow and specifying evacuation and medical limits (e.g., \$100 000 emergency care, \$250 000 evacuation) for international travel plans. Policy selection should be guided by premium impact, underwriting criteria and provider network strength.

Key Takeaways:

- Medigap supplements offset hospital cost gaps.

- Plan G covers most Part B coinsurance.

- Long-term care insurance preserves retirement savings.

- Simplified-issue life insurance avoids medical exams.

- Annuity income riders stabilize retirement cashflow.

- Travel medical plans cover overseas emergencies.

Medicare supplements close coverage gaps

Some people need more help with hospital or doctor bills. Medicare supplements, or Medigap, help with this. They protect your wallet from big deductibles.

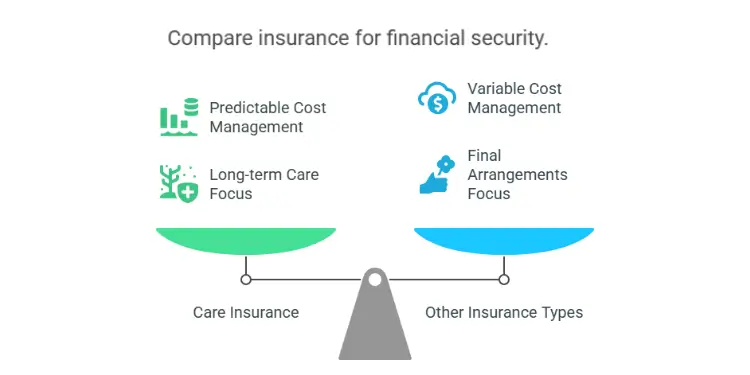

Choosing a policy is like picking life or car insurance. Each has its own rules. Seniors might choose life insurance for final costs and health insurance for everyday care. Travel insurance is great for those who travel a lot.

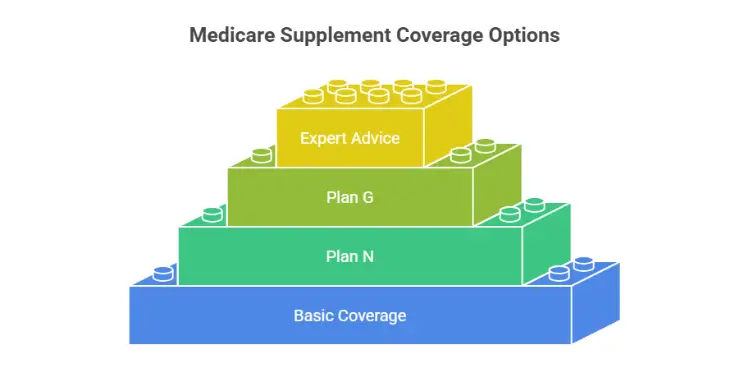

Select plan G for broad coverage

Plan G is good for those wanting lots of protection. It covers most gaps, like doctor copays. Cigna or Humana offer strong networks and easy claims. Always check the company’s license and finances.

- Pay attention to monthly premiums

- Confirm any required medical underwriting

- Ask about provider networks

| Plan | Coverage Level | Key Benefit |

|---|---|---|

| Plan G | High | Covers Part B coinsurance fully |

| Plan N | Moderate | Some copays may apply |

We all want costs we can count on. If you’re getting life or health insurance, talk to a licensed agent. They can give you the details you need.

Medicare Supplement Plan G is recognized for its comprehensive coverage, covering all Medicare-related costs after the Part B deductible. It’s a top choice for new Medicare beneficiaries seeking extensive protection. Ref.: “MedicareFAQ. (2024). Medicare Supplement (Medigap) Plan G Benefits and Coverage. MedicareFAQ.” [!]

Long term care protects retirement savings

Many families worry about paying for extended help when daily activities become challenging. I’ve watched clients embrace care insurance to preserve retirement nest eggs while securing reliable support. This strategy fits an insurance program for people who want peace of mind and straightforward coverage options from insurance companies. It’s smart to compare insurance plans, as insurance rates can vary based on age, health history, and benefit selections.

Coverage decisions often hinge on how well insurance policies manage rising expenses. A health insurance program for people needing home health aides or adult day services can close care gaps. Senior life insurance and term life insurance address final arrangements, yet term care insurance offers distinct shelter from unpredictable long-term costs. Premiums reflect each individual’s situation, so it’s wise to shop around for manageable terms.

Review elimination periods and benefit length

Elimination periods work like a deductible in time form. You pay out of pocket for a set number of days before coverage starts. Shorter waits raise insurance rates, while longer waits reduce monthly bills. Benefit length is also key. Shorter terms limit how long payments last, while more generous stretches protect you in case of a drawn-out illness.

Elimination periods in long-term care insurance function like time-based deductibles. Common options range from 0 to 180 days, with longer periods typically resulting in lower premiums. Ref.: “Compare Long Term Care. (n.d.). Understanding Elimination Periods in Long-Term Care Insurance. CompareLongTermCare.org.” [!]

Shared care rider adds flexibility

Spouses who share a joint benefit pool may use each other’s unused funds. This arrangement saves money if one partner needs more care than expected. Insurance program for people searching for versatile solutions might find this rider helpful. It extends resources at a critical moment, preventing a faster depletion of household assets.

| Plan Feature | Typical Range | Premium Impact |

|---|---|---|

| Elimination Period | 30–180 Days | Shorter wait = Higher cost |

| Benefit Length | 2–5 Years | Longer term = Higher cost |

Read More:

Guaranteed life insurance pays final expenses

I’ve seen people looking for a way to avoid big bills when they pass away. This program is for those who don’t want to go through many medical tests. It’s like car insurance, where your age or health affects the cost, but you don’t need to take many tests.

Even if you have health insurance, it might not cover funeral costs. This guaranteed life insurance can help. Each company has its own rules, but it’s like permanent life insurance that lasts forever. It’s a good way to protect your family from debt after you’re gone.

Avoid medical exams with simplified issue

This insurance is easy to get because it doesn’t require many tests. You just need to provide some basic information. It’s different from auto insurance, which is more detailed. This makes it easier to get, even if other insurance companies said no.

Guaranteed issue life insurance policies, requiring no medical exams, are particularly beneficial for seniors aged 50 to 85, ensuring coverage for final expenses without health-based eligibility concerns. Ref.: “SeniorLiving.org. (2025). Best Life Insurance for Seniors Without Medical Exams in 2025. SeniorLiving.org.” [!]

Choose how much coverage you want based on your budget and goals. It’s a good idea to compare different options. This way, you can see how it’s different from other insurance. You might find a better fit than you think.

| Coverage Amount | Typical Age Window | Waiting Period |

|---|---|---|

| $5,000 | 50-80 | 1-2 Years |

| $10,000 | 50-85 | 1-2 Years |

| $15,000 | 55-85 | 2 Years |

Take a step today and look into insurance for final expenses. It makes things easier for you and your loved ones.

Annuity income riders stabilize cashflow

I’ve helped families who worry about running out of money. They might think an annuity could mess with their health insurance. But it doesn’t. An annuity and health insurance for seniors over 65 can work together. They provide steady money for everyday needs.

Seniors often worry about big medical bills. They might also want travel insurance for trips. An income rider gives steady payments, even when the market goes down. It’s a way to get predictable income without extra stress.

Retirees can mix pensions, Social Security, and income riders. This mix helps with bills and fun money. An income rider can meet your needs, even if you’re looking at life insurance options. For more on steady income in retirement, check out this retirement plan steady income resource.

Seniors can travel without worry when their annuity checks come. Look at the rider’s fee, growth rate, and surrender period. These details help build a stable income plan.

| Rider Type | Pros | Cons |

|---|---|---|

| Immediate | Quick monthly checks | Lower growth |

| Deferred | Higher future payouts | Longer wait |

While annuity income riders provide steady cash flow, it’s essential to assess their compatibility with existing health insurance plans to ensure cohesive financial planning. Ref.: “Investopedia. (2025). Medicare Advantage vs. Original Medicare: Which Should You Trust Your Health To? Investopedia.” [!]

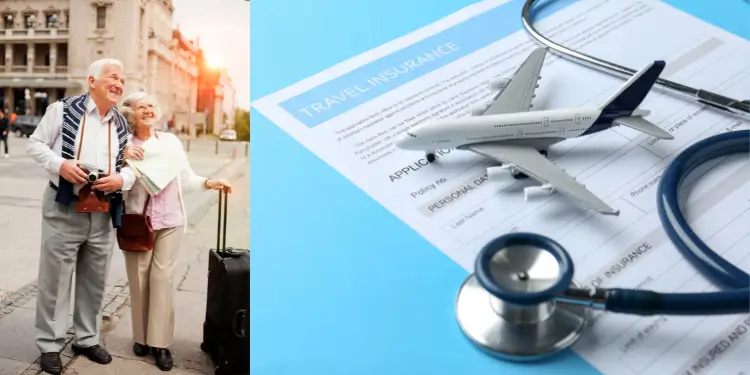

Travel medical covers international trips

Many retirees love to explore new places. A good travel medical plan keeps you safe from big hospital bills abroad. Medicare doesn’t cover treatment outside the U.S., so this plan is very important.

Senior travelers need at least $100,000 for emergency medical care. They also need $250,000 for evacuation. This plan costs about $28 a day, but can be more. Some plans cost $400 to $450 for trips.

Original Medicare offers limited coverage outside the U.S., making travel medical insurance crucial for seniors traveling internationally to cover potential emergency medical expenses. Ref.: “Medicare.gov. (2024). Medicare Coverage Outside the United States. Medicare.gov.” [!]

Check Evacuation Coverage for Remote Areas

When traveling, having life insurance is as important as a travel plan. Look at life insurance options for seniors. A good policy helps in medical emergencies. Check out this travel insurance guide for more information.

Choosing the right plan is key for safe travels. Make sure it fits your health and budget needs.