House hacking is a new way for budget-conscious buyers to buy their first home. It lets you live in part of the house and make money from the rest. This makes owning a home more affordable.

Did you know 63% of millennials say money is the biggest reason they can’t buy a home? “House hacking cut my housing costs by $850,” says Jamie. She bought a duplex in a neighborhood she thought was too expensive.

I’ve helped many cash-strapped buyers with house hacking. They build equity and learn to be landlords. Choosing a fixer-upper over new construction is often the best choice. It lets you use renovation loans to buy and fix the house at the same time.

This strategy works great for houses with separate areas, like basement apartments or detached buildings. My clients make 50-75% of their mortgage back through rent. They also get tax benefits that renters don’t get.

Quick hits:

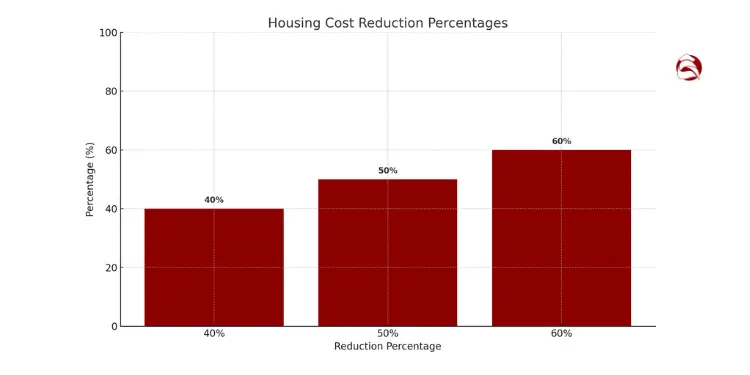

- Cut housing costs by 40-60%

- Build equity faster than renting

- Gain valuable property management experience

- Access neighborhoods that were too expensive before

What Is House Hacking Beginner Definition

House hacking is a smart way to own a home and make money at the same time. It lets you live in part of the house and rent out the rest. This way, you can cover your mortgage and other costs.

House hacking means finding ways to make money from your home. You buy a house, live in it, and rent out the other parts. This can really cut down your housing costs.

I’ve helped many first-time buyers with house hacking. It can save you 50-100% on housing costs. For example, a teacher in Greenville bought a $280,000 duplex. She lived in one part and rented out the other for $1,400 a month. This cut her housing costs to just $400 a month.

House hacking is not just about saving money. It also helps you build equity and get tax benefits. It’s a smart way for first-time buyers to get into real estate without needing a lot of money.

House hacking is different from buying a rental property just for investment. It’s a way to meet your housing needs and make money at the same time. This makes it easier to get financing for your home.

Live In Renovations Versus Turnkey Properties

When you start house hacking, you have to decide what kind of property to buy. You can choose a property that needs fixing up or one that’s ready to rent. Each option has its own challenges and benefits.

Live-in renovations mean buying a property that needs work and fixing it up while you live there. This can increase the property’s value a lot. My clients have added $50,000 to $75,000 in value through renovations.

Turnkey properties, on the other hand, are ready to rent right away. You pay more upfront but start making money from the beginning. This is a good choice for those who don’t want to deal with renovations.

| Factor | Live-In Renovation | Turnkey Property | Best For |

|---|---|---|---|

| Initial Investment | Lower purchase price, higher renovation budget | Higher purchase price, minimal additional costs | Renovation: Limited down payment funds Turnkey: Limited cash reserves |

| Time Commitment | Substantial (3-12 months of active work) | Minimal (immediate rental potential) | Renovation: Flexible schedule Turnkey: Busy professionals |

| Potential ROI | Higher (forced appreciation + rental income) | Moderate (rental income only) | Renovation: Growth-focused investors Turnkey: Income-focused investors |

| Skill Requirements | DIY abilities or contractor management | Basic property management only | Renovation: Hands-on personalities Turnkey: First-time landlords |

Choosing between live-in renovations and turnkey properties depends on your skills, time, and money. Those who enjoy fixing things or are willing to learn might prefer live-in renovations. Busy people or those who want an easy experience might prefer turnkey properties.

House hacking is not a quick way to make money. It takes careful planning and realistic goals. But, done right, it can help you achieve financial freedom while you live comfortably.

The best house hackers see it as a lifestyle choice, not just a way to save money. They’re willing to make some sacrifices for the freedom and financial benefits they gain.

Choosing Property Types Ideal For Hacking

House hacking starts with picking the right property. The property you choose affects your money and daily life. In Greenville, I’ve seen how the right property can change a buyer’s life fast.

Think about your money goals and lifestyle when picking a property. Some want privacy and less rent. Others want to make more money and don’t mind living with tenants.

Let’s look at common property types for house hacking. We’ll find the best one for you:

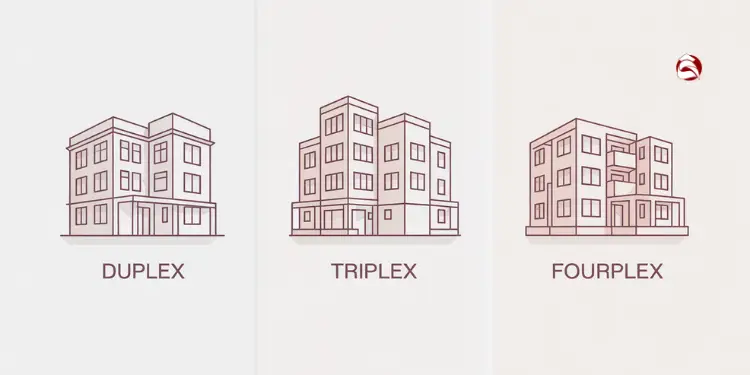

Duplex Triplex Fourplex Ownership Pros And Cons

Multi-family properties are great for house hackers. They have many living units under one roof. This lets you live in one and rent the others.

The main plus of multi-family properties is your privacy. You get rent checks that help pay your mortgage.

- Pros of multi-family house hacking:

- More money from rent than single-family homes

- Private entrances keep your space private

- It’s easier to get a loan for these

- Tracking expenses is simpler with separate meters

- Lower maintenance costs

- Cons of multi-family house hacking:

- They cost more than single-family homes

- Managing them is more complex

- Some areas have zoning rules

- There are fewer options

- Coordinating maintenance is harder

Jessica bought a triplex last year with just 3.5% down. She lives in one unit and rents the others. This covers her mortgage and adds $400 extra each month. The units are soundproof, keeping her private while she builds equity.

Single Family With Rentable Bedrooms Approach

If multi-family homes are too pricey, single-family homes are a good choice. You can rent out bedrooms or parts of the house.

This method needs less money upfront but means sharing spaces with tenants. It’s good for young people or those okay with roommates.

- Pros of single-family house hacking:

- Less money needed upfront

- More homes to choose from

- Easier to sell later

- Can appreciate more in value

- Financing is simpler

- Cons of single-family house hacking:

- Less privacy than multi-family

- Less total rent money

- Shared areas like kitchen and living room

- Managing tenants is harder

- HOAs might not allow renting rooms

Michael bought a four-bedroom house near the university. He lives in the master bedroom and rents the others to students. This covers 85% of his mortgage, helping him build equity while keeping costs low.

| Property Type | Typical Entry Cost | Monthly Cash Flow | Privacy Level | Management Complexity |

|---|---|---|---|---|

| Duplex | $250,000-350,000 | $300-600 | High | Medium |

| Triplex | $300,000-450,000 | $600-1,000 | High | High |

| Fourplex | $400,000-600,000 | $800-1,500 | High | Very High |

| Single-Family (3-4 BR) | $200,000-350,000 | $200-800 | Low-Medium | Medium |

When looking at properties for house hacking, look for these features:

- Separate entrances for different areas

- Multiple bathrooms to reduce sharing

- Sound insulation between areas

- Adequate parking for everyone

- Flexible floor plans for privacy

- Separate utility meters for fair bills

- Storage space for each unit

Market conditions affect which property type works best. In college towns, single-family homes with many bedrooms are great. In cities, duplexes and triplexes often do better because of higher rents.

The best property for you depends on your comfort with tenants, money, and investing goals. Many start with a single-family home and then move to multi-family as their portfolio grows.

House hacking isn’t just about finding any property—it’s about finding the right one. It balances your living needs now with your wealth goals later.

Financing Strategies Using Residential Loan Programs Available

Starting a house hacking journey is easier with the right loan programs. These can save you thousands upfront. As a REALTOR®, I’ve helped many first-time buyers find success with the right loan.

Owner-occupied loan programs make house hacking affordable. They offer better terms than investment loans. You don’t need 20% down to start.

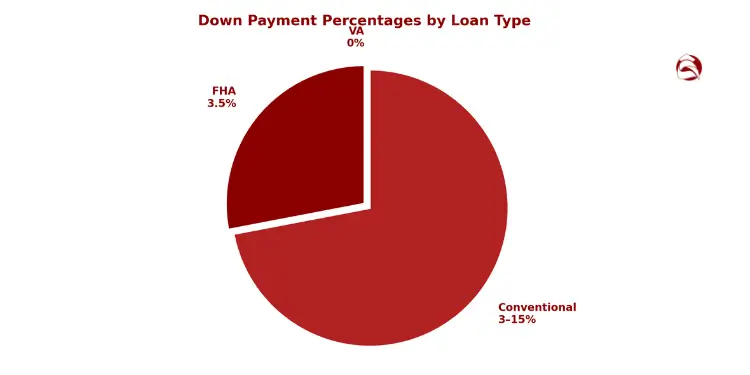

House hackers often choose FHA, conventional, or VA loans. Each has its own benefits. Knowing which one fits your plan is key.

Using FHA, Conventional And VA Loan Options

FHA loans are great for those with little savings. You can buy up to four units with just 3.5% down. This means a $300,000 property only needs $10,500 down.

FHA loans require a 580+ credit score. You’ll pay mortgage insurance upfront and monthly. This increases your monthly payment.

Conventional loans are flexible for those with strong finances. Down payments start at 3% for first-time buyers. Credit scores need to be 620+.

VA loans are perfect for service members and veterans. They offer zero down and no mortgage insurance. You can buy up to four units as your primary home.

“The house hack that changed my financial trajectory started with an FHA loan on a duplex. I put down just $12,250 on a $350,000 property. The rent from the second unit covered 70% of my mortgage, and I’ve never looked back.”

| Loan Type | Down Payment | Credit Score Minimum | Property Types | Key Advantage |

|---|---|---|---|---|

| FHA | 3.5% | 580+ | 1-4 units | Lowest barrier to entry |

| Conventional | 3-15% | 620+ | 1-4 units | Removable mortgage insurance |

| VA | 0% | 620+ (lender specific) | 1-4 units | No down payment or mortgage insurance |

| USDA | 0% | 640+ | 1 unit only | Rural property financing |

| HomeStyle Renovation | 3-5% | 620+ | 1-4 units | Includes renovation funds |

Special programs like Fannie Mae’s HomeStyle Renovation loans are great for live-in renovations. They let you buy and renovate a property at the same time.

First-time house hackers face many challenges. These include down payment, credit, and debt issues. Here are ways to overcome these:

- Down payment assistance programs – Many places offer grants or loans for down payments.

- Seller concessions – Sellers can help with closing costs, saving your down payment money.

- Gift funds – Family members can help with down payments.

- Budget check adjustments – Reducing expenses or getting extra income can help qualify you for better loans.

Before looking for properties, follow this 5-step checklist for house hacking success:

- Check your credit reports and scores from all three bureaus.

- Calculate your debt-to-income ratio (monthly debts divided by gross monthly income).

- Gather two years of tax returns, W-2s, and recent pay stubs.

- Document all assets including bank statements, retirement accounts, and investment portfolios.

- Meet with at least three lenders to compare loan options and interest rates.

The loan you choose affects your purchase and future house hacking plans. For example, FHA loans might not be best if you plan to move soon. Conventional loans might be better for your goals.

Interest rates change daily. Even a 0.5% difference can affect your monthly payment. Get pre-approved and lock your rate when you find the right property. Your financing strategy is key to affordable house hacking.

To avoid financial pitfalls, consider reading House poor meaning and how to avoid becoming it.

Rent Calculation And Cash Flow Analysis Basics

House hacking needs good rent math and cash flow checks. It’s not just about getting rent from tenants. You must plan your finances well to make money.

First, look at other rentals in your area. Use sites like Zillow and Apartments.com. Find places with similar features and location.

See if the rent can cover a big part of your mortgage. For example, if your mortgage is $1,800 and rent is $1,200, you save $600. This is often cheaper than renting a small place.

To understand all the costs involved in buying a house, refer to Cost breakdown buying house for first time buyers.

Estimating Vacancy And Maintenance Reserves

Even good rentals have empty times. House hackers save 5-8% of rent for this. In busy areas, save 5%. In less busy places, save 8%.

For a $1,200 rent, save $60-$96 each month. This helps pay the mortgage when tenants leave.

For repairs, save 1-2% of the property’s value each year. For a $300,000 property, save $3,000-$6,000 yearly. That’s $250-$500 monthly.

Start with higher reserves for older homes. A 1920s home might need 2%, while a newer one might need 1%. This keeps big repair costs from ruining your plan.

Tracking Utilities And Capital Expenditure Costs

Managing utilities is key to keeping cash flow good. You have three ways to handle this:

- Separate meters – This is the best but costs more upfront

- Flat rate – Easy but might lead to more use by tenants

- RUBS (Ratio Utility Billing System) – Shares costs based on use

For my duplex in Greenville, I used separate meters and RUBS for water. This saved me about $840 a year compared to including all utilities in rent.

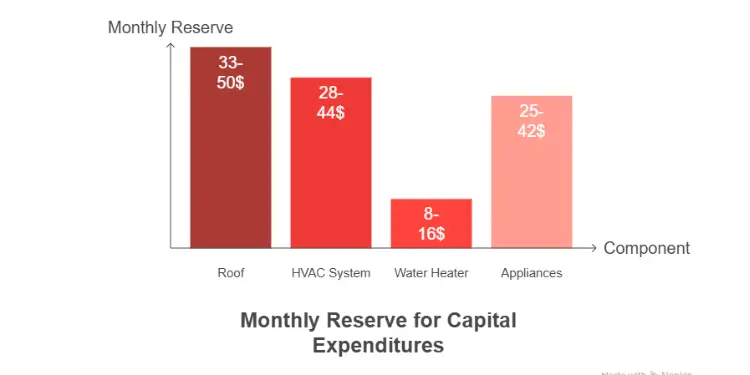

CapEx are big costs that need replacing. These are not monthly fixes but big items with set lifespans.

| Component | Typical Lifespan | Replacement Cost | Monthly Reserve |

|---|---|---|---|

| Roof | 20-25 years | $8,000-$12,000 | $33-$50 |

| HVAC System | 15-20 years | $5,000-$8,000 | $28-$44 |

| Water Heater | 8-12 years | $800-$1,500 | $8-$16 |

| Appliances | 10-15 years | $3,000-$5,000 | $25-$42 |

Keep track of these big costs separately. Living in the property helps you spot problems early. This gives you time to get ready for big expenses.

Stress Testing Cash Flow Under Rate Increases

Testing your house hacking plan under changing market conditions is key. Many beginners forget to plan for rate hikes, market drops, or long vacancies.

Make three cash flow scenarios for your property:

- Best case: Full rent, current rates, few repairs

- Expected case: 5% vacancy, slight rate rise, average repairs

- Stress case: 10% vacancy, 2% rate rise, more repairs

If your plan works in the stress scenario, it’s strong. If not, you might need to raise rent or find a better property.

When I bought my first house hack, I planned for a 2% rate increase. Rates went up 1.5% six months later. Knowing my plan could handle it was priceless.

I have a free cash flow calculator for house hackers. It does stress tests for you. Download it from the resources section below. Just put in your numbers and see if your property passes.

Be careful with your estimates. It’s better to be surprised by good performance than hit by unexpected costs. This careful approach has helped my clients succeed with house hacking, even in tough times.

For insights into calculating affordable home prices, consult House price to income ratio rule for buyers.

Managing Tenants And Maintaining Owner Occupied Harmony

House hacking is about living well with tenants. It’s different from just renting out a house. You need to think carefully about how to live together.

Screening tenants is key when you live with them. Look at more than just their credit score. Think about their lifestyle and how they keep things clean.

Make a special tenant application. Ask about their daily routines and how they handle messes. This helps you find the right fit.

Ask scenario questions during interviews. For example, “What if someone needs to leave before you?” or “How do you clean up?”

“The best house hacking relationships start with crystal clear expectations that leave no room for assumptions.”

Write down house rules before tenants move in. Your rules should cover:

- Quiet hours and noise limitations

- Guest policies and overnight visitor limits

- Shared space cleaning responsibilities

- Parking arrangements and vehicle limits

- Maintenance reporting procedures

House hacking can cause problems like parking fights and utility debates. Set clear rules for parking and utilities. Make a plan for fixing things.

Privacy is important when you live with tenants. Think about adding separate entrances or soundproofing. One client used a keypad lock on their door for peace of mind.

Good communication is key when you see tenants often. Set times for talking about issues. Use a special phone number or email for property stuff.

Conflicts will happen. Deal with them quickly but calmly. For late payments, send a friendly reminder first. For messes, ask how you can both do better.

Your lease agreement is very important. Make it fair but protect your rights. Learn to spot unfair clauses to keep things balanced.

House hacking needs good people skills. You’re not just collecting rent. You’re building a community. This takes emotional smarts, clear talk, and setting boundaries.

Living with tenants can be great. Many house hackers make friends with their tenants. They even find help with property and partners for future projects.

Be a good example. If you want quiet, be quiet. If you want clean spaces, keep them clean. Treat others the way you want to be treated.

To balance your needs and wants effectively, read Balancing needs vs wants home buying on a budget.

Tax Benefits And Risk Mitigation Considerations Key

House hacking is a smart way to use real estate. You live in part of your home and rent the rest. This lets you deduct expenses based on how much you use each part.

The rental part can be written off over 27.5 years. This makes a paper loss that lowers your taxes. Learn more at this link.

Now, tax rules limit how much you can deduct for mortgage interest and property taxes. When you sell your hack property, you can exclude up to $250,000 in gains. This is for the part you live in.

But, the rental part faces capital gains tax and 25% depreciation recapture. This means you’ll have to pay taxes on the profit from renting.

Landlord Insurance And Liability Coverage Essentials Key

Standard homeowner policies don’t cover rental activities. You need special landlord insurance. This insurance has at least $1 million in liability protection.

This protects you if someone gets hurt on your property. You should also add loss-of-rent coverage. This helps keep your cash flow steady during repairs.

Many house hackers also get umbrella policies. These policies offer extra protection beyond what standard policies cover.

Read more:

Setting Up LLC For Added Protection Entity

Creating an LLC keeps your personal assets safe. It separates your personal stuff from your house hack business. This way, your savings and other properties are protected if someone sues you.

Starting an LLC costs vary by state. It usually costs between $50-800 a year. While it adds to your expenses, the protection is worth it. Always check with your mortgage lender first. They might have rules about transferring property to an LLC.