When you talk about hot wallet vs paper wallet, you’re looking at two main choices for keeping your crypto safe. A crypto wallet doesn’t hold your coins. It keeps the private keys that show you own them on the blockchain.

Did you know over 23% of Americans now own some kind of cryptocurrency? This number is growing fast. That’s why keeping your wallet safe is more important than ever.

“The best wallet isn’t always the most secure one—it’s the one that fits your specific needs,” says blockchain security expert Sarah Chen.

I’ve found hot wallets great for everyday use and paper wallets perfect for keeping things safe for a long time. What you need depends on how you plan to invest.

Every wallet has its own strengths for different situations. If you trade often or hold for a long time, you’ll need a different wallet.

Quick hits:

- Hot wallets stay connected to the internet

- Paper wallets keep things safe offline

- Online access is good for daily trading

- Offline storage is better for long-term

- Both need good backup plans

Security vulnerabilities in physical and digital forms

Cryptocurrency storage has its own set of challenges. Both internet-connected hot wallets and offline paper wallets have their own risks. Knowing these risks helps you protect your digital assets.

Hot wallets are always online, making them vulnerable to threats. They are easy targets for hackers. Always be careful with your wallet that is always connected to the internet.

Hot wallets are online, which means your private keys are at risk. This doesn’t mean they are unsafe. But, you need to be extra careful.

Paper wallets are not online but face different risks. They can get damaged by water, fire, or mistakes. How you store them is very important.

Exposure to Moisture, Fire, and Hackers

Paper wallets can get damaged easily. A spill or high humidity can ruin them. This makes your private keys unreadable.

Fire can destroy your paper wallet quickly. Without backups, you could lose all access to your money. This loss is permanent.

Over time, paper wallets can fade. Ink can disappear, making your wallet useless. This can happen in a few years.

Hot wallets face digital threats. Malware can steal your wallet information. Always be careful with downloads and emails.

Phishing attacks are common for hot wallets. Scammers create fake sites to steal your login info. Always check the site’s URL.

Public Wi-Fi can be dangerous. Hackers can see your data. Always use secure networks.

| Security Aspect | Hot Wallets | Paper Wallets | Risk Level |

|---|---|---|---|

| Hacking Vulnerability | High (always online) | None (offline storage) | Critical for hot wallets |

| Physical Damage Risk | Low (data can be backed up) | High (vulnerable to water, fire) | Critical for paper wallets |

| Theft Possible | Remote (no physical access needed) | Requires physical access | Medium for both |

| Recovery Options | Often available through seed phrases | None without proper backups | High importance |

To keep hot wallets safe, use strong security. Enable two-factor authentication. Use unique, complex passwords and a password manager.

NIST SP 800-57 recommends storing master seed phrases offline and enabling multi-factor authentication to mitigate phishing and device compromise risks.Ref.: “National Institute of Standards and Technology. (2025). Recommendation for Key Management — SP 800-57 Part 1 Rev. 5. NIST.” [!]

Paper wallets need careful storage. Use waterproof, fireproof containers. Make copies and store them safely. Laminating can protect against moisture.

No storage method is perfect. Mix different solutions for your needs. Use hot wallets for frequent use and paper wallets for long-term storage.

Think about your risk tolerance and how you use your funds. Hot wallets are convenient but risky. Paper wallets are safer but vulnerable to physical damage.

“For More Information: Best mobile hot wallet options for digital currency commuters“

Ease of use for frequent transactions

Using cryptocurrency for daily buys is easy if you can quickly get to your money. The wallet you pick makes a big difference. Let’s see how hot and paper wallets stack up for easy use.

Hot wallets are easy to use and fast. Most apps have simple interfaces for quick money sending. With a hot wallet, your money is always online and ready.

Paper wallets are safe but harder to use. You must move your keys from paper to digital for each buy. This makes daily use harder.

“The best wallet isn’t necessarily the most secure one, but the one that strikes the right balance between security and usability for your specific needs.”

Scanning QR Codes for Payments

Paper wallets use QR codes for easy digital access. These codes hold your keys and can be scanned fast.

To use funds in a paper wallet, you sweep them. Here’s how:

- Open your hot wallet app on your device

- Choose the “sweep” or “import” option

- Scan the QR code from your paper wallet with your camera

- Check the transaction details and finish the transfer

This moves your crypto to a hot wallet for spending. Always sweep the whole balance to keep your wallet safe.

QR scanning works best in good light with clear prints. It’s okay for occasional use but not as fast as a hot wallet for quick buys.

Manual Entry Delays and Errors

QR codes can be hard to scan if they’re damaged or the print is bad. If this happens, you have to type in your private key. This can be tricky.

Private keys are long and have letters and numbers. Typing them wrong can cause problems:

| Error Type | Consequence | Prevention Strategy |

|---|---|---|

| Character transposition | Invalid key, transaction failure | Enter in small chunks, verify each section |

| Character omission | Invalid key, transaction failure | Count characters before and after entry |

| Case mistakes | Invalid key, transaction failure | Use copy-paste when possible, verify case |

| Exposure risk | Potential theft if key is observed | Enter in private location, clear history |

Manual entry takes longer than scanning a QR code. Even a little delay can matter in fast markets.

For new users, start with small amounts when learning to type in keys. This helps avoid big losses while you get the hang of it.

Hot wallets solve these problems. They make quick buys easy with just a few clicks. This makes them great for frequent users.

Choose your wallet based on how often you use crypto. Hot wallets are better for those who buy or trade often. But paper wallets might be safer for those who don’t use crypto much.

Longevity and durability of storage medium

How long your crypto stays safe depends on your wallet. Hot wallets and paper wallets have different lasting powers. Knowing this helps protect your digital money.

Paper wallets can get damaged easily. Normal paper starts to fall apart in months. Ink can fade or change color over time, making it hard to read.

For better paper wallet durability, consider these material upgrades:

- Archival-quality acid-free paper (pH neutral)

- Pigment-based inks instead of dye-based

- Laser printing for moisture resistance

- Lamination or storage in UV-protected sleeves

Hot wallets don’t get damaged but have other problems. They can stop working if the company goes out of business. Security issues can also arise over time.

“The best wallet isn’t the one with the most features—it’s the one that works years later.”

Hardware wallets are a good middle choice. They keep your keys safe on chips that hackers can’t get to. They also have extra security like PINs and passphrases.

Quality hardware wallets are built to last. They can withstand water, shocks, and last 5-10 years. But, they have parts that can break down.

It’s key to make backup copies, no matter your wallet type. For paper wallets, print many copies and keep them safe. For other wallets, back up your seed phrases or private keys well.

| Storage Medium | Physical Lifespan | Digital Lifespan | Maintenance Needed |

|---|---|---|---|

| Standard Paper Wallet | 1-5 years | Indefinite | High (regular inspection) |

| Archival Paper Wallet | 25+ years | Indefinite | Medium (climate control) |

| Hot Wallet | N/A | 2-5 years | High (updates, backups) |

| Hardware Wallet | 5-10 years | Varies by manufacturer | Medium (firmware updates) |

Check your storage often. For paper wallets, look for damage every 6-12 months. For hot wallets, update software and check if the platform is working. Hardware wallets need updates to stay secure.

Blockchain tech keeps changing. Some wallets might become old news. Check your storage often to avoid losing access to your money.

Using different types of wallets is smart. Use hot wallets for daily use and cold storage for long-term. This way, you get both ease and safety for your crypto.

“Check This Out: Mobile hot wallet vs desktop which is easier“

Setup process printing and backup steps

Setting up paper wallets is a mix of digital steps and physical safety. Unlike hot wallets, which are easy to set up, paper wallets need careful planning. This ensures they stay safe for a long time.

Hot wallets are easy to start with. You just download an app, make an account, and add security like two-factor authentication. These connected wallets stay online, making them handy but risky.

Paper wallets are cold storage, needing a detailed setup. Here’s how to make one:

- Choose and install a good paper wallet generator app

- Make sure you’re not connected to the internet

- Use the app to create your wallet

- Decide how many backup copies you need (at least two)

- Use a PIN or password if the app offers encryption

- Make your wallet with public and private keys

- Print it using a secure, offline printer

After printing, delete all digital traces. Clear your browser history, cookies, and cache. Remove the wallet app if you can. This keeps your keys safe.

Selecting Archival Quality Printing Paper

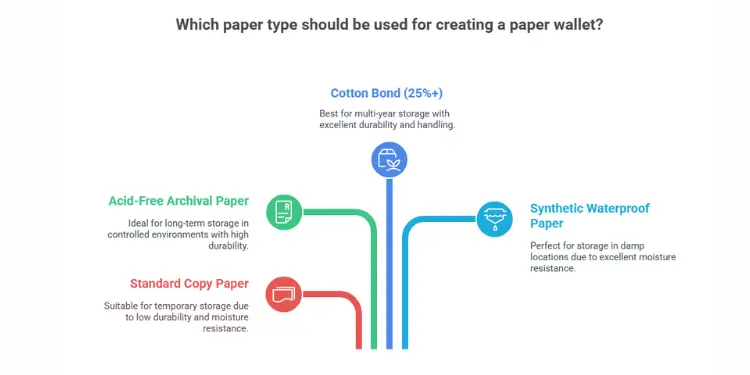

The paper for your wallet is very important. Regular printer paper gets damaged easily. For long-term storage, you need special paper.

Look for paper that won’t yellow or get damaged over time. Paper with 20-30% cotton is best. Some people even use waterproof paper for extra safety.

Choosing the right printer is also key. Laser printers are better than inkjet for paper wallets. Laser printing makes the text last longer against water and fading. Use high-resolution settings to make sure QR codes and small text are clear.

| Paper Type | Durability Rating | Moisture Resistance | Temperature Stability | Best Use Case |

|---|---|---|---|---|

| Standard Copy Paper | Low | Poor | Moderate | Temporary storage only |

| Acid-Free Archival Paper | High | Moderate | Good | Long-term storage in controlled environments |

| Cotton Bond (25%+) | Very High | Good | Excellent | Multi-year storage with occasional handling |

| Synthetic Waterproof Paper | Excellent | Excellent | Variable | Storage in potentially damp locations |

Backing up your wallet is just as important. For hot wallets, write down and store seed phrases safely. For paper wallets, make many copies and keep them in different places.

For paper wallets intended to last decades, choose ANSI/NISO Z39.48-certified permanent paper (pH 7.5–10, alkaline reserve ≥ 2 %) and pigment-based inks to resist fading.Ref.: “Library of Congress. (2025). Paper FAQ — What Is Permanent Paper? Library of Congress.” [!]

Test your wallet setup with a small amount of crypto first. Send a small transaction and check if you can get the funds. This step can prevent big problems.

Creating a paper wallet by hand is simple but safe. It avoids printer security issues. Use pens with ink that won’t fade.

Setting up a paper wallet might take more time than hot wallets. But, it’s worth it for safe storage of your crypto.

“Explore More: Best cheap hot wallet options for thrifty crypto users today“

Disaster recovery and loss scenarios

Wallet systems face big tests in disaster recovery. Hot and paper wallets have different challenges. Knowing how to recover from losses is key before choosing a storage method.

Let’s look at what happens when things go wrong with your crypto storage. And how to get ready for it.

Hot Wallet Disaster Scenarios

Hot wallets use the internet, which makes them vulnerable. If you forget your password, most services help you recover through email or security questions.

Lost or stolen devices are a big problem. If your phone with a hot wallet goes missing, act fast. Most wallet providers let you recover using your seed phrase on a new device.

Hacking is a huge risk. If a hacker gets into your hot wallet, your money can vanish quickly. You might not be able to get it back.

Exchange bankruptcy is another big risk. If a wallet provider goes bankrupt, you might lose access to your money. The crypto world has many examples of exchanges that disappeared with user funds.

“Related Articles: Top hot wallet apps reviewed for fast and secure crypto selection“

Paper Wallet Recovery Challenges

Paper wallets face different threats. Losing the paper with your private keys can lock you out forever.

Damage from water, fire, or extreme weather can also ruin paper wallets. Even if your crypto is safe on the blockchain, damage can make it unreadable.

Ink on paper wallets can fade over time. If you use standard inkjet printers, your keys might become hard to read. This can happen when exposed to light or humidity.

Stealing paper wallets is a serious issue. Unlike hot wallets, you might not notice theft until you try to use your funds.

Creating Effective Recovery Strategies

For hot wallets, here are some recovery tips:

- Store seed phrases in multiple safe places, away from your devices

- Use all security features, like 2FA (not SMS-based)

- Keep your contact info up to date for recovery

- Test logging in from different devices

- Keep records of wallet addresses and transaction history

For paper wallets, these steps are important:

- Make multiple copies and store them safely

- Use archival-quality paper and permanent ink

- Consider engraving keys on metal plates for extra protection

- Test recovery with small amounts first

- Split keys using cryptography for more security

Many users have learned that removing keys from digital wallets protects against hacking. But, it makes them vulnerable to physical loss. The seed phrase is your only hope in these situations.

Testing Your Recovery Plan

Test your recovery plan before using your wallet for big amounts. For hot wallets, try to restore access on another device with your seed phrase. For paper wallets, scan the QR code or enter the keys to make sure they work.

I’ve seen many cases where users found flaws in their recovery plans after disaster struck. One student in my class had a paper wallet but the QR code was wrong. He found out months later when he tried to access his funds.

“Learn More About: How to use blockchain technology practical examples and tips“

Hybrid Approach for Maximum Security

The best strategy combines hot and paper wallets. Here’s how:

- Use hot wallets for small amounts for daily transactions

- Store big amounts in paper wallets with backups

- Keep track of where your assets are stored

- Check your backups regularly

- Teach family members how to access funds in an emergency

This approach makes daily use easy while keeping your main crypto safe. Remember, once you print your paper wallet, you can safely remove the keys from your device or app. This reduces online risks.

Disaster Recovery Checklist

Use this checklist to check if you’re ready for wallet disasters:

- Have you stored seed phrases in multiple safe places?

- Can you recover funds if your main device is lost or damaged?

- Have you tested your recovery with a small amount?

- Do trusted family members know how to access funds in an emergency?

- Are your paper backups safe from damage?

- Have you documented the steps for recovery?

- Do you have a plan for each wallet type you use?

The difference in recovery between hot and paper wallets is all about preparation. Hot wallets offer easy recovery with seed phrases but need protection from digital and physical threats. Paper wallets avoid online risks but need strong physical security and backup plans.

By understanding these scenarios and taking the right steps, you can enjoy the benefits of both wallet types while reducing loss risk. Remember, in the crypto world, you’re responsible for your own security. There’s no “forgot password” button on the blockchain.

“Related Topics:

Cost efficiency for small investments

Starting with crypto means watching your money. Hot wallets are great because they’re free to use. They make money from small fees, not upfront costs.

Paper wallets are the cheapest cold storage. You just need ink and paper, costing less than $20. This is good for small investments, as hardware wallets can cost too much.

The FTC reports that consumers lost $1.4 billion to cryptocurrency-payment scams in 2024; lower-cost storage solutions are only economical if paired with robust anti-fraud vigilance.Ref.: “Federal Trade Commission. (2025). Top Scams of 2024. FTC Consumer Advice.” [!]

The cost isn’t just the price. Hot wallets online can be risky. But, paper wallets are safer for small amounts without the high hardware cost. For under $500, a paper wallet is a wise choice.

A hot wallet is often best for amounts under $100. But as your money grows past $1,000, hardware wallets are safer. Choose a wallet that fits your budget and needs.