Buying a home for the first time can be very hard. The 2025 real estate market moves fast. This checklist helps new buyers get ready financially. It makes sure you know what to expect at every step.

Did you know 52% of first-time homebuyers are surprised by hidden costs? Knowing what to expect can help you feel more ready and calm.

“A budget is telling your money where to go instead of wondering where it went.” — Dave Ramsey. I’ve been through renting and buying homes. A good budget is key for new buyers. Let’s look at what a home buying budget checklist should have.

Key takeaways:

- Assess current finances and credit standing.

- Estimate total upfront and hidden costs.

- Allocate funds for immediate post-move expenses.

- Plan reserves for maintenance and emergencies.

- Review budget with a professional financial advisor.

- Use digital tools to track expenditures.

Assess your current finances and credit standing

Before you start looking for a home, check your money situation carefully. This helps you know how much you can spend without surprises. Making a detailed financial checklist is the first step to knowing your financial health.

Calculate debt to income ratio accurately

First, figure out your debt-to-income ratio (DTI). This number is key because lenders use it to see if you can handle monthly payments. To find your DTI, add up all your monthly debts and divide by your monthly income before taxes. Aim for a DTI under 36%, with no more than 28% of that for your mortgage.

- Sum up all monthly debt payments

- Divide the total by your gross monthly income

- Multiply by 100 to get the percentage

Apply the 28/36 rule: keep housing costs below 28 % of gross monthly income and total debt below 36 % to strengthen mortgage approval odds and protect long-term affordability. Ref.: “Kagan, J. (2024). 28/36 Rule: What It Is, How to Use It, Example. Investopedia.” [!]

Pull credit reports to verify errors

Then, get your credit reports from Equifax, TransUnion, and Experian. It’s important to check these reports often for mistakes that could hurt your credit score. A good credit score helps you get approved for a mortgage and can even get you better interest rates. Fix any errors right away to make buying a home easier.

| Bureau | Website |

|---|---|

| Equifax | equifax.com |

| TransUnion | transunion.com |

| Experian | experian.com |

Checking your credit often and fixing mistakes quickly keeps your score healthy. This makes lenders see you in a good light.

Estimate total upfront and hidden costs

Buying a home has many costs beyond the price. These costs can add up quickly if not planned for. Knowing these expenses helps avoid surprises when you make an offer and buy a home.

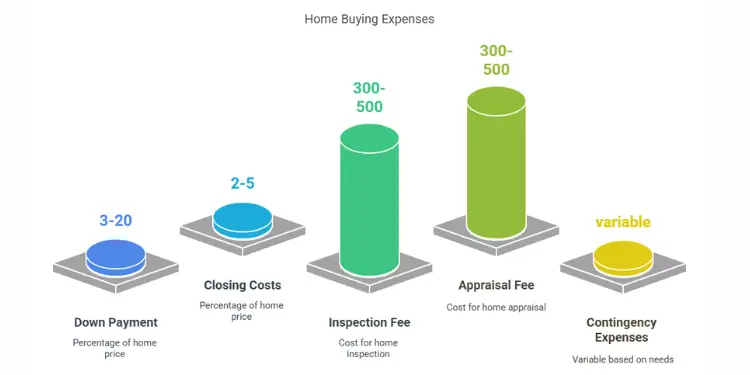

Down payment closing fees and reserves

Your down payment is a big cost, usually 3% to 20% of the home’s price. Closing costs, like attorney fees and title insurance, add 2% to 5% more. Also, having a reserve fund is key for both expected and unexpected costs.

“Closing costs” include:

- Attorney fees

- Title insurance

- Property taxes

- Recording fees

Reserves are a few months’ mortgage payments saved. This is for when income might stop.

“read more: How to organize finances before buying house successfully‘

Inspection appraisal and contingency expenses

Getting a home inspection and appraisal is smart. The appraisal spend on a home is $300 to $500. It checks the home’s value for the lender. A home inspection, costing $300 to $500, finds hidden problems.

The average professional home inspection costs about $343 nationwide, with most buyers paying between $296 and $424—well worth uncovering costly defects before closing. Ref.: “Lee, J. (2025). How Much Does a Home Inspection Cost, and Do I Need One? Bankrate.” [!]

Also, plan for contingency expenses like:

- Extra repairs from inspections

- More costs if the seller doesn’t fix things

- Higher home insurance based on value

| Expense Type | Cost Range |

|---|---|

| Down Payment | 3%-20% of home price |

| Closing Costs | 2%-5% of home price |

| Inspection Fee | $300 – $500 |

| Appraisal Fee | $300 – $500 |

| Contingency Expenses | Variable based on needs |

Mortgage closing costs typically equal 2 – 5 % of the loan amount—about $7,000 to $17,500 on a $350,000 purchase—so budget early to avoid last-minute cash shocks. Ref.: “Hunt, M. (2024). Closing Costs: What Are They and How Much Are They? Bankrate.” [!]

Allocate funds for immediate post-move expenses

Moving into your first home is exciting. But, it also comes with many costs. It’s important to plan for moving costs, furniture, appliances, repairs, and utility deposits.

Furniture, appliances, and basic repairs budgeting

After moving, you need a comfy and functional home. Start by planning your furniture budget. You’ll need things like beds, sofas, and dining tables.

Also, think about appliances like refrigerators, ovens, and washers. And don’t forget to save for repairs. This could be for things like plumbing or electrical issues.

Utility deposits and service activation fees

Setting up utilities in your new home has its own costs. You’ll need to pay deposits and fees for services. This includes electricity, water, and internet.

By saving for these costs, you won’t have any service problems. This makes starting your new home easier.

Planning for these costs helps a lot. It covers furniture, appliances, repairs, and utility deposits. This makes moving into your first home smoother.

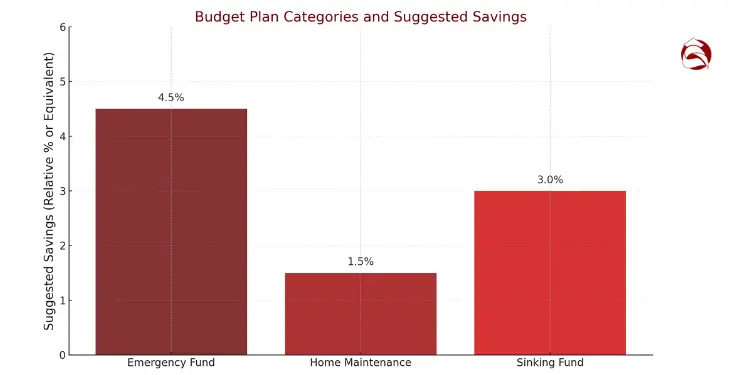

Plan reserves for maintenance and emergencies

It’s key to plan for home upkeep and emergencies. Saving a part of your income helps you face homeownership’s surprises. Use a monthly budget worksheet to set aside money wisely.

“read also: Tips for tight budget home buying success“

Set Percentage of Income Aside Monthly

Save a part of your income each month. Choose a goal that fits your financial plans and family needs. This way, you’re ready for sudden repairs and avoid money troubles.

A sinking fund is great for big home costs. Save for big projects or repairs to avoid financial stress. Remember to include these costs in your budget.

Plan to set aside 1 – 4 % of your home’s value each year for routine and unexpected maintenance—e.g., $4,000 – $16,000 annually on a $400,000 property—to safeguard comfort and resale value. Ref.: “Dehan, A. (2024). What Are the Most Common Home Maintenance Costs? Bankrate.” [!]

For a good budget plan, look at these categories and how much to save:

| Category | Example Expenses | Recommended Allocation |

|---|---|---|

| Emergency Fund | Medical emergencies, job loss, urgent repairs | 3-6 months of living expenses |

| Home Maintenance | Lawn care, gutter cleaning, HVAC inspections | 1-2% of home’s value annually |

| Sinking Fund | Roof replacement, kitchen remodel, HVAC system | Variable based on project scope |

Include these savings in your monthly budget worksheet. This way, you can handle both regular and surprise costs. Plan your budget well to keep your finances and home safe.

Review budget with professional financial advisor

Before you buy a home, talk to a financial advisor. They check your buying checklist and help with money worries. This helps keep your finances safe.

Validate affordability assumptions under stress scenarios

A financial advisor tests your budget in tough times. They look at income, interest rates, and surprise costs. This shows if your home is affordable, even when things get hard.

Adjust spending plan before loan application

Change your spending plan before you apply for a mortgage. This makes sure you stick to your budget and are ready for any money surprises. Working with a financial advisor helps make your plan strong and surprise-free.

| Financial Aspect | Considerations |

|---|---|

| Income Stability | Assess future job and salary changes. |

| Interest Rates | See how rising rates affect your mortgage. |

| Emergency Fund | Save for unexpected costs and upkeep. |

| Debt Obligations | Check if your debt fits your income. |

Use digital tools to track expenditures

Buying a home is busy. Keeping track of money is key. Digital tools make it easy. They save time and catch every expense.

Spreadsheet templates automating expense categories

Spreadsheet templates are great for organizing money. Tools like Microsoft Excel and Google Sheets have templates. They update your money info automatically.

Just enter your money, like down payments and utility deposits. It keeps your money status clear.

Read More:

Mobile apps sending real-time alerts

Mobile apps are super for tracking money. Apps like Mint and YNAB send alerts. They help you watch your spending and saving.

These alerts warn you if you spend too much. This lets you fix your budget fast. It keeps you on track with your home-buying money.