Choosing between a fixer-upper and new construction is a big decision. It deeply affects your home buying journey. With the real estate market having limited inventory, this choice is even more important.

Ever wondered about the cost difference? The median price of new construction homes is $171,000 more than existing homes as of 2024.

“Deciding between a fixer-upper and new construction is more than just looking at prices,” said Jenna Stauffer from Ocean Sotheby’s International Realty. “It’s about seeing the lifestyle each option offers.” This is something I’ve seen many buyers struggle with, helping them make this choice over the years.

Choosing between a fixer-upper and new construction hinges on balancing upfront purchase price against renovation and long-term operating costs. Existing homes typically list for significantly less—often by over $170 000—but require thorough structural inspections and a contingency reserve of 10 %–25 % of renovation budgets to address hidden defects. Prospective owners must also factor in permitting timelines, which can extend project schedules by weeks or months, whereas new builds follow more predictable phased inspection calendars but remain vulnerable to material and labor delays.

New construction commands a premium initially but delivers modern energy-efficiency standards, reducing utility expenses and maintenance outlays over time. Financing options like FHA 203(k) renovation mortgages bundle purchase and improvement costs into a single loan, while builder incentives may lower effective interest rates or closing expenses. Evaluating neighborhood maturity against projected appreciation helps align investment goals with risk tolerance, and studying comparable sales of renovated properties provides realistic post-upgrade valuation benchmarks.

Key Takeaways:

- Fixer-uppers might cost less upfront but need renovation budgets.

- New construction costs more initially but offers modern features and efficiency.

- Knowing the market trends helps understand long-term value.

Compare your purchase price and renovation budget

Choosing between a fixer-upper and a new home depends on your budget. Fixer-uppers cost less upfront but need more money for repairs. It’s key to weigh these costs carefully.

Estimate structural repair contingencies accurately

Older homes often have hidden structural problems. Adding 10% to 25% of your budget for repairs is wise. Thorough inspections can prevent unexpected costs when fixing up an old home.

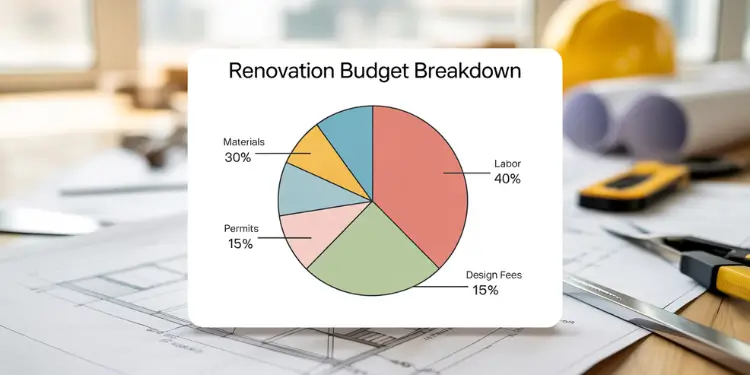

Calculate renovation material and labor costs

Planning a fixer-upper renovation requires detailed cost estimates. Include the price of new appliances, upgrades, and contractor work. A well-planned budget helps avoid financial shocks during the renovation.

Read More:

Estimate timeline differences affecting move in readiness

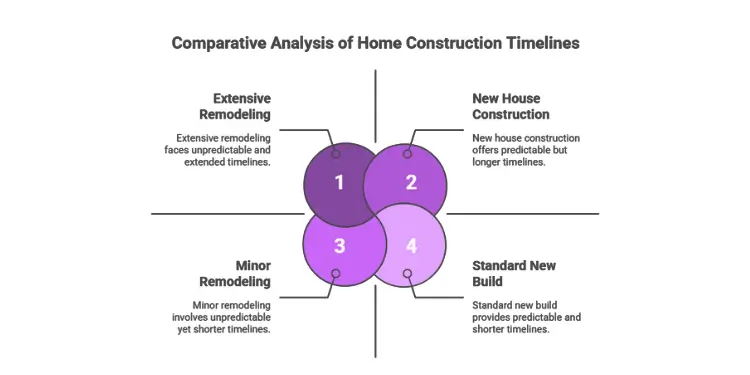

It’s important to know the time differences between fixing up an old house and building a new one. Each choice has its own challenges and delays. Buyers need to think about these when planning their move.

Permitting delays for extensive remodels

Fixing up an old house can lead to delays because of permits. Big remodels must follow strict rules. This can push back your move-in date a lot.

The permitting process for renovations can take anywhere from three weeks to three months, delaying move-in readiness. Ref.: “Paul Maynard (2024). The Pain of Permitting Delays: A Common Struggle in Renovations and Remodels. LinkedIn.” [!]

These delays can make your move-in date much later than expected. It turns a simple move into a long wait.

Builder schedules for phased inspections

Building a new house has a more set timeline because of phased inspections. Builders plan these inspections at different times. This helps avoid unexpected delays.

But, be ready for any issues with labor or materials. These can change your move-in date too.

Analyze long term maintenance and energy efficiency

When choosing between new homes and fixer-uppers, maintenance and energy efficiency are key. New homes usually meet the latest energy standards, which means lower bills.

Projected Utility Savings from Modern Standards

Modern homes come with energy-saving appliances and smart tech. This can lead to big savings on utilities. Studies show that homes built to exceed energy standards can save even more. This guide on buying a home points out that following these standards cuts energy use over time.

ENERGY STAR certified homes are on average 20% more energy efficient than code-built homes, translating into substantial utility savings. Ref.: “Energy Star (2025). ENERGY STAR. Wikipedia.” [!]

Ongoing Repairs Typical in Older Properties

Older homes, on the other hand, often need more frequent fixes. They might have outdated systems and structures. This means you could face costs for repairs or replacements of things like roofing, plumbing, and wiring.

Assess financing options including renovation loans

Looking into different financing options is key when choosing between a fixer-upper and a new home. There are many renovation loans out there, like the FHA 203k loan. It’s made for homes that need a lot of work. This loan combines your home’s price and renovation costs into one mortgage.

FHA 203k requirements for fixer uppers

The FHA 203k loan helps buyers fix up homes. It covers repair and improvement costs. The home must be at least a year old. This loan makes buying and fixing up a home easier by combining everything into one loan.

Builder incentives lowering construction loan costs

Builders often give incentives for new homes. These can include lower interest rates, better appliances, or help with closing costs. These perks can make buying a new home more attractive financially.

Thinking about how each financing option fits your budget and renovation plans is important. Whether it’s through home equity loans or programs for first-time buyers, looking at both fixer-uppers and new homes carefully will help you find the best renovation investment.

Consider neighborhood maturity and property appreciation

Choosing between a fixer-upper and new construction is more than just the property. It’s also about the neighborhood maturity and property appreciation. Knowing what each offers can help buyers make a smart choice.

Established communities offer stable resale value

Established communities are great for long-term investment. They have mature landscaping, good amenities, and a strong community. This makes their properties more stable, with less price change over time.

New developments forecast future growth

New developments have modern designs and new amenities. They appeal to those wanting the latest features. While they might be riskier, they could see big price increases as the area grows.

| Factor | Established Communities | New Developments |

|---|---|---|

| Neighborhood Maturity | High | Low to Moderate |

| Property Appreciation | Steady | Potentially High |

| Resale Value | Stable | Variable |

Evaluate resale value after making improvements

When deciding between a fixer-upper and a new home, knowing the resale value is critical. Home improvements can greatly increase your investment, boosting your home’s equity and financial health. To assess resale value, compare recent sales of similar homes after renovations. This helps you see the financial benefits of your upgrades.

Market Comparables Supporting Post Renovation Pricing

It’s vital to study market comparables. These homes set a standard for what renovated homes sell for in your area. Look for homes with the same size, age, and upgrades as your fixer-upper. This comparison will guide you to a realistic price for your renovated home, helping you make a better choice.

Check out the below:

Buyer Preferences Favoring Turnkey Convenience

Today’s buyers often want homes ready to move into without immediate repairs. This desire can sway their decision. While fixer-uppers might seem cheaper, new homes offer convenience and peace of mind. Knowing these preferences helps you weigh the effort and cost of fixing up a home against the comfort and possibly higher resale value of a new one.