Knowing the difference between financial and investment goals is key. I’ve helped many new investors understand this. They often get confused at first.

Financial goals are big money targets like buying a home or saving for college. Investment goals are about how your money grows and how much risk you take. Warren Buffett said, “Risk comes from not knowing what you’re doing.”

A young couple wanted to save $75,000 for a home in seven years. They focused on their goal, not just the market. Their success was about reaching their investment goals for their life.

Quick hits:

- Life milestones drive financial planning decisions

- Investment strategies support broader objectives

- Success means meeting your needs

- Specific targets outperform vague intentions

Goal Definitions and Target Time Frames

Setting goals with time frames helps you plan your investment journey. After 12 years of helping investors, I’ve learned that knowing your goals and timelines is key. Your investment time horizon shows how you’ll reach your financial goals.

Think of your financial goals as places on a map. Each place needs a different way to get there. Some trips are short, while others are long.

“Related Topics:

Short Term Consumption Goals Overview

Short-term goals last 0-3 years and focus on immediate needs. They have specific dollar amounts and fixed dates.

When working on short-term goals, we focus on being sure, not on growing fast. Your emergency fund, vacation savings, or car down payment must be ready when you need it. Market performance is not an excuse for not having enough.

For example, saving for a 6-month emergency fund ($15,000-30,000) is different from saving for retirement. Saving for a wedding ($28,000) or a house down payment also needs different plans.

Short-term goals need liquidity and stability. This means choosing safe investments over ones that might grow more. I suggest clients do these things for short-term goals:

- Assign specific dollar amounts to each goal

- Set firm target dates for completion

- Calculate required monthly contributions

- Choose appropriate low-risk vehicles

Bond prices typically fall when interest rates rise, so even “conservative” bond funds can drop 10 % or more in a rate-hiking cycle — a risk that can derail near-term cash needs. Ref.: “Financial Industry Regulatory Authority. (2024). Brush Up on Bonds: Interest Rate Changes and Duration. FINRA Investor Insights.” [!]

The amount and date of your goals shape your investment plan a lot. You need exactly $20,000 for that home down payment by next April, not “whenever the market performs well.”

Long Term Wealth Building Ambitions

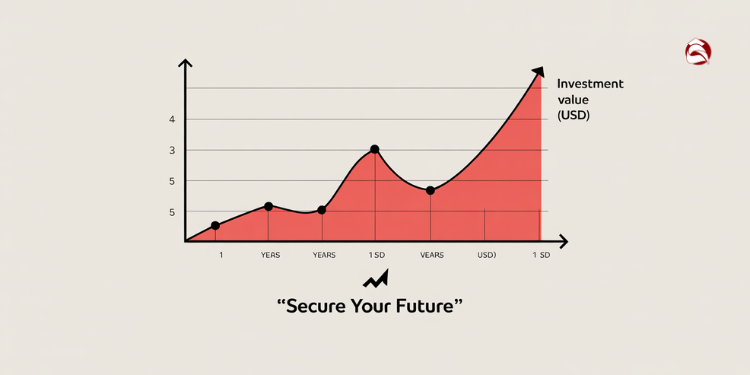

Long-term wealth goals last 10+ years and benefit from compounding. These goals, such as retirement funding or college education, allow for greater investment flexibility.

I’ve seen that successful investors have two types of long-term goals:

- Fixed-date goals: Retirement at 62, college funding starting in 2035

- Flexible-timeline goals: Reaching $2 million in investable assets

This difference is important because fixed-date goals need more conservative investments as the target date gets closer. For retirement, your goal should also account for the risk of living longer than your money lasts.

The average American spends 20+ years in retirement. This means your investment goal might need to keep growing even after you start. This longer time frame lets you invest in things that might grow more, but you should be less risky as you get closer to your goal.

Federal data show U.S. retirees spend roughly **two decades** living on accumulated assets — framing the need for portfolios that last 20 years or longer. Ref.: “U.S. Department of Labor. (2023). Top 10 Ways to Prepare for Retirement. Employee Benefits Security Administration.” [!]

| Characteristic | Short-Term Goals (0-3 years) | Medium-Term Goals (3-10 years) | Long-Term Goals (10+ years) |

|---|---|---|---|

| Primary Focus | Capital preservation | Balanced growth | Capital appreciation |

| Typical Examples | Emergency fund, vacation, car down payment | Home down payment, education funding | Retirement, generational wealth |

| Suitable Vehicles | High-yield savings, CDs, T-bills | Bond funds, balanced funds | Stock funds, real estate, retirement accounts |

| Risk Tolerance | Very low | Moderate | Higher (decreasing as target date approaches) |

| Flexibility | Low – fixed dates and amounts | Medium – some adjustment possible | High – time for market recovery |

Your next steps should be:

For short-term goals: List each goal with specific dollar amounts and target dates. Calculate how much you need to save monthly to reach these goals on time.

For long-term goals: Document your goals with target dates and decide if each date is fixed or flexible. Then, figure out the investment returns needed to achieve these goals and choose the right vehicles.

Remember, your financial journey will have both short-term and long-term goals. The key to success is balancing these goals and choosing the right investment strategies for each time frame.

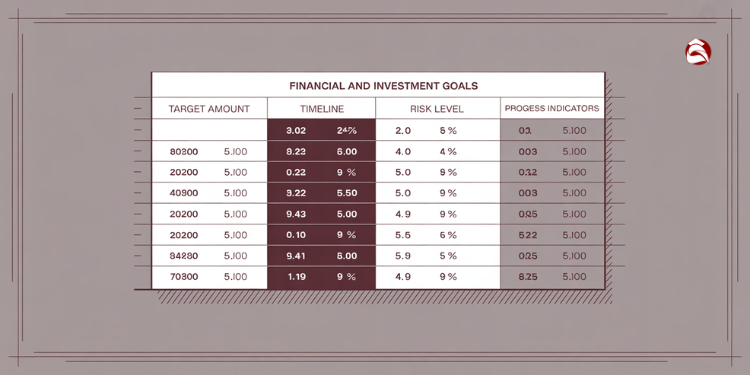

Success Metrics Tailored to Each Goal

Setting clear goals is powerful when you use the right success metrics. Clients who track progress well are 3.4 times more likely to hit their targets. This is key for financial and investment goals.

Financial goals are easy to measure. You either save what you need by the deadline or you don’t. Saving $100,000 for a home in 10 years is a clear goal.

Investment goals need more complex tracking. A good investment goal might aim for a 7% return with some risk.

Progress Tracking Techniques and Milestones

For both types of goals, I suggest a quarterly review. This helps catch small problems before they get big.

Three tracking methods work well for my clients:

- Percentage-to-target tracking for financial goals (e.g., “I’ve saved $42,000 toward my $100,000 home down payment—42% complete”)

- Compound Annual Growth Rate (CAGR) calculations for investment performance goals, which smooth out market volatility

- Risk-adjusted metrics like Sharpe ratio for investment goals that include risk parameters

Setting milestones boosts your chances of success. Celebrate at 33%, 66%, and 100% of your goal. This keeps you motivated and allows for adjustments if needed.

Frequent, documented progress-checks can raise the probability of hitting a goal by more than 25 percentage points, according to a meta-analysis covering 138 studies and 19,951 participants. Ref.: “Harkin, B., Webb, T., Chang, B., et al. (2015). Does Monitoring Goal Progress Promote Goal Attainment? Psychological Bulletin.” [!]

Success in investments doesn’t always mean the highest returns. Sometimes, a steady 5% with little risk is perfect. Your plan helps keep this focus, even when markets are shaky.

| Metric Type | Financial Goal Application | Investment Goal Application | Review Frequency | Success Indicator |

|---|---|---|---|---|

| Target Amount | Primary metric (e.g., $100K for down payment) | Secondary consideration | Quarterly | Percentage complete |

| Rate of Return | Helpful accelerator | Primary metric (e.g., 7% CAGR) | Quarterly | Comparison to benchmark |

| Risk Measures | Rarely considered | Critical component (e.g., Sharpe ratio) | Semi-annually | Volatility vs. expected range |

| Timeline Adherence | Fixed deadline focus | Flexible with market conditions | Annually | On-track percentage |

Setting goals needs a good measurement system. Without it, even big dreams stay dreams. Different goals need different tracking methods.

When clients struggle, they often use the wrong metrics. For example, just looking at quarterly returns for retirement savings misses the bigger picture.

What gets measured gets managed. But what gets measured incorrectly gets mismanaged.

Your next step: Make a simple spreadsheet for your financial goals. Track target amount, current progress, and any needed changes. This tool will help you stay on track.

“Read More: Financial Goals vs Investment Goals Differences Explained“

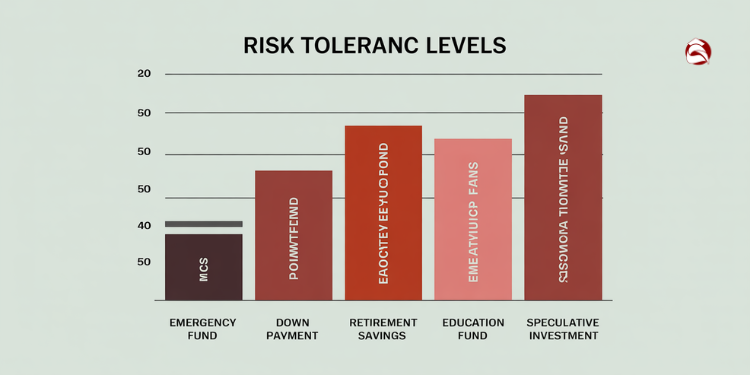

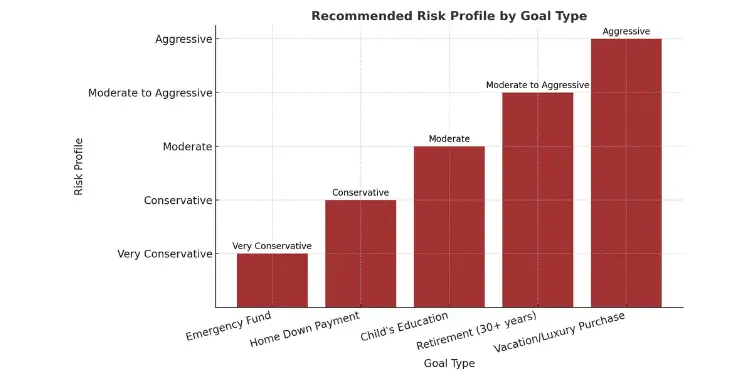

Risk Profiles Matching Goal Objectives

Risk profiles are not the same for everyone. They must fit each goal in your financial plan. Over 12 years, I’ve seen many think their risk tolerance is fixed. But, it really changes based on your financial goal.

Even the most careful investors can take big risks for some goals. This makes sense. Your emergency fund needs a different plan than your retirement or vacation fund.

Three key things decide the right risk level for each goal:

- Consequence of failure – How bad would it be if you miss this goal?

- Timeline flexibility – Can you delay this goal if needed?

- Amount flexibility – Can you change how much you need for this goal?

Think about your emergency fund. Failing here is very bad. You might get into debt. You can’t delay or change the amount much. So, you need to be very careful with your money here.

Now, think about buying a vacation home. Failing here isn’t as bad. You can wait longer or choose a smaller home. This goal can handle more risk, which might make your investment grow.

The biggest mistake I see investors make is applying a single risk profile across all their financial goals. This approach either leaves growth on the table or exposes critical goals to unnecessary volatility.

I suggest making a “risk budget” for each goal. Use your risk tolerance where it matters most. Goals that need to happen soon and are very important should be safe. Goals that can wait and are less important can take more risk for higher returns.

Your investment plan should show these differences. For goals that need to be safe, use things like high-yield savings accounts or short-term bonds. These keep your money safe but offer small returns. Remember, bonds can lose value when interest rates go up.

For goals that can wait and are more flexible, you might choose investments that grow more. These can change a lot in the short term but can grow more over time.

| Goal Type | Consequence of Failure | Timeline Flexibility | Amount Flexibility | Recommended Risk Profile |

|---|---|---|---|---|

| Emergency Fund | High | Low | Low | Very Conservative |

| Home Down Payment | Medium | Medium | Low | Conservative |

| Child’s Education | High | Low | Medium | Moderate |

| Retirement (30+ years) | High | Medium | Medium | Moderate to Aggressive |

| Vacation/Luxury Purchase | Low | High | High | Aggressive |

Next, rate each goal on a 1-10 scale for each factor. Goals that are flexible and not critical can handle more risk. This helps you tailor your risk profile for each goal, not just one for everything.

Investing is about finding the right balance between risk and reward. It’s not about always trying to make more money or avoiding risk. It’s about taking the right amount of risk for each goal. This is what makes investors successful, not stressed or missing their goals.

“You Might Also Like: Goal Based Investing Explained for New Investors“

Financial Vehicles Supporting Different Goals

Choosing the right financial vehicles is key to reaching your goals. Just like a sports car isn’t best for off-road, not all investments are right for every goal. Many investors fail because they picked the wrong tool for their needs.

Match your financial vehicles with your goals’ time and risk levels. This ensures your money works well, not against you. The right choice can lead to success, while the wrong one can cause setbacks.

Savings Products for Fixed Horizon Goals

Fixed-horizon goals need vehicles that keep your money safe and earn steady returns. These goals must be met exactly on time, as missing them can have big consequences.

For goals under 12 months, high-yield savings accounts are great. They offer safety and easy access, earning more than regular savings. They’re perfect for emergency funds or soon-to-be purchases.

For 1-3 years, Treasury bills or CDs are good choices. They offer better returns with little risk. I suggest a mini-ladder of these for multiple short-term goals.

For 3-5 years, short-duration bond funds are a good middle ground. They handle small interest rate changes well, beating inflation.

As the stakes of missing your goal rise, so should the safety of your investment. I advise clients to have separate accounts for each goal. This way, each goal has the right investment.

Don’t mix short-term goals with investments that can lose value. Even safe bonds can drop 5-10% in rising rates. This could hurt if you need that money soon.

Your next step is to match each goal with the right. This careful matching ensures your money is ready when you need it.

Investment Products for Growth Objectives

Growth goals need different vehicles than short-term ones. They benefit from time in the market and compounding. This allows for more aggressive investment strategies.

For 5-10 years, balanced funds or ETFs with 40-60% equity are good. They offer growth and some stability. This mix helps with market ups and downs.

For 10-15 years, 60-80% equity in index funds or managed options is suitable. This higher equity exposure aims for growth while allowing time to recover from downturns.

For goals over 15 years, like retirement, more aggressive investments are okay. This includes small-cap stocks, international equities, and alternatives, depending on your risk tolerance.

The key difference in these vehicles is their growth and adjustability. Growth portfolios should have a “glide path” that reduces risk as the goal date nears.

This risk reduction is vital to avoid losing money just before needing it. For retirement, target-date funds can help, but they might not fit your exact situation.

Money market funds are great for the final months before your goal. They offer liquidity and returns while keeping your principal safe from market swings.

Your portfolio should have various investments, each for a specific goal. This approach ensures each dollar has a purpose, not just chasing returns.

For each growth goal, plan how your investment allocation will change as the goal date gets closer. This strategy avoids panic during market ups and downs, keeping your plan on track.

“Related Articles: How to Set Realistic Investment Goals Successfully“

Prioritization Framework for Conflicting Goals

Financial goal conflicts are common, but they can be solved with a good plan. After 12 years of helping investors, I’ve learned that you can’t fund every goal at once. It’s important to understand how financial and investment goals work together.

When setting investment goals, you need a clear way to choose which ones to focus on first. It’s better to focus on a few goals than to spread your resources too thin. This way, you can make your financial health better.

I suggest a three-tier framework to help solve these conflicts:

- Security Tier – Start by saving for emergencies and insurance. This protects your other goals from big problems. Saving 3-6 months of expenses in easy-to-access accounts is key.

- High-ROI Tier – Next, grab all “free money” chances like employer 401(k) matches. These offer big benefits that can’t be found elsewhere.

- Aspiration Tier – Then, use what’s left for goals like buying a home, paying for kids’ education, or traveling.

More than 85 % of 401(k) plans offer an employer match—commonly dollar-for-dollar on the first 3 % of pay—effectively adding an instant 100 % return on those contributions. Ref.: “Fidelity Smart Money. (2024). How Does a 401(k) Match Work? Fidelity.” [!]

This method helps you decide how much to put into each goal when you don’t have enough. A financial advisor can make this plan fit your needs.

Balancing Security and Opportunity Costs

One big conflict is between saving for retirement and funding other big goals like buying a home or paying for kids’ education. Retirement is special because you can’t borrow for it later.

This makes retirement a top priority. Other goals might have other ways to get money, but retirement doesn’t.

When you’re choosing between goals, think about the “true cost of delay” for each:

| Goal Type | Immediate Cost of Delay | Long-term Cost of Delay | Alternative Funding Options |

|---|---|---|---|

| Retirement | Lost tax advantages | Compound growth (potentially decades) | Very limited |

| Home Purchase | Continued rent payments | Missed appreciation/equity building | Various mortgage options |

| Education | None (if pre-college) | Potential higher interest on future loans | Scholarships, loans, work-study |

For retirement, waiting means missing out on years of growth. For homes, waiting means more rent and less chance to own. Every choice has costs you might not see right away.

If your goals and priorities clash, get help from a financial expert. A registered investment advisor can guide you based on your unique situation.

There’s a lot to consider when trying to meet financial goals. Things like tax bracket, the amount of money you can invest, and whether you’re investing a lump sum or adding to your balance over time all come into play.

Your next step: Make a list of your financial goals using this three-tier system. Put a specific amount each month into each goal based on its priority. Check this plan every quarter to make sure it’s right for you now.

Adjusting Goals Amid Life Transitions

Life doesn’t always go as planned. You might face career changes, new relationships, or unexpected money. Your investment strategy must flex with these changes. I’ve helped many people adjust their plans, and those who separate their financial and investment goals do best.

When life changes, follow these three steps:

First, check if your financial goals are realistic. Some goals might need more time, others less. Starting with just $100 and a plan can help you begin.

“For More Information:

Second, update your investment goals to fit your new situation. You might choose lower returns for less risk during tough times. Having 3-6 months of expenses saved helps a lot.

Third, use special tactics for big changes. If you’re moving from saving to spending, your investing strategy must change too. You’ll need to split your money to meet different goals at once.

Changing your goals isn’t a failure. It’s smart financial planning. Make a plan for big life changes. This keeps your financial journey clear and helps you reach your goals, even when life throws surprises.