Ever look at your bank statement and wonder where your paycheck went? I did too. My credit card statements had charges I couldn’t explain. This left me confused and upset every month.

Then, I found a simple yet powerful way to manage money. It’s based on a simple idea: your income minus expenses equals zero. This isn’t because you’ve spent everything. It’s because every dollar has a job.

This budgeting method is different because you see everything. Other methods might leave room for random spending. But this one lets you know exactly where your money is going.

The best part of zero-based budgeting is how flexible it is. It works for anyone, no matter how much money you make. The rules stay the same, whether you have a little or a lot.

Zero-based budgeting is lauded for its adaptability across varying income levels, allowing individuals to tailor their budgets monthly based on current financial situations and goals. This flexibility ensures that budgeting remains relevant and effective, regardless of income fluctuations. Ref.: “The Budgetess. (2024). Zero-Based Budgeting 101 – Guide, Categories + Examples. The Budgetess.” [!]

- Assign every dollar a specific purpose before the month begins

- Track all expenses to maintain complete financial awareness

- Adjust your plan monthly to match your real-life needs

- Eliminate those “where did my money go?” moments permanently

Why tracking to absolute zero exposes hidden spending leaks fast

Tracking your money to zero is like turning on a light in a dark room. Suddenly, you see all your spending. When I started zero-based budgeting, I found I was losing over $400 a month on things I forgot I bought. That’s like losing a car payment or half a mortgage!

Old budgeting methods hide where your money goes. It might be streaming services you forgot about, daily coffee, or Amazon buys. Zero-based budgeting makes these leaks show up immediately, not at the end of the month.

This method makes you think about every dollar. That $15 lunch is now $15 that can’t go to your vacation or debt. This makes you more careful with your money.

“The moment I started tracking to zero, I understood where my money went each month. It was like putting on glasses for the first time and seeing all the details I’d been missing.”

Zero-based budgeting gives you instant feedback. Other methods might take months to show you where you’re spending too much. With zero tracking, you know right away if you’re about to overspend. This lets you fix it before it gets worse.

Getting rid of hidden spending makes your finances better fast. Most people I’ve helped find they’re losing $200-$600 a month. Imagine what you could do with an extra $3,600-$7,200 a year!

| Aspect | Traditional Budgeting | Zero-Based Tracking | Impact on Spending |

|---|---|---|---|

| Visibility | Partial – focuses on major categories | Complete – every dollar is assigned | Eliminates blind spots where money disappears |

| Feedback Speed | End of month review | Immediate awareness | Prevents overspending before it happens |

| Psychological Effect | Limited awareness | Heightened spending consciousness | Creates pause before impulse purchases |

| Leak Detection | Slow – patterns emerge over months | Fast – leaks visible immediately | Saves hundreds of dollars monthly |

| Flexibility | Rigid monthly templates | Adjustable as life happens | Reduces budget abandonment |

Tracking to zero changes how you think about money. You start to direct your money on purpose. This shift helps you stop spending randomly.

When every dollar has a purpose, you question your purchases more. “Do I really need this?” becomes your new question. This small change is what makes zero-based budgeting work.

Choose a tracking method that you will actually stick with daily

The secret to keeping a zero-based budget is not just making one. It’s finding a way to track your money every day. I learned this the hard way. I tried fancy apps but ended up using a simple notebook.

Zero-based budgeting needs you to pay attention every day. It’s different from traditional budgeting. With zero-based, you start fresh each month.

I started with three apps, a spreadsheet, and a budget planner. But the simplest thing worked best. It was a notebook by my wallet. Your best method might be different, and that’s okay.

Notebook spreadsheet or app each offers unique strengths

Each way to track money has its own good points. They match up with what you like and how you live:

- Paper notebooks help you feel connected to your money. Writing down what you spend makes you more accountable. It’s always there and never breaks.

- Spreadsheets are great for digging into your budget. They let you make your own categories and see how your money moves. They’re perfect if you like numbers.

- Budgeting apps make tracking easy and automatic. They connect to your accounts and send alerts. They’re great if you’re always on your phone.

Choose wisely based on what you do every day. Do you always check your phone? An app might be best. Do you like writing things down? A notebook could work for you. Do you like looking at data? A spreadsheet might keep you interested.

Watching friends, I see why some give up. They pick a system that doesn’t fit them. One friend who doesn’t like tech used an app. My brother, who loves tech, found a paper system hard.

“The best budget tracking system isn’t the most sophisticated one—it’s the one you’ll actually use consistently.”

When using zero-based budgeting, your method should help you use every dollar wisely. It should show you when you’ve used up all your money. This helps you see if you’ve reached your goals.

The right method should fit into your life easily. It shouldn’t feel like a chore. Your budgeting should be a natural part of your life, not something you dread.

“Related Articles: What is zero paycheck budget for irregular income earners”

Log every transaction immediately to maintain live category balances

Logging every transaction right away is key to budget success. It’s all about zero-based budgeting. Your budget is a living plan that needs updates.

I learned the hard way. Trying to log all transactions at once lost me $200. Don’t make the same mistake.

Every time money moves, log it right away. Got paid? Add it to your income. Bought groceries? Subtract from food.

Accurate balances stop overspending. They keep your budget on track.

Photo Receipt Capture Speeds Entry on Hectic Days

Life gets busy. Photo receipt capture helps on hectic days. Snap a picture of your receipt and process it later.

Most apps have this feature. Even a phone album works. Make logging easy to keep up with it.

Here are ways to log transactions daily:

- Keep your budgeting app on your phone’s home screen for one-tap access

- Set a daily reminder to check your wallet for receipts

- Process all photo receipts during the same time each day (like before bed)

- Log transactions while waiting in line for your next purchase

Consistency is more important than being perfect. Missing a transaction? Get back on track right away. This habit changes your financial awareness forever.

When your paycheck comes, you’ll know where every dollar goes. This clarity makes managing money easier. It helps you reach your goals like paying off debt or saving.

“You Might Also Like: What is zero based budgeting explained simply for beginners”

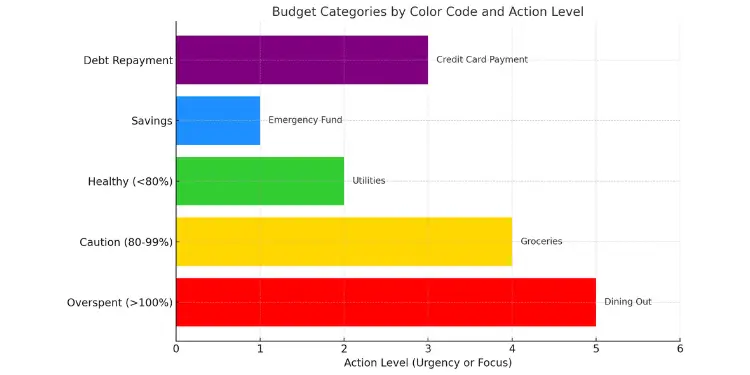

Color code categories so problem areas jump out visually

Colors are processed 60,000 times faster than text. This makes color-coded budget categories a powerful tool against overspending. Last year, I used this method and quickly saw my restaurant spending problems.

Incorporating color-coding in budgeting enhances clarity and efficiency, as visual cues facilitate quicker comprehension of financial data, aiding in better decision-making and spending control. Ref.: “FasterCapital. (2025). Expense Categories: Categorizing Expenses with Color: Clarity in Financial Modeling. FasterCapital.” [!]

Color coding turns your zero-based budget into clear visual feedback. It works with paper notebooks, spreadsheets, or apps. The goal is to make your money status clear at any moment.

Use a simple traffic light system. Red means you’ve spent too much. Yellow means you’re getting close to your limit. Green means you’re doing well.

For paper trackers, use colored pens. Spreadsheets can change colors automatically. Most apps also offer color coding, but you might need to adjust settings.

“Discover More: Best zero budgeting apps for effortless money control”

Red For Overspend, Green For Under Budget Comfort

Color coding affects your mind. Seeing red can motivate you to change. For me, seeing my restaurant spending in red pushed me to start meal prepping.

Green categories give you positive feedback. They show where you can spend more. This system helps you stick to good spending habits and alerts you when to adjust.

You can use more colors for special needs. Blue for savings, purple for debt repayment. Choose colors that make sense to you.

Color coding helps you manage your budget better. It makes it clear where your money should go. This makes it easier to decide between needs and wants.

| Color | Budget Status | Example Category | Action Needed |

|---|---|---|---|

| Red | Overspent (>100% used) | Dining Out | Immediate adjustment or transfer from another category |

| Yellow | Caution (80-99% used) | Groceries | Monitor closely, consider reducing spending |

| Green | Healthy ( | Utilities | Continue as planned |

| Blue | Savings categories | Emergency Fund | Continue contributions, celebrate growth |

| Purple | Debt categories | Credit Card Payment | Maintain minimum payments, add extra when possible |

Got money left over? Color coding helps you decide where it goes. It can go to red categories or your emergency fund or debt repayment.

This system is flexible. It changes with your budget needs. It keeps your financial plan on track. It’s a simple tool that becomes very powerful.

Set phone alerts when category balance drops near critical level

Phone alerts can help you manage your money better. They remind you when you’re close to spending too much. This can stop you from making big money mistakes.

Last summer, I lost track of my grocery money. Now, my phone alerts me when I’ve spent 70% of my budget. This gives me time to plan better.

Many budget apps, like EveryDollar, let you set alerts. You can also use calendar reminders or text alerts for spending limits.

While setting up spending alerts is beneficial, it’s crucial to customize alert thresholds to align with personal spending habits to prevent alert fatigue and ensure meaningful notifications. Ref.: “The Yale Wave. (2025). 7 Apps for Better Personal Budgeting. The Yale Wave.” [!]

“Further Reading: How to start zero budgeting with simple step by step guide”

Setting Effective Alert Thresholds

Finding the right alert levels is key. These levels should match your spending habits and what’s important to you.

For things like food and bills, set alerts at 70-80%. For fun money, alerts at 50-60% give you more time to adjust.

When you’re about to spend the last of your money, think carefully. This is true for things that often have unexpected costs.

Types of Budget Alerts That Prevent Overspending

- Threshold alerts: Tell you when you’ve spent a certain percentage (70%, 80%, 90%)

- Calendar-based alerts: Remind you to check certain categories at key times

- Trend alerts: Warn you if you’re spending more than usual

- Zero-approach warnings: Alert you when you’re about to spend the last of your money

The best alerts give you details, like how much money you have left and how long it will last. For example: “Grocery budget: $42 left for 8 days.”

This helps you make smarter choices when you’re tempted to spend. It turns abstract numbers into real-life decisions.

“Related Topics: How to track zero budget using free tools”

Customizing Alerts for Your Financial Priorities

Your alerts should match your financial goals. If you’re paying off debt, alert yourself early for fun money. This ensures you pay your bills on time.

When you’ve spent all your money, every dollar counts. Alerts help keep your spending balanced.

“The most powerful budget alerts aren’t the ones that tell you what you’ve already done wrong—they’re the ones that catch you before you make the mistake.”

At the start of each period, check and adjust your alerts. If you know you’ll spend more in certain times (like holidays), set alerts earlier.

For areas where you tend to overspend, use multiple alerts. For example, at 50%, 75%, and 90%. This warns you more urgently as you get closer to spending too much.

Alerts can change your spending habits. They make you think twice before buying, helping you save money. It’s like having a personal financial advisor reminding you to stay on track.

“Read More: How zero budget tracking works to stop random spending”

Weekly review highlights patterns and informs next spending decisions

Every week, take 30 minutes to look at your zero budget tracking. This helps spot spending patterns that daily tracking might miss. You’ll see trends that need attention before they become big problems.

Regular weekly reviews of budgeting practices can uncover spending patterns and trends not immediately evident, allowing for timely adjustments and improved financial management. Ref.: “Ramsey Solutions. (2025). Zero-Based Budgeting: What It Is and How to Use It. Ramsey Solutions.” [!]

During your weekly review, follow five easy steps. First, check all your transactions. Then, see how much money you have left in each category. Look for categories that are getting close to their limits.

If needed, move money between categories. Also, think about what you’ll spend in the future. This process requires you to explain both old and new. It helps you stay honest about your spending.

“Explore More:

Celebrate wins and identify habits you can tweak

Always celebrate when you stay under budget in a category. This keeps you motivated. When I started, I gave myself a small treat for every three weeks I stayed under my dining-out budget.

See overspending as a chance to learn, not as a failure. Each week, your budget is checked to see if it meets your needs. This way, you don’t just keep spending more without thinking.

After a few months, you’ll really understand your spending habits. You’ll be able to predict problems and make better financial choices. Zero budget tracking becomes a powerful tool that helps you control your money.