Can one budgeting formula work for everyone? From Manhattan executives to rural Midwest families? The 50/30/20 method has become popular in America. Elizabeth Warren introduced it in her book “All Your Worth: The Ultimate Lifetime Money Plan.”

This easy method splits your after-tax income into three parts. 50% goes to needs like housing and food. 30% is for wants, and 20% for savings and debt payments.

As a financial advisor, I’ve seen clients with different incomes try this method. Those with $40,000 salaries and those earning more have had different results. Their success depended on their location, debt, and family needs.

The big question is, will this system work for you? Let’s look at how it does for different people in America. We’ll see if you might need to change it to meet your financial goals.

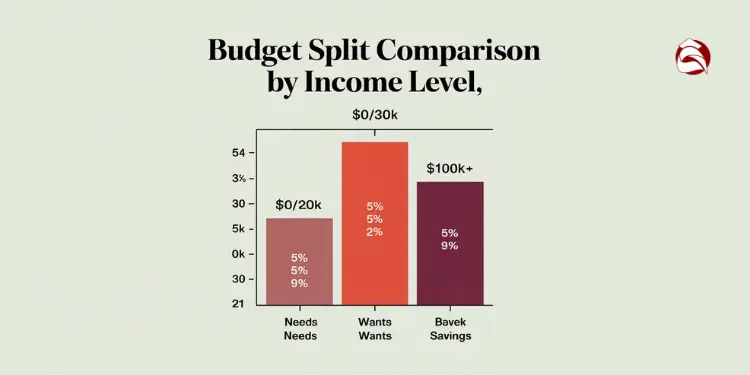

How the 50/30/20 Rule Performs by Income Group

The 50/30/20 rule is popular for budgeting. It suggests spending 50% on needs, 30% on wants, and 20% on savings. But does it work for everyone? I’ve helped many clients, and the results vary.

In the US, the Real median household income in the U.S. was $80,610 in 2023—a 4.0 % increase over 2022. This means a monthly take-home pay of about $5,406. The rule suggests spending $2,703 on needs. But most families spend more on basics like housing and food.

Let’s look at how this rule works for different income levels. We’ll see what changes might be needed.

Under 30k Income Sample Calculations

For those earning under $30,000, the rule is hard to follow. With a monthly income of about $2,000, there’s only $1,000 for needs. This rarely covers the basics.

Maria, a single parent in Phoenix, earns $28,000 a year. Her monthly income is about $1,950. The 50/30/20 rule would give her:

- Needs (50%): $975

- Wants (30%): $585

- Savings (20%): $390

But Maria’s rent is $950. She’s left with just $25 for other needs. In reality, her budget looks more like:

- Needs (75%): $1,462

- Wants (15%): $293

- Savings (10%): $195

This shows how hard it is for low-income families. The rule doesn’t account for the high cost of basic needs.

Middle Class Budget Outcomes and Gaps

Middle-income families find the rule a bit easier but not always. Let’s look at the Taylor family in suburban Atlanta.

They earn $75,000 a year. Their monthly income is about $4,700. The 50/30/20 rule would give them:

- Needs (50%): $2,350

- Wants (30%): $1,410

- Savings (20%): $940

But their mortgage, car payments, and other costs total $3,500. This is more than their “needs” budget. They have to cut back on savings or wants.

Middle-class families in expensive areas might need to budget 60/20/20. Even then, unexpected costs can mess up their budget.

Upper Income Lifestyle Creep Watchouts

For those earning over $100,000, the rule is mathematically possible. But they face a different challenge: lifestyle inflation. High-earning clients often struggle to decide what’s a need versus a want.

Consider the Johnsons, who earn $150,000 a year. Their monthly income is about $9,000. The 50/30/20 rule would give them:

- Needs (50%): $4,500

- Wants (30%): $2,700

- Savings (20%): $1,800

They have enough for basic needs. But they might start to see luxury items as needs. This is called lifestyle inflation.

Between 2021 and 2023, grocery costs rose ~15%, while average housing costs increased even more, forcing households to shrink their discretionary “wants” budget. Ref.: “Investopedia (2024). Frustrated by Rising Grocery Costs?” [!]

The Johnsons might buy a $700 SUV or a $3,000 home. They might also pay $1,500 a month for private school. The challenge is not the math but staying disciplined in what they consider needs.

The rule works best as a guide against unnecessary spending. It helps keep financial progress on track.

| Income Bracket | Ideal 50/30/20 Split | Realistic Split | Primary Challenge | Recommended Adjustment |

|---|---|---|---|---|

| Under $30k | $1,000/$600/$400 monthly | 75/15/10 | Basic needs exceed 50% allocation | Focus on increasing income; use 70/20/10 temporarily |

| $50k-$100k | $2,500/$1,500/$1,000 monthly | 60/20/20 | Housing costs in high-cost areas | Reduce housing costs or adjust to 60/20/20 |

| Over $100k | $4,500/$2,700/$1,800 monthly | 50/30/20 possible | Lifestyle inflation blurring needs/wants | Strict categorization; increase savings to 25-30% |

| Any bracket in HCOL areas | Varies by income | 60/20/20 or 70/15/15 | Housing costs consume 40%+ of income | Consider relocation or income increase strategies |

The 50/30/20 rule is useful but needs adjustments based on income and location. Low-income families might need to spend more on needs. Middle-income families might adjust the percentages. High-income families should avoid lifestyle inflation by being strict about needs and wants.

In high-cost living areas, financial planners suggest a 60/30/10 or 60/20/20 budget model to better reflect rising essentials spending while preserving savings. Ref.: “Time (2024). Why a 60/30/10 Budget Could Be the New 50/30/20” [!]

What’s key is not to follow the exact percentages. Use the rule as a starting point to cover needs, enjoy the present, and plan for the future.

“Learn More About: 50/30/20 vs 60/20/20 budget full comparison guide“

Impact of Recent Inflation on Budget Allocations

The 50/30/20 rule is hard to follow today because living costs are going up. When I looked at my clients’ budgets, I saw a big problem. The 50% for needs wasn’t enough for most families.

Average CPI‑U rose ~4.5 % annually 2020–2023, while real median household income increased only 2.4 % overall. This makes it tough for people to stick to their budgets.

Inflation Trend Compression on Wants Category

When costs for needs go up, wants have to shrink. This makes it hard to keep the 30% for wants. It can make people give up on budgeting.

If your rent or mortgage goes up by $200 a month, you have to cut back. Usually, this means taking from the wants category. It can shrink to 10-15% of your budget.

“The modern cost of living crisis isn’t just about tightening belts temporarily—it’s forcing a fundamental rethinking of how we categorize expenses in our financial planning.”

In expensive cities like San Francisco, housing can take 40-50% of your income. Maria, a marketing pro, spends 47% of her income on rent and other needs. This leaves only 33% for wants and savings.

| Necessity Category | Average Inflation (2019-2023) | Impact on 50/30/20 Budget | Adjustment Needed |

|---|---|---|---|

| Housing | 24.8% | Severe compression | Housing alternatives, roommates |

| Food | 19.2% | Moderate compression | Meal planning, bulk buying |

| Healthcare | 14.5% | Significant impact | HSA utilization, preventive care |

| Transportation | 16.7% | Moderate impact | Public transit, carpooling |

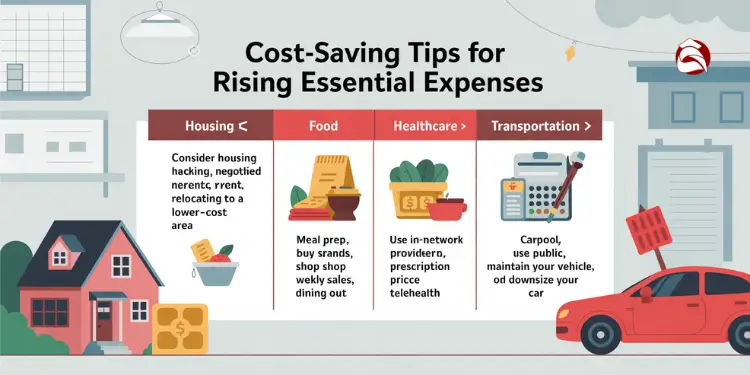

Strategies for Necessities Exceeding Guideline Share

When needs take more than half of your budget, you need smart solutions. I’ve helped many clients adjust the 50/30/20 rule to fit their lives. Here are some tips:

First, try adjusting your percentages temporarily. A 60/20/20 or 65/15/20 split can help during tough times. Always try to save 20%.

Second, look for “necessity creep” in your budget. This is when wants look like needs. Cutting back on things like cable or phone plans can save a lot. I saved $137 a month by reviewing my own needs.

- Housing alternatives: Think about downsizing, getting a roommate, or negotiating your lease. Even a 5% cut in housing costs can help a lot.

- Food cost management: Plan meals, shop smart, and cook in batches. My clients save 15-20% on food this way.

- Bill negotiation: Talk to service providers for better rates on insurance, internet, and phone. About 70% of my clients get discounts just by asking.

- Income boosting: Try side hustles to balance your budget during inflation.

The 50/30/20 rule is a guide, not a rule. Making temporary changes doesn’t mean you’ve failed. It shows you can adapt to economic changes. The rule’s value is in its idea of balance, not the exact numbers.

James and Sophia in Chicago had to adjust their budget when their rent went up. They changed to a 63/17/20 model. They worked to lower their costs and found a cheaper apartment. After eight months, they got their costs back to 54%.

The key is to know where your money goes. Even if you can’t stick to the 50/30/20 rule, tracking your money helps you make smart choices during hard times.

Adapting the Rule for High‑Debt Households

For Americans with a lot of debt, the 50/30/20 budgeting rule needs changes. Student loans, credit cards, and medical bills take up a lot of your money. This makes it hard to fit everything into neat categories.

First, understand how debt fits into the 50/30/20 rule. The rule says minimum debt payments are “needs” (50%). Extra payments toward debt are “savings” (20%). This creates a challenge for those trying to pay off debt and save at the same time.

I’ve helped clients with over $50,000 in student loans. They found it hard to follow the 50/30/20 rule. For example, a law school graduate’s student loan payments took 30% of her income. This made it hard to stick to the percentages.

Debt avalanche and balance-transfer refinancing have been shown to significantly reduce interest charges and monthly obligations—helping households restore healthier budgeting proportions. Ref.: “MoneyDigest (2023). Is The 50/30/20 Budget Rule Actually Realistic?” [!]

Balancing Debt Repayment Against Savings Rule

When debt is a big part of your finances, you need a smart plan. You must balance paying off debt and saving. The question is: Should you focus on debt or building an emergency fund?

Experts say start with a small emergency fund of $1,000 before tackling debt. This helps you avoid taking on more debt when unexpected expenses come up.

After you have a small emergency fund, you can put more money toward debt. There are two good ways to do this:

- Debt avalanche method: Pay off the debt with the highest interest first. Make minimum payments on other debts. This saves the most money in interest.

- Debt snowball method: Pay off the smallest debt first, no matter the interest rate. This gives you quick wins and keeps you motivated.

I usually suggest the avalanche method for high-interest credit card debt. But if you need motivation, the snowball method’s quick wins can help.

Your debt-to-savings ratio in the 20% savings category depends on your situation. If you have high-interest credit card debt, focus on debt repayment. But also aim to build an emergency fund to cover 3-6 months of expenses.

“I was drowning in $68,000 of student loan debt while trying to save for a house. By temporarily adjusting my 50/30/20 rule to more like 50/25/25 – with 15% to debt and 10% to savings – I made real progress without feeling completely deprived.”

“Check This Out: Should I use 50/30/20 budget or another budgeting method“

Refinancing Options to Restore Rule Proportions

Refinancing can help you get back to the 50/30/20 rule. Lower interest rates or longer repayment terms can reduce your monthly payments. This frees up more money for other needs.

For student loans, federal consolidation keeps you in the federal system but doesn’t lower interest rates. Private refinancing can lower your rate if your credit score has improved.

Credit card debt can be tackled through balance transfer offers or personal debt consolidation loans. Many balance transfer cards offer 0% interest for 12-18 months. This gives you a chance to make progress without interest.

| Refinancing Option | Potential Monthly Savings | Best For | Cautions |

|---|---|---|---|

| Student Loan Refinancing | $50-$300 | Borrowers with strong credit and income | Loses federal loan protections |

| Balance Transfer Card | $15-$25 per $1,000 (during promo period) | Credit card debt under $15,000 | Transfer fees; high rates after promo |

| Debt Consolidation Loan | $30-$100 | Multiple high-interest debts | Requires good credit for best rates |

| Mortgage Refinancing | $100-$500 | Homeowners with equity | Closing costs; extends debt timeline |

When considering refinancing, think about the total cost over the loan’s life. A longer repayment period might lower monthly payments but could cost more in interest.

I helped a couple consolidate five credit cards with rates between 18-24% into a single loan at 9%. This reduced their monthly payments by $320. It helped them stick to the 50/30/20 rule while aggressively paying off debt.

Homeowners with equity can use a cash-out refinance or home equity loan to pay off high-interest debt. This strategy comes with risks but can lower interest rates and restore budget proportions.

Remember, refinancing isn’t a solution for spending problems. You need to change your spending habits to avoid getting back into debt. Use refinancing with a solid budget and spending plan to achieve lasting financial health.

“For More Information: Why use 50/30/20 budget for your personal finances“

Making the Rule Work with Irregular Income

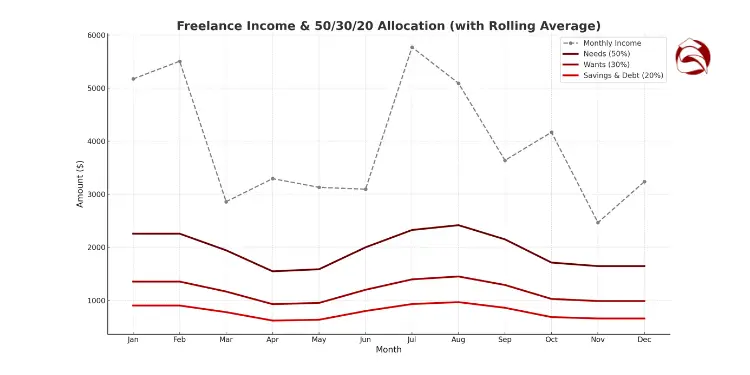

Freelance earnings can be unpredictable. This makes the 50/30/20 budget rule hard to follow. I learned this while freelancing for three years before starting Fahras.net.

Traditional budgeting doesn’t work well with unpredictable income. But, with some tweaks, you can manage your money. This is true even when your income changes a lot each month.

Freelancers and others with variable income face a big challenge. They can’t plan their budget for the next month. It’s tempting to give up on budgeting. But, you really need a flexible system then.

Adapting the 50/30/20 rule to variable freelance income works by using a rolling average or baseline from several months’ earnings—a method recommended by major banks. Ref.: “PNC Bank (2025). What is the 50/30/20 Rule?” [!]

Averaging Unpredictable Income for Baseline Percentage

To make the 50/30/20 rule work, find a reliable baseline. Don’t apply percentages to each month’s income. Look at your income patterns over time instead.

A 12-month rolling average gives a clear picture of your earning power. Add up your income for the past year and divide by 12. This is your baseline for budgeting.

For example, if your income varied from $2,500 to $7,000, averaging $4,200 a month, you’d allocate:

- $2,100 (50%) to needs

- $1,260 (30%) to wants

- $840 (20%) to savings and debt repayment

Another way is the “minimum income threshold” method. Average your three lowest-earning months. This is your baseline for essential expenses.

Tracking your income in a spreadsheet helps. It shows patterns and helps predict your income. Your spreadsheet should have columns for:

- Monthly gross income

- Taxes and business expenses

- Net income

- Rolling 12-month average

- 50/30/20 allocations based on your average

When you earn more than your baseline, save the extra. This disciplined approach helps manage your money better.

“Explore More: Does 50/30/20 budget work in real life situations“

Creating Rolling Buffer for Lean Months

A dedicated income stabilization fund is key for freelancers. It’s different from an emergency fund. It helps even out your cash flow during low-income periods.

Try to save enough to cover two months of expenses. In high-income months, add any extra to this fund. Then, use it in lean months to keep your budget on track.

When income drops, prioritize your spending. First, pay for essential needs. Then, make minimum debt payments and save for important goals. Spend on wants last and may need to cut back.

Keep track of your spending, even when income is low. Use apps or spreadsheets to stay on top of your money. This is even more important with variable income.

| Buffer Strategy | Best For | Implementation Method | Minimum Target |

|---|---|---|---|

| Percentage-Based Buffer | Freelancers with moderate income fluctuation | Save 10-15% of each payment regardless of amount | 2 months of baseline expenses |

| Surplus Capture | Seasonal workers with predictable high/low periods | Bank all income above baseline during high seasons | 3-4 months of baseline expenses |

| Minimum Expense Coverage | New freelancers with unpredictable income | Build buffer to cover only essential needs (50%) | 3 months of essential expenses |

| Separate Account Method | Disciplined budgeters who need physical separation | Deposit all income to savings, transfer monthly allowance | 6 months of total budget |

Successful freelancers treat their finances like a business. They have separate accounts for different needs. This helps avoid spending business income before taxes.

The 50/30/20 rule is a guideline, not a rule. Adjust it as your income and business grow. The key is to be consistent with your money management.

By using these strategies, you can make the 50/30/20 rule work for you. It helps manage your freelance lifestyle. Having a plan for both good and bad months is worth the effort.

“Related Articles: 50/30/20 needs vs wants categories for confident everyday spending choices“

Gather success stories plus cautionary tales

The 50/30/20 rule has helped many, but it’s not perfect for everyone. Over 10 years, I’ve seen it work well and not so well. It shows how simple budgeting can help in many ways.

Simplistic percentage-based budgeting should be treated as a flexible guideline—tracking actual spending and tailoring allocations leads to more sustainable outcomes. Ref.: “Empower (2025). The 50/30/20 Budget Rule Explained” [!]

Teacher Couple Doubles Savings Using Rule

Mark and Elaine, Ohio teachers, made $110,000 together. They wanted to save more but found it hard.

“We were skeptical about finding 20% for savings when we barely had anything left at month’s end,” Mark told me. They started tracking expenses with a spreadsheet.

They found they were spending too much on things they didn’t need. This included their cable and eating out too much. By changing how they spent, they saved almost $650 a month.

“The 50/30/20 rule gave us permission to enjoy our money while planning for tomorrow. We just needed to be honest about what was truly essential.”

They cut down on food costs by meal planning. They also stopped buying things on impulse. And they set up automatic savings for their emergency fund and retirement.

In 18 months, they doubled their savings to 16%. They even saved enough for a $15,000 emergency fund while traveling and having fun.

“You Might Also Like: 50/30/20 budget for low income households that stretches every dollar“

Recent Grad Adjusts Wants To Crush Debt

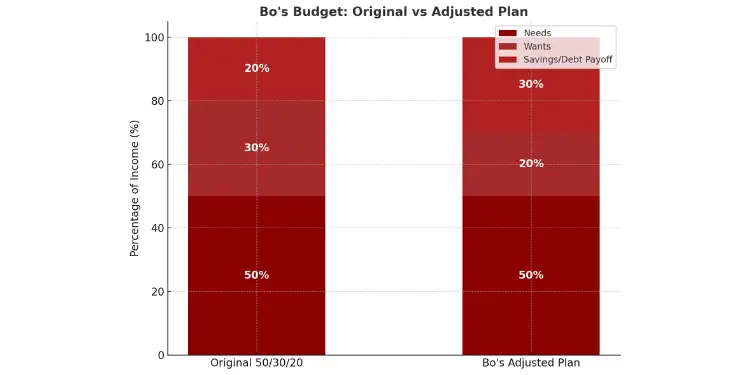

Bo graduated and got a job making $3,500 a month. They had $45,000 in student loans and wanted to pay them off fast.

Bo used a budgeting app to track spending. They decided to change the 50/30/20 rule to fit their goals. They put 30% toward debt instead of wants.

“I decided my future financial freedom was worth more than extra spending now,” Bo explained. This way, they could pay off loans faster while having some money for fun.

By paying $1,050 a month toward loans, Bo cut years off their debt. They kept wants to 20% by finding free fun and cooking at home. Needs took up 50% of their income.

In two years, Bo paid off almost half their debt. They also started saving for emergencies. This shows how the 50/30/20 rule can be flexible and effective.

Not everyone succeeds with the 50/30/20 rule. The Morales family in San Francisco found it hard because of high housing costs. They had to look for a new way to budget.

Freelancer Jamal found the rule too strict for his variable income. “The envelope system got complicated with unpredictable earnings,” he said. He had to plan by quarters instead of months.

These stories show the 50/30/20 rule is just a starting point. It needs to be adjusted to fit each person’s life. The key is to keep track of spending and be flexible.

Decide if tweaks make rule sustainable

The 50/30/20 rule is very flexible. It works for many, but you might need different numbers. This depends on your financial situation.

Alternative Percentage Splits That Work

If you live in a pricey city, try a 60/20/20 split. It lets you spend more on rent or a house. Yet, it keeps your savings goals in mind.

For those wanting to save more, a 50/15/35 split is good. It cuts down on spending on wants. This way, you can save more for retirement or emergencies.

Think of the 50-30-20 rule as a starting point. It’s not set in stone. Your spending will show where you need more money.

“Read More:

Customizing Percentages For Your Goals

Every budget should fit your life stage. New graduates might save 30% instead of 20%. Parents saving for college can adjust to fit education costs and daily expenses.

This rule is a guide, not a rule. Spend a month following the 50-30-20 rule. Then, change the numbers based on your spending. The right numbers help you sleep well and reach your goals.

Budget frameworks like 50/30/20 help build financial habits—but industry experts recommend periodic re-evaluation and adjustment to align with changing cost structures and personal goals. Ref.: “Marcus by Goldman Sachs (2024). The 50-30-20 Rule and Other Budgeting Methods” [!]

Your budget should grow with you. Change it yearly or with big life changes. The best budget is one you’ll use, not perfect math.