What if waiting just one year to start investing costs you over $100,000 in retirement savings? This isn’t just a theory—it’s a real cost. Vanguard research shows that waiting five years can cut your retirement savings by nearly 30%.

“The best time to plant a tree was twenty years ago. The second best time is now.” This saying is true for building wealth. I’ve seen many clients regret not starting their financial plans sooner. They didn’t understand how much time affects their wealth.

Every month counts. The numbers show the power of compounding. A 25-year-old who starts saving early will likely have more wealth than someone starting at 35. This is true even if the older person saves more.

The market will always change, but having clear long-term financial goals is more important. Starting today, no matter what the economy is doing, sets you up for success.

Key takeaways:

- Delaying investment decisions can significantly reduce your potential wealth.

- The power of compounding grows faster with more time.

- Starting now with a steady investment plan beats waiting for the “perfect” time.

- Clear financial goals guide you, even when the market is volatile.

Compound growth rewards early starters

Starting early in investing can lead to substantial wealth gains. I’ve seen how compound growth can turn small savings into immense wealth. Early starters get a head start with compound interest.

Compound interest works by making your returns earn returns. This creates a snowball effect that grows faster over time. Let’s see how significant this effect can be.

| Investment Scenario | Initial Investment | Age Started | Value at Age 65 | Total Growth |

|---|---|---|---|---|

| Early Starter | $10,000 | 25 | $149,744 | 1,397% |

| Late Starter | $30,000 | 45 | $81,136 | 170% |

| Difference | -$20,000 | 20 years | +$68,608 | +1,227% |

This table shows a 7% annual return. The early starter invests $20,000 less but gains nearly $70,000 more. It’s the power of time and compound interest.

Small Contributions Snowball Remarkably Over Time

Compound growth turns small, steady investments into immense wealth. It’s perfect for middle-income earners. You don’t need a lot of money to grow your wealth – just time and consistency.

A 30-year-old investing $300 monthly at 7% returns will have about $451,000 by age 65. They’ve only put in $126,000. The rest is from compound growth.

Now, compare this to someone starting at 45. By 65, they’ll have about $122,000, having put in $72,000. The compound growth adds only $50,000.

This shows why I tell clients to invest early, even with small amounts. Every five years of delay means doubling your monthly investment to reach the same goal. Your time is your most valuable asset for long-term goals.

Early Gains Buffer Later Setbacks

Starting early also makes your investments more resilient to market ups and downs. A big early gain can protect your portfolio during tough times.

I saw this in the 2008 financial crisis. Clients who started in their 30s felt the impact but had a big cushion. Their long-term view helped them stay the course.

On the other hand, those who started in their 50s faced a huge setback. With less time to recover and fewer gains to cushion losses, many panicked and sold at the worst time.

The best time to plant a tree was 20 years ago. The second best time is now.

This proverb is perfect for investing. While starting early is better, starting today is better than waiting. Every year, your delay reduces your potential returns.

Take a simple step today: determine what $100 monthly could grow over time. Use an online calculator to see your numbers. Most people are surprised by how much they could have saved if they started sooner.

The basics of investing are simple. The key to success isn’t finding the perfect stock or timing the market. It’s just giving your money more time to grow.

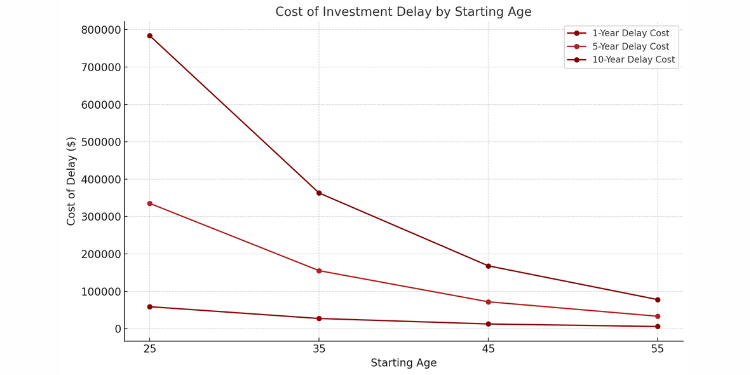

Opportunity cost escalates with postponement

Every delay in investing has a real cost to your financial future. As a financial advisor for over 12 years, I’ve seen many underestimate this cost. Opportunity cost is a real financial loss that grows with time.

Delaying a $5,000 investment from age 30 to 31 isn’t just missing one year. It’s losing the future growth of that investment. At an 8% return, that delay costs about $40,000 by age 67. This is money you’ll never get back.

Let’s look at how delaying investment affects your money over time:

| Starting Age | One-Year Delay Cost | Five-Year Delay Cost | Ten-Year Delay Cost |

|---|---|---|---|

| 25 | $58,902 | $335,283 | $783,869 |

| 35 | $27,298 | $155,340 | $363,132 |

| 45 | $12,646 | $71,983 | $168,170 |

| 55 | $5,859 | $33,357 | $77,939 |

These numbers are based on a $5,000 investment with 8% returns until age 67. The sooner you start, the bigger the cost of delay. This is why the financial markets favor the early bird.

Why do we find it hard to understand this? Several reasons make opportunity cost hard to see:

- Opportunity cost is about invisible losses, not real setbacks

- We tend to focus on now rather than later

- We don’t fully grasp how fast growth can add up over time

- Financial goals seem less pressing without a deadline

- The idea of future wealth doesn’t feel real to us

When you’re young, you can take more risks with your money. But as you get older, you need to be more careful. This means late starters face a double challenge: less time and lower returns.

I’ve made a worksheet to help clients see their own opportunity cost. It’s a powerful tool to get people moving. The numbers show that delaying costs more and more with each year.

Remember, the best time to invest was yesterday; today is the next best. This isn’t about feeling guilty but about taking action now. Every dollar you invest today helps you reach financial freedom faster.

Lifestyle inflation complicates delayed saving

Lifestyle inflation is when you spend more as you earn more. I’ve seen this happen many times in Phoenix over 12 years. It’s like your spending grows with your income, taking away from what could be saved for the future.

It’s okay to want better things as you make more money. But, it’s hard to save for retirement when your spending goes up. My data shows that most people’s expenses rise 4-7% each year, often more than their salary increases.

Delaying to invest can be costly. Every year you wait, your spending grows, making it harder to save later. It’s tough to change your spending habits as you get older.

“read more: Saving vs Investing for Financial Goals Explained“

Rising Expenses Squeeze Contribution Capacity

As you get older, your expenses increase. Buying a house or a bigger car costs more. Having kids adds to your expenses, especially for childcare and education. Healthcare also gets pricier with age.

These are normal parts of life. But, they make it hard to save for retirement. Let’s compare two clients with the same income:

| Investment Approach | Starting Age | Income Percentage Invested | Major Financial Obligations | Retirement Outcome at 65 |

|---|---|---|---|---|

| Early Starter | 25 | 10% | Minimal debt, modest housing | $1.2M+ with moderate stress |

| Delayed Investor | 40 | 5% | Mortgage, car payments, education costs | $380K with significant anxiety |

| Late Scrambler | 50 | 15% | Maximum financial obligations | $320K with extreme lifestyle compromise |

The early starter saved 10% of their income early on. The delayed investor, with the same salary, could only save 5% after lifestyle expenses.

Starting retirement savings in your 20s rather than 40s can nearly double your final balance, even if you contribute less overall — a pattern validated across decades of historical returns. Ref.: “Fidelity Investments. (2023). The Power of Starting Early. Fidelity.” [!]

The late scrambler had to save 15% but still saved less than the early starter. This shows how lifestyle inflation hurts your savings and time to grow them.

To fight this, I give clients a budget template. It helps find money to invest before it’s spent on lifestyle upgrades.

Start small by investing 1% of your income. Increase it by 1% with each raise. This way, you can save more without changing your lifestyle too much.

Working with a financial adviser can also help. They can find ways to save money in your budget. Many clients find they can save for retirement without big lifestyle changes.

Remember, the sooner you start investing, the better. Lifestyle inflation will take more of your money if you wait. Start investing now to secure your future.

“read also: Financial Goals vs Investment Goals Differences Explained“

Age impacts feasible risk tolerance

Age and risk tolerance are closely linked, especially for those who wait to invest. Many clients face challenges when they start investing later. Their shorter time horizon limits how much market risk they can handle.

Your age affects how much market risk your portfolio can take. A 30-year-old has 35 years to recover from market drops. But, someone starting at 50 has only 15 years to build wealth.

Shrinking Horizon Demands Conservative Mix

As retirement nears, your investments should focus on keeping your money safe rather than growing it fast. This is a key rule of wealth management. The closer you are to needing your money, the less time you have to recover from market drops.

I suggest this age-based investment plan to my clients:

| Age Range | Growth Assets | Income Assets | Preservation Assets |

|---|---|---|---|

| 30-40 | 70-80% | 15-25% | 5% |

| 41-50 | 60-70% | 20-30% | 10% |

| 51-60 | 40-60% | 30-40% | 10-20% |

| 61-65 | 30-40% | 40-50% | 20-30% |

Delaying a single $5,000 retirement contribution by one year at age 25 can cost over $50,000 in lost future growth at 8% returns — a widely recognized figure in retirement savings projections. Ref.: “U.S. Department of Labor. (2021). Saving Early and Consistently Is Key. DOL Retirement Toolkit.” [!]

Investing in your 50s means choosing between a safe, lower-growth portfolio or a risky one. This is a tough choice. You might miss your financial goals with safety or risk losing money before retirement with growth.

Your retirement account becomes more vulnerable to market risks as time runs out. A big market drop five years before retirement leaves little time to recover. But, a 35-year-old can see market corrections as chances to buy, not disasters.

Late Catchup Strategies Carry Stress

Many late investors try to make up for lost time by taking big risks. But, this often backfires. Managing a very risky portfolio near retirement can lead to poor choices during market ups and downs.

Studies show that late starters who take too much risk are more likely to:

- Panic-sell during market downturns, locking in losses

- Chase performance in high-risk sectors

- Overtrade in attempts to “make up for lost time”

- Experience heightened anxiety affecting other areas of life

Morningstar data reveals that portfolios overly tilted toward high-risk assets in later years are far more likely to underperform long-term goals, as late investors tend to panic-sell during downturns. Ref.: “Blanchett, D. & Morningstar Research. (2022). Retirement Portfolio Construction. Morningstar.” [!]

One client said, “I know I need aggressive growth, but I can’t sleep when the market drops. I’m constantly checking my accounts.” This stress can lead to abandoning good investment plans at the worst time.

The greatest threat to your financial future isn’t market risk but rather the behavioral risk of making emotional decisions under pressure.

I recommend a formal risk tolerance assessment to find the right risk level for you. These tools check how willing you are to take risks and how much you can afford to lose based on the time you have left to invest.

While delayed investors face real challenges with risk tolerance, smart allocation can still help grow your wealth without too much risk. The key is to accept your situation and work within safe risk limits, not against them.

Even conservative portfolios can earn good returns with the right strategy. A balanced approach that fits your age and risk tolerance is better than trying to make up for lost time with too much risk.

Myths encouraging procrastination debunked today

Building wealth is often hindered by myths that prevent investors from taking action. Let’s remove these obstacles from your investment plan.

Waiting for perfect market timing

Investors who waited for the “perfect” time between 1990-2020 lost 3.7% annually. Market ups and downs are normal, not bad.

Between 2008-2010, dollar-cost averaging led to a 27% gain over waiting for clear skies. Predicting market highs and lows is hard, even for experts.

Some say “I need to pay off all debt first” or “I should wait until I earn more.” While an emergency fund is crucial, delaying retirement investing loses valuable time.

Read More:

Investment performance changes, but your long-term goals need steady effort. Open an investment account today, even with a small amount, to overcome the fear of delay.

Your financial goals depend on starting, not waiting for the perfect moment. The best time to invest was 20 years ago. The second best time is now.