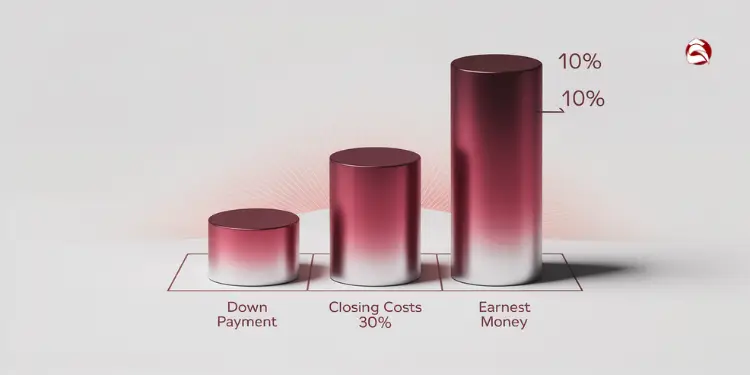

Buying a house costs more than the price you see online. First-time buyers often forget about extra costs. Down payments are just 60% of what you’ll pay upfront.

The National Association of REALTORS® says first-time buyers in 2023 spent $22,500 on a $300,000 home. That’s 8% of the price before you get the keys!

“The sticker shock isn’t from the home price—it’s from all those unexpected fees that appear at closing,” notes veteran loan officer Janet Harmon.

In my nine years helping Greenville residents find homes, I’ve seen many buyers scramble for money. With planning, you can avoid this. There are many hidden costs of homeownership beyond the mortgage.

This guide shows every dollar you’ll spend from pre-approval to closing. Print it, highlight what matters to you, and take it to lender meetings.

Quick hits:

- Inspection fees range $300-$600

- Closing costs average 2-5% total

- Lenders require specific cash reserves

- Pre-approval expenses often surprise newcomers

- Budget tools prevent financing hiccups

Upfront purchase expenses beyond sale price

Buying your first home costs more than the sale price. You’ll need to pay 3-6% of your loan amount upfront. The Johnson family found out the hard way, needing $14,500 extra for their first home.

First-time buyers often forget about the extra costs. These include closing costs, earnest money, and inspections. It’s important to budget for all these expenses.

“The purchase price is just the tip of the iceberg when buying a home. The upfront costs below the surface are what sink unprepared buyers.”

Lenders ask for fees before you apply for a loan. These fees are for the application, credit report, and loan origination. The Consumer Financial Protection Bureau requires lenders to give you a Loan Estimate within three days.

It’s smart to get Loan Estimates from at least three lenders. This way, you can compare costs and rates. Some lenders might have higher fees but lower rates.

Request a Loan Estimate from at least three lenders and compare the “Closing Cost Details” line-by-line; CFPB research shows this simple step can shave hundreds off origination charges and keep surprise fees in check. Ref.: “Consumer Financial Protection Bureau. (2022). Loan Estimate Explainer. CFPB.” [!]

Earnest Money Deposit Typical Percentages

Earnest money shows you’re serious about buying a home. In the U.S., it’s usually 1-3% of the home’s price. For a $350,000 home, that’s $3,500-10,500 you’ll need right away.

In competitive markets, buyers might offer up to 5% earnest money. This helped the Wilsons get their dream home last summer.

- Typical earnest money range: 1-3% of purchase price

- Competitive market deposits: 3-5% of purchase price

- Payment timing: Within 1-3 days of accepted offer

- Deposit holder: Escrow company or title company (not directly to seller)

Sellers commonly expect earnest money of ≈3 % of the purchase price—and escrow must receive verified funds within 1-3 days of offer acceptance. Miss that window and your bid can be voided. Ref.: “National Association of REALTORS®. (2025). Earnest Money & Escrow Real Estate. NAR.” [!]

Include inspection and financing contingencies in your agreement. These protect your earnest money. You can get it back if there are big issues or financing problems.

Have your earnest money ready in a checking account before house hunting. You might need to write a check quickly. Make sure to include earnest money in your home buying budget checklist.

Home Inspection Appraisal and Survey Fees

Professional assessments are important and must be paid upfront. They help avoid surprises and ensure the home is safe and sound. These costs are worth it to avoid future problems.

| Assessment Type | Typical Cost | Timing | Purpose |

|---|---|---|---|

| Standard Home Inspection | $350-600 | 7-10 days after offer acceptance | Evaluates structural, mechanical, and safety aspects |

| Appraisal | $500-700 | 2-3 weeks before closing | Verifies home value for lender |

| Specialized Inspections | $75-500 each | During inspection period | Assesses specific concerns (radon, termites, etc.) |

| Property Survey | $400-700 | 3-4 weeks before closing | Confirms property boundaries |

A standard home inspection costs $350-600. It’s a good idea to be there. The inspector will find issues and give you a chance to negotiate or feel secure.

Consider extra inspections when needed:

- Radon testing ($150)

- Termite/pest inspection ($75-150)

- Sewer scope ($125-300)

- Mold testing ($300-500)

- Lead paint testing ($250-350 for pre-1978 homes)

The appraisal costs $500-700. It checks if the home’s value matches the loan. If it’s lower, you might need to negotiate or walk away.

In some places, you need a property survey ($400-700) to check boundaries. This is important for future projects like fences or pools.

Pro tip: Pay close attention to inspection timelines in your purchase contract—typically 7-10 days after acceptance—and schedule these services immediately to avoid missing deadlines. These upfront costs total approximately $1,500-3,000 and must be paid before closing, not rolled into your mortgage.

While these fees aren’t negotiable, sellers might cover some in buyer’s markets. Negotiate for a seller credit for these costs during the negotiation phase.

These upfront costs need immediate cash flow, separate from your down payment. Save for these expenses in a dedicated account. This way, you won’t be stressed about money during the homebuying process.

Mortgage related fees and interest charges

When you buy a home, you might be surprised by extra fees. These can add 2-5% to your total cost. Knowing these costs early helps avoid last-minute money troubles.

Most people only think about the down payment and monthly payments. But there are thousands in loan fees to consider. These fees show up on your Loan Estimate and Closing Disclosure, but by then, you might not be able to negotiate as well.

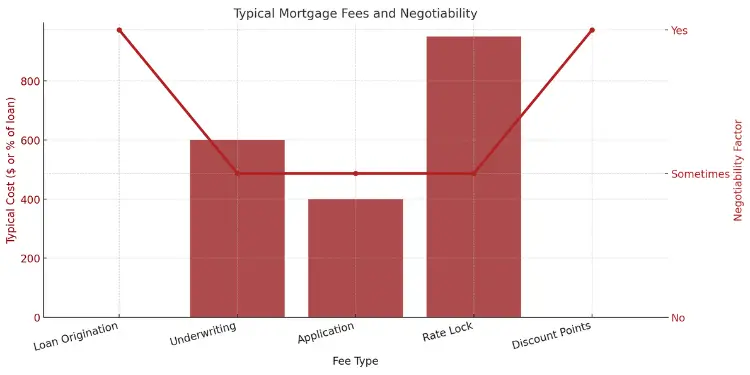

Loan Origination, Underwriting and Discount Points

Loan origination fees are 0.5% to 1% of your loan amount. For a $300,000 mortgage, this is $1,500-$3,000. It covers the work of setting up your loan.

Underwriting fees are $300-$900. They pay for the lender to check your finances. This step decides if you get the loan and what rate you’ll pay. Some lenders include this with origination fees, others list it separately.

Application fees are $300-$500, and rate lock fees are $400-$1,500. Rate locks keep your interest rate the same for 30-60 days. Extending this period costs about $375 a month on a $300,000 loan.

| Fee Type | Typical Cost | Negotiable? | When Paid |

|---|---|---|---|

| Loan Origination | 0.5-1% of loan amount | Yes | At closing |

| Underwriting | $300-$900 | Sometimes | At closing |

| Application | $300-$500 | Sometimes | When applying |

| Rate Lock | $400-$1,500 | Sometimes | When locking rate |

| Discount Points | 1% of loan per point | Optional | At closing |

Discount points are optional fees to lower your interest rate. Each point costs 1% of your loan amount. For example, on a $300,000 loan, one point ($3,000) might lower your rate from 6.5% to 6.25%, saving about $50 a month.

I helped the Johnson family pay 1.5 points ($4,500) on their $300,000 loan. This reduced their rate from 6.75% to 6.25%. It saved them $94 a month and over $33,800 over 30 years. But points aren’t always the best choice.

To see if points are good for you, calculate your “break-even point.” This is the cost of points divided by your monthly savings. For the Johnsons, it was 48 months. They planned to stay in their home for at least 10 years, so it was a smart choice.

Some lenders offer “no closing cost” mortgages. But these just add fees to your loan or raise your interest rate. The Federal Reserve says each 0.25% increase in your rate adds about $30 to your monthly payment per $100,000 borrowed. Over 30 years, this can cost tens of thousands in extra interest.

Your down payment size affects your mortgage a. A bigger down payment means a smaller loan, which lowers your fees and interest rate. It might also get you better rates, saving thousands over your loan’s life.

Always ask for a Loan Estimate from each lender. Then, compare the “Closing Cost Details” section to find out about fees. Some fees can be negotiated, like in the “Origination Charges” section. Don’t be afraid to ask lenders to match or beat other offers. This saved my client Maria $1,200 last month.

“First-time buyers often leave money on the table by not shopping for their mortgage as aggressively as they shop for their home. A 0.25% rate difference might seem small, but it can mean $15,000 in savings over a 30-year loan.”

If you plan to move or refinance in 5-7 years, discount points might not be worth it. Instead, focus on getting lower origination fees and finding competitive rates without points.

Ongoing homeowner costs after moving in

Buying a home means new costs that need careful planning. Your mortgage stays the same, but other costs can go up. Knowing these costs helps avoid being “house-rich, cash-poor.”

Those who plan well for these costs enjoy their homes without money worries. Let’s look at the main costs you’ll face after moving in.

Property Taxes Projected Annual Increases

Property taxes help pay for schools, roads, and services. They vary a lot by where you live. In places like New Jersey or Illinois, taxes can be over $10,000 a year for small homes.

Lenders often ask for an escrow account for taxes. You’ll pay 1/12 of your yearly taxes with each mortgage payment. At closing, you’ll also pay 2-6 months of taxes upfront, adding $1,000-5,000 to your costs.

Property taxes usually go up each year. Plan for increases of 2-6% to keep up with inflation. Check your county’s website for past tax increases in your area.

ATTOM’s 2024 analysis shows the average single-family tax bill rose 2.7 % to $4,172—use that benchmark when projecting future escrow and escrow-prefund requirements. Ref.: “ATTOM Team. (2025). Average Property Tax Amount on Single-Family Homes Up 2.7 Percent Across U.S. ATTOM.” [!]

Be careful, as property values can change after you buy. The Martinez family saw their taxes go up 18% the next year. This was a $2,400 increase they didn’t expect.

To figure out your property tax:

- Find the tax rate (in dollars per $1,000 of value)

- Multiply the rate by your home’s value

- Add 4-6% each year for future increases

Homeowners Insurance Premium Budget Factors

Homeowners insurance is needed and costs $1,200-2,500 a year. Several things can change your costs:

| Factor | Impact on Premium | Example |

|---|---|---|

| Location | 40-100% variation | Coastal or tornado-prone areas cost more |

| Home Age | 10-30% variation | Newer homes with updated systems cost less |

| Deductible Choice | 15-25% savings | Raising from $500 to $2,500 lowers premium |

| Special Coverage | 5-20% increase | Home office, jewelry, or electronics riders |

Most lenders want the first year’s premium paid at closing. I tell my clients to shop for insurance early. This avoids delays and helps find better rates.

Calculate the break-even before paying points: each point costs 1 % of the loan and cuts the rate only if you’ll keep the mortgage beyond the break-even months, per CFPB guidance on points versus lender credits. Ref.: “Consumer Financial Protection Bureau. (2023). How Should I Use Lender Credits and Points? CFPB.” [!]

If your home is in a flood zone, you’ll need flood insurance. This adds $700-1,800 a year to your costs. I learned this the hard way when I bought my coastal home.

To save on insurance, consider bundling with auto insurance (10-15% savings) and installing security systems (5-10% discount). Getting quotes from three carriers can show big price differences.

“Explore More: Free home buying budget worksheet for download“

HOA Dues Special Assessments Possibilities

If you buy a condo, townhome, or home in a community, HOA fees are big. These fees are $200-600 a month, depending on what’s included.

HOA dues cover:

- Common area upkeep and landscaping

- Building insurance (for condos and townhomes)

- Some utilities (like water, sewer, and trash)

- Amenities like pools, gyms, and security

- Reserves for big repairs

Before buying in an HOA community, ask for and review the association’s financials. Look at the reserve study to see if there’s enough money for repairs. This can help avoid special assessments.

Special assessments are one-time fees for repairs when the HOA doesn’t have enough money. These can be $1,000 to $15,000 per unit. Being prepared is key, as new communities usually have lower risks.

Last quarter, I helped buyers in Oakridge Community face a $7,500 special assessment. The HOA didn’t have enough for pool and clubhouse repairs, so all homeowners had to chip in.

Always check HOA meeting minutes for the last year to see if there are any upcoming fees or increases. Some lenders want 2-3 months of HOA dues paid at closing, adding to your costs.

Plan for 3-5% annual increases in HOA fees. These often go up faster than inflation because of maintenance and insurance costs. In older communities, increases can be even bigger.

Homeowners also face utility costs ($200-400 a month) and maintenance costs (1-3% of your home’s value each year). For a $300,000 home, that’s $3,000-9,000 a year for repairs, landscaping, and system replacements.

I suggest setting up a home maintenance fund with monthly contributions of $250-500. This helps avoid big financial surprises and keeps your home in good shape.

“Related Topics: Cost breakdown buying house for first time buyers“

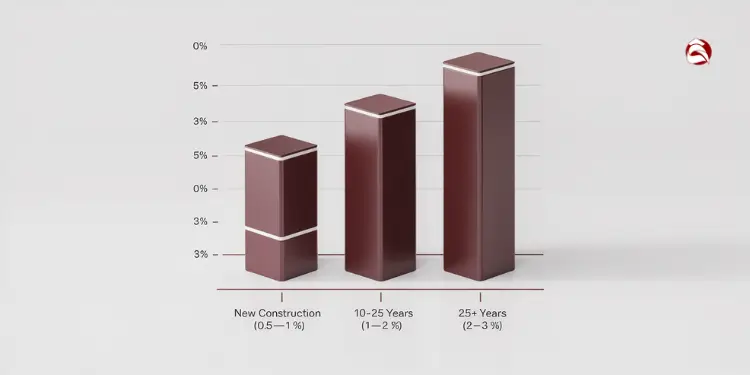

Hidden maintenance reserves first timers overlook

Homeownership costs more than just the price of the house. Maintenance reserves are key, but many first-time buyers ignore them. Owning a home means fixing every problem yourself, a surprise for many.

The Bankrate study in 2024 found homeowners spend over $18,000 a year on their homes. This is more than many first-time buyers expected, focusing only on mortgage payments.

Experts suggest saving 1% of your home’s value each year for repairs. For a $300,000 home, that’s $3,000 a year or $250 a month. This rule helps keep your home in good shape.

But, the more your home ages, the more you’ll need to save:

| Home Age | Recommended Annual Reserve | Monthly Contribution | Estimated Annual Costs |

|---|---|---|---|

| New construction | 0.5-1% of home value | $125-250 (on $300K home) | $1,500-3,000 |

| 10-25 years | 1-2% of home value | $250-500 (on $300K home) | $3,000-6,000 |

| 25+ years | 2-3% of home value | $500-750 (on $300K home) | $6,000-9,000 |

Major home systems need to be replaced at certain times. I made a calendar for my 1980s home to keep track of these times.

Here’s what first-time buyers should expect for big system replacements:

- Roof replacement: Every 20-25 years at $8,000-15,000

- HVAC system: Every 15-20 years at $5,000-10,000

- Water heater: Every 8-12 years at $1,000-2,000

- Exterior painting: Every 7-10 years at $5,000-10,000

- Appliance replacement: Every 10-15 years at $4,000-8,000

The HUD suggests saving $1 per square foot of your home each year. For a 2,000 square foot home, that’s $2,000 a year or $167 a month.

Many first-time buyers use all their savings for the down payment. This leaves no money for repairs. I had to fix a water heater and found carpenter ant damage early on, but I had saved for it.

Keep $5,000-10,000 in an emergency fund for home repairs. This should be separate from your personal emergency fund. Set up automatic monthly transfers to this fund right after you buy your home.

The real cost of homeownership isn’t just what you pay to buy the house—it’s what you pay to keep it functioning properly for decades to come.

Setting up these reserves can seem hard for beginners. Start small if you need to, but start right away. Even $100 a month adds up to $1,200 a year for maintenance.

When working with first-time buyers, I tell them to ask for a seller’s disclosure on home systems. This helps plan for future repairs and can help negotiate the price.

Preventive maintenance is cheaper than fixing problems later. Spending $300 a year on HVAC service can save thousands in the long run. These small steps protect your home and your wallet.

“Check This Out: Must have home buying budget tools for buyers“

Smart saving strategies to cover total costs

Smart financial planning makes buying a house easier. After nine years helping first-time buyers in Greenville, I’ve seen the difference. A good plan covers all costs upfront and ongoing.

Before buying a house, make a detailed budget. This prevents surprises later. My best clients plan 12-24 months ahead. They save for all homeownership costs.

“For More Information: How to make home buying budget step by step“

Automating Savings Toward Closing Costs

Automate your savings to avoid missing payments. Studies show automated savers save 56% more. This can help you reach your closing cost goal faster.

Open separate savings accounts for different costs. Use high-yield savings accounts for down payments and other costs. Online banks often let you have many accounts without extra fees.

For $15,000 in closing costs, save $300 every two weeks. This will take about 24 months. Save the money right after you get paid to keep it safe.

Here are some ways to automate your savings:

- Paycheck splitting – Have your employer send part of your income to your savings

- 52-week challenge – Save $1 the first week, $2 the second, and so on, for $1,378 in a year

- Save your raise – Put extra money from a raise into your savings

- Round-up apps – Save extra money from purchases by rounding up to the nearest dollar

The Thompsons used automated savings and a “no-spend weekend” plan. They saved an extra $4,200 in 10 months.

“Learn More About: Clear signs you are not ready to buy house yet“

Negotiating Credits to Reduce Cash Requirement

Negotiating can lower your costs at closing. Many buyers overlook credits and concessions. These can save a lot of money.

Seller concessions can save up to 6% of the purchase price. On a $300,000 home, that’s up to $18,000 saved.

Ask for concessions early. You can:

- Include them in your initial offer

- Request them after inspections

- Ask for repairs instead of lowering the price

Lender credits can also help. Accept a slightly higher interest rate for $3,000-5,000 in credits. Check if this is worth it by comparing the monthly increase to the credit amount.

For the Wilson family, we got $8,000 in seller concessions and a $4,500 lender credit. This reduced their cash needs by 46%.

Don’t forget these other savings:

- Builder incentives ($5,000-15,000 with their lender)

- First-time homebuyer programs (grants up to $15,000)

- State programs (Maryland SmartBuy offers up to $30,000)

Most programs have income limits and require courses. Start looking 6-12 months before you plan to buy.

| Saving Strategy | Potential Savings | Time Required | Effort Level | Best For |

|---|---|---|---|---|

| Automated Bi-weekly Transfers | $15,000+ | 18-24 months | Low | Steady income earners |

| Seller Concessions | 3-6% of purchase price | During negotiations | Medium | Buyer’s markets |

| Lender Credits | $3,000-5,000 | During loan application | Low | Short-term homeowners |

| First-Time Buyer Programs | $5,000-30,000 | 3-6 months application | High | Income-qualified buyers |

| Tax-Advantaged Accounts | $1,000-3,000 annually | 12+ months | Medium | Higher tax bracket buyers |

Budget checklist template for confident purchase

After looking at all the costs of buying a house, it’s time to put it all together. Let’s look at a real example for a $400,000 house:

- Home Purchase Price: $400,000

- Earnest Money: $4,000 (1% of purchase price)

- Home Inspection: $500

- Appraisal: $600

- Closing Costs: $12,000 (3% of purchase price)

- Down Payment: $40,000 (10% of purchase price)

This example shows why you need a full cost breakdown for buying a home. Many first-time buyers only think about the down payment. But, they forget about the extra 30-50% in other costs.

“Further Reading:

Printable Worksheet for Calculating Personalized Budget

I’ve made a downloadable budget worksheet for you. It’s based on real transactions. It breaks down costs into three main parts: upfront costs, closing costs, and post-purchase expenses.

The worksheet has formulas to estimate costs based on your home price and loan type. It also lets you record actual quotes. This helps you spot any budget gaps early on.

When thinking about what home features affect your budget the most, remember a few things. Premium locations and extra bedrooms usually keep their value better than cosmetic upgrades.

Download the worksheet today. Take charge of your home buying budget with confidence.