In today’s housing market, a big question is: should you buy a home now or wait? The debate is ongoing. Median sale prices hit $426,900 in June 2024, and mortgage rates are now 6.76%.

Does waiting save you money in the long run? Think about this: 76% of people find the market bad for buying now, says the Fannie Mae Home Purchase Sentiment Index. But, will waiting make things better?

Lawrence Yun, Chief Economist at the National Association of Realtors, says, “The best time to buy a house is when you’re ready financially and personally.” He notes that buying a home is a personal choice, influenced by your situation and market trends.

As you make this important decision, remember these points:

- High home prices and changing mortgage rates make the market unpredictable.

- Looking at your finances and future can help decide when to buy a house.

- Waiting has costs, like rising rental prices.

- Checking if you’re financially ready can show the best time for you, now or later.

Current homebuyers face a market defined by elevated median prices (around \$426,900 as of June 2024) and mortgage rates near 6.8%. While 76% of consumers perceive conditions as unfavorable (per Fannie Mae), delaying purchase isn’t necessarily beneficial—rental inflation and opportunity costs can erode savings. Market consensus advises purchasing when one’s personal financial readiness aligns with market conditions. Critical considerations include your income stability, savings for down payment and closing costs (typically 2–4% of purchase price, varying regionally), and preparedness for rate fluctuations and inflation.

Initial expenses include down payments—which reduce liquidity but increase equity and lower insurance/financing costs—and regional closing fees (West Coast: 2–3%; Midwest: 1.5–2.5%; South: 2–2.5%; Northeast: 2–4%). Mortgage payments vary significantly with interest rate changes (e.g., monthly payment rises from \~\$1,432 to \$1,799 and total interest from \~\$216k to \~\$363k when rate increases from 4% to 6%). A detailed budget should include credit score thresholds (FHA ≥ 580, conventional ≥ 620–640), debt‑to‑income ratio (<36%), down payment targets (20% to avoid PMI), and reserves for emergencies. Buyers should evaluate personal financial checkpoints and/or consult a financial professional to determine whether immediate purchase or continued savings aligns best with their long‑term goals.

NAR economist Lawrence Yun noted that even with record prices and high rates, supply–demand conditions are nearing balance. Ref.: “FOX Business (2024). Home prices hit another record in June even as sales fall. FOX Business.” [!]

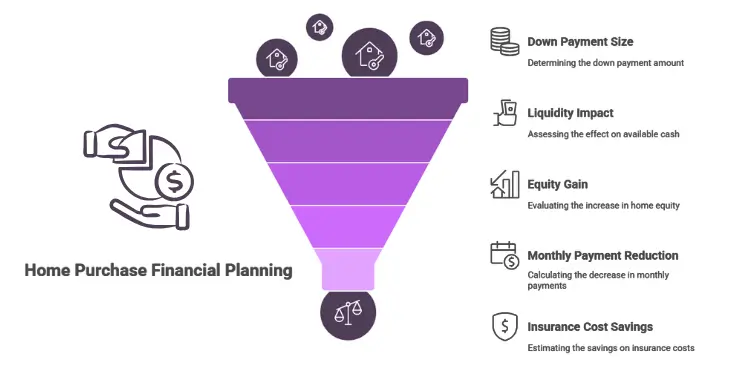

Upfront purchase expenses analyzed in detail

When you buy a home, you face many upfront costs. These include the down payment and closing costs. Buyers need to get ready for these expenses, which can affect their money on hand.

Down payment size implications on liquidity

The down payment size is key to your money situation. A big down payment means you use more money at the start. This leaves you with less cash later on.

But, a bigger down payment can also mean more equity in your home. This can lower your monthly payments and help you avoid extra insurance costs. This makes your payments easier to handle over time.

Closing fees average percentages by region

Closing costs vary by area, affecting your total spending on a home. These costs include fees for appraisals, inspections, and title insurance. Knowing these regional differences helps with planning your budget.

| Region | Average Closing Costs (% of Home Price) |

|---|---|

| West Coast | 2%-3% |

| Midwest | 1.5%-2.5% |

| South | 2%-2.5% |

| Northeast | 2%-4% |

These differences show why it’s crucial to research and understand regional costs. This helps manage your money and plan your home purchase better.

Read More:

Projected mortgage payments under rising rates

Understanding your mortgage payments is key, especially with changing interest rates. When rates go down, your monthly payment gets easier. But, when rates rise, your payments can grow a lot, affecting your finances.

A mortgage calculator helps see how rate changes impact your payments. It shows how small rate changes can add up. This tool helps buyers decide the best time to buy a home.

Amortization timeline and interest share

The amortization process shows how your payments are split between interest and principal. At first, most goes to interest. Later, more goes to the principal. Knowing this helps understand the long-term cost of a home.

Forecasting how rates affect this timeline can save a lot on interest. This is crucial for making smart financial decisions.

| Interest Rate | Monthly Mortgage Payment | Total Interest Paid |

|---|---|---|

| 4% | $1,432 | $215,609 |

| 5% | $1,610 | $289,387 |

| 6% | $1,799 | $363,095 |

This table shows how rates change your payments and total interest. Planning and making timely decisions based on these projections can save a lot. A mortgage calculator gives quick insights, helping buyers feel more confident about their finances.

Market trajectory outlook over five years

The real estate market faces both challenges and opportunities over the next five years. Experts predict that home values will rise, but at a slower rate than before. This change is due to steady demand and more homes available for sale.

IDespite slowing pace, housing prices remain historically elevated with 4.1% YoY growth and rising inventories approaching 4‑5 months supply. Ref.: “Danielle Hale (2024). June 2024 Existing‑Home Sales. Realtor.com Economic Research.” [!]

As home sales meet this steady demand, it’s important for buyers to be ready. Deciding if now is the right time to buy or wait for better conditions is key. Sellers should also consider the best time to sell to benefit from home appreciation.

Economic factors like Federal Reserve policies and changing interest rates add uncertainty. But, the market is not expected to crash. Instead, there’s cautious optimism about home sales. It’s vital for both buyers and sellers to keep up with local market trends.

For sellers, tracking the market in times in 2024 is crucial. Buyers should also do their homework to get the best deal. Whether you’re buying a home today or soon, preparation is key.

Opportunity costs of delaying home purchase

When deciding between buy now vs wait later for a home, it’s important to understand the costs. Waiting to buy a house might mean you could earn more money elsewhere. But, you must think about how inflation can make rental costs go up, which could eat into your savings.

Inflation Effect on Rental Cost Savings

Inflation makes rental costs go up, which is a big deal. So, if you save money by not buying now, you’ll still pay more in rent later. Saving money is good, but you have to remember that inflation is always working against you.

Rental inflation has outpaced wage gains, making prolonged renting increasingly costly versus homeownership. Ref.: “The Guardian (2025). Why is the number of first‑time US homebuyers at a generational low? The Guardian.” [!]

Potential Investment Returns During Wait Period

While you wait, you could put your down payment money into other investments. If the market is good, you could make more money than the housing market is going up. But, investing is risky and you need to know what you’re doing to make it work.

| Scenario | Rent Savings | Investment Returns | Inflation Impact |

|---|---|---|---|

| Immediate Purchase | N/A | N/A | Reduced risk of rising rental costs |

| Wait Period with Investment | Potential savings on down payment | Returns depend on market conditions | High risk of increased rental costs |

Assessing personal finances for purchase timing

Deciding when to buy a home requires careful financial planning. Start by checking your credit score. It’s key for the mortgage rates you can get. A score above 580 for FHA loans and 620-640 for conventional loans is good.

Then, make sure you have enough savings for a down payment. A 20% down payment can lower your monthly payments and avoid PMI. But, it’s also important to save for unforeseen circumstances. This helps improve your financial health and buying power.

Do an affordability check to consider all costs. Closing costs are 2-5% of the loan amount, affecting your budget. A detailed budget check is needed to account for all expenses.

A good debt-to-income ratio, below 36%, boosts your mortgage approval chances. Getting financial advice from a pro can help. They can offer strategies to improve your financial health. Your financial readiness affects your buying power and affordability.

Finally, watch the current interest and inflation rates. As of November 2024, rates are around 6.84% and inflation is 2.6%. These rates impact the long-term costs of owning a home and whether to buy now or later.

Check out the below:

Decision matrix summarizing timing scenarios

Deciding when to buy a house can be like solving a puzzle. A decision matrix helps by organizing your thoughts. It looks at your finances, lifestyle, and the market to see if now is the right time.

Checklist Weighting Financial and Lifestyle Factors

Begin by making a list of important factors. Think about your job, family plans, savings, and the housing market. Also, consider how interest rates might change your buying power.

Then, make a checklist for buying a house. Look at how your finances fit with your lifestyle. Figure out mortgage payments under different conditions. Think about what you might miss out on if you wait, like investment gains. This way, you make a smart choice that fits your life plan.