Buying a house with a friend is a big step. It’s both a financial move and a test of your friendship. Today’s housing market is making this option more appealing for first-time buyers.

More Americans are choosing to share the cost of a home. Almost half of them now think about splitting home costs with someone else. This is because friends are finding creative ways to share a home, like basement apartments or special agreements.

“The strongest friendships can crumble under mortgage stress without proper planning,” I tell my clients in Greenville. I’ve helped many friend-pairs buy homes successfully. Having two incomes really helps in buying power.

Many first-time buyers don’t think about growing out of their shared home. The average American stays in their forever home for just 13 years. It’s important to plan how to leave the home together.

Quick hits:

- Clear ownership structure prevents future disputes

- Written agreements protect both parties legally

- Exit strategies preserve friendships long-term

- Combined incomes increase purchasing power significantly

Discuss Shared Homeownership Goals Early

Starting a joint homeownership journey needs early talks about your goals. This avoids misunderstandings that could harm your friendship and investment. In my nine years helping first-time buyers in Greenville, I’ve seen how missing these talks can ruin what should be a great experience.

First, look at your money together. Each person’s financial situation affects your loan options and what you can buy. Your money situation decides the house you can afford and the interest rates you’ll get.

I suggest making a shared document for your goals. This simple step has saved many friendships among my clients. Be open about your money, including credit scores, savings, and monthly budgets.

Clarify Timeline Expectations and Priorities

One big issue I see is different timelines. Maybe one person sees it as a short-term home, while the other plans to stay long. Talk about how long you both plan to stay and what might make you sell.

Then, list what’s most important to each of you. Use two columns: “must-haves” and “nice-to-haves” that you both agree on. Is location key for one due to work? Does the other need a home office or garage? Agreeing on these points helps avoid later disappointment.

“The most successful friend-to-homeowner transitions I’ve guided started with a priorities workshop where both parties ranked their top five non-negotiables. When these aligned, the partnership thrived.”

Think about how you’ll live together before looking at houses. Will you share spaces or need your own? What about guests, pets, or future partners? These details affect your daily life and the right house for you.

Write down these talks, even if it’s just an email or notes. This helps you remember your agreements later. I’ve seen how these early talks prevent big problems and help you both own a home successfully.

| Discussion Topic | Questions to Address | Why It Matters |

|---|---|---|

| Investment Timeline | How long do you each plan to own the home? | Prevents conflict when one wants to sell before the other |

| Financial Transparency | What are your credit scores, savings, and monthly budgets? | Determines mortgage qualification and affordability |

| Property Priorities | What features are must-haves vs. nice-to-haves? | Guides property search and prevents disappointment |

| Lifestyle Compatibility | How will you share spaces and handle guests/pets? | Ensures daily living arrangement satisfaction |

Remember, building equity takes time. If one friend sees it as an investment and the other as a home, you’ll need to find common ground. Talking about your goals early sets the path for your journey together.

Determine Optimal Ownership Structure Legally

When you buy real estate with a friend, picking the right ownership structure is key. It sets the rules for your investment partnership. It affects how you manage the property and what happens if someone wants to leave.

Choosing the right legal framework is important. It decides your rights, duties, and money matters. It also affects what happens to the property if someone dies.

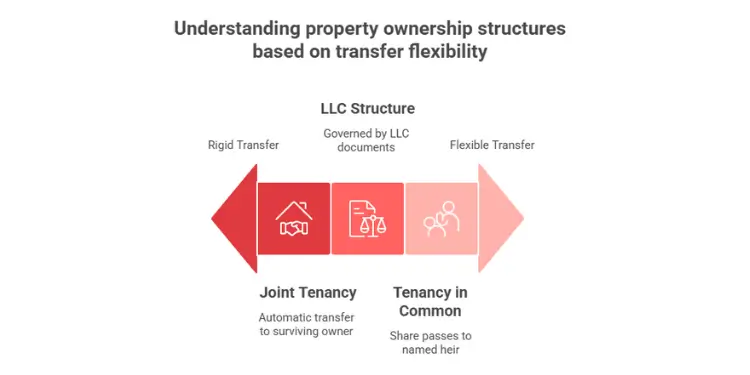

Joint tenancy offers equal ownership and automatic transfer of property to surviving owners upon death, while tenancy in common allows for unequal shares and individual transfer of ownership rights. Understanding these distinctions is crucial for co-owners to align their legal and financial expectations. Ref.: “Joint Tenancy vs. Tenants in Common: What’s the Difference?. LegalZoom.” [!]

Let’s look at your options for owning a home together.

“The $300-500 you’ll spend consulting with a real estate attorney about ownership structure is the best insurance policy you can buy when purchasing property with a friend. It’s the small investment that prevents five-figure disputes later.”

There are two main ways to own property with a friend:

Joint Tenancy with Rights of Survivorship

This setup means equal ownership for all involved. Each person has the same share, no matter their financial input. If one owner dies, their share goes to the others without court trouble.

Joint tenancy is good for friends who split costs equally. It makes inheritance easy. But, it can cause problems if one person pays more.

Tenancy in Common

This option lets you have different shares based on your contributions. For example, if you pay 60% and your friend pays 40%, your shares will reflect that.

With tenancy in common, each owner can sell or pass on their share. It’s flexible but needs careful planning for exit strategies.

Keep track of your expenses with How to track home buying expenses during the process

LLC Ownership Structure

Some friends choose to own through a Limited Liability Company (LLC). This adds protection and treats the home as an investment property.

LLC setup costs more and needs ongoing care. But, it offers a clear business setup. This can help keep your friendship strong by separating personal and financial issues.

While forming an LLC for property ownership provides liability protection and operational flexibility, it introduces additional costs, including setup fees and annual state-specific charges, which can be substantial depending on the jurisdiction. Ref.: “Real Estate LLC Guide: Pros, Cons And How To Set Up. Forbes.” [!]

| Ownership Structure | Ownership Split | Death Scenario | Best For | Tax Implications |

|---|---|---|---|---|

| Joint Tenancy | Equal shares only | Automatic transfer to surviving owner | Equal contributors with simple inheritance plans | Shared tax benefits split equally |

| Tenancy in Common | Flexible percentages | Share passes to named heir in will | Unequal contributors or different exit timelines | Tax benefits proportional to ownership |

| LLC Structure | Defined by operating agreement | Governed by LLC documents | Investment-focused purchases with liability concerns | Pass-through taxation to individual owners |

Your choice should match your financial input, future plans, and comfort with legal matters. If your friend’s credit score is better, you might qualify for a loan together. But, the right structure is key to protect both of you.

The type of property also matters. A primary home might use joint tenancy for simplicity. But, an investment property with rental income might need tenancy in common or an LLC.

Remember, housing costs include more than just the mortgage. Your agreement should cover property taxes, insurance, and upkeep. It’s important to know how these costs affect your shares.

Always talk to a real estate attorney before deciding. This small investment—usually $300-500—can save you thousands in future disputes. The attorney will help you create a legally binding agreement that protects your friendship and finances.

Don’t rush this choice. The right structure brings clarity and protection. It lets you enjoy your new home without stressing your friendship.

Gain insights from Frugal home buying tips for budget conscious buyers

Align Mortgage Qualification and Contributions

Buying a house with a friend means you must align your mortgage and money contributions. Lenders see you both as one unit, not separate. This affects your loan, interest rate, and how much you can buy.

I’ve helped many friends through this. The best start is meeting lenders 4-6 months before you look for houses. This time helps you handle any money surprises.

Lenders check your credit scores, income, debt, and down payment. It’s important to be open about your finances.

Utilize the Free home buying budget worksheet for download

Decide Down Payment Split Ratio

Choosing how to split your down payment is key. Think about your money now and your future plans. You can split it equally or based on who earns more.

Equal splits work well for joint ownership. But if one person earns more, a split like 60/40 might be better. This way, you both know what to expect.

How much down payment you make affects your mortgage. You don’t always need 20%. Learn about big and small down to find what’s best for you.

Fannie Mae’s Desktop Underwriter now uses the average of co-borrowers’ median credit scores for loan qualification, potentially benefiting applicants with varying credit profiles by improving eligibility and loan terms. Ref.: “Credit score eligibility in Desktop Underwriter (DU) for multiple borrowers. Fannie Mae.” [!]

Write down how much each person pays for the down payment. This is important if you sell the house or if one person wants to buy out the other.

“The down payment split should reflect not just what you can afford today, but how you envision sharing in the property long-term. I’ve seen friendships strain when the 60/40 contributor expected 60/40 decision-making power that wasn’t explicitly agreed upon.”

Coordinate Credit History Checks Beforehand

Get your credit reports 3-4 months before you start looking for houses. Waiting too long can ruin your chances of buying.

Lenders use the lower credit score when deciding on your loan. So, if one person has a lower score, it affects both of you.

If one person’s credit is bad, here’s what to do:

- Pay down credit card balances to below 30% of available credit

- Avoid opening new credit accounts during the mortgage application process

- Address any collections or delinquent accounts immediately

- Correct any errors on your credit report through the dispute process

Some friends have only one person apply for the mortgage if there’s a big difference in credit scores. But, you need a lawyer to make sure both people are protected.

When you meet lenders, look at different loan options together. Conventional loans need better credit but offer better rates with 20% down. FHA loans accept lower credit scores but require mortgage insurance. First-time homebuyer programs might offer extra benefits.

Even if you split payments, both borrowers are responsible for the mortgage. If one person doesn’t pay, both credit scores will suffer.

| Contribution Type | Best Ownership Structure | Documentation Needed | Tax Implications |

|---|---|---|---|

| Equal (50/50) | Joint Tenancy | Contribution receipts, joint account statements | Equal mortgage interest deductions |

| Proportional (e.g., 60/40) | Tenancy in Common | Written agreement, contribution receipts | Deductions proportional to ownership |

| One person down payment, shared mortgage | Tenancy in Common with unequal shares | Detailed co-ownership agreement, gift documentation | Complex – consult tax professional |

Buying a house together is a big step. Keep talking about your money situations. Changes in income or credit can affect your loan until the very end.

Prepare for additional costs with How to budget for closing costs in advance

Drafting a Co-ownership Agreement

When you buy a house with a friend, making a detailed co-ownership agreement is key. In my nine years helping first-time buyers, I’ve seen friends disagree without a plan. It’s not about not trusting each other. It’s about being clear when life gets tough.

A co-ownership agreement keeps your money and friendship safe. Verbal agreements might seem good when you’re excited. But they don’t work when life throws surprises like job changes or money problems.

Get a real estate lawyer who knows about co-ownership. Spending $500-1,000 now can save you a lot later. Your agreement should cover everything from buying to selling the house.

Engaging a real estate attorney to draft a customized co-ownership agreement ensures that specific circumstances are addressed, outlining ownership shares, financial contributions, usage rights, and dispute resolution mechanisms, thereby safeguarding all parties involved. Ref.: “Co-Ownership Agreements Explained: The Lawyer Hat. Get Happy at Home.” [!]

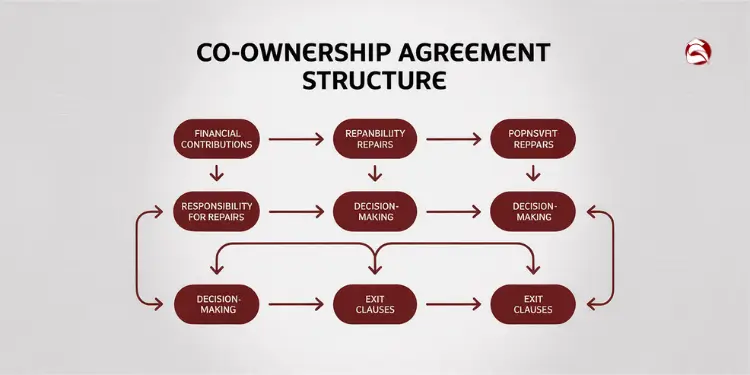

Outline Decision Making Process Clearly

Make a plan for making decisions to avoid fights. Your agreement should say who decides what and when. It should also say when you both need to agree.

Set a rule for when you both need to okay big expenses. Usually, anything over $500 needs both of you. But small things can be done by one person. Decide on:

- Improvements and renovations

- Choosing service providers

- Changing insurance

- Renting parts of the house

- Things like paint colors

Make a digital document for all decisions. This keeps everyone on the same page and avoids confusion.

Align your financial goals with your co-buyer using Joint home buying budget tips for couples

Specify Responsibilities for Unexpected Repairs

Unexpected repairs can test your friendship. Your agreement should say who does what for repairs.

Decide who does routine tasks like lawn care. For big repairs, say how costs will be split. You might also want a joint fund for emergencies.

One person might do more tasks or pay more. Make sure this is clear to avoid resentment. Your agreement should cover:

| Repair Type | Financial Responsibility | Coordination Responsibility | Decision Timeline |

|---|---|---|---|

| Emergency Repairs (e.g., burst pipes) | Split according to ownership percentage | Whoever discovers the issue | Immediate action authorized |

| Major Systems (HVAC, roof) | Split according to ownership percentage | Jointly coordinated | 48-hour decision window |

| Cosmetic Updates | Negotiated case-by-case | Proposing owner | 1-week consideration period |

| Routine Maintenance | Split according to predetermined schedule | Assigned by agreement | Monthly review |

Agree Procedures for Refinancing Events

Refinancing a house needs careful planning. Your agreement should say when and how to refinance.

Decide when to talk about refinancing, like when rates drop or you need to remove PMI. Say how to handle it if only one owner can refinance.

Your refinancing plan should cover:

- Getting both owners to agree before refinancing

- Sharing costs of refinancing

- Evaluating loan options

- Handling cash-out refinancing

- Changes in credit affecting refinancing

Plan for what to do if one owner wants to refinance but the other doesn’t. This could include buyout options or other arrangements.

Refinancing a jointly owned property requires unanimous consent from all co-owners, which can be challenging if financial goals diverge, potentially delaying or complicating the refinancing process. Ref.: “Legal Considerations When Purchasing a Home with a Friend or Partner. JAD Law Firm.” [!]

Your co-ownership agreement isn’t set forever. Review it every year and update it as needed. Life changes like getting married or having kids might mean you need to change your agreement.

The best co-ownership arrangements have one thing in common: good planning. When you buy a house with a friend, this agreement is your guide for the ups and downs of shared ownership.

Consider the benefits of House hacking first home guide for new buyers

Plan Ongoing Maintenance and Expense Management

When you buy a house with a friend, you need a plan for expenses. The mortgage is just the start. How you handle daily costs can make or break your partnership.

Start an emergency fund for your home. Aim for 3-6 months of expenses, with a minimum of $5,000. This fund helps when unexpected things happen, like a broken furnace or a leaky roof.

Each owner should put money into the fund based on their share. For example, if you own 60% and your friend owns 40%, you should contribute 60% and your friend 40%. Set up automatic monthly payments to grow the fund without effort.

Discover strategies for How to buy house on low income successfully

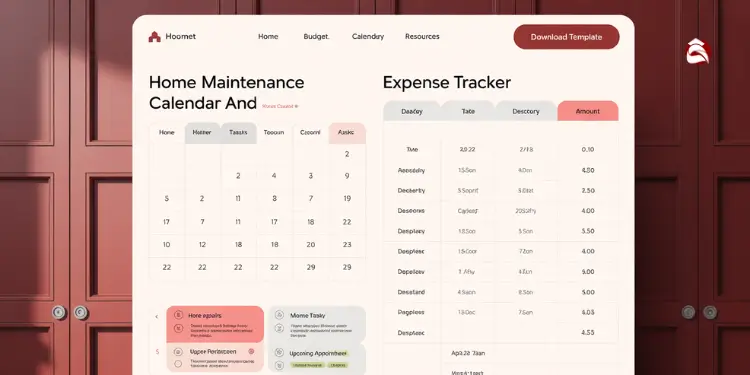

Track Shared Expenses with Budgeting Apps

Tracking expenses is easier now thanks to technology. Budgeting apps for shared finances make money talks easy. They turn awkward conversations into simple digital exchanges.

Here are some ways to manage expenses:

- Dedicated apps like Splitwise track who paid what and keep balances

- Payment services like Zelle or Venmo for quick paybacks

- Joint checking account for house costs with clear rules

- Shared spreadsheets for monthly expenses and payments

Make a maintenance calendar with clear tasks. Seasonal jobs like cleaning gutters and servicing the HVAC should have owners. This avoids confusion.

Plan how to pay for utilities before they arrive. Will you split them equally or adjust based on who’s home? These details are important when buying a home with a friend.

For big home changes, have a plan. Include:

- Written proposals with contractor quotes

- Talk about how changes affect the home’s value

- Keep track of who paid what

- Agree on how costs affect equity if you sell

Keep records of all home expenses and improvements. These records help with taxes and show who contributed what. Even if you trust your friend, keeping records helps avoid misunderstandings.

Have monthly meetings to talk about finances and maintenance. These meetings help prevent small problems from becoming big issues. Treat your co-ownership like a business, but enjoy the personal benefits of sharing a home.

Remember, contracts are not just for buying homes. Make a plan for managing expenses, including big contributions. This might be part of your agreement or a separate document that changes as your ownership does.

Explore the comprehensive guide on:

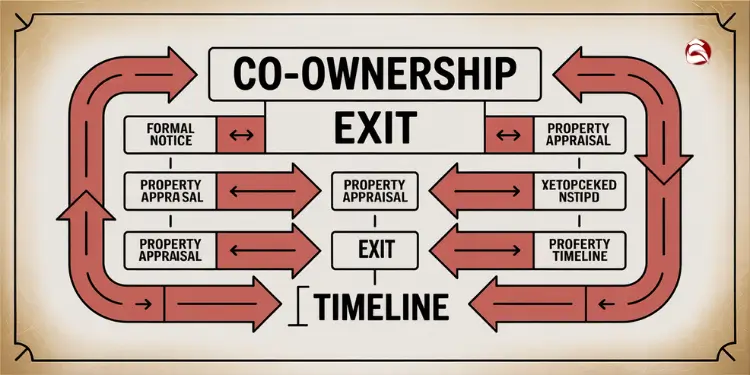

Establish Exit Clauses and Dispute Resolution

Even best friends face life changes. As a real estate pro, I’ve seen co-ownership work when exit plans are made. Your agreement should have clear buyout rules if one person wants out.

Include these exit clause basics in your agreement:

• Required notice period (30-90 days)

• Property valuation method (professional appraisal)

• Timeline for completing the buyout

• Financing options for the remaining owner

Including clear exit strategies, such as buyout clauses and predefined sale conditions, in a co-ownership agreement can prevent conflicts and provide a structured process for resolving disputes or changes in ownership. Ref.: “Before Co-Buying a Home With Someone, Have an Exit Strategy: The Prenup of Real Estate. Nolo.” [!]

For beginners, dispute resolution steps save money and friendships. Start with talks, then structured mediation if needed. This helps protect your budget when unexpected issues come up.

Address big life changes that might affect home ownership. These include marriage, job moves, or financial changes. These events often mean you need to change your living setup when buying a house with someone.

Review these clauses yearly as your situations change. A real estate attorney can help write language that protects both sides. This small investment helps your buying power by creating a safety net for your friendship and finances.

With proper planning, you can enjoy shared home-buying steps while keeping an exit path. This balance is key to successful co-ownership that keeps your investment and friendship safe.