The best budgeting apps make managing money easy. They help you understand where your money goes. This is key when looking for your dream home.

Only 18% of Americans feel sure about managing money with tech. But, those who use special tools save 34% more for big buys.

“The difference between homeownership dreams and reality often comes down to daily financial habits,” says housing economist Sarah Jenkins. This is true, like balancing rent and saving for a down payment.

I’ve helped many first-time buyers. The right budget tools do more than track spending. They show future mortgage payments and closing costs. They turn big goals into daily steps.

Quick hits:

- Connect accounts for automatic expense tracking

- Visualize down payment progress clearly

- Calculate affordable mortgage payment ranges

- Flag spending that delays purchase timelines

- Build reserves for unexpected inspection issues

A June 2025 survey of 3,000 U.S. adults found that only 17 % would let AI make a major financial decision without their approval—highlighting why many first-time buyers still prefer hands-on budgeting apps to fully automated tools. Ref.: “Jorgensen, E. (2025). Survey shows how much Texans trust AI with their finances. Houston Chronicle.” [!]

Criteria for selecting budgeting app winners

I’ve helped many first-time homebuyers get ready financially. I found that not all budgeting apps are the same. You need special tools for buying a home.

My criteria focus on features that help with home buying. Real client experiences show how the right tools can make a big difference. Let’s look at what’s important.

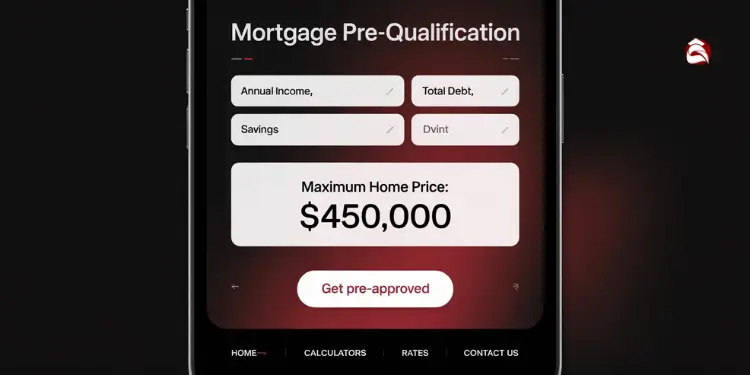

Mortgage Pre-qualification Tools

The best apps have calculators to show how much you can buy. They look at your income, debt, and savings. This helps you know what you can afford.

Look for apps that update these estimates as your money situation changes. Some even connect with lenders for more accurate figures.

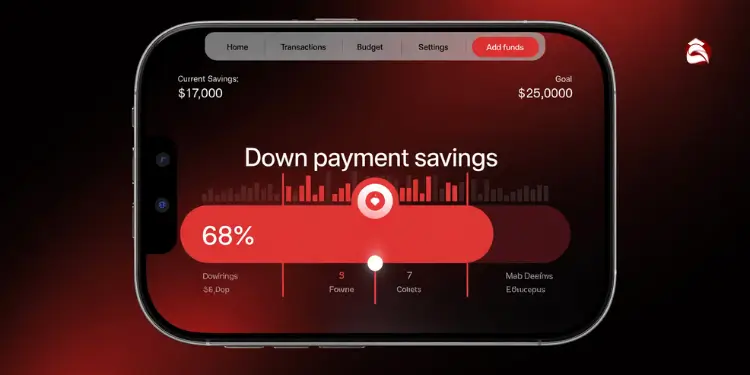

Down Payment Goal Tracking

Good apps show how close you are to your down payment goal. They help you track your savings in small steps. This keeps you motivated.

The best zero budgeting apps let you track your down payment separately. This keeps you focused on your goal.

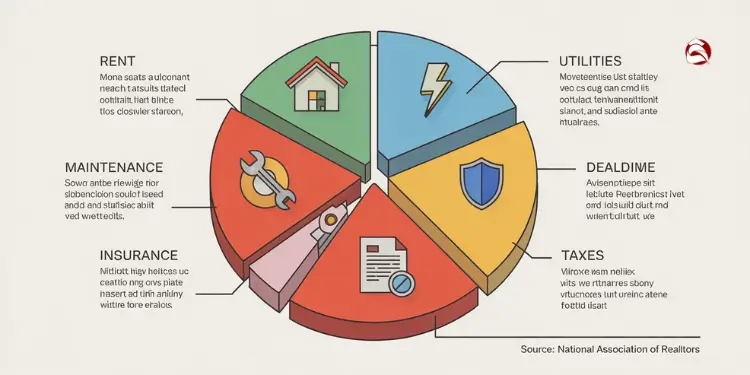

Housing-Specific Expense Categories

Just tracking expenses isn’t enough for buying a home. Top apps track housing costs like rent and utilities. This helps you understand what you can afford.

These apps include categories for all home costs. They help you plan for the future before you buy.

Debt-to-Income Ratio Monitoring

Lenders check your debt-to-income ratio for mortgages. Good apps track this for you. They alert you if it’s too high.

This helps you decide between paying off debt or saving for a down payment. It’s a big decision for first-time buyers.

Under the Qualified Mortgage rule, lenders must verify that your total monthly debt payments do not exceed 43 % of gross monthly income—a pivotal benchmark most mortgage prequalification calculators use. Ref.: “Consumer Financial Protection Bureau. (2018). Appendix Q to Part 1026—Standards for Determining Monthly Debt and Income. CFPB.” [!]

Closing Cost Estimators

Many forget about closing costs, which add 2-5% to your total. The best apps estimate these costs. This prevents surprises.

Look for apps that break down closing costs by category. They also let you adjust for location and property type.

Shared Access for Couples

For couples buying together, sharing accounts is key. Top apps offer multi-user access with privacy controls. This keeps both partners informed without sharing too much.

The best apps for couples have features like notifications and shared goal setting. They track individual contributions too.

Premium vs. Free Considerations

Free apps are okay for basic tracking, but premium features are worth it for a big purchase. Paid apps often help you save more.

Think about the value: a $5-15 monthly subscription can save you thousands. Focus on features that help with your home buying, not extras.

Helping clients with their finances for home buying has shown me the power of the right app. The apps I recommend are top-notch in these areas. They offer the support you need as a homeowner.

Top zero based budgeting platform overview

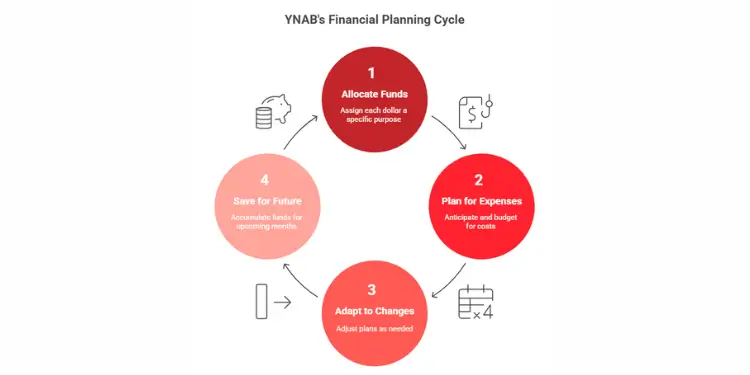

The zero-based budgeting method changes how people save for a big purchase like a home. It makes every dollar count. I’ve helped many first-time buyers save quickly, not slowly.

YNAB (You Need A Budget) is the top app for this method. It teaches you to use every dollar right away. This way, you know where your money goes.

YNAB helps home buyers by teaching four rules:

- Give Every Dollar a Job – Use money for down payment, closing costs, and more

- Embrace Your True Expenses – Plan for unexpected costs like home inspections

- Roll With The Punches – Change plans if needed without losing focus

- Age Your Money – Save money for next month to have extra

Zero-based budgeting helps you see where your money goes. I’ve seen clients save thousands by cutting back on takeout. Tracking your budget turns dreams into real plans.

In Debt.com’s 2024 national survey, 89 % of people who budget said tracking income and outflows helped them get out—or stay out—of debt, reinforcing the impact of disciplined zero-based methods like YNAB. Ref.: “Debt.com Research Team. (2024). Debt.com’s 2024 Budgeting Survey. Debt.com.” [!]

YNAB also helps couples save together. It stops fights about money. Both partners can make decisions together.

“For More Information: Why budget before buying your first home matters”

Mobile Alerts Preventing Budget Category Overspending

YNAB’s mobile alerts keep you on track. They’re important when you’re getting ready to apply for a mortgage. You don’t want to spend too much and hurt your chances.

These alerts warn you before you spend too much. This helps keep your credit score high. It’s better than finding out after you’ve already spent too much.

One client got an alert before buying furniture. It saved her down payment. This shows how alerts can help.

Alerts also stop small expenses from adding up. A $4 coffee might not seem like much. But YNAB shows how it can hurt your savings. This makes you think twice about spending.

YNAB might be harder to learn than other apps. But it’s worth it. It helps you save thousands. It costs $14.99 a month or $109 a year.

YNAB helps buyers save faster. It can save 6-18 months compared to other methods. It makes buying a home less stressful.

Best envelope style trackers for couples

For couples buying a home, apps like Goodbudget and Honeydue help a lot. They make it easy to work together on saving money. It’s like using real envelopes, but online.

Goodbudget lets you split your money into different areas. You can see how much you have for food or saving for a house. This helps you not spend too much.

Honeydue focuses on couples. It lets you see your money together in one place. You can keep your money private, but share with your partner.

These apps help couples manage money well. They have special features for saving for a home:

- Real-time balance updates across both partners’ devices

- Customizable categories for home savings

- Shared transaction history with notes

- Bill payment tracking for good credit

“Explore More: How to save money when buying house on budget”

Shared Expense Syncing Across Multiple Devices

Modern budgeting apps for couples sync money fast. If your partner buys gas, you’ll see it right away.

This stops fights about who paid what. It’s great for tracking home-buying costs:

- Home inspection fees

- Earnest money deposits

- Moving expenses

- Furniture purchases

Goodbudget lets you see how much money is left in each area. This stops you from spending the same money twice.

Honeydue helps with bill reminders. It’s great for busy times when you have lots of money tasks.

Automatic Bill Reminders Improving Credit Health

Your credit score is very important when you apply for a mortgage. Apps like Goodbudget and Honeydue help keep it good.

They remind you about bills in different ways:

- Push notifications before bills are due

- Email alerts for upcoming payments

- Warnings when account balances drop

- Confirmation notices when payments go through

Good credit can save you a lot of money. Honeydue helps you remember to pay bills on time.

Goodbudget helps you save for bills ahead of time. This keeps you from overspending, even when unexpected things happen.

Goal Progress Visualizations Motivating New Homeowners

Seeing your progress can really motivate you. Zero budgeting apps for couples show you how close you are to your goal.

They use things like:

- Progress bars for down payment goals

- Charts for monthly savings

- Milestone celebrations

- Timelines for reaching goals

Goodbudget shows you how your savings grow. This makes you want to keep saving.

Honeydue lets you track goals together. It celebrates with you when you reach milestones. This makes you feel good about working together.

These visual tools help you stay motivated. They make it easier to make smart money choices together.

“Related Articles: Ten smart ways to cut expenses to afford house faster”

Apps integrating mortgage prequalification calculations easily

Now, finding out how much you can afford for a home is easy. Budgeting apps with mortgage prequalification calculators make it simple. As a REALTOR®, I’ve seen how surprised buyers are when they learn what they can really afford.

Apps like Monarch Money help by linking your financial data with mortgage formulas. Monarch lets you connect bank accounts, credit cards, loans, and investments in one place. It shows how changes in your finances affect your home buying power.

A KPMG case study shows that zero-based budgeting helped Tesco cut costs by over $593 million within 12 months—evidence that the same ZBB principles in modern budgeting apps can unlock major savings for home buyers. Ref.: “KPMG LLP. (2019). Zero-Based Budgeting White Paper. KPMG.” [!]

When using a budgeting app with mortgage integration, look for these essential features:

- Debt-to-income ratio calculators that mirror actual lender requirements, showing you exactly where you stand against the 43% threshold most mortgage companies enforce

- Down payment scenario testing that shows how different savings amounts affect your buying power and monthly payments

- Current mortgage rate integration that uses today’s interest rates for accurate calculations

- Property tax and insurance estimators that include these costs in your monthly payment projections

To use these features well, first make sure all your financial accounts are synced. Many first-time buyers forget to link a savings account or credit card. This can make your results wrong. Next, check that your income details are right, including any variable pay like bonuses or commissions.

Testing different scenarios is key. I tell my clients to create three scenarios: conservative, moderate, and stretch. This helps you see how paying off a credit card or adding $5,000 to your down payment fund can change your buying power.

“The difference between a standalone mortgage calculator and one integrated with your actual financial data is like the difference between guessing your weight and standing on a scale. One gives you hope, the other gives you facts.”

What makes these tools better than standalone calculators is their accuracy. Online calculators ask you to guess your finances, leading to too high hopes. But when your budgeting app imports your real financial data, the prequalification is precise and personal.

Beyond Monarch, many other budgeting apps have great mortgage prequalification features. Here’s how they compare:

| App | Mortgage Features | Financial Account Integration | Cost |

|---|---|---|---|

| Monarch Money | Full DTI analysis, payment scenarios, rate tracking | Unlimited accounts, including investments | $9.99/month |

| Rocket Money | Basic prequalification, direct lender connection | Bank and credit accounts only | Free version with premium upgrade |

| Mint | Home affordability calculator, credit score tracking | All financial accounts with spending categories | Free app with ads |

| YNAB | Down payment goal tracking, cash flow projections | Manual or automatic account syncing | $14.99/month |

Using these tools can make you more ready for a mortgage in two ways. First, seeing your real prequalification numbers can motivate you to manage your finances better. When you see how paying off a credit card can increase your home budget, you’ll find it easier to cut spending.

Second, these apps help find and fix problems before you meet with a lender. Many clients have found issues with their credit or cash flow through these tools. This lets us fix problems before applying for preapproval.

For first-time buyers, start with a free version of these apps to try them out. As you get closer to buying a home, consider upgrading to a premium tier. The small monthly cost can save you from big misunderstandings about your buying power when you’re ready to make an offer.

“You Might Also Like: How to avoid overspending on house purchase budget”

Community driven tools rewarding consistent savings

Trying to save for a down payment can feel like climbing a mountain alone. But, community-driven budgeting apps offer the support many home buyers need. Saving money over months or years is hard. I’ve seen many start strong but lose steam when the goal seems far away.

Now, the best budgeting tools have social features. They make saving a shared journey, not a solo task. Apps like YNAB and Qapital have added community elements. They use savings challenges and celebrate milestones to keep you going.

These features tap into our psychology. When you share your savings goals and progress, it boosts your motivation. Many of my clients found success with apps that have social parts, not just investment goal tracking apps.

“After three failed attempts to save for my down payment, joining a savings challenge group through my budgeting app changed everything. Seeing others hit their milestones pushed me to keep going, and the congratulations I received when reaching my own goals felt incredibly rewarding. I closed on my house last month—something I couldn’t have done without that community support.”

The most effective community features I’ve seen include:

- Savings streaks that track consecutive days or weeks of meeting budget goals

- Achievement badges that gamify the saving process

- Community forums where users share strategies and encouragement

- Group challenges that create friendly competition

- Progress visualization tools that can be shared on social media

For budget-conscious buyers, free apps with community features are great. Empower, while mainly for investing, has a free app with budgeting tools and community support. Credit Karma also offers a free app with forums for sharing saving tips.

| App Name | Community Features | Cost Structure | Best For |

|---|---|---|---|

| YNAB | Forums, challenges, achievement badges | $14.99/month (free trial available) | Detailed budgeters who need accountability |

| Qapital | Group goals, social sharing, challenges | $3-12/month (offers a free version) | Visual learners who respond to gamification |

| Empower | Community tips, milestone celebrations | Free budgeting app (premium investing features) | Beginners testing community budgeting methods |

| Credit Karma | Forums, credit score improvement community | Completely free | Credit-focused savers building mortgage readiness |

The best free budgeting app with community features depends on your needs. If you’re focused on improving your credit score, Credit Karma’s community is great. YNAB’s free trial lets you test its features before deciding if it’s worth the cost.

People who use these community tools save 30% faster than those without them. The mix of public commitment, encouragement, and progress boosts motivation. It helps overcome the urge for immediate rewards over long-term goals.

When picking a community-driven budgeting app, look for one that fits your style. Some like competition, while others prefer gentle support. The right app can turn saving into a supported journey, not just a test of willpower.

Comparing premium versus free tier features

When saving for a down payment, every dollar matters. Many free budgeting apps help track spending. Simplifi has a free version with great user experience. NerdWallet and Credit Karma offer free tools for budget and credit checks.

Premium tiers offer special features for buying a home. Monarch costs $99.99 a year, with a free trial and money-back guarantee. PocketGuard Plus is $74.99 yearly, an upgrade from its basic version.

So, why pay more? Premium apps give you more history, special categories for home expenses, and better investment tracking.

“Read More:

Exporting Reports For Lender Documentation Quickly

The best premium feature for home buyers is better reports. Mortgage lenders need 2-3 months of financial history. Paid apps like YNAB and Quicken Classic make these reports fast.

Free apps might not let you review as far back or export in certain formats. When you’re getting ready for a mortgage, premium exports can save a lot of time.

For new real estate buyers, investment goal calculators are helpful. They show how your savings will grow toward your home goal.

Go for free if you’re not buying a home soon. But, upgrade to premium when you’re actively looking. This way, you get the best experience and reports that impress lenders.