Many wonder how to budget for down payment on first dream house in Greenville. That single goal keeps nights restless.

Is there a smooth path to lock in your savings? Over 62% of new buyers worry about the upfront cost (NAR, 2022). “A consistent plan shortens the journey,” shares the National Association of Realtors. I recall doubting my own readiness before seeing my monthly math was doable.

Quick hits

- Determine your monthly leftover funds

- Estimate 20% with an online tool

- Track progress with weekly reviews

42% of prospective U.S. homebuyers identify saving for a down payment as their primary obstacle, underscoring the need for a disciplined savings plan. Ref.: “National Association of Realtors & Morning Consult. (2022). Obstacles to Home Buying. National Association of Realtors.” [!]

Set realistic purchase price target

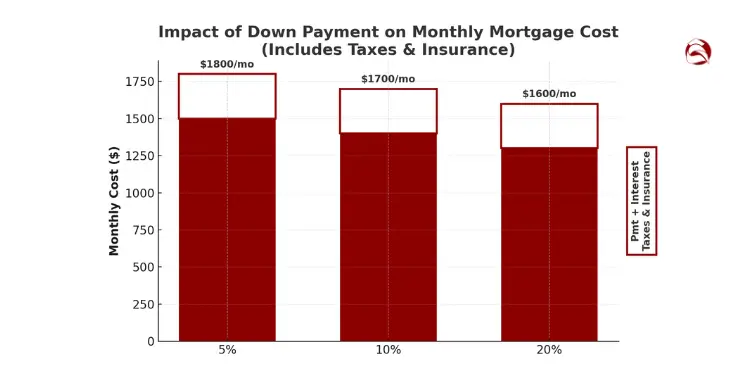

I start by figuring out a monthly mortgage cost that’s 25% of your income. This includes the loan’s principal, interest, and fees. It helps keep your future payments in check with your daily costs.

Taxes and insurance also add up. Including them early helps avoid surprises in your budget.

Choosing between an FHA loan or a conventional loan depends on your savings. A smaller down payment means you’ll pay for private mortgage insurance. This extra fee can increase your monthly payments.

Leading budgeting guidance caps total housing costs at 25 % of after-tax income to prevent buyers from becoming “house poor.” Ref.: “Money Under 30 Editorial Team. (2024). What Percent of Income Should Go to Mortgage Payments? Money Under 30.” [!]

Looking at a quick guide to down payments in this resource can help. It shows you the difference between big and small down payments.

| Mortgage Type | Min Down Payment | PMI Range |

|---|---|---|

| FHA | 3.5% | ~ 0.8% – 1.05% annually |

| Conventional | 3-5% | ~ 0.5% – 1.5% annually |

| VA | 0% | None |

Freddie Mac estimates that PMI can add ≈ $30–$70 per month for every $100 k borrowed, with costs scaling alongside credit risk and loan size. Ref.: “Freddie Mac. (2025). Breaking Down PMI. Freddie Mac — MyHome.” [!]

Determine required down payment percentage

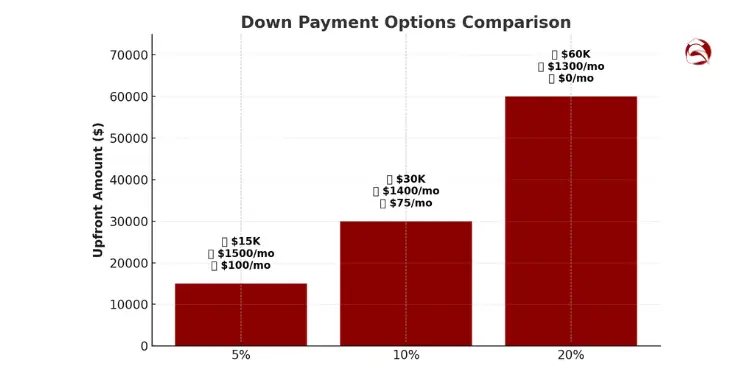

Some buyers want a small down payment, while others aim for more. It’s smart to compare numbers before deciding. A 5% down payment lowers costs but raises monthly payments.

A bigger down payment, like 20%, can get you a better rate. People often think about both short-term money needs and long-term savings.

Compare five ten twenty percent scenarios

At 5%, you pay less at closing but more each month. At 10%, you find a middle ground. This cuts down on interest but keeps options open.

The CFPB finds that moving from a 5 % to a 10 % down payment can reduce both mortgage-insurance costs and interest rates, delivering measurable lifetime savings. Ref.: “Consumer Financial Protection Bureau. (2025). Explore Interest Rates Tool — Down Payments and Rates. CFPB.” [!]

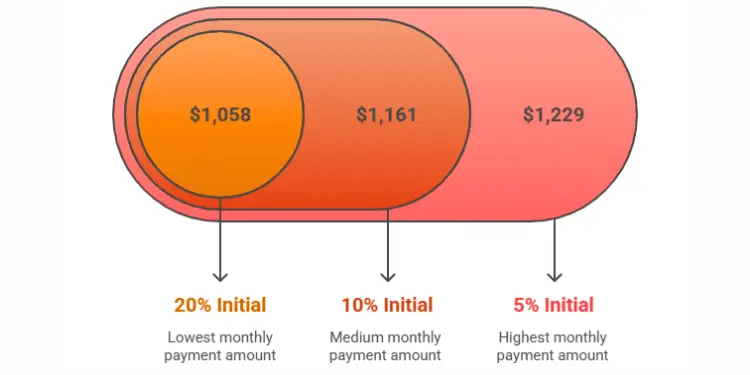

A 20% down payment on a $225,000 home means about $1,058 monthly at 3.946% APR. This info comes from this down payment calculator.

| Option | Upfront Amount | Monthly Payment | Insurance |

|---|---|---|---|

| 5% Initial | $11,250 | ~$1,229 | Needed |

| 10% Initial | $22,500 | ~$1,161 | Needed |

| 20% Initial | $45,000 | $1,058 | Avoided |

Account for mortgage insurance thresholds

With less than 20% down, you’ll likely need mortgage insurance. This adds to your monthly costs. Fannie Mae and CFPB say down payments can be 3% to 20%.

This home-buying budget checklist shows common percentages. It helps you plan your budget.

Incorporate timeline into savings plan

I often suggest choosing a 6-, 12-, or 18-month runway for setting aside the down payment. This makes your goal smaller and easier to reach. You see each part add up, keeping you focused and not feeling too much.

Check out smart budgeting strategies that help you win every day.

“Explore More: House hacking first home guide for new buyers“

Break goal into quarterly benchmarks

Split your target into quarters. Each quarter is like a finish line. You measure progress in shorter spans and can adjust if needed.

I’ve seen buyers stay confident as they complete each phase. They know steady growth gets them to the final tally.

Align bonuses with lump sum deposits

Some jobs give annual or mid-year bonuses. Use that extra money for your home fund. One deposit can clear a whole benchmark, speeding up your savings.

Use apps tracking daily contributions

Free tools and budget apps help you log progress daily. Seeing your account grow motivates you to keep going. A daily update shows if you need to make changes and if you’re on track.

“Related Articles: How interest rates affect affordability for home buyers“

Boost income streams to grow fund

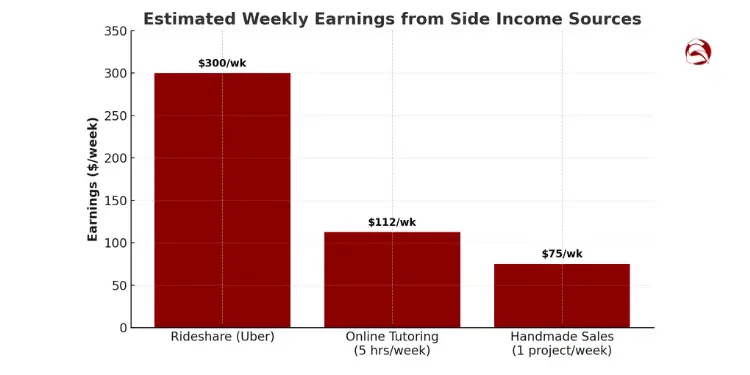

I’ve helped people find that a side job can move their down payment date up. One person made money by driving for Uber. They used their weekend hours to earn money for closing costs.

Another person cut their rent by getting a roommate. This made more room in their budget for saving.

Think about using your free time for online tutoring or making things to sell. Even a small sale can bring in $50–$100. This money adds up quickly. Keeping track of your extra work helps you reach your goal faster.

Sharing your space or renting out a room can also help. I’ve seen this help people buy a house sooner. For more on hidden costs, check out this guide.

- Find a side job that fits your schedule.

- Put the extra money in a special fund.

- Check your progress each month and adjust if needed.

| Side Hustle | Approximate Earnings | Time Involved |

|---|---|---|

| Rideshare services (Uber) | $200–$400 weekly | 10–20 hours |

| Tutoring (online) | $15–$30 per hour | Flexible |

| Handmade sales (Etsy) | Varies by demand | Project-based |

Guard savings from market volatility

I once put my future down payment in stocks and worried when they fell. A safer choice was to keep some money in stable places. Short-term CDs are good, but watch out for early withdrawal penalties.

The SEC warns that stock volatility makes equities “very risky in the short term,” making them unsuitable for funds needed within just a few years. Ref.: “U.S. Securities & Exchange Commission. (2009). Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing. SEC.” [!]

Be ready to change plans and think about your time frame.

Read More:

Shift funds into high yield account

A high-yield savings account is safer and often pays more than checking accounts. Some people use both to balance safety and growth. Having a secure emergency fund helps a lot.

FDIC data (June 2025) sets the savings-deposit rate cap at 5.08 %, illustrating how high-yield accounts can accelerate your down-payment timeline versus traditional savings rates. Ref.: “Federal Deposit Insurance Corporation. (2025). National Rates and Rate Caps — June 2025. FDIC.” [!]

Learn more about budgeting before buying to reach your goals.