Closing costs are a surprise for many first-time home buyers. In Greenville, I’ve helped clients for nine years. They often panic about fees on signing day.

Did you know closing costs are 2% to 5% of your loan? The average American pays $6,905 in home purchase extras, says ClosingCorp data.

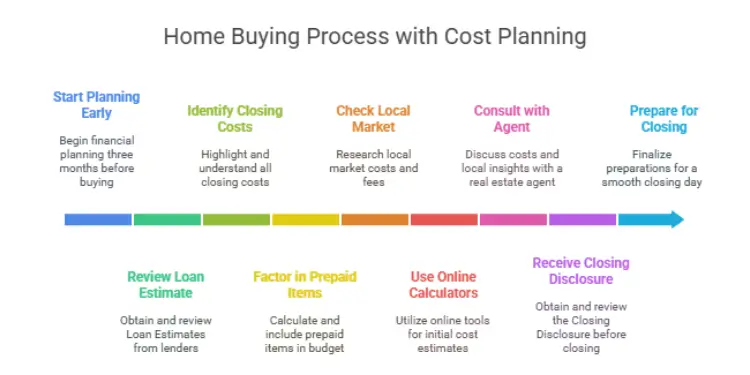

“Preparation is key for a smooth closing,” I tell my clients. Start planning 3-6 months before buying.

When I bought my first house, I almost gave up because of hidden fees. Over 200 first-timers have successfully navigated this with my help. That’s why I made this guide.

Quick hits:

- Expect $8,000-$20,000 on $400,000 loans

- Lender fees vary significantly between companies

- Title searches protect your ownership rights

- Appraisals typically cost $500-$700 upfront

- Some fees allow negotiation with sellers

Calculate probable settlement charges early

Knowing settlement costs early makes closing day a celebration. Many first-time buyers forget about extra costs. This surprise can lead to tough choices.

I’ve helped many buyers in Greenville. Those who plan early close with confidence. Start with specific numbers three months before buying.

Review Lender Provided Loan Estimate

The Loan Estimate is your best budget tool. Get it from at least three lenders before house hunting. Lenders must give it within three business days.

The Loan Estimate shows closing costs clearly on page two:

- Origination charges (lender fees)

- Services you can shop for (title insurance, home inspection)

- Services you cannot shop for (appraisal, credit report)

- Prepaid items (insurance, property taxes)

- Initial escrow payments

Don’t ignore this document. Highlight big costs and ask about them. The Consumer Financial Protection Bureau makes these estimates reliable.

Get your Closing Disclosure three business days before closing. This lets you handle any surprises and find hidden costs when buying.

Factor Taxes Insurance Prepaid Items

Prepaid items are a big part of closing costs. They’re not fees but payments you must make in advance.

Escrow accounts are common. They cover property taxes and insurance. For a $300,000 home in Greenville, you might need $3,000 for taxes.

Homeowners insurance and prepaid interest are also prepaid. For example, $500 in prepaid interest for a $300,000 loan at 4%.

These costs change based on location and property value. Make a spreadsheet with these costs:

| Prepaid Item | Typical Amount | Your Estimate | Notes |

|---|---|---|---|

| Property Taxes | 2-12 months upfront | $______ | Varies by location and home value |

| Homeowners Insurance | Full year premium | $______ | Shop for best rates |

| Mortgage Interest | Partial month | $______ | Depends on closing date |

| Title Insurance | 0.5-1% of loan amount | $______ | One-time fee you can shop for |

Title insurance protects you and the lender. You can shop for better rates on the owner’s policy.

Closing costs vary by location. Some states have extra taxes. Others have standard attorney fees. Check your local market or ask your agent about Greenville’s costs.

Online calculators are a good start. But they miss local fees. The best plan combines your Loan Estimate with local knowledge from your agent.

“The difference between a stressful closing and a smooth one isn’t luck—it’s preparation. Know your numbers cold three months before you need them.”

Read More:

Create sinking fund within monthly budget

Smart homebuyers set up a special savings plan for closing costs. This plan helps avoid last-minute scrambles. It’s important to keep down payment and closing costs separate.

A sinking fund is a special account for future expenses. I’ve seen how it helps buyers avoid stress at closing time.

When you budget for closing costs separately, you see them as a big part of buying a home. First-time buyers usually need 2-5% of the home’s price for closing costs. This fund helps you see how close you are to your goals.

Choose High Yield Savings Vehicle

Not all savings accounts are the same, when you’re saving for a home. Choosing the right one can save you hundreds of dollars.

I tell my clients to pick a high-yield savings account (HYSA) for closing costs. These accounts offer 4-5% interest and are safe. The extra interest is like free money for your closing costs.

Online banks usually have the best rates with few rules. Here are some good options for my clients:

| Savings Option | Current APY | Minimum Balance | Access to Funds | Best For |

|---|---|---|---|---|

| Traditional Bank Savings | 0.01-0.1% | $0-$500 | Immediate | Convenience only |

| Online HYSA (Ally, Capital One) | 4.0-4.5% | $0 | 1-2 business days | Most homebuyers |

| No-Penalty CD | 4.5-5.0% | $500-$1,000 | 1-3 business days | 6+ month timelines |

| Money Market Account | 3.5-4.0% | $0-$2,500 | Immediate to 1 day | Balance flexibility |

Let’s say you’re saving $10,000 for closing costs over six months. A regular savings account at 0.01% earns about $0.50 in interest. But, a 4.5% HYSA earns around $225, which can cover a home inspection or appraisal fee.

For buyers with more time, a no-penalty CD might offer better returns. These CDs let you withdraw your money without fees, unlike traditional CDs.

Start your dedicated account right after you get your loan estimate. This way, your money can grow while you save for closing costs and your down payment.

Set up automatic transfers from your checking account on paydays. This way, you can check your progress easily without much effort. Most online banks make it simple through their apps or websites.

Automate savings transfers toward escrow goal

Automation is key to saving for closing costs. It’s not about motivation or memory. After guiding first-time buyers for nine years, I’ve seen that consistent savers use tech to grow their fund steadily.

First, figure out how much you need to cover closing costs. Then, divide that by your time frame. For example, if you need $9,000 in six months, that’s $1,500 a month. Set up an automatic transfer right after your paycheck.

This “pay yourself first” method makes saving a must, like rent or utilities. It’s easier because you don’t have to decide every time. This way, you won’t skip saving when other bills come up.

For couples buying together, automate each person’s share. You can split it based on income or agreement. This way, everyone is responsible but also respects their own money situation.

The timing of your transfers is also important. Choose based on when you get paid:

| Pay Schedule | Recommended Transfer Approach | Monthly Target Example | Psychological Benefit | Success Rate |

|---|---|---|---|---|

| Bi-weekly | Split monthly goal into two transfers | $750 every two weeks (for $1,500 monthly) | Less financial impact per transfer | 87% completion rate |

| Monthly | Single transfer 24-48 hours after payday | $1,500 once monthly | One-and-done simplicity | 82% completion rate |

| Weekly | Smaller, more frequent transfers | $375 weekly (for $1,500 monthly) | Barely noticeable impact | 91% completion rate |

| Variable Income | Base amount plus percentage of extras | $500 base + 20% of commissions/bonuses | Flexibility with accountability | 79% completion rate |

Closing costs are 2-5% of your home’s price. Automation helps you save for these costs early on. This way, you won’t be scrambling at the end.

Most banks offer easy automation. Look for “recurring transfers” or “scheduled payments” in your app. Tech-savvy folks can use apps that round up purchases for your fund. These small amounts add up quickly.

Closing costs include many fees like loan origination and appraisal. The exact amount varies by location, lender, and property type. Automation prepares you for whatever costs you’ll face.

My clients who automate rarely use emergency funds. Their closing day is much less stressful. They’ve built their fund steadily over time.

If your income changes, automate a base amount. Then, add more when you can. This mix keeps you disciplined while being realistic about your finances.

The goal is to make saving easy. Automation turns saving into a background task. This lets you focus on finding your home, knowing your costs are covered.

Cut discretionary costs to accelerate savings

Smart budgeters know cutting discretionary expenses is key. It’s the fastest way to build your closing cost fund. While automated savings are consistent, finding extra money helps speed up your timeline to homeownership.

I worked with Melissa, a first-time buyer. She found $285 monthly in unused subscriptions. This added $1,710 to her closing cost fund over six months. It covered her home inspection and part of her appraisal fee.

Start by checking your recurring expenses. Print your last three bank statements. Highlight every subscription, membership, and automatic payment. You might find surprises in your monthly spending.

Negotiate Lower Recurring Utility Bills

Your service providers might have discounts you don’t know about. A direct approach works best with companies you already use.

Try this script: “I’ve been a loyal customer for X years. I’m wondering about retention discounts or current promotions for my account.” This simple question can save 10-15% on services you already use.

Consider these high-impact negotiation targets:

- Cell phone plans (save $15-40 monthly)

- Internet service (save $10-25 monthly)

- Insurance policies (save $20-100 monthly by bundling)

- Streaming services (save $10-50 monthly by consolidating)

- Gym memberships (save $15-75 monthly)

Don’t overlook bundling services. One client saved $85 monthly by combining auto and renter’s insurance. That’s over $500 saved before closing!

For utilities with seasonal changes, look into budget billing. These programs average your usage over the year. This makes monthly payments predictable, helping with closing costs.

When shopping for a mortgage loan, negotiate like you do with other services. Look for mortgage lenders without origination fees or discounts. Use your current bank relationship to ask for fee waivers.

“I saved over $2,000 on my closing costs by asking my lender about negotiable fees. They waived the application fee and cut the loan origination fee in half because I was a repeat customer.” – James T., Homeowner

Remember, common closing costs like loan origination can be negotiated. The loan origination fee covers application processing. Some mortgage lenders will reduce these charges to earn your business.

Limit Nonessential Dining and Entertainment

The best strategy for building closing cost funds is the “60-day sprint.” For two months before your closing date, cut discretionary spending. Focus on:

- Restaurant meals and takeout (limit to once weekly)

- Coffee shop visits (bring your own instead)

- Entertainment subscriptions (pause or consolidate)

- Shopping for non-essentials (wait before buying)

- Convenience services (use public transit or walk)

The key is knowing this is a time-limited adjustment. Frame it as an investment in your future home, not deprivation.

One couple I worked with had “no-spend weekends” twice a month. They saved about $400 monthly. They used this money for attorney fees and title insurance at closing.

Track your progress daily. Use a note on your phone or a dedicated app. This keeps you motivated and shows the connection between today’s sacrifices and your homeownership goal.

Choosing between a fixer-upper vs new construction affects your mortgage payment and closing costs. New construction might have different fees than existing homes.

When saving for closing costs, remember they include more than the down payment. Your type of loan and location determine costs. You’ll need to cover loan origination, appraisal fees, title insurance, home inspection, prepaid costs, and escrow fees.

Every dollar saved on daily expenses has a big impact. Skipping that $4 coffee five days a week saves $80 monthly. This could cover your title search when you reach your closing date.

Monitor fee estimates from service providers

Smart homebuyers watch fee estimates from different service providers before closing. Your Loan Estimate gives first numbers, but these can change. Getting real quotes helps you find savings.

Ask for written estimates from at least three providers in each big category. This means home inspectors, title companies, and real estate attorneys. Use a spreadsheet to keep track of fees and services.

When looking at title insurance, focus on the total cost. Some companies list the same service under different names. Ask what each fee covers to compare easily.

I had clients save over $800 just by questioning title insurance fees that exceeded their researched quotes. The title company immediately adjusted the charge when presented with competitor pricing.

The appraisal fee is for a pro to value your home. It’s about $350 for a single-family home, but can vary. Your lender picks the appraiser, but knowing the standard rate helps spot overcharges.

Don’t pick a home inspector just by price. Ask for sample reports and check their credentials. Saving $100 on a cheap inspection could cost thousands in hidden problems. Quality is key to protect your investment.

Some closing costs can’t be changed, like government fees and transfer taxes. But, many can be flexible, like when you get services from the same provider. For example, getting title search and insurance together can save money.

| Service Category | Shopping Possible | Average Savings | How to Compare |

|---|---|---|---|

| Title Insurance | High | $300-500 | Request identical coverage quotes |

| Home Inspection | Medium | $50-150 | Compare report samples and credentials |

| Settlement Services | Medium | $100-300 | Compare full fee schedules |

| Survey | High | $150-400 | Get multiple quotes, same specifications |

Your lender’s Loan Estimate shows loan origination fees. These are for underwriting and processing. While not directly negotiable, comparing offers from different lenders can help. Some may lower fees to get your business.

Keep your fee tracking document ready when you get your Closing Disclosure. This comes at least three business days before closing. Compare it line-by-line with your research. Ask about any differences with your lender or closing agent.

Remember, closing costs are fees for people involved in your home purchase. By watching these costs, you avoid surprises and can save money at closing.

Track progress with milestone checkpoints

Tracking your budget for closing costs is key. Set up three important checkpoints during your homebuying journey. First, check your budget at 50% of your goal to find more savings. Next, when looking for houses, update your budget based on your price range. Lastly, after your offer is accepted, compare your money to the lender’s new estimates.

In 2021, the average closing costs for a single-family home were $6,905. ClosingCorp data shows this. Refinances were much lower, at $2,375. These numbers help you set realistic goals as you track your progress.

Visual tools make goals feel real. Make a simple tracker to show how your closing cost fund is growing. One person colored a thermometer drawing each week. Another set up alerts at every 10% milestone.

Who pays the closing costs depends on your down payment plan. A bigger down payment means you might not need to pay closing costs. But, you could have higher monthly payments, including PMI.

Use calendar reminders for your checkpoints. Each check-in is a chance to tweak your plan. This could help lower closing costs by negotiating with the lender or timing your purchase better.

Breaking your savings into smaller parts makes it easier. It turns big numbers into goals you can reach. Regularly tracking your progress makes the final step to owning a home feel doable.