The digital finance world often mixes up two big ideas. Did you know 42% of Americans think blockchain and cryptocurrency are the same?

This mix-up can cost you a lot. Bitcoin started both ideas in 2009. But now, they are different and serve different purposes.

Naval Ravikant, a tech investor, said, “Blockchain is to cryptocurrency what the internet is to email – a bigger, broader platform where the currency is just one application.”

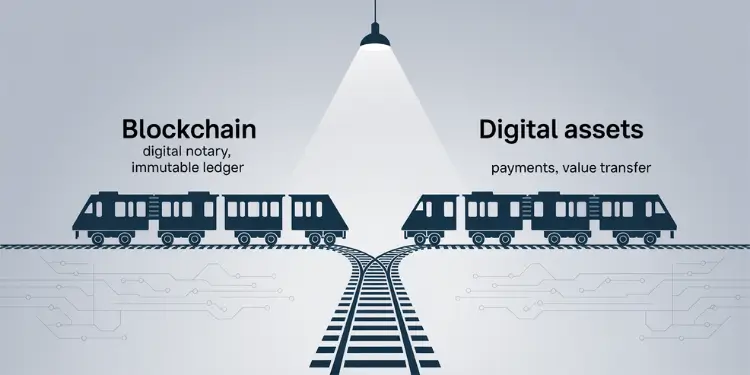

When I taught these ideas in 2015, I used a simple example. I said blockchain is like railroad tracks. Digital assets are like trains running on those tracks.

In this guide, I’ll show you the big differences between these technologies. You’ll see how they change our money world. You’ll learn what’s important for your money choices.

Blockchain is a distributed, append-only ledger maintained by a network of nodes that validate and cryptographically link data blocks to ensure immutability and transparency. Consensus protocols such as proof-of-work or proof-of-stake coordinate network agreement, preventing single-point failures or tampering. This infrastructure supports data integrity and timestamped record keeping across applications ranging from asset tracking to legal document management without requiring a central authority.

Cryptocurrency represents tokenized digital value that leverages blockchain to enable peer-to-peer transactions, programmable monetary policy, and standardized units of account. Native coins like Bitcoin fulfill roles as medium of exchange, store of value, and unit of account, governed by protocol-defined issuance schedules and consensus-driven upgrades. Token economic models vary in supply mechanisms—mining, staking, or pre-mining—while governance frameworks determine protocol evolution and monetary policy, illustrating that cryptocurrency is a specific application built on blockchain rather than the underlying technology itself.

- Understand the fundamental structure of each technology

- Learn why confusing these terms leads to investment misconceptions

- Discover which aspects matter most for your specific financial goals

- Gain clarity on how these technologies function independently and together

Core purpose and functional objectives

Blockchain and cryptocurrencies are different. They solve different problems in our economy. This is important to know if you’re new to digital assets.

Blockchain is like a digital notary. It keeps records forever and is checked by many computers. This makes it very secure.

Cryptocurrencies are for storing value and making payments. Bitcoin lets people pay each other without banks.

Blockchain is used for more than just money. It can store data like real estate and legal documents. Cryptocurrencies are just one use of this tech.

Value Storage Versus Transaction Recording

When you use cryptocurrency, you’re dealing with value. Think about the last time you paid for something. Was it the payment or the record of it that mattered?

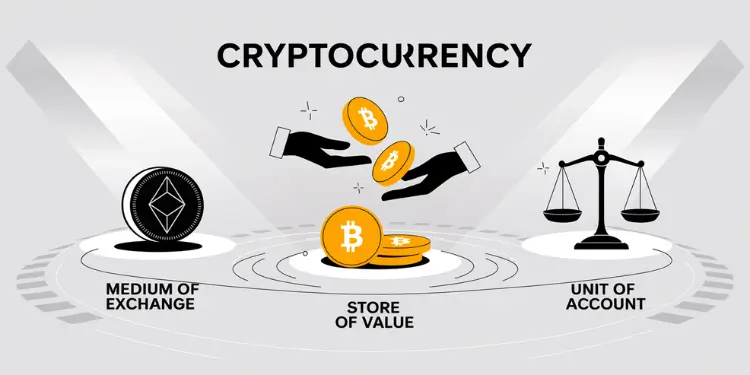

Cryptocurrencies have three main jobs:

- Medium of exchange – for direct payments

- Store of value – keeping value over time

- Unit of account – measuring worth

Cryptocurrencies like Bitcoin have value because they’re useful and rare. The blockchain keeps track of all transactions.

The blockchain makes sure transactions are recorded right. When you send cryptocurrency, it’s not just the value that moves. It also records who sent it, who got it, and when.

For example, Bitcoin’s blockchain has all transactions from 2009. This record proves who owns all Bitcoin, making the system trustworthy without needing a central authority.

“Related Articles: Best blockchain books for beginners“

Token Economics Compared to Ledger Integrity

Token economics and blockchain integrity are two different things. Knowing this helps you decide what’s more important to you.

Token economics deals with how a cryptocurrency’s value is set. Different projects have different models:

- Bitcoin has a limited supply to create scarcity

- Some cryptocurrencies grow in supply

- Others reward users for helping the network

I tell my students that cryptocurrencies are like digital commodities. Their value changes based on how useful they are and how people feel about them.

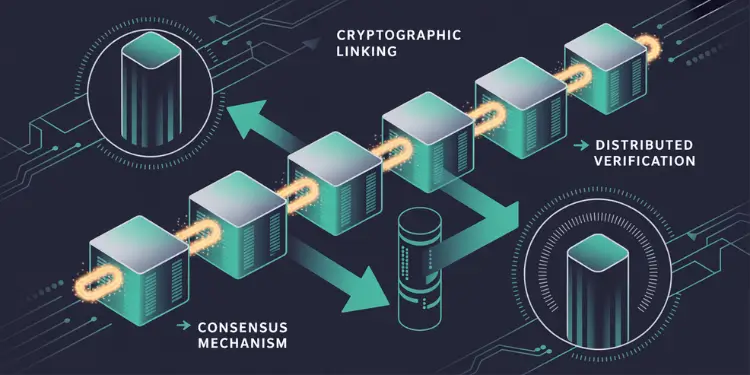

Blockchain’s main point is its integrity. It ensures that once something is recorded, it can’t be changed without everyone agreeing. This comes from:

| Blockchain Feature | Purpose | Benefit |

|---|---|---|

| Cryptographic linking | Connects blocks sequentially | Makes tampering evident |

| Distributed verification | Spreads validation across nodes | Prevents single points of failure |

| Consensus mechanisms | Establishes agreement rules | Ensures network-wide consistency |

When looking at a blockchain project, check how it keeps its integrity. What method does it use to agree on changes? How many people secure the network? The answers show how secure it is.

Imagine sending $100 in cryptocurrency to a friend. The cryptocurrency is the value, and the blockchain makes sure the transaction is recorded right. This shows why blockchain and cryptocurrencies are different, even though they work together.

“Read More: Best blockchain courses for beginners guiding first steps“

Governance models and network control

Every blockchain and cryptocurrency has a governance system. This system decides who has power and how decisions are made. It shapes the project’s future.

Blockchain is the technology that provides the base. But, the governance structures show big differences in how these systems grow.

Think of blockchain as a digital town square. Everyone can see what’s happening. But, someone must decide on changes like fixing roads or adding benches. That’s governance – the rules for making decisions.

“Related Articles: Hot wallet vs cold storage options explained“

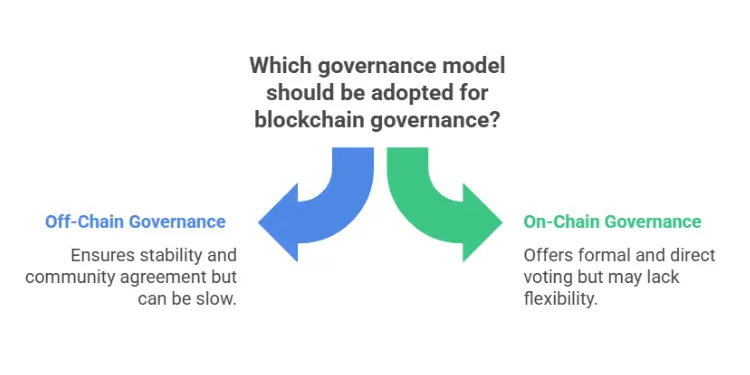

Off-Chain vs. On-Chain Governance

Blockchain governance has two main types. Bitcoin, a famous cryptocurrency is a digital currency, uses “off-chain governance.” In this model, developers suggest changes, miners show support, and users decide by updating their software.

When Bitcoin proposes big changes, the community talks a lot. No single person can force updates. It needs everyone’s agreement. This makes decisions slow but keeps things stable.

Newer blockchain platforms like Tezos use “on-chain governance.” Here, token holders vote on proposals directly on the blockchain is a distributed ledger. This makes the process more formal.

Cryptocurrency Governance and Monetary Policy

Blockchain governance deals with technical changes. But, cryptocurrency governance focuses on money and token distribution. It asks who issues new tokens and how fees are shared.

For example, Bitcoin’s “halving” event every four years cuts mining rewards. It’s not decided by anyone. It’s set in the protocol from the start – an automatic money policy.

Other cryptocurrencies might have companies controlling a lot of tokens. This gives them a big say in the project’s direction. This seems centralized, even though the tech is not.

The governance structure directly impacts how centralized or decentralized control over the network really is, regardless of marketing claims.

Evaluating Governance Transparency

When looking at blockchain or cryptocurrency projects, check who really makes decisions. Projects with open governance, active communities, and successful updates without central control are healthier.

Ask these questions when evaluating a project:

- Who can propose changes to the protocol?

- How are proposals evaluated and approved?

- What mechanisms exist for resolving conflicts?

- How distributed is the voting power?

- Is the governance process documented and accessible?

The answers show if a project really follows decentralization. Or if control is held by a few powerful people.

| Governance Aspect | Blockchain Technology | Cryptocurrency Projects | Real-World Example |

|---|---|---|---|

| Primary Focus | Protocol upgrades and technical changes | Monetary policy and token economics | Ethereum’s transition to Proof of Stake |

| Decision Makers | Core developers, miners, node operators | Token holders, foundations, development teams | Bitcoin Core developers proposing BIPs |

| Voting Mechanism | Often informal through software adoption | Token-weighted voting or foundation decisions | Polkadot’s on-chain referenda |

| Centralization Risk | Mining pool concentration, developer influence | Whale token holders, pre-mine distribution | Binance Smart Chain’s limited validator set |

The difference between blockchain and cryptocurrency governance shows a key truth. The tech may be decentralized, but human groups often make it centralized. Knowing these governance models helps you choose projects that match your values and expectations for digital finance.

“For More Information: Blockchain Myths and Facts Revealed Debunking Common Crypto“

Supply mechanisms and issuance limits

Blockchain and cryptocurrencies are different. Blockchain is the tech behind them, like a digital ledger. But, it doesn’t need tokens to work.

Cryptocurrencies, on the other hand, are digital money. They have rules for making and sharing new money. This affects their value and use.

Bitcoin’s hard-coded 21 million-coin cap—and quadrennial “halving” events—limits monetary expansion, affecting miner incentives and network economics Ref.: “Hayes, A. (2024). What Happens to Bitcoin After All 21 Million Are Mined? Investopedia.” [!]

Imagine blockchain as a digital book. It tracks info without making money. But, cryptocurrencies are the money in that book. They need rules to exist.

“Further Reading: Blockchain vs distributed ledger clarifying terminology“

Mining, Minting, Staking Creation Methods

Bitcoin uses mining to create new coins. Miners solve puzzles with special computers. They get new coins for solving the puzzle.

This secures the network and gives out new coins. Bitcoin’s rules cut mining rewards in half every four years. This will eventually stop at 21 million coins.

“Mining isn’t just about creating new coins – it’s the process that secures the entire network by making attacks prohibitively expensive in terms of computing power.”

Other methods like Proof-of-Stake (PoS) came later. It uses coins to choose who validates transactions. This uses less energy than mining.

The Cambridge Bitcoin Electricity Consumption Index estimates the network now draws ~105 TWh per year—roughly the power used by a mid-sized country Ref.: “Cambridge Centre for Alternative Finance. (2025). Cambridge Bitcoin Electricity Consumption Index (CBECI). Cambridge Judge Business School.” [!]

Some projects use Proof-of-Authority (PoA) or pre-mining. These methods don’t need mining or staking. They create coins differently.

| Creation Method | Energy Usage | Distribution Model | Example Cryptocurrencies |

|---|---|---|---|

| Proof-of-Work | High | Competitive mining | Bitcoin, Litecoin, Dogecoin |

| Proof-of-Stake | Low | Proportional to holdings | Ethereum 2.0, Cardano, Solana |

| Proof-of-Authority | Very Low | Authorized validators | VeChain, POA Network |

| Pre-mining | Initial only | Developer-controlled | Ripple (XRP), Stellar (XLM) |

These methods affect inflation and wealth. Knowing how coins are made is key. It shows a project’s economic plan.

Try mining or staking with small amounts. It’s a great way to learn. You’ll see how blockchain and cryptocurrencies work together.

“Check Out: Blockchain Limitations and Challenges“

Use cases across industry verticals

Blockchain and cryptocurrency are used in many ways. They solve real-world problems in different ways. When I teach blockchain basics, people often think they are the same. But they are not used the same way in every industry.

Blockchain is used in many places, not just for money. It helps keep records safely and clearly. This is great for tracking things in supply chains.

“Blockchain lets us keep a safe record of a product’s journey,” says Sarah Chen of TrackChain Solutions. “Everyone can trust it without needing a boss.”

Walmart’s IBM Food Trust pilot cut mango-trace time from 6 days to 2 seconds—demonstrating blockchain’s unrivaled traceability power in supply-chain contexts Ref.: “Kamath, R. (2018). Food Traceability on Blockchain: Walmart’s Pork and Mango Pilots with IBM. Journal of the British Blockchain Association.” [!]

In healthcare, blockchain keeps patient records safe. It lets doctors share information when needed. Governments use blockchain for voting and to keep track of property.

| Industry | Blockchain Application | Key Benefit | Cryptocurrency Involvement |

|---|---|---|---|

| Supply Chain | Product tracking and verification | Transparency and authenticity | Optional (incentive systems) |

| Healthcare | Patient record management | Security with controlled access | Rarely needed |

| Finance | Settlement systems, smart contracts | Automation and reduced intermediaries | Often integrated |

| Art/Media | Provenance tracking, royalty distribution | Proof of ownership | Common (NFTs) |

Cryptocurrencies are mainly used for money things. Bitcoin is like digital gold. Ethereum lets people write smart contracts, starting DeFi.

There are special cryptocurrencies for different things:

- Monero is for secret money

- Utility tokens get you into services

- Stablecoins are like regular money

- Governance tokens let you vote

Choosing between blockchain and cryptocurrency depends on the problem. A supply chain might just need blockchain, not cryptocurrency.

When thinking about blockchain or cryptocurrency, ask these questions:

- Does it need to be decentralized?

- Is keeping records important more than money?

- Does adding a token add value or mess things up?

Not every blockchain needs its own cryptocurrency. Trying to force it can fail. I’ve seen startups try to use blockchain where it’s not needed.

The best use of blockchain matches the problem. For example, sending money across borders works with blockchain and cryptocurrency. But a hospital might just need blockchain for records, not cryptocurrency.

Think of a problem in your field that blockchain could solve. Then decide if you need cryptocurrency too. This helps understand how blockchain and cryptocurrency are different.

“Dive Deeper: Hot wallet vs custodial wallet“

Security architecture and risk considerations

Blockchain networks and cryptocurrency holdings have different security needs. Blockchain is the base for cryptocurrencies. But, each has its own security challenges.

Blockchain security uses a system where everyone agrees on the data. This makes it hard to change the data. It’s like a chain where each link is connected to the next, making it hard to break.

Crypto security focuses on keeping your digital money safe. This means keeping your private keys safe. Even with a secure blockchain, your crypto can be lost if your keys are not safe.

Consensus Attacks Versus Wallet Exploits

Blockchain networks face threats like the 51% attack. This attack lets one person control most of the network. They can then spend money twice or block transactions.

Bitcoin’s security comes from its proof-of-work system. It’s very hard to attack because it needs a lot of computer power. Other blockchains use different systems, each with its own risks.

Crypto wallets have their own risks. These include:

- Private key theft through malware or phishing

- Exchange hacks that compromise custodial holdings

- Smart contract vulnerabilities that allow unauthorized withdrawals

- Social engineering attacks targeting recovery phrases

I once almost lost my wallet because of a bad seed phrase backup. The blockchain was safe, but my security wasn’t. This taught me that blockchain can’t protect you if you don’t protect your keys.

“The security of your cryptocurrency depends not just on the blockchain’s integrity but on how well you manage your keys. Even the most secure distributed ledger can’t save you from a compromised private key.”

Regulatory Oversight Impact on Stability

Blockchain and cryptocurrencies have different rules. Blockchain is seen as a technology like databases or cloud computing. It gets less direct rules.

Blockchain for things like supply chains and identity systems has clear rules in many places. These rules focus on the technology’s ledger, not its money side.

Cryptocurrencies have a complex and changing rule set. In 2015, the U.S. said Bitcoin is a commodity. But, countries have different rules:

| Regulatory Aspect | Blockchain Impact | Cryptocurrency Impact | Stability Effect |

|---|---|---|---|

| Securities Laws | Minimal direct impact | May classify tokens as securities | High price volatility during regulatory shifts |

| Anti-Money Laundering | Compliance requirements for certain applications | KYC/AML mandates for exchanges | Increased transaction friction |

| Tax Treatment | Business expense considerations | Capital gains and income reporting | Compliance burden affecting adoption |

Rules can make crypto prices go up and down a lot. This doesn’t happen with blockchain projects that aren’t about money.

When looking at rules, think about current rules and future changes. Some places want more crypto, while others don’t.

To stay safe, keep up with rule changes. Make sure you follow tax rules for your crypto. Talk to a financial advisor who knows about digital assets.

Do something extra to keep your crypto safe today. This could be using two-factor authentication, getting a hardware wallet, or backing up your recovery phrases well.

“Learn More About: Hot wallet vs paper wallet benefits drawbacks“

Future trends and interoperability outlook

Interoperability is the next big thing in blockchain vs cryptocurrency. As these techs grow, they’re breaking down walls between networks. This opens up new ways for digital stuff and deals.

New tools like Polkadot and Cosmos are key. They help different blockchains talk and share stuff easily. This means different networks can work together, not just fight each other.

But, we’re not there yet. Research from the Federal Reserve shows we’re making progress slowly. The price of stablecoins on different networks doesn’t always match up. This shows both the hurdles and chances in making blockchains work together.

New York Fed analysts find stablecoin prices diverge across chains, underscoring the technological and legal hurdles to full blockchain interoperability Ref.: “Durfee, J., Lee, M. J., Torregrossa, J., & Wang, S. Y. (2025). Interoperability of Blockchain Systems and the Future of Payments. Liberty Street Economics.” [!]

Crypto is growing in new ways too. We’re seeing new kinds of money and smart financial tools. This means blockchain and crypto might join forces with old systems, not just replace them.

If you’re new to crypto and blockchain, start with the basics. The tech is changing fast. But knowing the main ideas helps you understand this fast-changing world.