Campus life needs smart money skills. The average student spends about $3,015 a month. Those who borrow graduate with around $31,000 in debt. Wonder how some classmates go on trips and keep good grades without money worries?

Creating a simple plan can change your money situation. Financial advisor Dave Ramsey says, “A budget is telling your money where to go instead of wondering where it went.” This method splits your money into three parts, fitting well with student earnings.

In my first semester, I tried managing money without a plan. I ate ramen for two weeks. That taught me small incomes need a plan.

This method is great for campus life. It’s easy to remember, flexible, and builds lasting money habits. Before you read more, write down all your income sources for this semester.

Quick Hits:

- Works with part-time or irregular income

- Prevents common campus money emergencies

- Builds lasting financial confidence

- Reduces stress during exam periods

- Adapts to changing semester needs

Budgeting around tuition room and board costs

Learning the 50/30/20 budget as a college student starts with big expenses. These include tuition, housing, and meal plans. They take up most of your money and are your “needs”. Knowing how to handle these costs is key to staying financially stable in college.

The 50% of your budget for needs must cover these big costs. With books costing $1,212 and meal plans $4,500 a year, planning is essential to avoid money troubles.

College Board’s national guidance pegs the moderate 2024-25 nine-month living-expense budget at $26,390 — roughly $2,930 per month — confirming that tuition, housing, and meals dominate the “needs” category for most students.Ref.: “College Board. (2024). Guidance for Nine-Month Living Expenses 2024-25. College Board.” [!]

Separating Direct and Indirect Education Costs

To manage your college budget well, know the difference between direct and indirect costs. Direct costs are paid to your school and show up on your bill. Indirect costs are extra expenses you face while studying.

Direct education costs include:

- Tuition fees (the cost of your classes)

- Mandatory student fees (tech fees, activity fees, etc.)

- On-campus housing charges (if you live in a dorm)

- University meal plans (if bought through the school)

Indirect education costs include:

- Off-campus housing (if you live in an apartment)

- Groceries and meals outside your meal plan

- Transportation expenses (bus passes, gas, car maintenance)

- Personal supplies and toiletries

Both types are in your “needs” budget, but knowing the difference helps. Direct costs are fixed and can’t be changed. Indirect costs might offer ways to save.

When you figure out your income and expenses, use separate columns for direct and indirect costs. This helps you focus on what’s really important and find ways to spend less. For example, you can’t change your tuition, but you might find cheaper housing or eat out less.

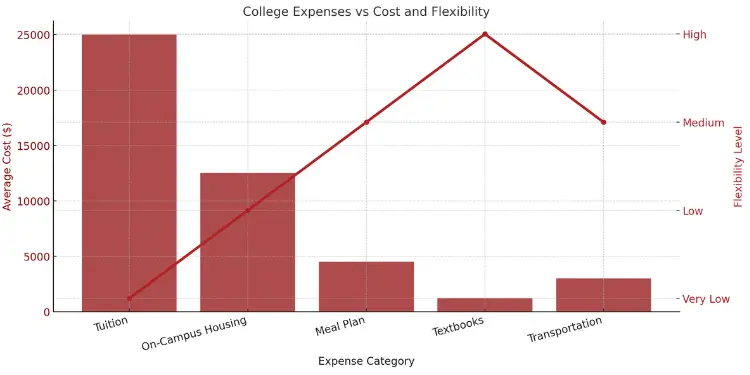

| Expense Category | Average Cost | Budget Category | Flexibility Level | Saving Strategies |

|---|---|---|---|---|

| Tuition | $10,000-$40,000/year | Needs (50%) | Very Low | Scholarships, grants, financial aid |

| On-Campus Housing | $10,000-$15,000/year | Needs (50%) | Low | Become an RA, choose cheaper dorm options |

| Meal Plan | $4,500/year | Needs (50%) | Medium | Select smaller meal plan, supplement with groceries |

| Textbooks | $1,212/year | Needs (50%) | High | Rent, buy used, e-books, library resources |

| Transportation | $1,000-$5,000/year | Needs (50%) | Medium | Use campus transit, carpool, bike |

Budget risk alert: Many students don’t think about indirect costs enough. Always add a 10% buffer to your indirect expenses for unexpected costs.

A 2022 GAO audit found 91 % of colleges under-state or omit key indirect costs (books, transport, personal expenses) in financial-aid offers, obscuring the true net price for students — build a 10 % buffer to cover these gaps.Ref.: “U.S. Government Accountability Office. (2022). Financial Aid Offers: Action Needed to Improve Information on College Costs and Student Aid. GAO-23-104708.” [!]

Allocating Percentage Toward Course Materials

Course materials are a big but often forgotten expense. With students spending over $1,200 a year, planning is key.

Set aside 10-15% of your “needs” budget for course materials. This way, you have money for textbooks, lab supplies, and more without cutting into other needs.

To make your course materials budget go further:

- Rent textbooks instead of buying (savings: 30-50%)

- Purchase used books from campus bookstore or online (savings: 25-75%)

- Look into e-book options, which are often cheaper

- Check if your library has course reserves for required readings

- Split costs with classmates for books you’ll only use occasionally

When taxes are taken out of your income or financial aid, use your after-tax amount for course materials. This category also includes special items for your major, like art supplies or lab equipment.

I saved over $300 last semester by checking the library first for my literature course books and only buying what wasn’t available. For my biology textbook, I found the previous edition for $45 instead of paying $250 for the current one—the differences were minimal.

Before each semester, make a list of all required materials from your syllabi. Buy what you need first and then other items as you can. This way, you won’t spend all your money in the first week.

Remember, spending on extra study guides or materials should come from your “wants” budget, not your needs. This keeps your 50/30/20 budget in order.

To decide if an expense is a “need,” ask: “Will my grade suffer without this item?” If yes, it’s a need. If it just makes studying easier, it’s a want.

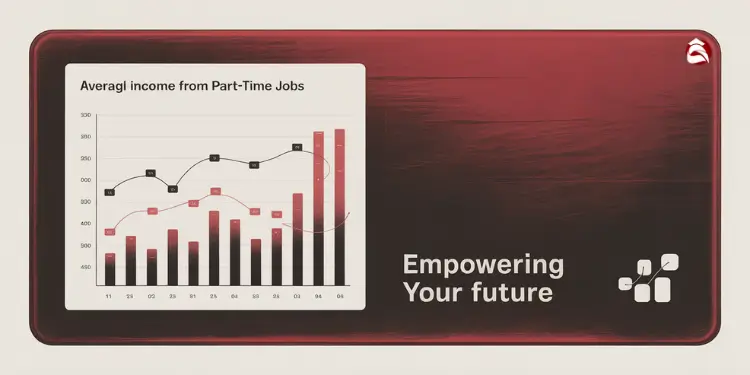

Stretching limited income from part time jobs

Getting your part-time money to last all semester needs smart budgeting. College students often work part-time while studying. This makes managing money hard, as income changes every week.

Working at the bookstore, waiting tables, or helping professors, you must stretch every dollar. It’s key to make your money go further.

To stretch your income, start by figuring out your monthly budget. If your hours and pay change, use a three-month average. Add up your income from the last three months, then divide by three. This gives you a good idea of your monthly income.

| Month | Hours Worked | Income | 3-Month Average |

|---|---|---|---|

| January | 42 | $546 | N/A |

| February | 38 | $494 | N/A |

| March | 45 | $585 | $542 |

Knowing your average monthly income, use the 50/30/20 rule. With $542 monthly, you’d spend $271 on needs, $163 on wants, and $108 on savings. This rule helps you see where your money goes.

To make more money, try these ideas:

- Look for higher-paying campus jobs that offer study time (library, computer lab)

- Maximize work-study opportunities if you qualify

- Stack multiple short shifts around your class schedule

- Explore seasonal campus jobs during peak periods

Keep track of your spending to find ways to save. Many students spend a lot on small things. A spending journal for two weeks can show you where to cut back.

Scheduling Pay Dates With Auto Transfers

When you handle your money matters a lot. Paying yourself first through automatic transfers is a smart move. This way, you save before you spend.

Setting up automatic transfers takes just minutes but helps you save. Most apps let you schedule transfers on specific dates. Pick the day after payday to make sure you have the money.

Here’s how to divide each paycheck using the 50/30/20 approach:

- Calculate 20% of your expected paycheck amount

- Set up an automatic transfer for this amount to your savings account

- Schedule the transfer for 24 hours after your regular deposit time

- Leave the remaining 80% in your checking for needs (50%) and wants (30%)

CFPB research on “guaranteed” automatic transfers found participants grew balances 1.5 – 3.5 × faster and hit $500–$1,000 emergency-fund milestones sooner than manual savers — automating the 20 % slice materially boosts results.Ref.: “Consumer Financial Protection Bureau. (2022). Consumer Savings App Strategies and Savings Outcomes. CFPB.” [!]

This system works well with different jobs and paydays. For each job, set up a separate automatic transfer. Make saving automatic, not something you have to remember.

Even small automatic transfers add up over time. Saving $25 from each weekly paycheck for college years means over $5,000 by graduation, plus interest.

The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.

Set a reminder for your next payday and spend 15 minutes setting up your first automatic transfer. This small step can put you ahead financially and start a lifelong habit.

Finding student discounts to lower wants spending

College life has a secret money-saving trick: student discounts. These discounts can change how you spend money. About 30% of your income goes to “wants,” like fun things. Learning to find discounts can really help your money situation.

What’s a “want” versus a “need” in college? Needs are things like food, housing, and textbooks. Wants are things like coffee, streaming services, and new clothes. That daily coffee? That’s a want, not a need.

Businesses know students have little money and offer discounts to win your loyalty. By using these discounts, you can enjoy college while saving money. The trick is knowing where to find these deals.

Campus Perks You Might Overlook Daily

Many students pay fees each semester without knowing they get many benefits. Before spending money, see if you’re already getting these perks:

- Fitness center access – Campus gym memberships include classes, pool access, and equipment for $50+ monthly

- Entertainment options – Free or discounted tickets to campus events, plays, concerts, and movie nights

- Software and subscriptions – Colleges often give free access to expensive software like Adobe Creative Suite and Microsoft Office

- Health services – From basic medical care to counseling sessions that cost hundreds off-campus

- Museum and cultural venue access – Student IDs give free admission to local attractions

These campus resources offer free fun and services without using your “wants” money. Before buying something, check your student portal or visit your student services office. You might find free perks you didn’t know about.

A survey found students who used campus resources saved $120 monthly. That’s $1,000 a year that can go toward other things orsaving for college.

Stacking Coupon Codes With Student Status

Using campus perks is just the start. The real savings come from combining discounts. Here’s how to stack discounts like a pro:

- Start with your student discount (usually 10-15% off)

- Add seasonal or promotional sales (can be 20-50% off)

- Apply coupon codes from sites like RetailMeNot or Honey

- Use cashback apps or credit card rewards for more savings

- Consider buying during tax-free weekends in some states

Let’s say you buy a $50 pair of jeans with a 15% student discount. That’s $42.50. Then, a 30% sale brings it to $29.75. Add a $5 coupon and 3% cashback, and you pay about $24.15. That’s less than half the original price!

Websites like UNiDAYS and Student Beans verify your student status and offer hundreds of discounts. Tech companies like Apple, Microsoft, and Best Buy also have education pricing. Even streaming services like Spotify, Hulu, and YouTube offer big discounts for students.

The goal isn’t to cut out wants completely. That’s hard and can make budgeting hard. Instead, spend wisely. Ask yourself: “Is this worth the money I worked for?” This question can stop you from buying things that don’t fit your financial goals.

Before we go, take this step: Check your student email for campus event announcements. Then, plan three free activities for this month. This simple habit will help you enjoy college while keeping your spending in check.

Saving portion for emergencies and future goals

Setting aside money in your college budget is key. It helps you deal with unexpected costs. Even with little money, saving 20% is important.

I learned this the hard way when my laptop broke before finals. My $600 emergency fund helped me buy a new one right away. This saved my semester.

This 20% is for two big things: an emergency fund and saving for the future. Let’s talk about how to do this.

The Tiered Approach to Your 20%

Start small to build your financial safety net. Here’s how:

- Build a starter emergency fund of $500-1000

- Address high-interest debt (like credit cards)

- Expand your emergency fund to 1-3 months of expenses

- Begin saving for post-graduation goals like moving or a new wardrobe

A 2024 Bankrate poll shows many adults worry about their savings. Don’t wait until after college to start saving. Small steps now can help a lot later.

Bankrate’s June 2024 Emergency Savings survey found 59 % of Americans are uncomfortable with their savings — and 27 % have no emergency fund at all — underscoring why the 20 % savings allocation is non-negotiable.Ref.: “Bankrate. (2024). Nearly 3 in 5 Americans Are Uncomfortable With Their Emergency Savings. Bankrate.” [!]

Calculating Your Savings Target

Figure out how much to save by using this formula:

Monthly Income × 0.20 = Monthly Savings Target

For example, if you make $800 a month, aim to save $160. It’s easier to save a little each month.

| Income Level | Monthly Savings Target | Weekly Amount | Daily Amount | Priority Focus |

|---|---|---|---|---|

| $500 (Work-Study) | $100 | $25 | $3.57 | Starter Emergency Fund |

| $800 (Part-Time) | $160 | $40 | $5.71 | Emergency Fund + Debt |

| $1,200 (Internship) | $240 | $60 | $8.57 | Emergency Fund + Debt + Future |

| $2,000 (Summer Job) | $400 | $100 | $14.29 | All Categories + Student Loan Prep |

Where to Keep Your Funds

Use a high-yield savings account for emergencies. It’s separate from your checking. This helps you avoid spending it on non-essential things.

Online banks offer accounts for students. They have no minimum balance and higher interest rates. Even small interest adds up over time.

“The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.”

Automating Your Savings

Automate savings on payday. This way, you’ll spend less. Even $20 a week helps.

For money that comes in irregularly, save 20% first. This way, you won’t spend it all on wants.

Overcoming Common Obstacles

Many students think they can’t save now. Start with 5% and increase it. Adjust the 50/30/20 budget to fit your needs.

To save $5-10 a week, try these:

- Make coffee in your dorm instead of buying it twice weekly ($8)

- Use campus meal plans fully instead of ordering delivery once ($15)

- Go to free campus events instead of paid entertainment ($20)

These small changes can help you save for emergencies all year.

Balancing Savings and Debt

Decide between saving and paying off debt. It depends on your situation. But usually:

First, build an emergency fund of $500-1000. Then, pay off high-interest debt while saving a little. Once debt is down, focus on your emergency fund again.

For student loans, save first. Having money for emergencies helps you avoid more debt when unexpected costs come up.

Your Action Step Today

Open a separate savings account for emergencies today. Even $5 is a start. This step helps you manage your money well now and in the future.

“Check This Out: 50/30/20 budget example for a typical monthly income“

Managing irregular financial aid refund checks

Financial aid refund checks come as big sums. They must last all semester. If you got more money than you needed, you’ll get the extra. This can make you feel very secure financially.

But, the timing is tricky. Most costs happen all semester long. Yet, your money comes in big chunks. This can lead to bad money habits if you’re not careful.

Creating Your Semester-Long 50/30/20 Plan

To handle your refund check well, adjust the 50/30/20 rule for your school year. First, figure out how many weeks your money must last. This is usually 15-16 weeks for a full semester.

Divide your refund by the weeks to get your weekly budget. For example, a $3,000 refund for 15 weeks means $200 a week to manage your money.

“The biggest mistake I made as a freshman was treating my refund check like a windfall. By week ten, I was surviving on ramen and borrowing from friends. Now I immediately divide my refund by weeks in the semester and set up automatic transfers to my checking account.”

Now, use the 50/30/20 rule for your weekly budget:

- 50% for needs: groceries, off-campus rent, utilities, transportation

- 30% for wants: social activities, streaming services, dining out

- 20% for savings: emergency fund and future goals

Creating Artificial Scarcity

Stretching your refund check means avoiding quick spending. When a lot of money comes in, it’s easy to want to spend it all.

Open separate accounts for your financial aid. Keep most of your money in savings. Then, move money to your checking account weekly or bi-weekly based on your budget.

This makes it seem like you have less money. You’ll only see what you can spend in your main account. Many campus financial services can help you set this up.

“Learn More: 50/30/20 budget breakdown of needs, wants, and savings“

Building in Buffers for Unexpected Expenses

As a student, you’ll face surprise costs. Things like textbooks, emergency trips home, or laptop repairs can mess up your plans.

Take 10% off your refund before budgeting. Use this for emergencies. If you don’t use it, you’ll have money for next semester.

| Refund Amount | Emergency Buffer (10%) | Remaining for Budget | Weekly Amount (16-week semester) |

|---|---|---|---|

| $2,500 | $250 | $2,250 | $140.63 |

| $3,500 | $350 | $3,150 | $196.88 |

| $5,000 | $500 | $4,500 | $281.25 |

Tracking and Adjusting Mid-Semester

Managing your semester budget needs constant attention. After a month, check how you’re spending. See if you need to change your weekly budget.

If you’re spending too much in one area, cut back. Don’t increase your weekly spending. This way, you’ll have more money later when you might need it.

Expenses can vary throughout the semester. You might spend more at the start (books) and end (projects, travel). Adjust your budget to match these changes.

Figure out how many weeks your aid must last. Then, divide your refund by that number for your weekly budget. Set up your transfers now. You’ll be glad during finals week when you’re not out of money.

“Explore This: How to make 50/30/20 budget with clear practical step by step“

Recommended apps and printable dorm worksheets

Good tools make budgeting easier. A budget calculator turns theory into action. Let’s find affordable options.

Start with basic spreadsheets. Microsoft Excel has free templates for college students. Google Sheets is great for cloud access.

For digital banking, some apps are top picks. Mint tracks your spending automatically. YNAB offers a free student year. EveryDollar makes 50/30/20 easy.

“Discover Insights:

Free Tools Avoiding Subscription Traps Today

Watch out for “free” apps that cost later. True free options include:

• NerdWallet’s budget worksheet – print it for your dorm

• Mint – free with ads

• Excel/Google templates – download once, no ongoing costs

Small costs for extra features add up. A $5 monthly fee is $60 a year. Better spent on savings.

For roommates, use a shared expense tracker. A simple chart on your door helps avoid money issues.

Choose a tool today and check in weekly for 15 minutes. This guide aims to simplify, not add stress. The best budget is one you’ll stick to!