Is your paycheck gone before you even see it? You’re not alone. Over half of Americans—53%—report living paycheck to paycheck In 2025, 53% say they live paycheck to paycheck, per Spendmenot, while nearly 60% can’t cover a $1,000 emergency from savings alone, according to recent surveys. This leaves their financial future uncertain.

“Financial freedom isn’t about having more money—it’s about controlling the money you have,” Sen. Elizabeth Warren (then-Harvard Law professor), along with her daughter Amelia Warren Tyagi, popularized the 50/30/20 rule in their 2005 book All Your Worth.

I watched my clients struggle with hard spreadsheets and plans that didn’t work. Then, I found this method. It divides after-tax income into three easy parts that help real families.

This guide shows how to make a budget using percentages. You’ll see how a family with average income spends every dollar. They balance needs, wants, and saving for the future.

By the end of this article, you’ll have a budget plan that fits you. It helps with high housing costs, debt, or saving in tough times.

The Smith Family’s Budget Using 50/30/20

Meet the Smiths, a family of four facing budget challenges like many in 2025. John and Sarah live in a mid-sized American city with kids Emma (14) and Noah (10). They aim to balance daily costs and save for the future.

The Smiths are interested in the 50/30/20 rule for budgeting. This method helps them manage their money better, avoiding the mystery of where it goes each month.

Step 1: Calculate After-Tax Household Income

The first step is to figure out their net income. The Smiths need to know their monthly take-home pay after taxes and other deductions.

John brings home $4,200 a month as a certified healthcare technician as a healthcare technician. Sarah makes $2,300 after taxes as a graphic designer. Together, they have $6,500 monthly.

This after-tax income is key. It’s the real money they have to budget with. Many fail to budget with their gross income, not after-tax earnings.

| Income Source | Monthly Amount | Annual Amount |

|---|---|---|

| John’s Healthcare Job | $4,200 | $50,400 |

| Sarah’s Design Work | $2,300 | $27,600 |

| Total Household Income | $6,500 | $78,000 |

Step 2: Track All Monthly Expenses

To use the 50/30/20 rule, the Smiths must track their spending. They looked at receipts and bank statements for three months to see where their money goes.

Fixed expenses include their mortgage, car loans, insurance, and utilities. These costs stay the same each month and are considered needs.

Variable expenses change and include groceries, dining out, and entertainment. Some are needs, others are wants.

- Fixed Monthly Expenses: Mortgage: $1,600

- Car payments: $550

- Insurance (home, auto, life): $420

- Utilities (electricity, water, gas): $380

- Phone and internet: $210

- Student loan payment: $325

- Variable Monthly Expenses:Groceries: $850-950

- Dining out: $300-450

- Gas/transportation: $280-320

- Children’s activities: $200-350

- Entertainment: $150-300

- Clothing: $100-250

- Miscellaneous: $200-400

The Smiths found they spent about $6,300 monthly. This left little for savings or long-term goals. They decided to use the 50/30/20 rule to manage their money better.

Listing all expenses helped the Smiths understand their spending. This step showed them where they could save and pay off debt.

“The most difficult thing is the decision to act. The rest is merely tenacity.”

Now, the Smiths are ready to organize their budget with the 50/30/20 rule. They plan to spend 50% on needs, 30% on wants, and 20% on savings and debt.

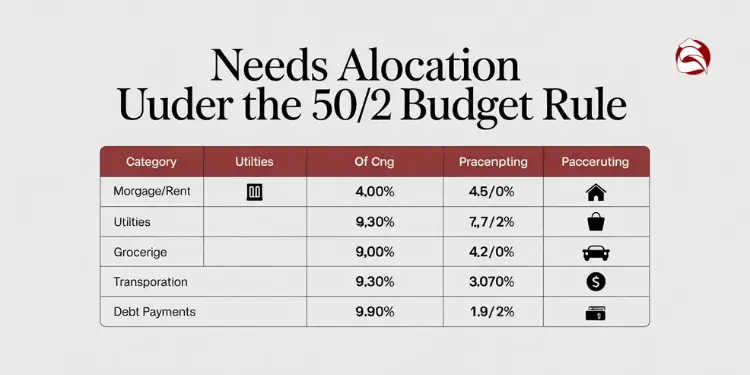

Step 3: Allocate 50% Toward Needs

The Smith family starts their budget by setting aside for needs. This is the base of the 50/30/20 budget. They use 50% of their $6,500 monthly income, which is $3,250, for must-have expenses.

Needs are the basic costs that keep a home running. For the Smiths, sorting these out helps them stay financially stable. They can then plan for wants and savings.

The rule defines “needs” as essential expenses (housing, utilities, groceries, transportation, insurance, minimum debt payments) capped at 50% of after-tax income Ref.: “Investopedia staff (2016). The 50/30/20 Budget Rule Explained. Investopedia.” [!]

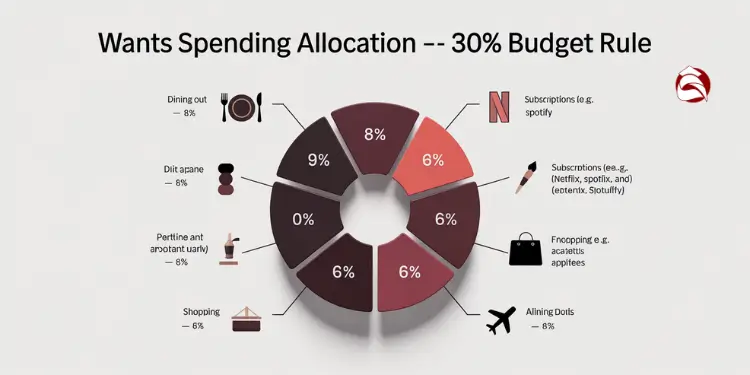

Step 4: Allocate 30% Toward Wants

The Smiths need to plan how to spend their extra money for a good life. They use the 50/30/20 rule. This means 30% of their $6,500 a month, or $1,950, goes to wants.

Wants are things that make life fun but aren’t needed. These include hobbies, dining out, and entertainment.

The Smiths started tracking their wants spending. They found out where they were spending too much. This helped them control their spending better.

What the Smiths Include in Their Needs Budget

Let’s see how the Smiths split their $3,250 for essential costs:

| Essential Need | Monthly Cost | Percentage of Needs Budget | Notes |

|---|---|---|---|

| Rent/Mortgage | $1,600 | 49.2% | Largest essential expense |

| Utilities | $350 | 10.8% | Electric, water, gas, internet |

| Groceries | $650 | 20.0% | Basic food and household supplies |

| Transportation | $400 | 12.3% | Car payment, insurance, gas |

| Minimum Debt Payments | $250 | 7.7% | Student loan, credit card minimums |

The Smiths spend nearly half of their needs budget on housing. Their rent or mortgage is $1,600 a month. This is common advice to keep housing costs under 30% of income.

Utilities cost $350 a month for things like electricity and internet. These costs can change with the seasons, so they might save extra in extreme weather.

For groceries, they set aside $650 a month. This covers food and household items, not dining out. They save money by planning meals and buying in bulk.

Track Your Needs Spending to Stay on Target

The 50/30/20 rule is a target, but it’s important to keep track. The Smiths spend exactly 50% of their income on needs, matching the target. But, they need to keep an eye on it.

If their needs go over 50%, they have ways to adjust:

- Negotiate better rates on bills like insurance or internet

- Look into refinancing their mortgage or student loan

- Save energy to lower utility costs

- Try carpooling or public transport to cut down on travel costs

If needs always go over 50%, it might mean they’re spending too much. They might need to downsize or get a cheaper car.

The 50/30/20 rule is a guide, not a rule. Some might need to spend 55-60% on needs in expensive areas. The goal is to know where your money goes and make smart choices.

“The first step toward financial freedom is understanding exactly what you need versus what you want. When you clearly define your true needs, you gain control over your financial future.”

By watching their needs spending, the Smiths make sure they have money left for wants and savings. This helps them stay financially healthy in the long run.

Include Routine Treats Entertainment and Hobbies

The Smiths’ wants budget helps them enjoy life more. It includes:

- Entertainment subscriptions – $65 for streaming and music

- Dining out – $400 for eating out and takeout

- Hobbies – $250 for Mike’s golf and Sarah’s art

- Shopping – $350 for clothes and home items

- Family activities – $300 for movies and outings

- Vacation fund – $300 for trips

- Miscellaneous wants – $285 for surprises

This adds up to the $1,950 they aim for in wants. Budgeting for fun makes them enjoy it more. They feel good knowing they can afford it.

“Before, we felt bad about spending on fun,” Sarah says. “Now, we know it’s okay within our budget.”

“Read also: Why use 50/30/20 budget for your personal finances”

Trim Wants Category When Costs Balloon

Sometimes, the Smiths spend more than planned on wants. This happens during holidays or birthdays.

When this happens, they make smart changes:

- Prioritize high-value wants – They choose the most important ones.

- Implement the 48-hour rule – They wait 48 hours for big purchases.

- Use the substitution method – They find cheaper ways to enjoy things.

- Temporarily reduce automatic contributions – They cut back on savings for special times.

This way, they don’t spend too much on wants. They keep their money for needs and savings.

Mike says, “The 50/30/20 rule helps us know where to cut back.”

By being careful with wants, the Smiths save enough for savings and debt. They enjoy today and plan for tomorrow.

| Want Category | Monthly Budget | Percentage of Wants | First to Cut When Needed |

|---|---|---|---|

| Entertainment Subscriptions | $65 | 3.3% | Medium priority |

| Dining Out | $400 | 20.5% | High priority |

| Shopping | $350 | 17.9% | First to cut |

| Vacation Fund | $300 | 15.4% | Adjustable |

| Miscellaneous | $285 | 14.6% | Emergency buffer |

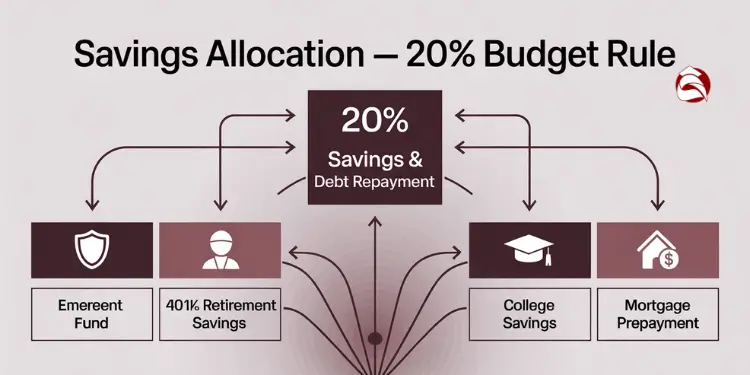

Dedicate savings and debt payoff shares

The Smiths now focus on the 20% slice for their financial future. This part of their budget is $1,300 monthly from $6,500 after-tax income. These dollars are key for building wealth and security.

This category has two main jobs. It builds assets and reduces liabilities. Every dollar here helps improve the family’s net worth, whether by paying down debt or growing investments.

Automate Transfers on Each Payday Instantly

The best way to save money is to make it disappear before you can spend it. The Smiths set up automatic transfers for their $1,300 savings. This way, they save money right away, without forgetting.

Their bank’s system makes these transfers easy:

- $650 on the 1st payday of the month

- $650 on the 15th payday of the month

- Special one-time transfers when bonuses arrive

Automation makes saving easy. The Smiths don’t have to remember to save. The system does it for them, helping them stick to their budget.

Automating transfers for the savings portion significantly increases adherence to the budget by removing manual decision points Ref.: “ScientificOrigin.com (2025). The 50/30/20 Budget Rule… Benefits…” [!]

Split Between Emergency Fund and Investments

The Smiths divide their savings into several areas. They first focus on building an emergency fund. Then, they work on other goals.

Here’s how they split their savings:

| Category | Monthly Amount | Purpose | Timeline |

|---|---|---|---|

| Emergency Fund | $400 | 3-6 months of essential expenses | Until target reached |

| 401(k) Contributions | $350 | Retirement with employer match | Ongoing |

| Extra Mortgage Payment | $250 | Reduce 30-year mortgage term | Until paid off |

| College Fund | $200 | Children’s education | Until children enter college |

| Vacation/Large Purchases | $100 | Planned expenses without debt | Rotating savings goals |

Once their emergency fund is $19,500, they’ll save more for retirement and debt. This balances their need for security and growth.

INDUSTRY BENCHMARK DATA:

Experts recommend first building a 3–6 month emergency fund within the savings allocation before shifting to investments—a core practice in the 50/30/20 framework Ref.: “Josh Pigford (2024). The 50/30/20 Rule: A Simple Path to Financial Wellness. Maybe Finance.” [!]

For those with high-interest debt, like credit cards, paying it off first is wise. The Smiths already did this, so now they focus on saving and growing assets.

The secret to building wealth isn’t making more money, but keeping more of what you make. The 20% savings category is where financial independence begins.

The Smiths check their savings plan every quarter. As their children get closer to college, they’ll increase the education fund. They’ll adjust other savings areas too.

By saving 20% of their income, the Smiths build lasting financial security. Their disciplined savings show how families can grow wealth through steady habits.

“read more: How to stick to 50/30/20 budget without constant willpower battles“

Prepare for Income Ups and Downs

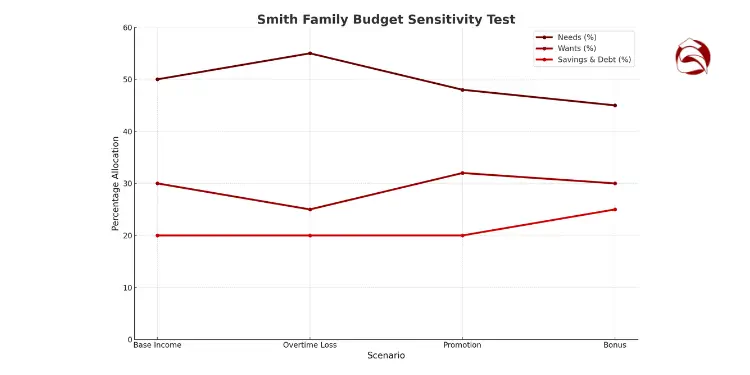

Running sensitivity tests on your budget helps prepare for financial reality. This includes overtime hours, bonuses, and income changes. The Smith family learned this lesson quickly.

They realized their 50/30/20 plan needed flexibility. I tell my clients that the strongest budget bends without breaking when life happens.

A sensitivity test means asking “what if?” about your income. What if you lose overtime hours? What if you get a year-end bonus? Planning for these scenarios helps you not panic when your paycheck changes.

Let’s see how the Smiths prepared for these financial twists.

Budgeting models like 50/30/20 may falter with irregular income (freelancers, gig workers); adjusting allocations monthly increases feasibility Ref.: “POPSUGAR staff (2024). The 50‑30‑20 Rule For Budgeting: Experts Weigh In. POPSUGAR.” [!]

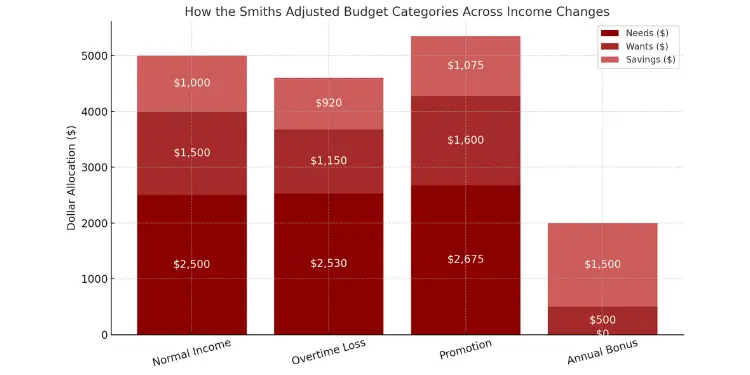

Adjust Percentages if Overtime Drops Suddenly

When Michael’s overtime disappeared, the Smiths’ monthly income dropped by $400. They had already planned their response:

- Reduce “wants” category first (streaming services and dining out)

- Maintain automatic transfers to emergency savings

- Temporarily adjust the 50/30/20 ratio to 55/25/20 until income stabilizes

The 50/30/20 rule is simple and flexible. When income drops, tweak the percentages while keeping the structure. This prevents cutting savings first.

The true test of a budget isn’t how it works when everything goes right—it’s how it performs when things go wrong.

The Smiths found their transportation expenses were higher than expected. They started carpooling with colleagues. This freed up $120 monthly, which they redirected to their “needs” category.

“read also: 50/30/20 needs vs wants categories for confident everyday spending“

Boost Savings When Bonuses Arrive Unexpectedly

Six months into their budgeting journey, Bo received a promotion with a $350 monthly raise. They immediately ran another sensitivity test to optimize their financial situation and goals.

For unexpected income boosts, I recommend the “50/50 rule.” Put half toward your future and half toward improving your present. The Smiths followed this approach by:

- Increasing their personal savings rate by directing $175 to saving for a down payment on a house

- Adding $100 to their “wants” category for a monthly date night

- Allocating the remaining $75 to inflate their emergency fund faster

This approach ensures that every dollar of income serves both short- and long-term goals. Treating windfalls and raises intentionally makes them powerful accelerators for your financial progress.

| Income Scenario | Needs (50%) | Wants (30%) | Savings (20%) | Adjustment Strategy | |

|---|---|---|---|---|---|

| Normal Income | ($5,000/month) | $2,500 | $1,500 | $1,000 | Standard 50/30/20 ratio |

| Overtime Loss | ($4,600/month) | $2,530 | $1,150 | $920 | Adjust to 55/25/20 ratio |

| Promotion | ($5,350/month) | $2,675 | $1,600 | $1,075 | Keep 50/30/20 but boost savings |

| Annual Bonus | ($2,000 one-time) | $0 | $500 | $1,500 | Apply 0/25/75 to windfall |

The Smiths remained disciplined with their budgeting practice even as their income changed. They prioritized their financial well-being by regularly evaluating progress toward goals like building their emergency fund and saving for a house down payment.

I’ve found that families who run these sensitivity tests quarterly are far less stressed when income changes actually occur. Like the 50-30-20 approach itself, this practice transforms budgeting from a restrictive chore into a flexible tool that supports your changing life.

Remember that part of your budget’s job is to adapt to your reality—not the other way around. By planning for both income dips and windfalls, you’ll ensure that half of your budget isn’t vulnerable to unexpected changes, while making progress on what matters most to you.

Read more: 50/30/20 budget for beginners simple steps toward money confidence“

Final Takeaways from the Smith Family Budget

The Smith family shows how the 50/30/20 rule works. It helps organize your money in a good way. Their example is a guide for managing your money each month.

Copy Template Then Plug Your Own Figures

First, write down your after-tax monthly income. Then, track your spending for 30 days. Use a notebook or a budgeting app.

Sort your expenses into needs, wants, and savings. See how your spending compares to the 50/30/20 rule. If your needs are more than 50%, look for ways to cut costs.

Maybe your housing costs are too high. Your financial situation is different. So, adjust the budget to fit your needs while saving money.

Read more:

Review Quarterly To Refine Spending Mix

Check your budget every three months. This helps you see changes in spending early. Your income should match your changing priorities.

Save money automatically on payday. This ensures you save 20% first. Remember, budget amounts can change to meet your goals.

Needs and wants change over time. The budget rule helps you understand where your money goes. It’s not about perfect percentages, but being aware of your spending.